The Dealmaker’s Return: How America’s M&A Engine Is Reigniting

By Cole Wenner

As Donald Trump settles back into the Oval Office, Wall Street's dealmakers are dusting off their mergers and acquisitions (M&A) playbooks. The self-proclaimed master of "The Art of the Deal" has returned to Washington with a pro-business agenda that could spark a revitalization in M&A. January's data report on deal activity was quite positive. There was a 29% year-over-year spike in billion-dollar-plus transactions, suggesting the long-awaited M&A recovery may finally be materializing after years of subdued activity.1

Despite hurdles like inflation and "Liberation Day" tariffs causing a pullback in global equity markets and casting doubt on the economy's near-term trajectory, we believe the KraneShares Man Buyout Beta Index ETF (Ticker: BUYO) is positioned for success in the deal-making environment that we expect to unfold in 2025 and beyond. KraneShares partnered with Man Group to launch BUYO, which is sub-advised by Man Numeric, leveraging Man’s deep research and quantitatively driven analytics to create a basket of U.S. small to mid-capitalization companies exhibiting characteristics that mirror those of past acquisition targets of private equity (PE) firms. If the early signs of an M&A resurgence come to fruition, BUYO’s constituents may receive increased interest from buyout firms and strategic buyers.

Early Signs of an M&A Renaissance

The M&A market entered 2025 with considerable optimism after hitting its lowest level in more than 30 years (adjusted for the size of the economy) in 2023.2 Dealmakers anticipated that Trump's return to the White House, combined with the potential for lower interest rates and a solid economic foundation, would create ideal conditions for corporate M&A.

This optimism wasn't unfounded. EY noted in its Merger Monthly Series: M&A Activity Insights January 2025 report, "M&A activity in 2025 is expected to surge due to favorable economic conditions, falling interest rates, and substantial uninvested capital, despite ongoing regulatory scrutiny and geopolitical uncertainties." Financial industry experts have highlighted that many executives who had stayed on the sidelines are now actively considering deals again.

Catalysts Driving the Potential Rebound

Several key factors are expected to accelerate M&A activity in 2025.

The most significant catalyst may be Trump's deregulation agenda. His administration is expected to ease the regulatory burden on businesses, making the deal approval process more predictable and efficient. This approach is different from the Biden administration, which took a tougher view of antitrust vetting, blocking more mergers because of competition concerns.

Under Trump, companies anticipate fewer regulatory hurdles for large deals that might have faced challenges before. Tom Miles, Co-Global Head of M&A at Morgan Stanley, noted in their 2025 M&A Outlook: 4 Trends Driving an Anticipated Rebound: "We have a positive view of the M&A market for 2025. Two key drivers will be increased activity from financial sponsors selling companies and a more favorable antitrust environment."

If inflation continues to decline, as it did in February, the Federal Reserve (Fed) could resume cutting interest rates. Lower interest rates will reduce borrowing costs, making deal financing more attractive. If public markets keep selling off, PE is more likely to do public-to-private takeout deals because those public companies are becoming cheaper. At the same time, publicly listed strategic acquirers will have less firepower for stock deals if their own stocks are depressed, which means less competition for PE and fewer bidding wars.

Furthermore, companies have accumulated substantial cash reserves and are under pressure to deploy capital strategically. John Collins, Co-Global Head of M&A at Morgan Stanley, explained in the same report that "corporates with robust balance sheets will pursue capital deployment through M&A". Trump's plan to extend the 2017 Tax Cuts and Jobs Act, which cut the corporate tax rate from 35% to 21%, is expected to further boost corporate profits.3 This may provide companies with additional capital for acquisitions.

Where will PE Buyout Firms Look for Deals?

PE firms are increasingly turning their attention to public markets as they search for acquisition targets in a challenging environment. This trend reflects the growing difficulty in finding attractively valued private companies. Dechert, a global law firm that advises asset managers, financial institutions, and corporations, released a survey in their Take-Private Deals: Interest Remains High Despite Rising Costs and Risks, which was published in November 2024, revealed that 93% of respondents are at least somewhat likely to consider take-private deals in the next 12 months. However, compared to last year, the number of respondents who responded “very likely” dropped significantly from 80% to 44%, which they cited was due to the positive performance of the public markets at the time.4 Now, with public equities cheaper, this number may be higher.

Small-cap valuations in public markets have reached historically attractive levels, with the Russell 2500 falling into bear market territory after a 23% decline from its November 25th, 2024 peak.5 This continues a 14-year pattern of small caps lagging large caps, creating extreme valuation gaps.5 The April 2025 market selloff has exacerbated this and, in the process, made many public small-cap companies cheaper than their private counterparts. This environment creates ample opportunities for PE firms, which are sitting on record levels of deployable capital, to pursue public-to-private transactions. They're actively seeking discounted valuations in both private and public markets, and year-to-date performance has created exactly that opportunity among public small to mid-capitalization companies, which is the universe BUYO selects from.

BUYO applies a systematic approach to identifying public companies that share characteristics with those targeted by buyout firms while deliberately avoiding stocks that we believe are obviously not PE-like. For example, rather than pursuing the largest or most expensive public companies, BUYO focuses on small to mid-cap stocks from the Russell 2500 Index that demonstrate specific financial qualities valued by potential buyers.

A testament to the strategy's ability to identify companies that are attractive to buyout firms, KKR & Co. announced on March 18, 2025 that it is exploring the acquisition of New Mexico utility and BUYO holding TXNM Energy Inc.6 While the deal is not official, and TXNM Energy can still decide to remain independent or sell to another buyer, this is a great recent example of an announced public-to-private takeover as buyers search for attractive acquisition targets in a challenging environment. TXNM Energy is held in BUYO at a 0.30% weight as of March 31, 2025.8

In more recent news, BUYO holding Accolade announced on March 27, 2025, that its stockholders voted to approve a merger with Transcarent, a transaction that will take the healthcare technology company private.7 The deal, expected to close in the second quarter of 2025, further validates BUYO's strategy of identifying potential acquisition targets as PE-backed firms like Transcarent seek strategic acquisitions and add-on deals that often involve undervalued public companies across various sectors.7 Accolade Inc. is held in BUYO at a 0.14% weight as of March 31, 2025.8

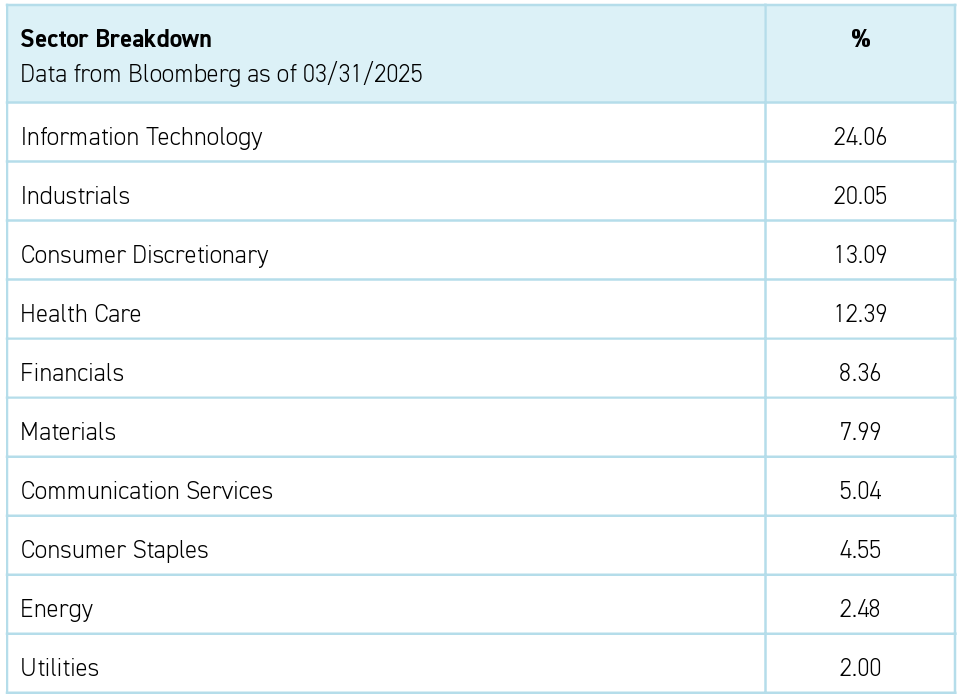

Furthermore, BUYO is considerably overweight to the Information Technology sector, which currently represents 24.06% of the fund's holdings.8 This substantial weighting reflects the strong preference among PE firms for technology companies that offer scalable business models, recurring revenue streams, and potential for operational improvements. By maintaining this strategic sector emphasis that aligns with current PE acquisition trends, BUYO provides investors exposure to the types of companies most likely to attract buyout interest in today's market environment.

Industrials are also an important part of this portfolio, as the second largest sector exposure in BUYO at 20.05% of the fund's holdings.8 On-shoring could create opportunities for many of these small/mid-cap industrial companies based in the U.S. as other companies on-shore their supply chains to avoid tariffs. This same logic can apply to the Materials sector too, which is the sixth largest weight in BUYO at 7.99%, which is higher than that of the Russell 2500 Index.8

Challenges Softening M&A Enthusiasm

Despite positive catalysts, experts have noted several challenges to the anticipated M&A boom for now:

- What started as 25% tariffs on imports from Canada and Mexico and 20% tariffs on imports from China has now expanded to a much broader list of countries. The risk of retaliatory tariffs creates further uncertainty, which makes dealmakers more cautious and may push back some deal timelines as businesses evaluate the potential impact on their operations and supply chains.9

- Trade uncertainty has extended to the stock market, with the S&P 500 erasing its gains since November and the tech-heavy Nasdaq following suit.8 The deal environment may get worse before it gets better, but this uncertainty and some fairly dire outcomes are starting to get priced in for many stocks.

- Inflation levels are still a focus for investors and the Fed. Many experts do not see the Fed cutting rates until it is clear inflation is entering a downtrend.

Despite these concerns, optimism persists. Historically, the Trump Administration has used tariffs as a means to secure the best possible trade deal. Stock market volatility was a hallmark of Trump's first Administration, which ultimately saw the S&P rise 68% over the term. While it is too early to call it a trend, inflation may be showing signs of slowing as the monthly Consumer Price Index (CPI) rose by just 0.2% in February, lower than January's 0.5% increase.8

The Outlook for 2025 and Beyond

Despite these challenges, the fundamental drivers for increased M&A activity remain strong.

"If windows do open up, there may be significant activity in these periods," noted Marc Cooper, CEO of Solomon Partners, a leading investment bank that specializes in providing advisory services. Their M&A Outlook: Strategic Deals Soar, Private Equity Stalls highlights the large deal backlogs building at many investment banks. The pressure on PE firms to return cash to investors will likely drive increased selling activity, creating opportunities for strategic buyers.

There is an immense amount of PE dry powder on the sidelines waiting to do deals. Or, in reality, more than just waiting – it has limited partners (LPs) pressuring general partners (GPs) to do deals and get their capital to work. In recent years, there hasn’t exactly been a plethora of good (i.e., cheap) deals in public or private, but maybe that’s changing in the public market now if this recent downward move turns out to be an overreaction. When the dust settles, there will likely be companies that emerge as well-positioned for the new economic reality and turn out to be attractive investments but that have been the proverbial "baby thrown out with the bathwater" in the recent market downturn.

M&A activity is expected to remain selective in the near term, with top-tier assets commanding premium valuations and structured deals playing a critical role in generating liquidity. While a broad-based M&A boom may not materialize immediately, the conditions for a significant uptick in dealmaking are falling into place as the new administration implements its business-friendly agenda.

Time will tell where the real risks and opportunities lie in this new tariff regime, but we are confident in one thing – tariffs are just the latest example of a dominant top-down force that doesn’t distinguish between public and private companies and helps drive the shared beta and reasonably high correlation between the two asset classes. Take two auto part suppliers as an example: Auto Part Supplier A and Auto Part Supplier B. Company A is publicly traded, while Company B is a privately held company. Both are based outside of the U.S. but ship auto parts into the U.S.; therefore, both are subject to tariffs. Is there any reason the dominant market driver at this time, tariffs, should affect one disproportionately? We can't think of any reason that would be the case.

Across both public and private companies, it seems that the art of the deal is making its return to corporate America—albeit with a cautious eye on the policies that may yet reshape the landscape.

Conclusion

The KraneShares Man Buyout Beta Index ETF (Ticker: BUYO) specifically targets companies that share characteristics with PE acquisition targets, potentially positioning it to benefit from increased M&A activity. With its focus on small to mid-cap stocks across sectors favored by PE firms, BUYO provides investors with exposure to companies that could become acquisition targets as PE buyout firms and strategic buyers accelerate their deal-making activity and look to public markets for attractive deals.

For BUYO standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- Data from "Merger Monthly series M&A activity insights February 2025," EY-Parthenon, as of 2/28/2025.

- Data from "Looking Ahead to 2025: Preparing for What Comes Next," Bain & Company, as of 2/4/2025.

- Data from Bloomberg Government as of 2/20/2025.

- Data from "Dechert Report Reveals Private Equity Firms' Resilience and Adaptability Amid Economic Challenges," PR Newswire, as of 11/6/2023. Retrieved 2/28/2025.

- Data from Bloomberg as of 4/4/2025.

- Data from Bloomberg as of 3/18/2025.

- Data from Bloomberg as of 3/27/2025.

- Data from Bloomberg as of 3/31/2025.

- Data from "Fact Sheet: President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico and China," The White House, as of 2/1/2025.

Index Definitions:

S&P 500 Index: The S&P 500 is a stock market index that tracks the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Term Definitions:

Inflation rate: The inflation rate is the percentage change in a price index over a specific period, usually calculated on an annual basis, measuring the rate at which the general price level of goods and services is rising in an economy.

Consumer Price Index (CPI): A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, calculated by taking price changes for each item in the predetermined basket of goods and averaging them.