Evergrande Explained

By Henry Greene, Investment Strategist

Upcoming Webinar:

Join us this coming Wednesday, September 29th, 2021 at 9:00 am EDT for

Evergrande Briefing With Top Asia Fixed Income Manager

A Conversation with KHYB Portfolio Manager Wai Hoong Leong from Nikko

Click here to register.

Executive Summary

- China real estate mega developer Evergrande sparked cries of “China’s Lehman Moment” in the Western media when it postponed a scheduled debt repayment.

- Neither a disorderly default nor a complete government bailout are likely. The most likely outcome is a government-facilitated debt restructuring, which appears to already be underway

- Evergrande’s story is intertwined with the story of China’s ongoing economic transformation and shift away from real estate investment towards investment in growth industries such as technology and consumer products.

- The Evergrande moment may present an attractive entry point into the Asia high yield bond market because risk controls are tightening at the same time yields have been driven up.

Introduction

Investors worldwide have been eyeing the difficulties China’s second largest property developer, Evergrande, is having paying its debts. The fallout from the company’s restructuring, the specifics of which are still in the works, has had a broad impact on global commodities, equities, and bonds. While the extreme scenarios have dominated the conversation, we expect there to be a more moderate resolution.

Evergrande’s woes of late have not turned out to be China’s “Lehman Brothers moment,” as some media sources suggested. Evergrande will join the ranks of firms including Fosun, Anbang Insurance, and HNA Group, which were also mischaracterized as tipping points for China’s economy in the past. However, the developer’s trouble does represent a pivotal moment for China’s capital markets, demonstrating their importance to the global financial system and that China is no longer an emerging market. For Asia’s high yield bond market, it could represent a policy tightening event that may lead to enhanced risk management among other real estate developers in the region, whose balance sheets are already strong.

What Happened?

The Evergrande story is years in the making. Evergrande has been through many business cycles over the past decade and has come close to defaulting before. The property developer sought to capitalize on the construction boom in China, which was bolstered by intense economic growth, easily accessible credit, and the fastest urbanization in human history.1 Homebuyers used leverage to purchase properties being developed by the firm. In turn, the firm borrowed heavily to finance those projects.

Real estate investment accounts for nearly 60% of Chinese household savings compared to 33% in the United States.2 This resulted in a situation where even middle and lower-middle-class households were purchasing one or more investment properties in addition to their own homes, many of which sat empty. As such, Evergrande saw extreme demand for its projects. Chinese households, lacking an alternative, channeled their savings into real estate. This resulted in inflated prices for real estate.

China’s capital markets have come a long way since Evergrande was founded in 1996. Chinese households now have a wide array of financial assets available to them. The Shanghai and Shenzhen Stock Exchanges now boast a total market capitalization of over $11 trillion.3 Furthermore, these markets are now liquid, modernized, and are beginning to invite investment management services provided by foreign firms.

Nonetheless, it appears that Chinese households have continued to focus on real estate rather than diversifying risks. As a result, the government has implemented new regulations that are making it more difficult to speculate on real estate and easier for investors to enter the stock market. At the end of 2020, China’s banking regulators announced caps on real estate lending. This sent a strong signal that “housing is for living, not speculating,” a statement Xi Jinping made at the 19th Party Congress in 2017.4

Investment continues to grow in real estate. However, between the government’s nudging towards securities markets and the expanding opportunities and maturity of the traditional markets, we should see the complexion of Chinese retail investments continue to diversify

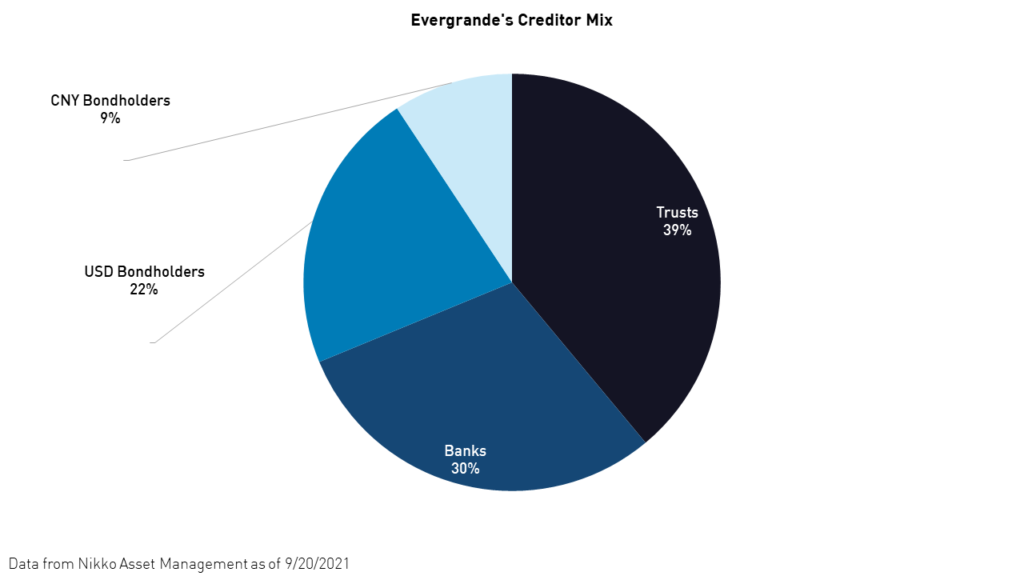

Evergrande has current liabilities worth $310 billion, approximately $90 billion of which is owed to creditors, while the rest is owed to suppliers and homebuyers for down payments on projects that were delayed by the pandemic and may not proceed under the current environment. The latter two groups will likely be prioritized by the government in any restructuring plan to avoid social unrest.

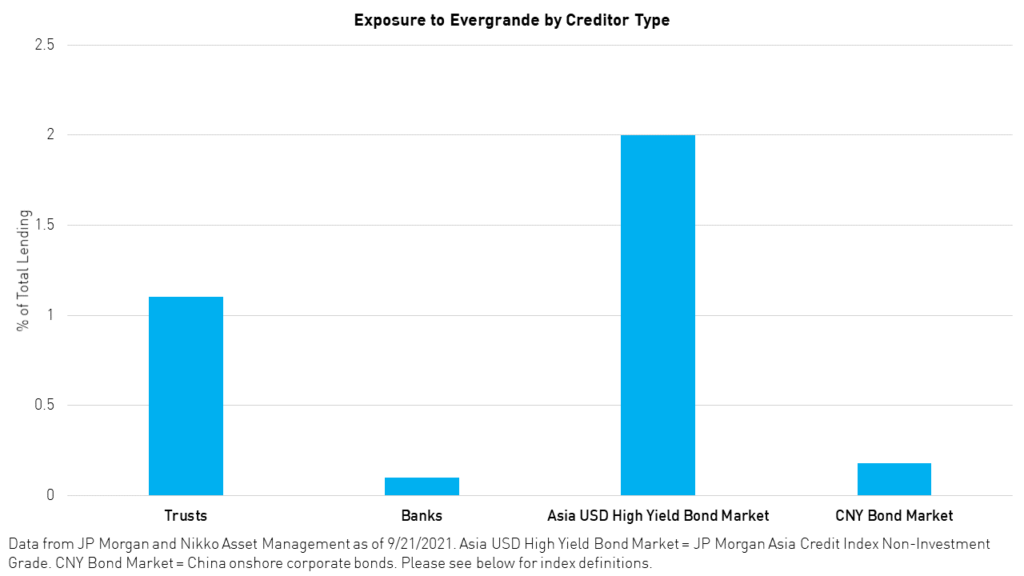

The CNY-denominated bond market is little exposed to Evergrande’s debt while the USD-denominated bond market in Asia is more exposed, at 2% of high yield.

Evergrande made a $35.9 million coupon payment to CNY bondholders on Thursday, September 22nd. However, the firm still has $700 million in payments due through January, mostly to USD bondholders. The company will have to negotiate with USD creditors to make these payments in order to stave off a default.

We believe that neither a disorderly default nor a complete government bailout are likely. The most likely outcome is a government-facilitated debt restructuring, which appears to already be underway. The government has stressed that Evergrande’s debt should be resolved through a market-oriented approach while preventing systemic risks in the process and ensuring stable operations at Evergrande’s projects. While the government will not guarantee Evergrande’s debt, it will facilitate restructuring and bankruptcy proceedings. All legal proceedings against the company have already been centralized in a court in Guangzhou. Furthermore, the government is corralling banks to form a creditors’ union.

Takeaways

Evergrande’s story is intertwined with the story of China’s ongoing economic transformation. Investors in emerging markets often lean on real estate to passively capitalize on a high rate of economic growth. However, shifting market dynamics are causing China’s savings mix to increasingly resemble a developed market. Evergrande’s recent trouble is a symptom, not a cause, of this new reality. China’s future growth will be supported by industries such as internet services, information technology, health care, and consumer products. Furthermore, China’s public will be taking advantage of investing in growing companies, not only housing, as seen in traditional developed markets.

The restructuring of Evergrande will be an important test for China’s still developing bankruptcy laws. If successful, the government’s actions here will serve as an example for future cases and even other Asian governments with fledgling bankruptcy and default provisions.

Impact on Asia High Yield

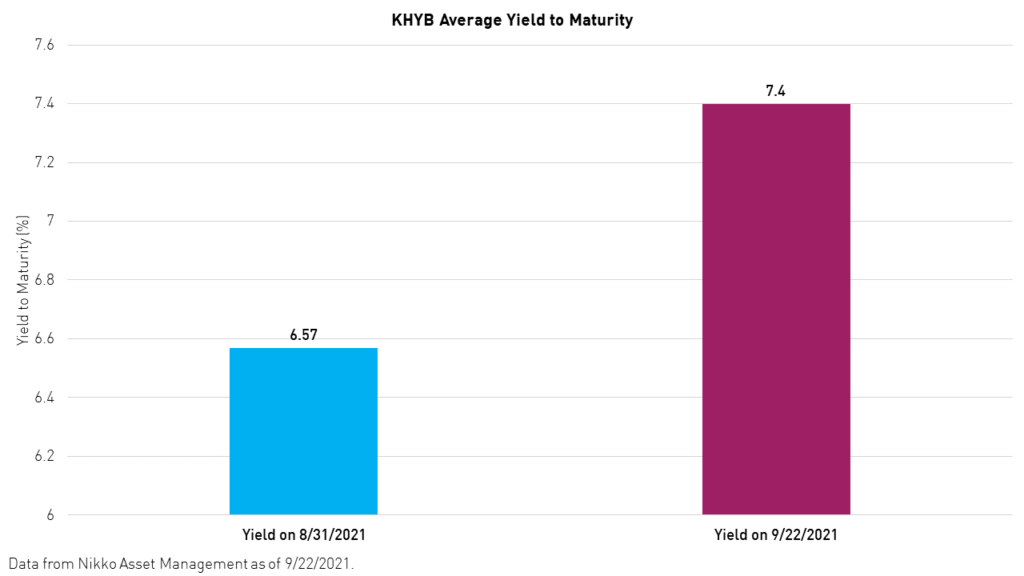

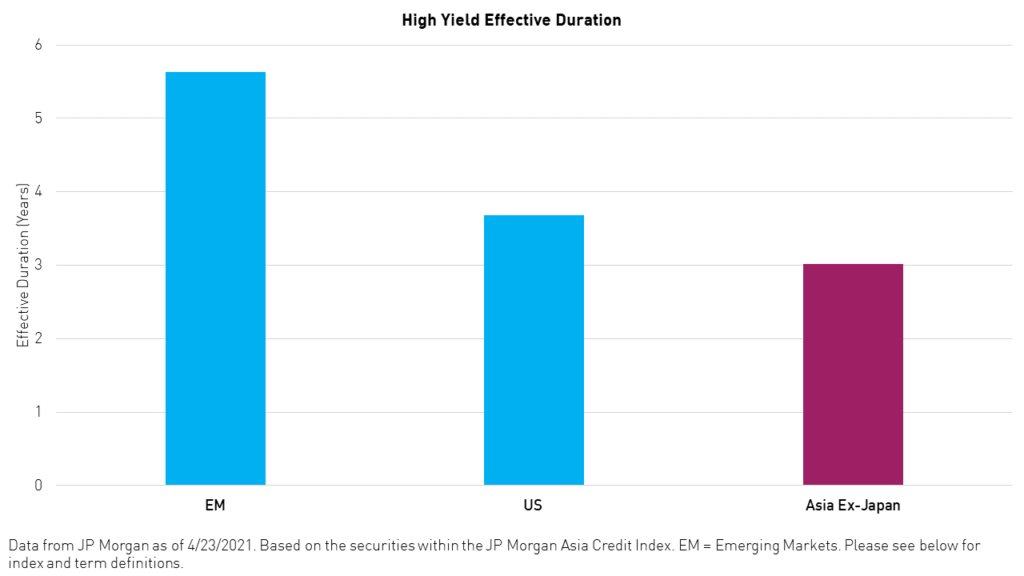

The Evergrande moment may present an attractive entry point into the Asia high yield bond market because risk controls are tightening at the same time yields have been driven up. This compounds the existing benefits of Asia high yield, which include high relative yields and lower duration.

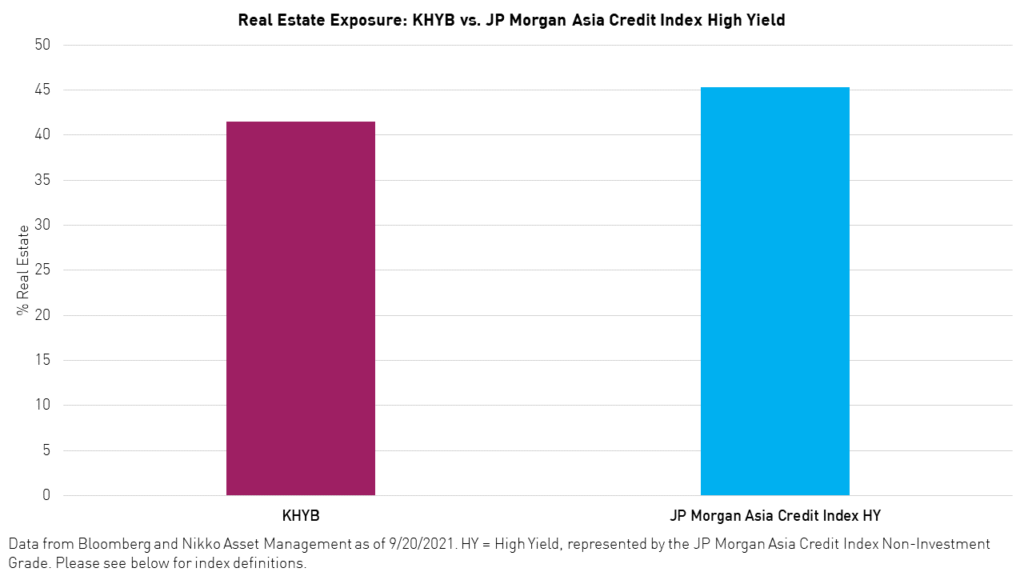

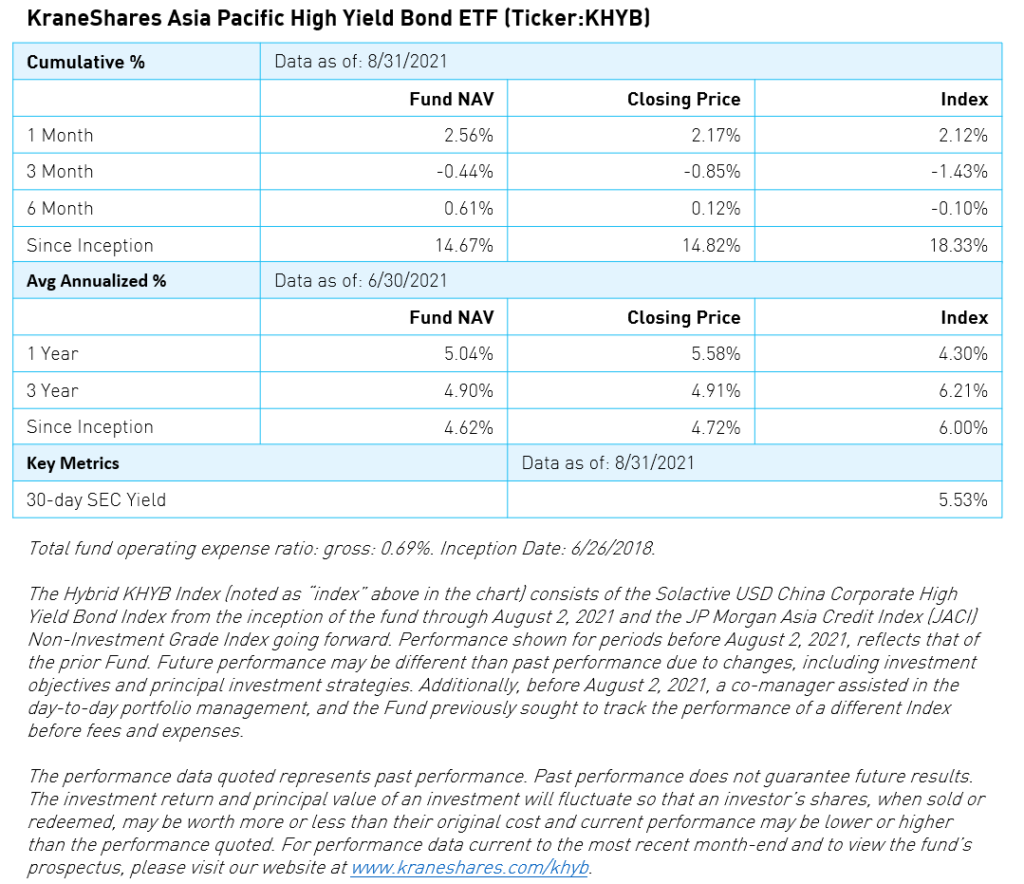

Recently, we partnered with Nikko Asset Management to launch the KraneShares Asia Pacific High Yield Bond ETF (Ticker: KHYB). The fund is actively managed by veteran fund manager Wai Hoong Leong from Nikko. While the fund does not hold any bonds issued by Evergrande, it does maintain exposure to the real estate sector across economies in Asia ex-Japan, including China, though that exposure is currently lower than the benchmark.

The fund’s average yield to maturity has spiked over the past month as debt issued by property developers sold off.

The systematic risk implications from Evergrande as well as a tightening policy environment may cause Asia high yield managers to move up the credit scale and down the duration scale to reduce risks, at least in the real estate sector. This strategic repositioning may expose opportunities in other sectors within Asia high yield, such as industrials, utilities, banks, and government-sponsored entities.

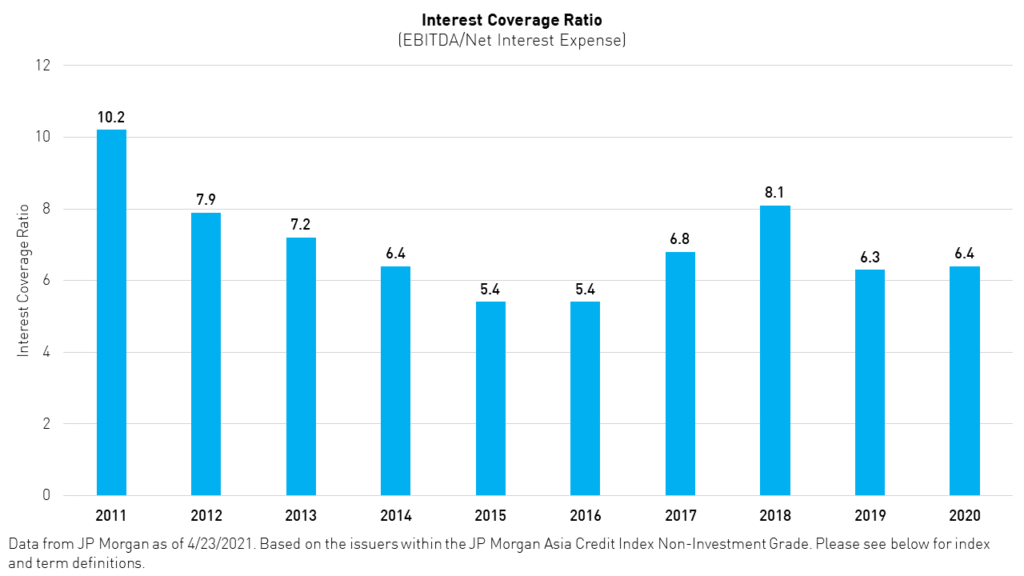

Furthermore, the seismic disruption presented by Evergrande in China may cause yield-seeking fixed-income investors to rotate to other Asian nations for real estate or other sector exposures. Paradoxically, Asian issuers are especially solvent. Overall, interest coverage ratios of high yield issuers in Asian countries are relatively high at 6.4x, on average, while an interest coverage ratio of 3x is, generally speaking, enough to convince a lender that a business can meet its debt obligations.

Asia high yield also offers lower durations than other high yield markets, which means less risk. Over the past ten years, Asia Ex-Japan high yield bonds have offered an average yield of over 7% and currently offer an effective duration of only 3 years, compared to over 5 years for emerging markets.

Most crucially, Asian real estate developers and their creditors alike may have learned a valuable lesson from the restructuring of Evergrande. Both will likely enhance their risk management practices as a result. Fortunately for many issuers in Asia, they will be starting from a base of already strong fiscal management.

Conclusion

Evergrande’s restructuring was a long-time coming and is a symptom, rather than a cause, of China’s ongoing economic transformation. While the developer’s uncertain future has sent shockwaves through global commodity, fixed income, and equity markets, it may ring in a new age of Asia investing. For Asia high yield, the event may cause yields to rise for low duration bonds issued by relatively solvent issuers, representing a unique opportunity for investors.

Citations

- Bloomberg Businessweek. “Evergrande Debt Crisis Is Financial Stress Test No One Wanted,” Bloomberg. July 22, 2021.

- Data from CICC Research as of February 9, 2021.

- Data from World Federation of Exchanges as of January, 2021.

- Wilson, Barry. “Xi Jinping says houses are ‘for living in, not speculation’. But is Hong Kong listening?” South Morning Post. November 12, 2017.

Definitions:

Effective Duration: Effective Duration is a duration calculation for bonds that have embedded options. This measure of duration considers the fact that expected cash flows will fluctuate as interest rates change and is, therefore, a measure of risk.

High Yield: The term ‘high yield’ refers to the quality of a company’s credit. To be considered a high yield issue, the company must be rated lower than ‘BBB’ by Standard and Poor’s or Moody’s. Anything ‘BBB’ or above is considered investment grade.

Interest Coverage Ratio: A debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. The interest coverage ratio may be calculated by dividing a company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) by its interest expense during a given period.

China CNY Onshore Bond Market: All debt securities traded publicly in China and denominated in Renminbi (RMB or CNY), the official currency of the People’s Republic of China.

Index Definitions:

JP Morgan Asia Credit Index Non-Investment Grade: The J.P. Morgan Asia Credit Index Core (JACI Core) consists of liquid US-dollar denominated debt instruments issued out of Asia ex-Japan. The JACI Core is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market-capitalization-weighted. JACI Core includes the most liquid bonds from the JACI by requiring a minimum $350 million in notional outstanding and a minimum remaining maturity of 2 years. JACI Core also implements a country diversification methodology. Historical returns and statistics for the JACI Core are available from December 30, 2005. The non-investment grade version of the index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P.