Biden’s Summit on Climate, Carbon Pricing Update & New Carbon Markets

By Eron Bloomgarden, Partner at Climate Finance Partners

April was a busy month for climate policy and carbon markets. Coinciding with Earth Day, President Joe Biden hosted 40 world leaders on April 22nd and 23rd for the “Leaders Summit on Climate.” The goal of the summit was to underscore the urgency and economic benefits of climate action.

President Biden told summit participants that countries that take decisive action now would reap the economic benefits of a clean energy future. Showing the United States’ resolve to address the climate crisis and commitment to climate action, President Biden submitted a new “Nationally Determined Contribution” (NDC) under the Paris Agreement, setting an economy-wide emissions target to reduce emissions 50-52% below 2005 levels by 2030. NDCs, which are at the core of the Paris Agreement, are emissions reduction goals established by each participating country.

Beyond the United States, leaders participating in the summit noted the need to accelerate decarbonization. Announcements included:

- The European Union is putting into law a target of reducing net greenhouse gas emissions by at least 55% by 2030 and a net-zero target by 2050.

- The United Kingdom will embed in law a 78% GHG reduction below 1990 levels by 2035.

- China indicated that it would join the Kigali Amendment, strengthen the control of non-CO2 greenhouse gases, strictly control coal-fired power generation projects, and phase down coal consumption.

Carbon emissions pricing was a key theme of the summit as it is a fundamental component to many countries achieving their reduction goals. It is considered one of the most important tools for systemic change to reduce carbon emissions.

Update on KRBN's Carbon Market Exposure

European Union Emissions Trading System (EU ETS)

EU carbon allowances (EUA) consolidated the spectacular gains of the first ten weeks of 2021, ending March at €42.55/ton (~$51.40 USD), up 30% so far this year. The benchmark December 2021 futures contract, KRBN’s leading investment, rose to a new all-time high of €43.77/ton (~ $52.87 USD) mid-month before settling back in the €40-42/ton range (~$48- $50.75 USD).1

The European Commission published preliminary data on verified emissions for 2020, showing a 12.6% drop from 2019. The decrease was due mainly to the effects of the Covid-19 pandemic, but also to the continuing shift away from coal in the power sector.

April 30th marks the height of the European market's annual compliance cycle when industrial installations and power stations buy any remaining allowances to match their verified emissions.

Industrial companies, particularly smaller ones, are less likely to buy allowances throughout the year. Instead, they wait until their audit is complete before entering the market. As a result, the EUA market was well-supported in March, with strong buying interest emerging whenever prices sank towards €40/ton (~$48.33 USD).

At the same time, however, coal-fired utilities have been holding back from the market as current carbon and power prices mean that coal-based electricity isn’t profitable. Instead, more natural gas-fired power is coming online, particularly in more coal-reliant member states like Poland, Romania, and the Czech Republic. This will maintain demand for carbon, as regulators look to shrink the pool of available permits going forward.

That hasn’t stopped the market’s broader appetite for carbon, either. Investment funds continued to build their long positions in EUAs. According to Commitment of Traders data supplied by ICE Futures, funds increased their positions by around 2 million EUA over the course of March.

Once the annual compliance cycle comes to a close at the end of April, the market will focus its attention on the regulatory process. The European Commission, which regulates the EU ETS, will table proposals to underpin the EU’s ambition to achieve net-zero emissions by 2050. This will involve recalibrating the market to achieve a 55% to 60% cut in CO2 from 1990 levels by 2030. The current target is a 40% reduction.

The Commission will table a wide-ranging set of reforms to the EU ETS, which may include a one-time re-basing of the cap, more aggressive management of the market surplus and, a widening of the ETS to include emissions from transportation and buildings.

California Cap-and-Trade System (CCA)

California allowance prices were largely unchanged throughout the course of March: the benchmark December 2021 futures contract slipped just $0.08 to end the month at $18.51/ton.1 The flat trading suggested traders were considering bearish indicators, such as the continuing impact on emissions of the Covid pandemic, as well as the likelihood that the Air Resources Board will add an additional 10 million carbon allowances to the next auction on May 19th.

The extra carbon allowances will be added to the next auction after the last two sales sold out, allowing California to begin emptying its bank of unsold allowances.

Despite the additional supply, analysts remain optimistic that the overall picture remains bullish, as they expect emissions in 2022 to exceed the total number of allowances auctioned and issued. This will help draw down some of the surplus allowances in the market and boost prices.

Washington state’s legislature has passed a cap-and-trade bill that would align a new state-wide system with the Californian market. The “Climate Commitment Act” (Senate Bill 5126) calls for a cap-and-trade system to cover about 100 entities, currently accounting for around 75 percent of statewide emissions, through 2050. Many of the draft elements of the new market are designed to link seamlessly with California’s system.

Regional Greenhouse Gas Initiative (RGGI)

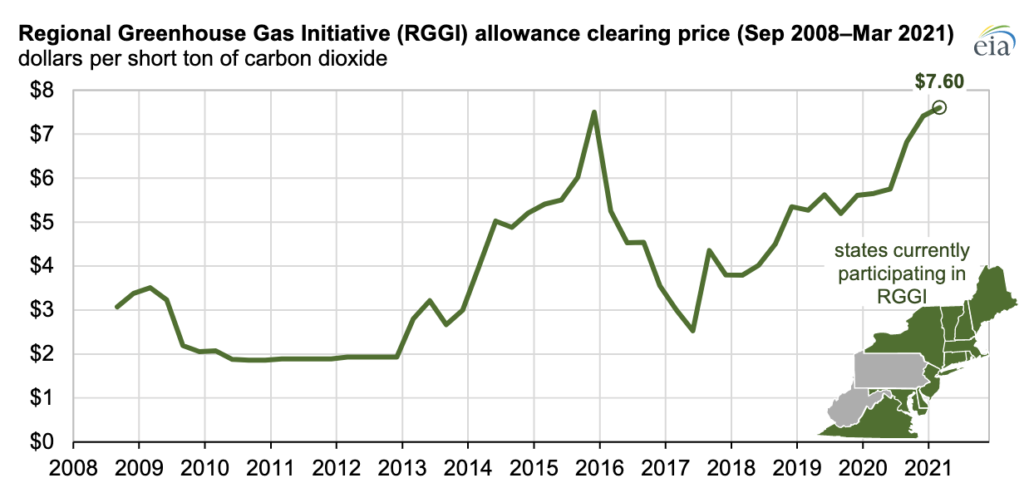

RGGI’s first auction of the year set a new record, with the March 3rd sale clearing at $7.60/short ton, beating the existing record from 2015 by 10 cents.2 States can reinvest the proceeds from these auctions in consumer benefit programs to improve energy efficiency and accelerate the deployment of renewable energy technologies in the electric power sector. Nevertheless, the auction result disappointed as prices had been significantly higher, trading above $8/short ton in the run-up to the sale.

The auction data showed that compliance entities bought fewer allowances than at any time since mid-2018, and the much-anticipated surge of buying from utilities in Virginia, which joined the market this year, did not materialize as many new entrants had already started buying last year.

As a result December 2021 RGGI prices declined by around 50 cents or nearly 6% during March, ending the month at $7.98/short ton. Some of the weakness was offset by the news that the regulator will reduce auction volumes by 95 million allowances over the next five years. The cut represents a decrease in auction supply of 16% in 2021, rising to 18% in 2025.

RGGI published an updated allocation table for 2021 in mid-March, which showed that the adjustment will remove 19 million RGAs from the total supply this year.

New Carbon Markets

2021 is proving to be a bullish year for carbon pricing as a number of new or revamped markets boost the share of global emissions that are regulated.

Cap-and-trade is growing in popularity, with 24 national and sub-national markets currently in effect and 19 more markets in the development or consideration process.

2021 has already seen three new markets launched, in China, the UK, and New Zealand.

China

China has launched the first phase of its national emissions trading system, in which more than 4.3 billion tons of emissions from the country’s more than 2,000 power plants will be regulated. The country presently accounts for around 28% of global greenhouse gas emissions, according to the International Energy Agency.

China’s ETS will not place an absolute limit on emissions in the first phase. Instead, it sets a carbon intensity benchmark – emissions per unit of output – for all coal-fired power plants. In this way, total emissions may increase until the government sets a hard cap on CO2.

Allowances will be issued to power plants based on their benchmarks and can be traded. Regulators are currently finalizing some of the technical rules governing trading of allowances, with prices expected to start at around $6/ton, according to experts.

The focus in the first phase is on setting up the systems for reporting emissions and familiarizing companies with the regulations and procedures, according to most observers. Prices and market activity are expected to pick up significantly once the government has set an upper limit on emissions and a gradual decrease in that cap every year.

United Kingdom

The United Kingdom is also launching its new emissions trading system to replace the EU ETS after it left the EU in January 2020.

The UK ETS has been deliberately designed to resemble its larger neighbor market to facilitate linking between the two at a future date. The UK’s system will begin auctioning UK allowances (UKAs) for power generators in May, and will issue free permits to trade-exposed heavy industries like steel and cement in the second quarter.

ICE Futures has been selected as the auctioneer for UK allowances, and the exchange will also list futures contracts as it already does for EU allowances.

UKA prices are expected to start trading at an equivalent Sterling value to EUAs, since many UK utilities have continued buying EU allowances to cover their emissions since January in the absence of UK permits.

New Zealand

New Zealand has also revamped its emissions market, setting a hard cap on emissions for the first time since the system started in 2008.

The government has set a limit on total emissions from sectors covered by the New Zealand ETS of 40 million tons a year between 2021 and 2025

The system will issue 9 million New Zealand Units (NZUs) free of charge to covered installations in addition to auctions of allowances. The first such sale took place on March 17, at which 4.75 million NZUs were sold at NZ $36/ton (~$25.73 USD).3

CO2 from all sectors of the economy has grown since the 1990 baseline, with transport emissions more than doubling, manufacturing rising by 34% and domestic aviation up 18%. Only electricity generation showed a decrease, with overall power emissions dropping 5.5% from 1990 levels.4

- Data from Intercontinental Exchange

- Data from www.rggi.org

- Ministry for the New Zealand Environment, https://www.etsauctions.govt.nz/public/auction_noticeboard

- Ministry for the New Zealand Environment, New Zealand’s Greenhouse Gas Inventory 1990-2019 Snapshot