KHYB: Adding Growth and Income to Your Bond Strategy

By Henry Greene, Investment Strategist

Asia high yield currently offers an attractive income opportunity due to the relatively high growth rates among the region’s economies and the financial health of issuers in the region. However, this opportunity has been compounded by the recent restructuring of Evergrande, China’s second-largest real estate developer. The average credit rating among the issuers within the KraneShares Asia-Pacific High Yield Bond ETF (Ticker: KHYB) is BB.1 However, many of the fund’s holdings are currently trading at distressed levels, offering the opportunity to earn some price returns on top of its coupon payment.

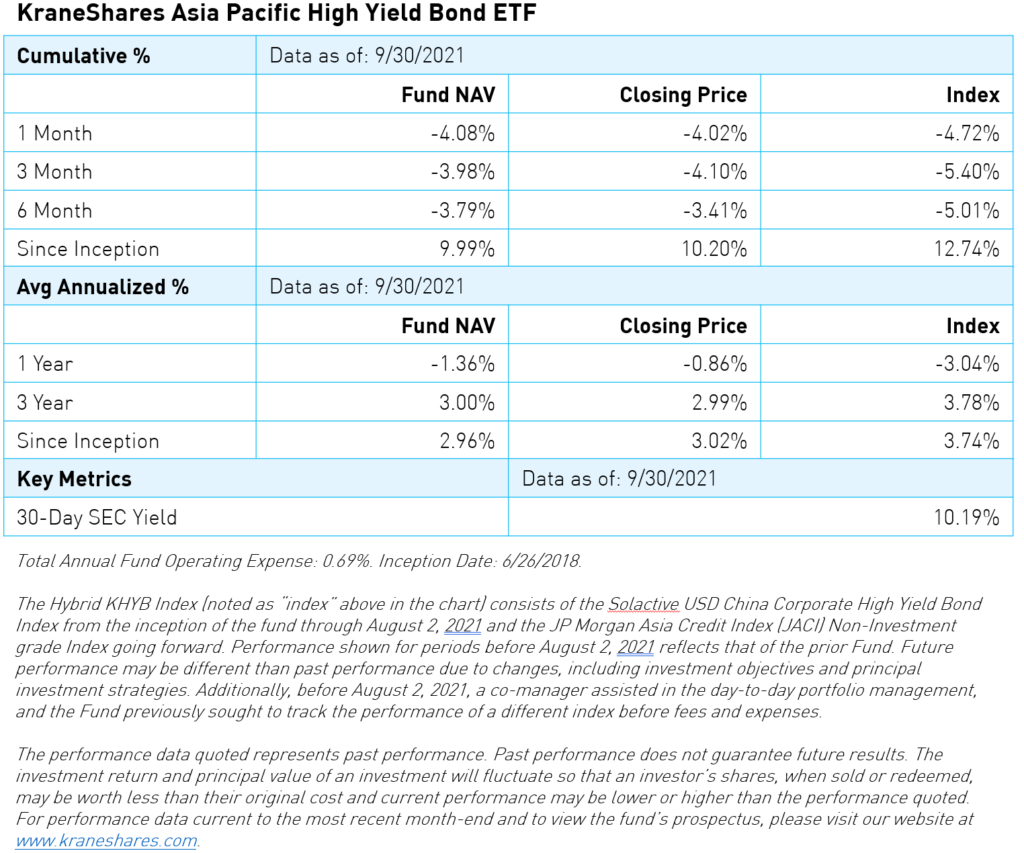

KHYB, which is actively managed by Nikko Asset Management, currently has an average yield to maturity of approximately 10%1 compared to the JP Morgan Asia Corporate Credit Non-Investment Grade Index’s 8%.2 The fund’s annualized distributed yield is 7.74% based on the most recent month.3 After lowering their exposure to the sector in August, portfolio manager Wai Hoong Leong and his team have recently re-deployed cash into quality China real estate issuers.

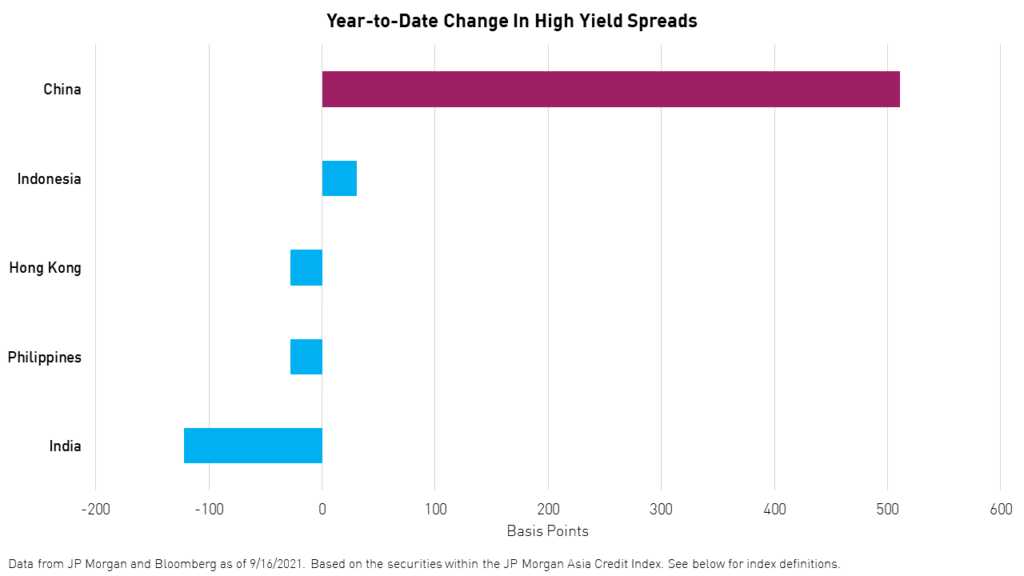

Spreads have widened, but run-up in risk was limited to China.

Year-to-date, spreads in the Asia high yield bond market have risen by +122 basis points overall. However, the spike can be primarily attributed to moves in China. Meanwhile, spreads in India, the Philippines, and Hong Kong have fallen by -122, -28, and -28 basis points, respectively.

Evergrande’s impact has created a rare yield opportunity.

Evergrande’s troubles represented a spread-widening event for Asia high yield. The downgrading of certain issuers has created an opportunity to achieve potential strong price returns on top of the fund’s monthly distribution. Although the fund’s average credit rating is BB,1 given the risk event presented by Evergrande’s restructuring, some of the fund’s holdings are currently trading at distressed levels.

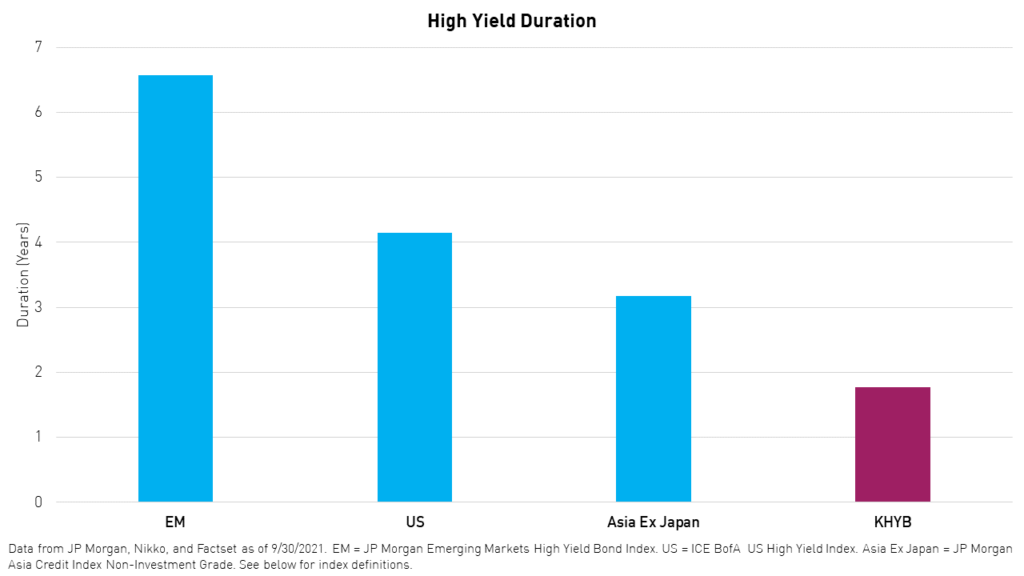

We believe KHYB is well-positioned for a rising rate environment.

Global fixed income investors are bracing for Fed tapering as early as next month in the wake of mounting inflation pressures. Against this backdrop, we believe Asia high yield bonds can provide meaningful income generation and less interest rate risk compared to US and other high yield markets. For KHYB, duration is low, at 1.77 years, compared to 4.15 for the US high yield benchmark and 3.17 for the Asia ex-Japan benchmark. KHYB’s lower duration means less interest rate risk.

The US Federal Reserve has indicated that they may begin dialing back asset purchases as early as November, which may push rates higher in the short term. While we believe the market is already pricing in an aggressive rising rate cycle, it may take until 2023 to see the first rate hike in the US.

Meanwhile, on the other side of the Pacific, central banks in Thailand, Malaysia, Indonesia, and the Philippines left policy rates unchanged in September. At the same time, 2021 inflation is expected to be softer in many East Asian economies than in the United States. Furthermore, China, which makes up 50% of KHYB1, has signaled the end of its tightening cycle and may pursue easing in the near term. This means that China corporate high yield bonds may remain attractive compared to investment grade and government bonds, yields on which may stagnate or fall in the near to medium-term.

Conclusion

We believe KHYB currently offers an attractive income opportunity that has been compounded by the risk event of Evergrande’s restructuring. In addition to the fund’s coupon payment, investors may benefit from a substantial price return on bonds currently trading at distressed levels. Furthermore, the fund’s low average duration and significant exposure to China, which is unlikely to taper in the near term, mean it is well-positioned for a rising rate environment.

This material must be preceded or accompanied by a current prospectus. Investors should read it carefully before investing or sending money.

Citations:

- Data from Nikko and Factset as of 9/30/2021.

- Data from JP Morgan as of 9/9/2021.

- Data from KraneShares as of 10/29/2021.

Definitions:

Average Yield To Maturity: Yield to maturity is a measure of the return an investor can expect from holding a bond to maturity. Average yield to maturity is the weighted average of the yield to maturities of all the bonds held in the fund.

Duration: Duration measures how long it takes, in years, for an investor to be repaid the bond’s price by the bond’s total cash flows. Duration can fluctuate based on interest rates, thus it is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

30-Day SEC Yield: The SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund's filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund's expenses.

Index Definitions:

JP Morgan Asia Corporate Credit Non-Investment Grade Index: The JP Morgan Asia Corporate Credit Non-Investment Grade Index consists of liquid US-dollar denominated debt instruments issued out of Asia ex-Japan. It is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market-capitalization-weighted. The index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P.

JP Morgan USD Emerging Markets High Yield Bond Index: The JP Morgan USD Emerging Markets High Yield Bond Index tracks liquid, US Dollar emerging market fixed and floating-rate debt instruments issued by corporate, sovereign, and quasi-sovereign entities. The index tracks instruments that are classified as non-investment grade (HY) in the established JP Morgan EMBI Global Diversified Core and JP Morgan CEMBI Broad Diversified Core indices and combines them with a market capitalization-based weighting. The returns and statistics are available since December 2011.

ICE BofA US High Yield Index: The ICE BofA US High Yield Index provides a comprehensive, accurate representation of the US high yield market and its components.

r-ks-sei