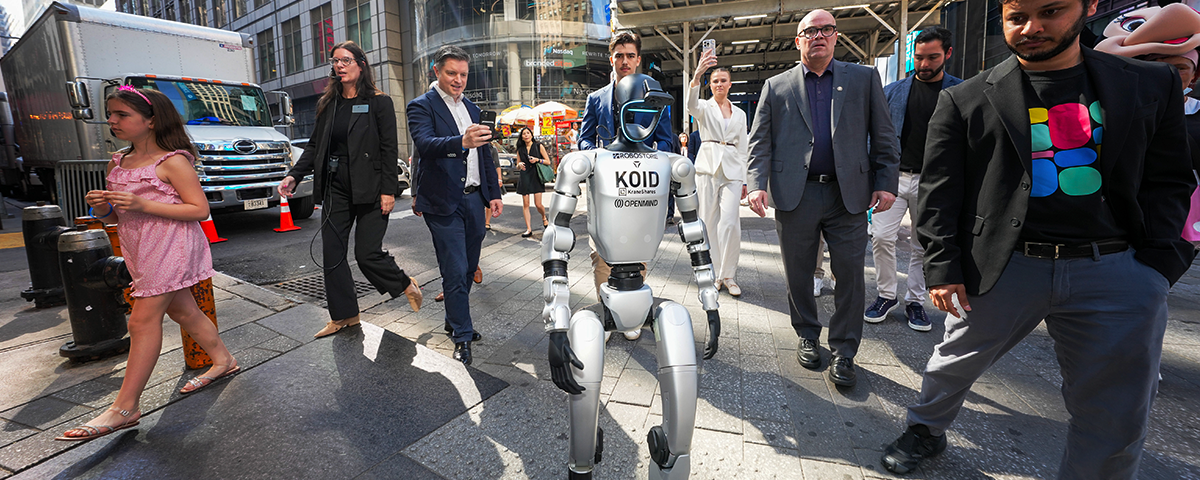

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

View More >

KSTR: Getting Exposure to China’s IPO Market

KSTR: Getting Exposure to China’s IPO Market

View More >

KCCA: Targeted Carbon Exposure to California and an Inflation Hedge

KCCA: Targeted Carbon Exposure to California and an Inflation Hedge

View More >

How Can Investors Capture The Humanoid Robotics Investment Opportunity?

How Can Investors Capture The Humanoid Robotics Investment Opportunity?

View More >

KraneShares provides investors access to China, Climate, and Alternative Assets through differentiated, high-conviction investment strategies.

View All ETFs

KraneShares strives to deliver innovative first-to-market strategies developed based on our strong partnerships and deep investment knowledge.

Learn MoreWe pride ourselves in delivering timely, best-in-class investment insights and education on China, Climate, and Alternative Assets. Access our latest research and insights below.

Learn More

Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on the websites linked hereto.

Click here to continue