How Managed Futures May Help Diversify Investment Portfolios & Mitigate Risk

By Tim Rudderow, Co-Founder and CEO of Mount Lucas Management

When most people hear the word "futures," they associate them with commodities like corn, oil, and precious metals. In reality, the futures market is incredibly complex, with contracts encompassing both physical goods as well as financial instruments such as currencies, stocks, and bonds.

Managed futures are portfolios of futures contracts that are bought and sold by investment professionals. Investment managers employ strategies in an effort to take advantage of upward or downward pricing trends identified through quantitative technical analysis. As an investment strategy, managed futures' main purpose is to manage risk within a portfolio by delivering uncorrelated returns, although historically they have often outperformed the broad market in times of economic duress.1

Last year we launched the KFA Mount Lucas Index Strategy ETF to help investors of all types benefit from portfolio diversification and risk mitigation through managed futures.

Types of Futures Investors

Futures investors generally fall into three categories:

Buy-side hedgers, such as oil refineries and food manufacturers, use futures to lock in future purchasing prices for the raw materials they use.

Sell-side hedgers, such as farmers, shale oil producers, and mining companies, use futures to lock in higher future selling prices for the commodities they produce to offset potentially lower prices in the physical markets.

Speculators attempt to profit by taking on the price risk that both buy-side and sell-side hedgers are willing to pay to avoid, thereby benefitting from both the premium hedgers pay and the upside potential.

A Trend-Based Strategy

"Managed futures" is a general description of a professionally managed portfolio of futures contracts. Their overall purpose is to improve the risk/return profile of a portfolio by delivering returns with low correlations to those of the equity and bond markets. They also offer the additional benefit of potentially generating strong returns during periods of market stress.

Nearly all managed futures investors employ trend-following strategies. Trend following is a quantitative trading method used to capture risk premiums that occur during periods of market volatility and price dislocation. Professional trend followers use algorithms that signal the beginning of potential large pricing trends, and then take short and long positions to capture the returns.

While portfolio managers may consider current economic and market conditions when looking for certain sectors, currencies, or countries to focus their analysis, their actual trading decisions are based primarily on pricing trends. Fundamental factors are not considered.

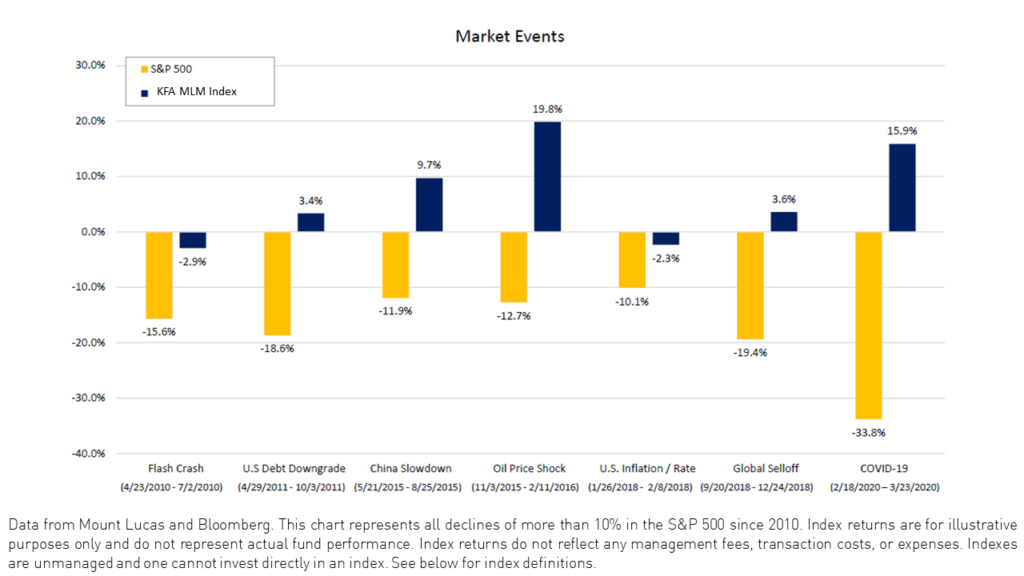

Non-Correlated Returns Plus Outperformance in Times of Stress

Managed futures are most commonly used to deliver non-correlated results under most market conditions, serving as a risk mediator within the alternative investments allocation of an institutional portfolio. Generally, they deliver lower relative returns during periods of price stability. But, during periods of market stress, managed futures often outperform the broad market, as illustrated in the following chart.

Historical Outperformance of Other Major Asset Classes

Over the past decade, when global economic and market events have spurred a selloff in the broad market, managed futures, as represented by the KFA MLM Index, a recognized benchmark of the returns available to managed futures investors often delivered exceptional non-correlated returns.

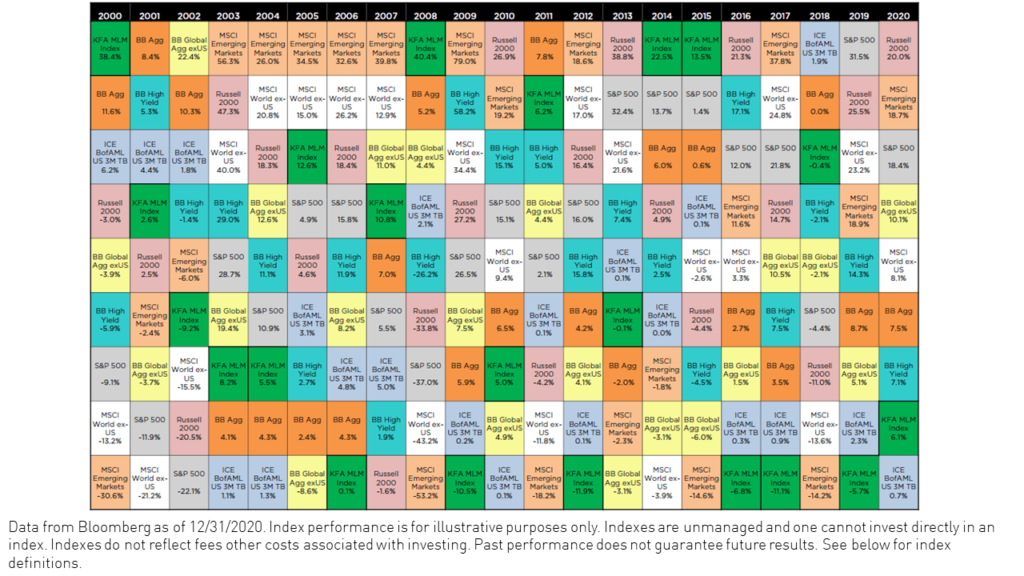

When included in a diversified asset allocation strategy, managed futures not only have the potential to mitigate risk but often outperformed all other asset classes, particularly during recessionary periods, as illustrated in the following table of periodic returns spanning the past 20 years.

As we see in the chart above, the KFA MLM Index was the top-performing asset class in four of those years and in the top three in three other years. More impressively, in 10 of those years, the KFA MLM Index outperformed the S&P 500.

Because managed futures investors employ trend-following strategies in an effort to capitalize on pricing spikes, they tend to perform best during periods of high market volatility such as those that occur during market downturns. Thus, we see that the KFA MLM Index was a top performer in the wake of the burst of the high-tech bubble in 2000 and in the post 9/11 recession of 2001 and 2002, as well as during the collapse of the markets in 2008 that marked the start of the Great Recession.

Conversely, managed futures tend to underperform in years when domestic and international equity markets grow at a steady pace with low levels of volatility. In fact, over the past 20 years, returns have historically correlated most closely with those of investment-grade bonds in periods of low equity market volatility, a reason why many institutional investors use them as risk mitigators.

Managed Futures in the COVID-19 Era

The ongoing Coronavirus-driven market has provided numerous opportunities for managed futures investors to exploit pricing opportunities.

One example: When the global economic contraction began at the end of February 2020, sophisticated investors took short positions in energy and copper futures, a strategy that paid off handsomely when fossil fuel prices collapsed in April.

Another example: When the extent of the economic damage in the U.S. became apparent, many investors, anticipating a global stampede to safety, went long on U.S. Treasury futures, which rallied strongly despite interest rate cuts that have driven yields to near-microscopic levels.

With the growing uncertainty of the long-term global economic impact of the pandemic, the markets are likely to experience periods of high volatility for the immediate future, creating opportunities for managed futures investors to exploit.

Entering 2021, with rates this low, fixed income allocations suffer from an asymmetric payout, providing limited benefit in an equity sell-off and introducing the risk of significant losses in a rising rate environment driven by inflation, stimulus, and pandemic recovery. Yet, equity valuations remain high and portfolio diversification is still warranted.

The KFA Mount Lucas Index Strategy ETF may provide diversification in this environment with the potential to capitalize on rising commodity prices and falling bond prices, all with a reasonable fee structure and complete transparency.

How Are Managed Futures Typically Used?

In an institutional portfolio, managed futures usually comprise a portion of an allocation to alternative investments. Typically, we see institutional managed futures allocations ranging between 10%-20% of a portfolio as a whole, depending on the institution's risk-return profile.

Managed futures can play a variety of roles within an overall portfolio. The low to negatively correlated returns they generate may help reduce risk in times of market volatility. When markets are falling, they have often delivered positive returns through the effective use of shorting. And when markets begin to recover, savvy managers can get in on the ground floor of upside momentum before the rest of the market catches on. Thus, managed futures can be an attractive all-weather investment.

About Mount Lucas Management

Mount Lucas Management seeks to provide innovative alternative investment strategies that enhance and diversify traditional investments. As an innovator in managed futures since 1986, Mount Lucas created the widely followed MLM Index™ - the first generic trading index for trend-following investors seeking diversification from equity portfolios. Mount Lucas had more than $1.4 billion in assets under management as of December 31, 2020. For more information, please contact Mount Lucas at (267) 759-3500 or [email protected]. Mount Lucas is the sub-adviser of the KFA Mount Lucas Index Strategy ETF.

This article is intended for informational purposes only. This material contains the opinions of the manager and such opinions are subject to change without notice. This commentary does not constitute an offer to sell or a solicitation of an offer to buy securities and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Any offer for an interest in a fund sponsored by Mount Lucas Management LP ("Mount Lucas") will be made only pursuant to an offering memorandum of such fund.

Diversification does not ensure a profit or guarantee against a loss.

Citation

- Data from Bloomberg and Mount Lucas as of 12/31/2020. Managed futures are measured by using the performance of the KFA MLM Index. See index definition below.

Index Definitions

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid-cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

Bloomberg Barclays Global Aggregate Index ("BB Agg"): The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers. The index was launched on January 1, 1999.

KFA MLM Index (“KMLM’s Index”): The KFA MLM Index is a diversified trend-following portfolio of commodity, currency, and global fixed income futures contracts traded on US and foreign exchanges. The performance data for the index is a representation of the MLM Index from 9/30/1992 to 12/31/2004, the MLM Index EV (“EV”), with enhanced Execution and Volatility characteristics, from 1/1/2005 to 11/30/2020, and, using the same methodology as the “EV,” the KFA MLM Index from 12/1/2020 on.

Russell 2000 Index: The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. The index was launched on January 1, 1984.

MSCI World Ex-USA Index: The MSCI World ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries-- excluding the United States. With 962 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The index was launched on March 31, 1986.

ICE BofA US 3-Month T-Bill Index: This index measures the price and yield performance of the 3-month US Treasury Bond.

Bloomberg Barclays US Corporate High Yield Index: The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition, are excluded. The US Corporate High Yield Index is a component of the US Universal and Global High Yield Indices. The index was launched in 1986.

Bloomberg Barclays Global Aggregate Ex-USD Total Return Index: The Bloomberg Barclays Global Aggregate ex USD Index is a measure of investment-grade debt from 24 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers. Bonds issued in USD are excluded.