Choosing The Right China Tech ETF: KWEB & KTEC

Investors seeking exposure to China’s dynamic technology sector are faced with a critical choice: which China Tech ETF best captures the country’s innovation and growth potential? KraneShares offers two options, the KraneShares CSI China Internet ETF (Ticker: KWEB) and the KraneShares Hang Seng TECH Index ETF (Ticker: KTEC), each with a different approach to China’s emerging tech story.

Performance

The start of 2025 brought a significant turning point for China’s technology sector. In January, Chinese artificial intelligence (AI) startup DeepSeek unveiled a breakthrough large language model that rivaled top U.S. offerings at a fraction of the cost. This announcement sent shockwaves through global markets, causing a sharp selloff in U.S. tech stocks and sparking a dramatic rerating of Chinese tech companies.

It also led investors to question whether they were overpaying for U.S. tech exposure and to reconsider the valuation gap between U.S. and Chinese technology firms. Prior to the news, U.S. tech stocks traded at 31.6x forward earnings, while their Chinese counterparts traded at just 13.1x.1 These numbers currently stand at 30.3x and 14.3x forward earnings.2 The DeepSeek announcement was a potential catalyst for renewed optimism and the beginning of an uptrend in Chinese equities.

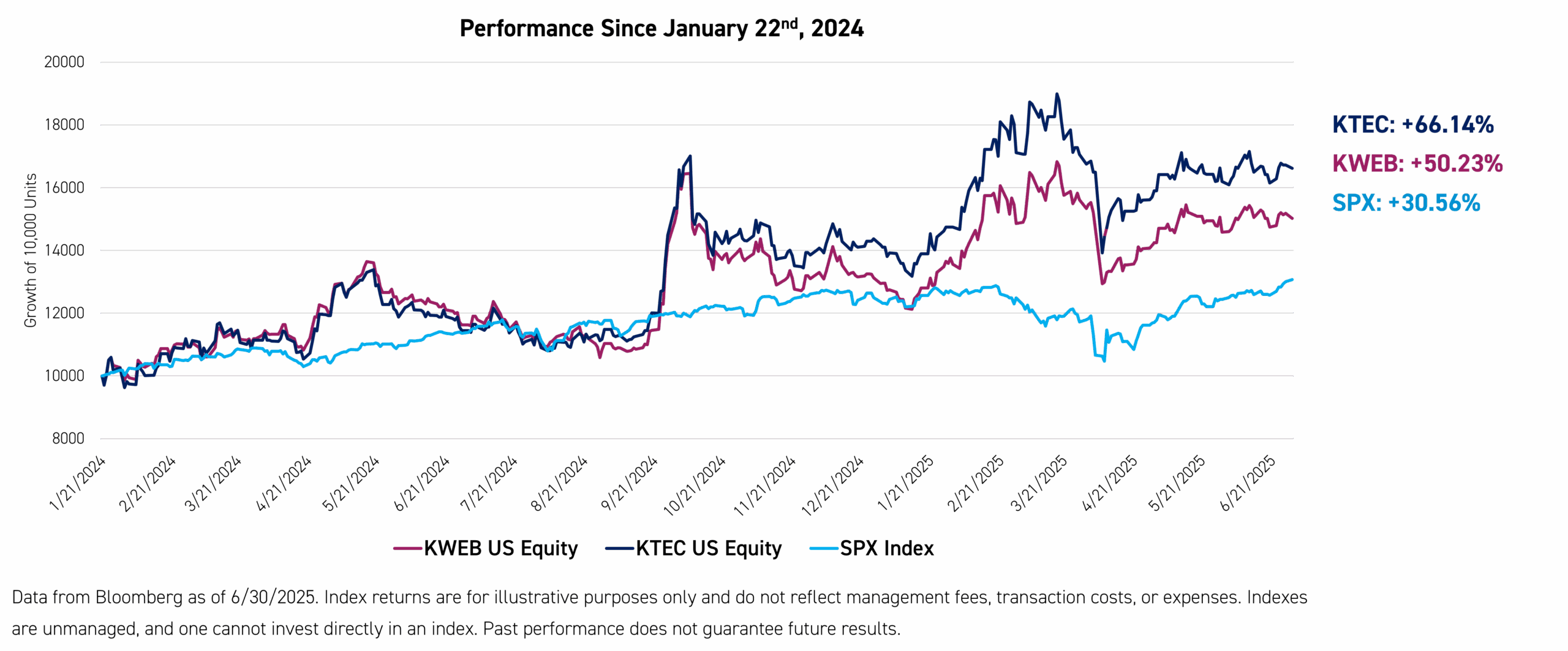

KWEB and KTEC’s year-to-date performance reflects this positive momentum. From the start of 2025 through June 30, 2025, KWEB and KTEC returned 16.01% and 17.85%, respectively, compared to a 6.16% gain in the S&P 500 Index over the same period.3

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit https://kraneshares.com/etf/kweb and https://kraneshares.com/etf/ktec.

However, we believe the uptrend began a year prior to DeepSeek’s breakthrough. In January 2024, China’s capital markets suffered a sharp downturn triggered by the widespread knock-in of “snowball” derivatives.* These specific derivatives are structured financial products that forced brokers to sell large amounts of stocks and index futures when certain price levels were breached.

China’s government responded with sweeping stimulus measures, including liquidity injections, interest rate cuts, and support for stock buybacks, to stabilize markets and restore investor confidence. From the market bottom on January 22, 2024, through June 30, 2025, KWEB and KTEC returned 50.23% and 66.14%, respectively, compared to a 30.56% gain in the S&P 500 Index.3 This recovery was a signal many investors were potentially waiting for to add China exposure back into their portfolios.

Why KWEB and KTEC Stand Out

When analyzing a China tech ETF to choose, we believe looking at the underlying index is important. Some China tech ETFs follow legacy sector definitions that can result in conspicuous omissions in their holdings. For example, prior to the Global Industry Classification Standard (GICS) reclassification in 2018, E-Commerce and internet platforms were grouped with hardware and chip-makers in the information technology (IT) sector.

The reclassification split these companies into consumer discretionary and communication services, leaving the IT sector with mostly hardware firms. As a result, some major indexes now exclude China’s top tech companies like JD.com and Alibaba, which are classified outside of IT. This means that investors in China tech ETFs that did not adopt the new GICS classification may miss out on China’s most important growth names.

KWEB and KTEC are different. Both funds track indexes that reflect the new GICS classifications, ensuring extensive exposure to the most dynamic segments of China’s tech market. This approach allows investors to capture many of the growth drivers of China’s digital economy, rather than legacy or exclusively hardware-focused names.

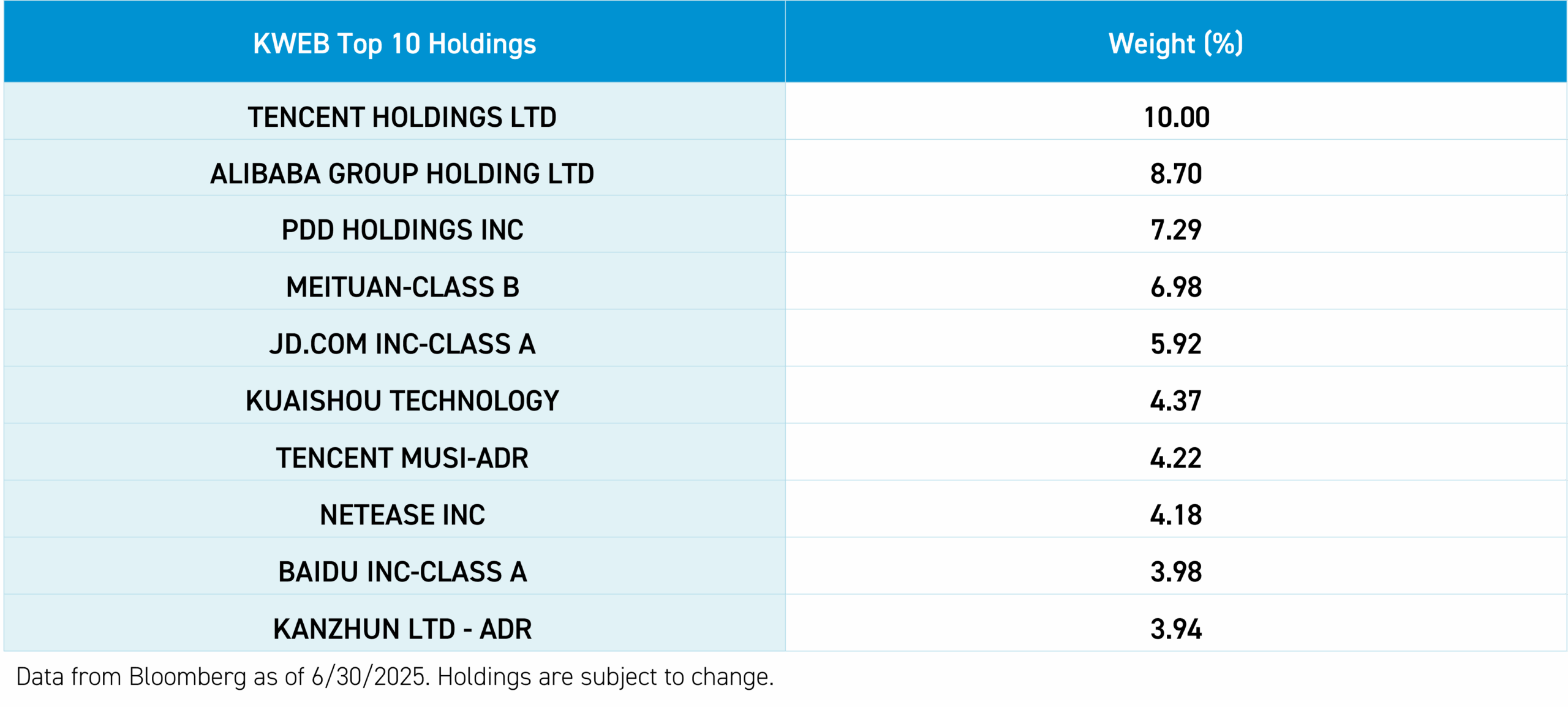

The Growth Story Behind KWEB

KWEB is designed for investors who want to tap into the emerging growth of China’s internet and platform economy. Over the past decade, China has witnessed a digital transformation, with companies like gaming leader Tencent, E-Commerce giants Alibaba, PDD, and JD.com, and delivery company Meituan, altering how people shop, communicate, and consume entertainment. KWEB provides access to these internet companies, positioning investors to benefit from rising consumer demand and technological innovation.

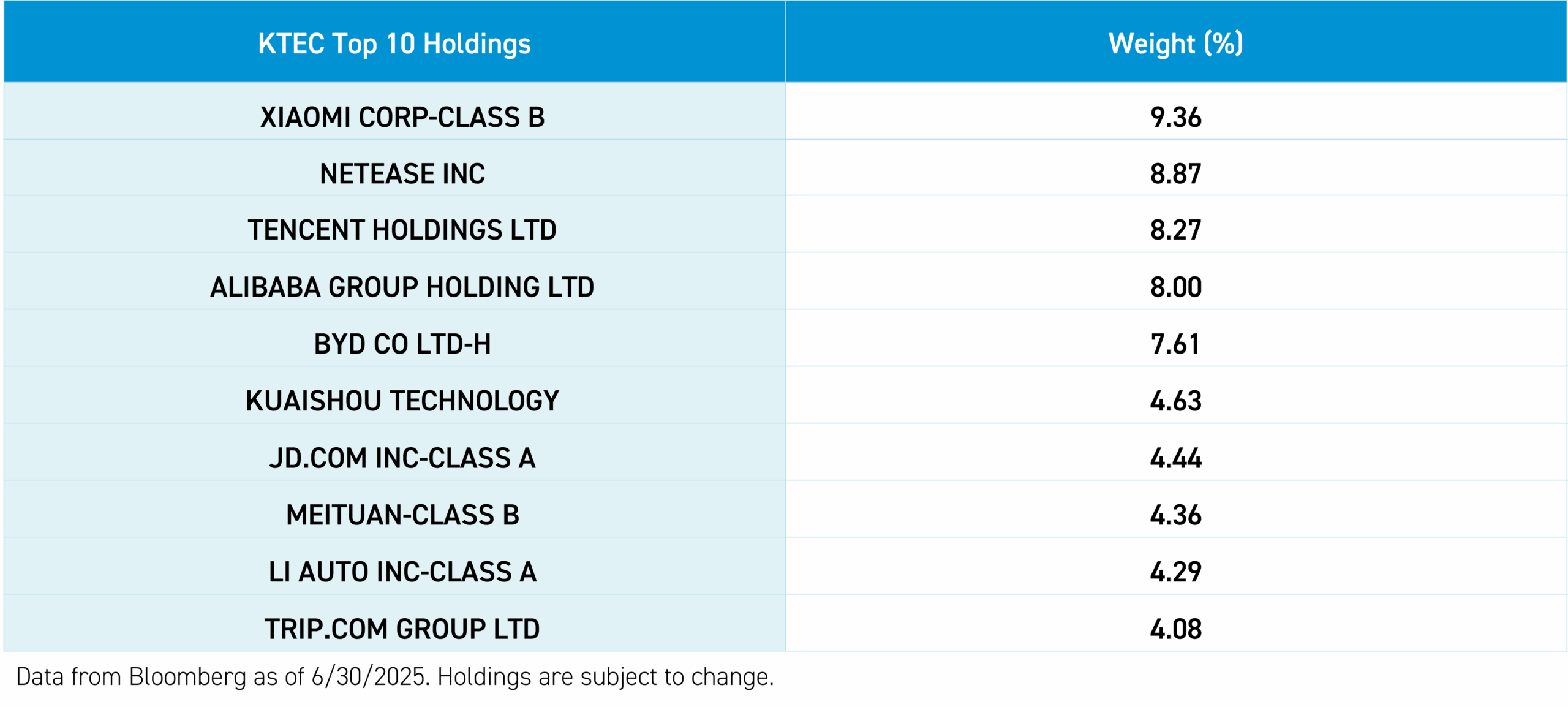

The Growth Story Behind KTEC

KTEC tracks the Hang Seng TECH Index which offers a different angle on China’s tech evolution by focusing on the most innovative technology companies listed in Hong Kong. This fund captures the next wave of tech leaders driving advancements in cloud computing, fintech, 5G, and electric vehicles. With top holdings like smart technology company Xiaomi, gaming leaders NetEase and Tencent, E-Commerce giant Alibaba, and electric vehicle maker BYD, KTEC provides exposure to companies that are shaping China’s future and making a global impact.

Key Takeaways:

- KWEB provides exposure to China’s internet giants and the expansion of the digital economy.

- KTEC provides access to Hong Kong’s innovative tech companies and the next generation of technology leaders.

- Both funds are compelling options for investors seeking to access China’s technology growth story.

For KWEB standard performance, risks, and other fund information, please click here.

For KTEC standard performance, risks, and other fund information, please click here.

Citations:

- Data from FactSet as of 12/31/2024.

- Data from FactSet as of 6/30/2025.

- Data from Bloomberg as of 6/30/2025.

*Snowball derivatives are structured financial products that pay investors regular, bond-like coupons as long as the underlying stock index stays above a set “knock-in” level. If the index falls below this threshold, the product’s structure changes, often requiring brokers to unwind hedging positions by selling related assets. This forced selling can accelerate market declines and increase volatility, especially in already weak markets. While snowballs can offer attractive returns in stable conditions, they carry significant downside risk when markets fall.