The Inflation Reduction Act (IRA): Positive Road Forward for US Electric Vehicle Policy

By Anthony Sassine, CFA

Introduction

The surprise climate deal announced on July 27th has the potential to improve the outlook for electrification in the US significantly and demonstrates why we believe it is important to expect the unexpected when it comes to energy transition policy. The Inflation Reduction Act (IRA), announced by Democratic leader Chuck Schumer and Senator Joe Manchin, includes $369 billion focused on the energy transition and carbon reduction in the form of new and expanded production and investment tax credits for electrification, carbon capture, and renewable energies including wind, solar, geothermal, nuclear and hydrogen. This represents the highest-ever subsidy for fighting climate change to be introduced through legislation in the United States.1 The Act became law on August 16, 2022.

We believe the Act will help accelerate EV adoption in the United States, bringing EVs closer to cost parity with internal combustion engine (ICE) vehicles. The Act is a breath of fresh air for the EV market in the US, which has lagged global peers in recent years.

Key Takeaways For Electrification

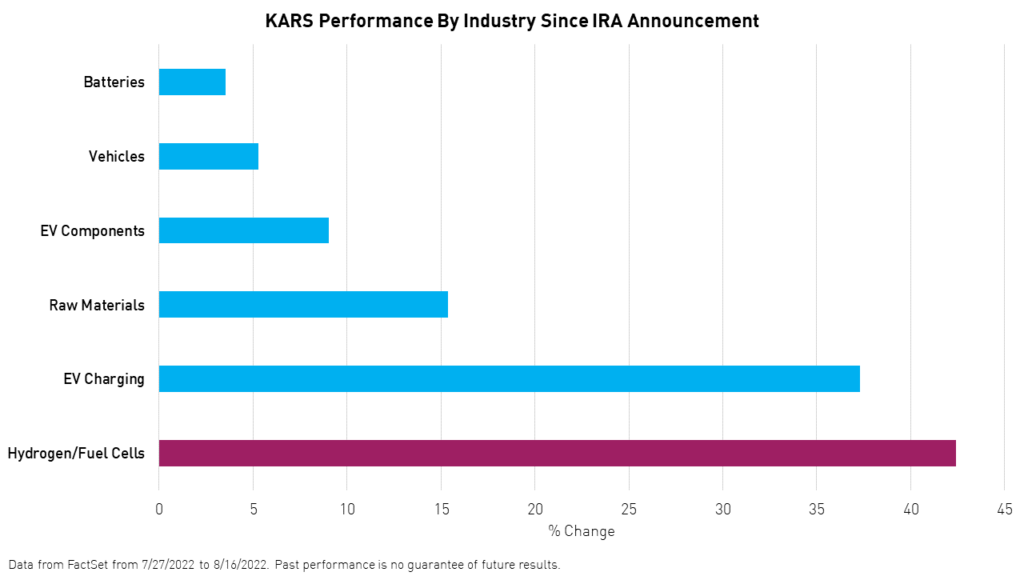

Below are some key takeaways for electrification that should benefit automakers, battery markers, hydrogen/fuel cell producers, EV charging companies, and metals producers in the US and countries with Free Trade Agreements (FTAs) with the US. The net impact should be a significant increase in demand for EVs and electrification infrastructure and a boost to the battery supply chain and other essential industries in the US, China, and globally.

- The IRA will extend the expiring EV tax credit of $7,500 to 2032 and eliminate the previous restriction limiting tax credits to EVs produced by automakers who sold less than 200,000 EVs. These credits are available to consumers who earn equal to or less than $150,000 individually or $300,000 as a family. While Tesla and GM are the biggest beneficiaries of the elimination, other automakers like Ford will continue to benefit.

- The IRA includes fuel cell vehicles in the tax credit for the first time, benefiting Plug Power, a US leader in fuel cell and hydrogen production.

- The IRA created a new tax credit of $4,000 for used EVs that cost less than $25,000. This provision should help accelerate used EV sales among middle and lower-income consumers who make equal to or less than $75,000 individually or 150,000 as a family.

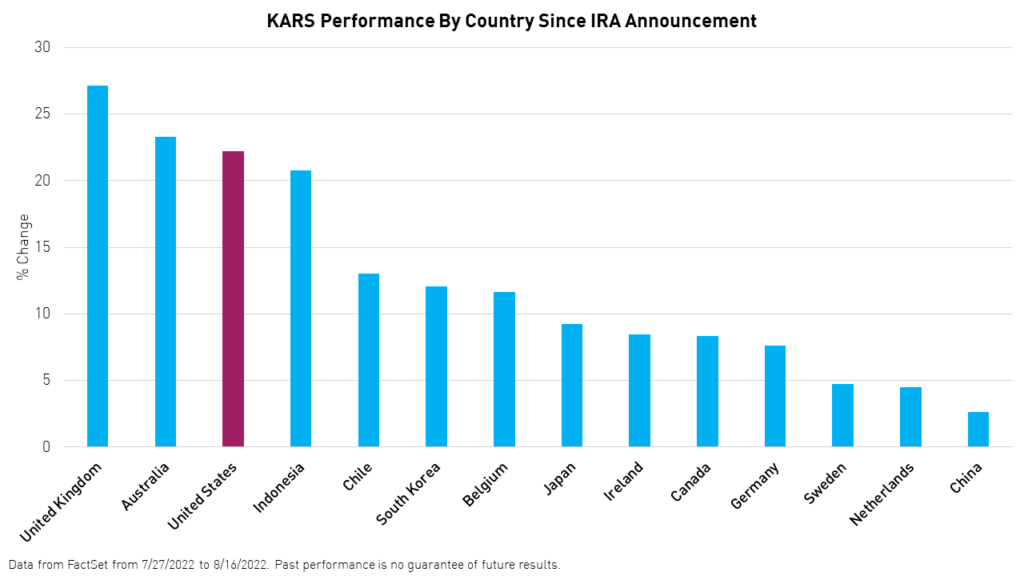

- For EVs to qualify for the consumer tax credit, the IRA requires automakers to use a certain percentage of raw materials (mined and processed) in North America or countries in the FTA with the US. The list includes critical raw materials producers such as Canada, Australia, and Chile.

- The IRA revives the recently expired alternative fuel tax credit of 30% for EV charging and alternative fuels and increases the maximum use of the credit from $30,000 to $100,000. The provision is a boon for EV infrastructure companies such as EVGO, ChargePoint, and Plug Power.

- The IRA also includes a significant tax credit for commercial EVs, especially heavy-duty trucks weighing more than 14,000 lbs. The tax credit includes the lesser of 30% of the difference between the clean energy vehicle and a comparable internal combustion engine (ICE) and $40,000.

- On the battery manufacturing side, the IRA provides significant tax breaks to encourage the localization of the battery supply chain. The provisions include a 10% cost credit, which translates into an almost 7% discount on battery cells, $10/kWh for battery modules, constituting a 30% discount on battery packs, and a $35/kWh production credit for battery cells, which accounts for an average of 35% discount to global battery cell prices.

- Finally, the IRA includes a slew of provisions to help institutions and companies transition to electrification. It includes $3 billion for the United States Postal Service (USPS) to transition to clean energy trucks, $2 billion for automakers to retool and convert existing production lines to the production of clean energy vehicles and $20 billion in loans for automotive companies to help them build clean energy facilities across the country.

China Impact

While China’s EV market is independent of the Act, being 4.5 times larger than the US,2 we believe the IRA will eventually have a positive impact on China's market as well, despite the Act's targeting of North American suppliers. China’s leadership in batteries and the electrification supply chain overall means that Chinese companies are likely to benefit from the IRA. China refines 68% of the world’s nickel, 73% of cobalt, 93% of manganese, and 100% of the graphite used in lithium-ion batteries.3 We believe that China exposure is essential to capturing not only the impact of the IRA but also the full EV ecosystem opportunity. Please click here to read our latest commentary on the EV ecosystem’s development and how to invest.

Conclusion

While the overall direction of the bill is positive, we believe some of the restrictions on electric vehicle (EV) tax credits are not ideal, especially for those who are perceived by the tax code as mid to higher-income individuals or families.

Nonetheless, the IRA will accelerate adoption in the US, which was needed, and we believe that short to medium-term EV sales in the US will increase meaningfully as a result. The bill may also create a used market for EVs for the first time. Furthermore, the Act will help build much-needed new supply chains to meet the high demand and accelerate innovation and ICE parity.

Citations:

- Liasson, Maria. “The Inflation Reduction Act becomes law,” NPR. August 14, 2022.

- Bloomberg New Energy Finance (BNEF) as of 12/31/2021.

- Finley, Allysia. “China Gets a Great Leap Forward From Congress,” The Wall Street Journal. August 14, 2022.

Please click here for the full text of the Inflation Reduction Act (H.R. 5376).

Please click here for KARS top ten holdings.

Definitions:

Kilowatt-Hour (kWh): A measure of electrical energy equivalent to power consumption of 1,000 watts for one hour.