The Outlook for Private Equity in 2025

Man Group’s John Lidington Shares His Views On Key Developments That Could Unfold In The World Of Private Equity This Year

Exit Environment

Prediction – the exit environment will improve for private equity (PE)-backed companies in 2025.

While we expect the exit environment for PE-owned companies to improve, we acknowledge that this might not be that bold a prediction given how sluggish exit activity has been for PE in recent years. It could be said that there is nowhere to go but up!

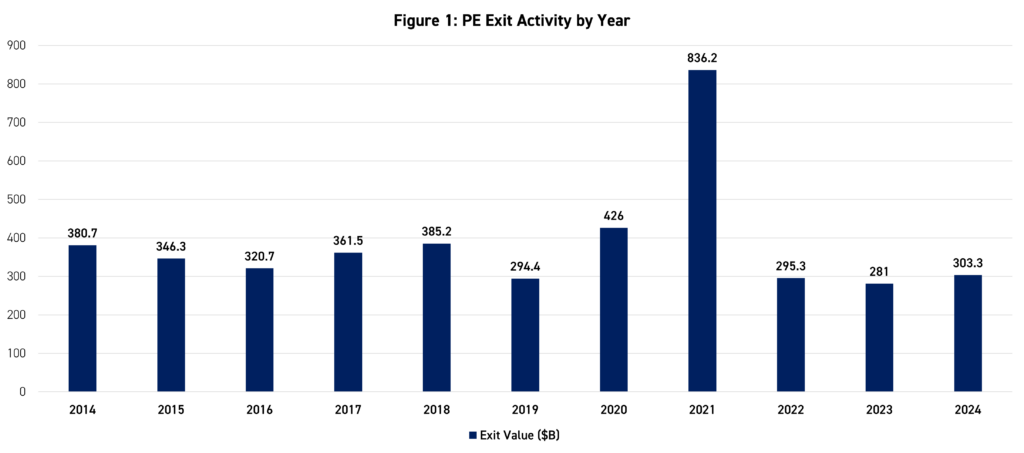

The first thing that jumps out in Figure 1 is that the exit volume of the past three years is a far cry from what it was in 2020 and particularly 2021. 2021 was indeed an all-time great year for exits, and missing that window has been painful for many PE investors.

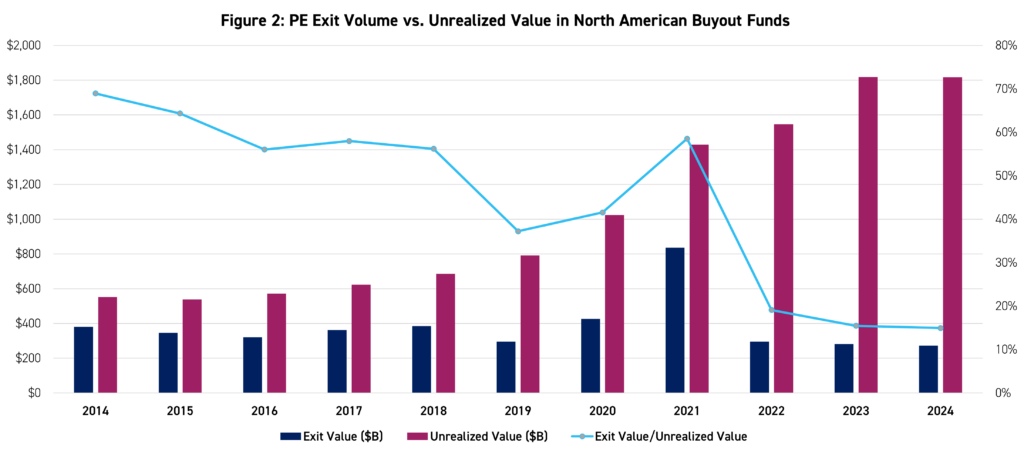

However, these exit volume numbers are not the whole story for this post-2021 plummet. The amount of capital in the asset class has more than tripled in the past decade, from $810 billion at the end of 2014 to $2.47 trillion in 2024. More importantly, the value of PE-owned companies that are available to be sold – but are not yet sold – has also more than tripled in the past decade (Figure 2). This means that the $380.7 billion of exit value in 2014 is not directly comparable to the 303.3 billion of exit value in 2024 since there is triple the amount of capital in buyout portfolios these days, and with more capital invested, one would hope for a greater exit volume than the 2022-24 exit figures that have underwhelmed many limited partners (‘LPs,’ i.e., PE fund investors).

History aside, there is now so much pressure on PE general partners (‘GPs’) to exit their investments, plus a bit of urgency given the uncertainty of future inflation and its impact on interest rates, that we would not be surprised to see a flurry of exits in the coming months.

We expect that PE will continue to exit its more attractive assets first since they can fetch better valuations and these companies presumably won’t require large markdowns from the valuations at which they’ve been held on the books, but the increase in exit activity could spread to less successful investments as well. If the PE industry can realize enough favorable exits that can salvage the returns of heretofore underperforming funds/vintages, then we expect to start seeing exits of lagging PE-backed companies too, as PE GPs seek to alleviate LP pressure for the return of capital without needing to close out a whole fund/vintage with a suboptimal return.

If these exits – successful or less successful – don’t materialize in the first half of 2025, there will be a lot of hand-wringing and perhaps a bit of ‘forced’ selling in the back half of the year at whatever valuations GPs can get.

PE Distributions

Prediction – PE distributions will increase in 2025.

Many investors in PE funds have been unsatisfied regarding distributions from their PE portfolios in recent years. Going directly hand in hand with the substantial slowdown in exits during this time, distributions hit multi-year lows, albeit with some signs of life in recent months. LPs continue to pressure GPs to return their capital, which we expect will lead GPs to exit any companies for which they can fetch even fairly attractive valuations.

Dry Powder

Prediction – dry powder will decrease in 2025.

Our expectation is that deals will be completed and that a portion of the capital currently on the sidelines will be put to work.

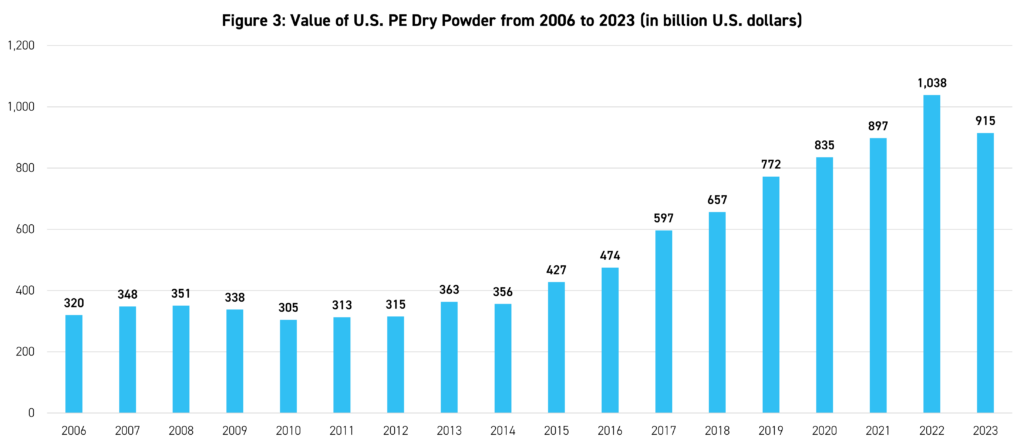

For years, we have heard from the PE industry that the inventory of dry powder is not at extreme levels and can be worked down in relatively short order. Of course, this has not happened yet, and there is a massive amount of private capital that is still looking for a home (Figure 3). At the same time, however, the pace of PE fundraising slowed in 2024, creating less upward pressure on the dry powder from new capital than there has been since 2020. With many industry experts forecasting an improved dealmaking environment in 2025, this may be the year to prove that the dry powder can actually be worked down at a pace that will satisfy LPs.

As shown in Figure 3, buyouts saw a spike in dry powder to all-time record highs in 2022 but then a decrease in 2023. When final numbers are published for 2024, we expect a further decrease year over year, but we are likely still nowhere near pre-2019 levels.

We believe that if public markets dip in 2025 (especially for reasons other than interest rates jumping), more listed companies could become targets for public-to-private takeouts. The headline valuation multiples of smaller and medium-sized listed US companies continue to compare favorably to their large and mega-cap counterparts that have been on a multi-year tear, possibly leading to many of these smaller companies being attractive takeover targets.

Valuations

Prediction – buyout purchase price multiples remain elevated.

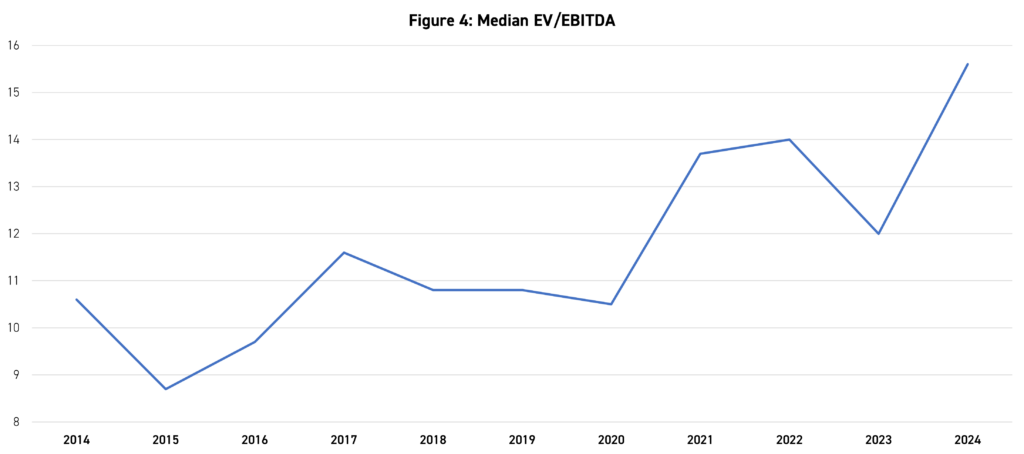

2022 had been the high-water mark for US PE purchase price multiples, but after declining in 2023, purchase price multiples as measured by enterprise value (EV) / earnings before interest, taxes, depreciation, and amortization (EBITDA) bounced back in 2024. The median EV/EBITDA multiple set a new all-time record during the year. This is important because the valuations paid for assets are one of the most important predictors of the future returns for each PE vintage.

Public equity markets had another above-average year in 2024, partly driven by valuation multiples expanding for the companies that often serve as comps for PE takeover targets. In addition, the fact that dry powder has remained stubbornly high contributes to creating somewhat of a floor on purchase price multiples because the chances of finding a true hidden gem in terms of valuation are significantly lower when numerous investors and many dollars are chasing a finite number of attractive deals. As an aside, these elevated multiples should, in theory, be beneficial to GPs looking to exit companies. In light of that, the obvious question is whether buyers are willing to pay the valuations that companies have been marked at on these GPs’ books in recent years.

Interest Rates

Interest rates are the real linchpin for all of the above. The big risk to all of these predictions is that inflation rises or stays high enough that we don’t see a substantial drop in interest rates. Even macro experts – which I do not claim to be – are notorious for not always getting it right on interest rate projections, but we believe most industry participants would agree that there is certainly not a zero probability of interest rates holding steady or even increasing in 2025. While we do not profess to have any edge in interest rate forecasting, we are confident that there would be a negative impact on PE if rates were to stay higher for longer, as there has been in the past few years when deal financing became significantly more expensive and, in the cases of the many PE-owned companies with short-term, floating rate debt, the debt on the companies’ balance sheet became more onerous.

Other PE Predictions

There are also some broader secular trends that we believe will continue in 2025, regardless of whether the predictions above come true. In some cases, these trends could really accelerate if these variables play out in a way that is unfavorable to PE and continue to put downward pressure on internal rates of return (‘IRRs’) and other measures of PE performance.

- We expect that investors will care increasingly more about the fees they’re paying for PE and scrutinize the true alpha of those investments more. Historically, when times are good, PE tends to get a bit of a pass on its higher fees, but another sluggish year in PE could change that. PE could start exiting companies at valuations that keep the critics at bay, but if the broader exit / M&A environment improves and PE doesn’t exit its investments en masse, then we expect a lot of questions from LPs, financial media, and others about the premium fees being paid to access the asset class.

- We believe that pricing power could continue to shift in favor of larger LPs as they continue to increase their use of other ways to get PE exposure. These other avenues include co-investments, direct investments, and cost-efficient ways to invest in PE ‘beta.’

- Going hand in hand with the prior point about lower fee, investable beta solutions now available to LPs, we predict continued growth in investors’ interest in more cost-efficient alternatives to traditional private equity that still allow them to maintain exposure to the same primary return drivers that have powered PE over the years.

- We expect that the traditional PE industry will see significant growth in assets from retail investors this year and for the foreseeable future, as many experts agree that barriers to adoption could be relaxed by the new administration in the US. At the same time, we also expect to see growth in liquid PE alternatives in the wealth market, including the aforementioned ones focused on delivering PE beta.

- Despite the prediction of an overall relaxing of the regulatory environment for PE, we believe that some aspects of regulatory scrutiny should naturally intensify as traditional PE continues to make inroads with retail investors, including greater transparency on fees and performance calculations.

Conclusion

We may or may not see all of these predictions come true this year, but one thing is certain—it makes sense for investors to have a flexible, cost-efficient alternative to traditional PE available in their toolkits, particularly if they are concerned about the current environment and the vintage risk of investing in traditional buyout funds at this time.

Please click here to explore whether the KraneShares Man Buyout Beta Index ETF (Ticker: BUYO) can be that flexible, cost-efficient alternative for you or your clients.

For BUYO standard performance, top 10 holdings, risks, and other fund information, please click here.

Buying and selling shares of the BUYO can result in brokerage commissions.

Definitions:

Exit Environment: The exit environment for private equity is the set of conditions that affect the sale of an asset in a private equity-backed company. The goal of an exit is to generate returns on investment.

PE Distributions: Private equity distributions are not the same as dividends. Both are payments to investors, but they differ in how they are taxed, who receives them,