The World’s Largest Carbon Allowance ETF, Surpasses $500 Million Within First Year of Trading

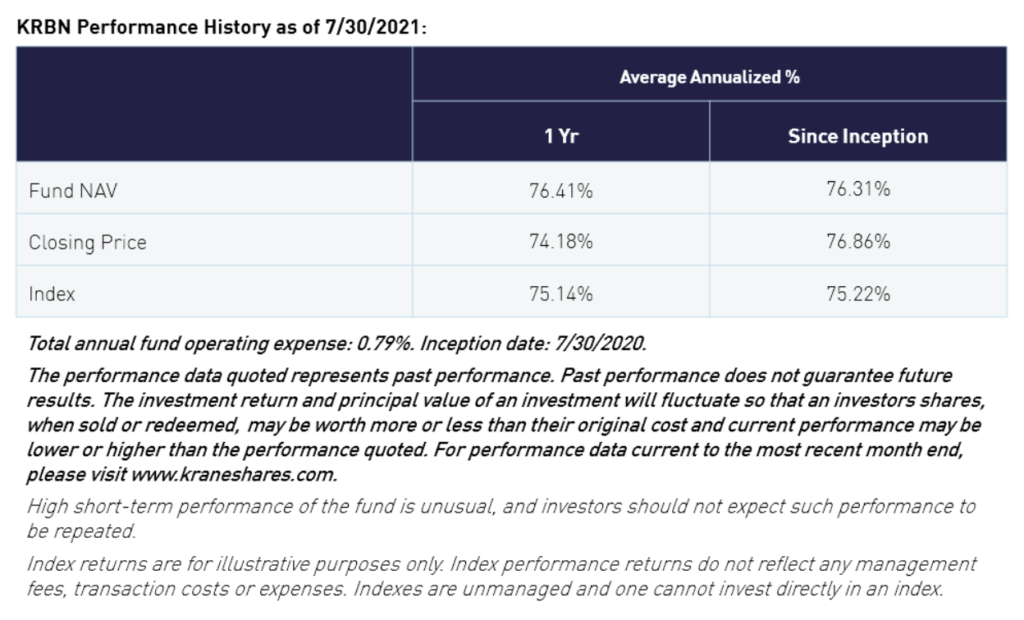

New York, N.Y. August 04, 2021 – Krane Funds Advisors, LLC, ("KraneShares”) an asset management firm known for its global exchange-traded funds (ETFs) and innovative investment strategies, is pleased to announce that the KraneShares Global Carbon ETF (NYSE: KRBN) has surpassed $500 million in assets under management (AUM) within its first year of trading. KRBN is the largest publicly-listed carbon allowance ETF in the world.1 In addition, KRBN recorded 77% return as of 7/31/21.1

“As KRBN reaches its one-year milestone, it has been one of the best-performing strategies since launch,” said Jonathan Krane, CEO of KraneShares. “On top of KRBN’s strong performance, investing in carbon allowances can directly reduce carbon emissions by making it more expensive for companies to pollute – we believe this makes KRBN an attractive impact investment.”

“Economists agree that the best way to reduce emissions and save our planet is through putting a price on carbon,” said Eron Bloomgarden Co-Founder of Climate Finance partners, the non-discretionary subadvisors to KRBN. “We believe that in order for us to stave off the detrimental effects of climate change the price of carbon emissions needs to be higher."

One of the primary goals of the Paris Climate Agreement is to limit global average temperatures to no more than 1.5o Celsius above pre-industrial levels, a widely accepted threshold for averting global climate disaster. The Organization for Economic Co-operation and Development (OECD) sees a central estimate of $147 by 2030 to facilitate net zero emissions by 2050. Currently IHS Markit puts the global price of carbon at $33.85.2

Today, KRBN holds over 15,000 carbon futures contracts3, which represents over 15 million tons of carbon emissions. This is equivalent to the annual emissions of over three million passenger vehicles4 or more cars than there are in the entire state of Michigan.5As KRBN grows, its potential to benefit to the environment increases.

Along with increasing prices for emissions, the global carbon markets are also expanding. The UK launched its own domestic Emission Trading System (ETS) at the end of May and China launched theirs in July.

“While the EU market is 15 years old now, we believe the global carbon markets are only just getting started,” said Richmond Mayo-Smith, Founder at Climate Finance Partners. “Right now is a really exciting time to be an investor in carbon allowances. With KRBN we have democratized access to these historically inaccessible markets.”

KRBN is benchmarked to IHS Markit’s Global Carbon Index, which offers broad coverage of cap-and-trade carbon allowances by tracking the most liquid segment of the tradable carbon credit futures markets. The index introduces a new measure for hedging risk and going long the price of carbon while supporting responsible investing.6 Currently, the index covers the major European and North American cap-and-trade programs: European Union Allowances (EUA), California Carbon Allowances (CCA), and the Regional Greenhouse Gas Initiative (RGGI).

For more information about KRBN, please visit http://www.kraneshares.com/krbn or email [email protected].

About KraneShares

Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. Our suite of China-focused ETFs provides investors with solutions to capture China's importance as an essential element of a well-designed investment portfolio. We strive to deliver innovative, first-to-market strategies developed based on our strong partnerships and deep knowledge of investing. We help investors stay up to date on global market trends and aim to provide meaningful diversification. Krane Funds Advisors, LLC, is a signatory of the United Nations-supported Principles for Responsible Investing (UN PRI). The firm is majority owned by China International Capital Corporation (CICC).

About Climate Finance Partners

Climate Finance Partners (CLIFI) serves as the non-discretionary subadvisor to KRBN. CLIFI delivers innovative climate finance solutions and investment products to address capital needs for emerging environmental challenges. CLIFI is led by a team of investment professionals with deep experience in the fields of traditional investment and environmental finance. The Advisory Board is Chaired by Nobel Laureate, Robert Engle.

Citations

1. Data from Bloomberg as of 7/30/2021

2. Data from IHS Markit as of 7/20/2021

3. Data from StoneXS as of 7/22/2021

4. Data from EPA.gov, Greenhouse Gas Equivalencies Calculator

5. Data from Statista, Number of Registered Automobiles in Michigan in 2016 by Type, retrieved 7/23/20211

6. IHS Markit, “A Global Price for Carbon Emissions”, April 2020