Navigating Rising Volatility As Inflation & Interest Rate Uncertainty Persist, How KSPY Can Help

By Cole Wenner

Equity market uncertainty has re-emerged to start 2025, with volatility returning to levels not seen since last summer, a time when Tech & Magnificent 7 earnings, economic data (weaker ISM Manufacturing, Nonfarm payroll, and higher Jobless Claims) along with a Yen carry trade unwind, saw the S&P 500 drop 845 basis points from July 16th to August 5th.1 According to Hedgeye Asset Management CIO John McNamara III, “the phenomena perpetuating this current increase in volatility have been well-telegraphed for many months in our client conversations. Inflation’s re-acceleration and uncertainty regarding the Federal Reserve's policy trajectory, both highlighted in our November article (read here), have now become the topics du jour.”

While markets continued their march higher in 2024, as the S&P 500 returned 25% to finish 20242, some signs of waning investor confidence have started to emerge. The timing is particularly interesting when considering recent updates from Hedgeye Risk Management's GIP or Quad model. The model is a quantitatively oriented, regime-based framework that seeks to identify macroeconomic themes by measuring and mapping rate-of-change data for both growth and inflation while considering monetary policy biases. This framework is designed to provide guidance on where economies, as well as asset prices, are likely to trend and how central bank policies may respond to these conditions. Quad 4, an environment when both economic growth and inflation decelerate and the S&P 500 typically declines, is currently expected for the month of February.

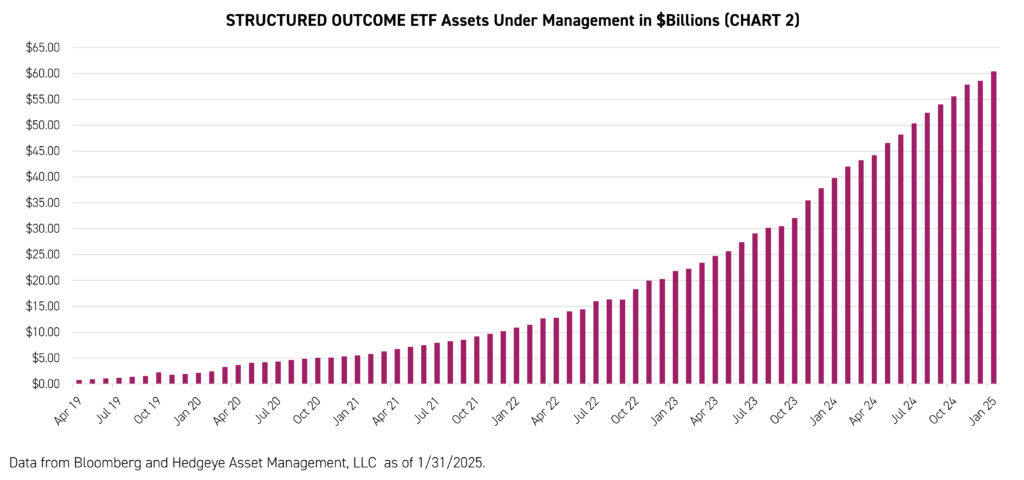

"Conversations around risk management in equity portfolios tend to be top of mind for investors during periods of volatility," said John McNamara. "Recently, our client conversations have shifted from focusing on using options strategies for the amplification of returns to using options strategies for smoothing portfolio returns and reducing volatility. That said, there seems to be a constant desire to participate in equity market upside while avoiding or cushioning the degree of drawdowns." The pervasiveness of this theme is nowhere more visible than in the growth of Structured Outcome ETF assets under management (AUM), which surpassed $60 billion in January 2025 (Chart 2).3

Against this backdrop, KraneShares partnered with Hedgeye Asset Management to launch the KraneShares Hedgeye Hedged Equity Index ETF (Ticker: KSPY), which seeks to help investors navigate volatility while still participating in the upside potential of U.S. equity markets. KraneShares believes that KSPY is a potentially unique tool with a dynamic approach that differentiates the strategy when compared to incumbent “Hedged” or “Buffered” products.

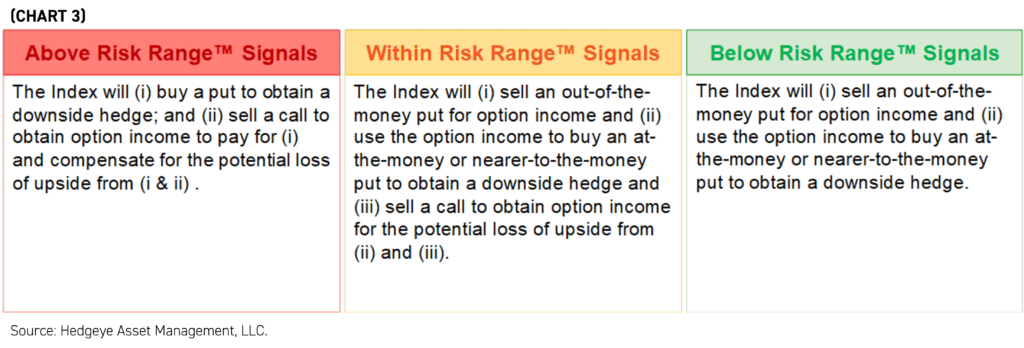

Taking a look specifically at how KSPY's Index compares to incumbent “Hedged” or “Buffered” products, we would note the ability to dynamically adjust portfolio delta through a systematic framework based on the utilization of Hedgeye’s Risk Range™ Signals. Similar to Hedgeye's GIP or Quad model, these signals were developed by ex-hedge fund manager and current Hedgeye CEO Keith McCullough, with the goal of providing a quantitative risk management tool to augment fundamental views. The proprietary Risk Range™ model analyzes price, volume, and volatility to help market participants identify entry and exit points. Since 2015, the S&P 500 has closed within Hedgeye’s daily published Risk Range™ Signals 83% of the time.4 KSPY's Index toggles between three unique options strategies based on where the S&P 500 falls in reference to these Risk Range™ Signals (Chart 3).

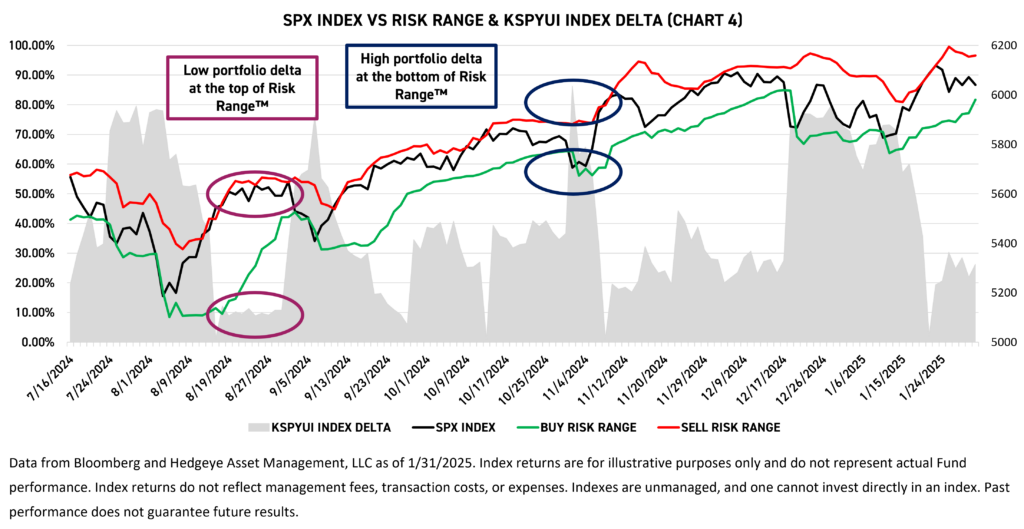

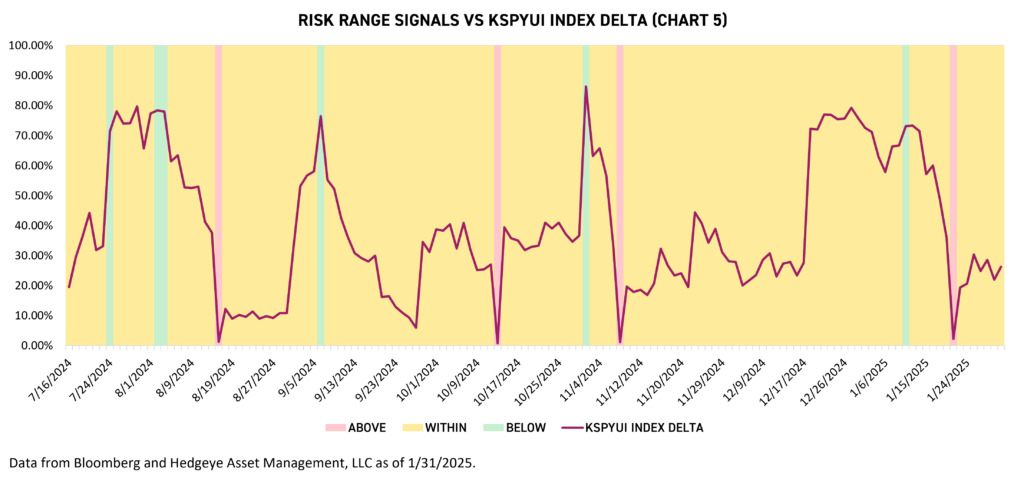

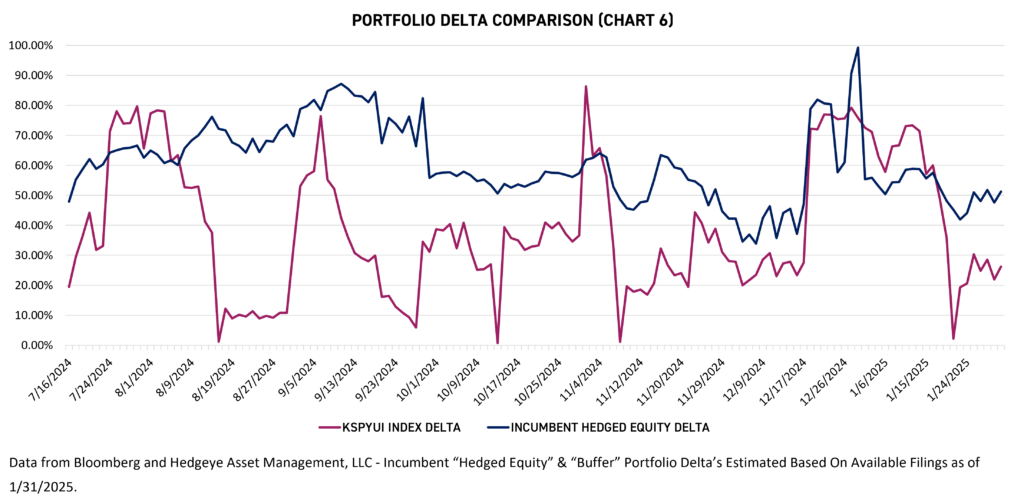

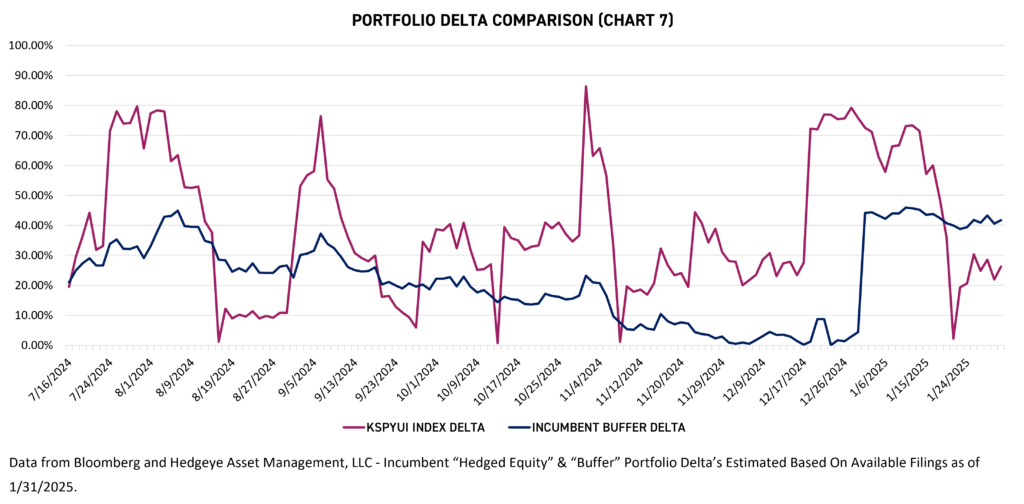

The fully systematic index-based methodology allows the strategy to dynamically adjust portfolio delta, a measure of how sensitive a portfolio's value is to changes in the price of the underlying assets. KSPY's index portfolio delta adjusts towards 100% when the S&P 500 is below or near the buy Risk Range™ Signal and towards 0% when above or near the sell Risk Range™ Signal (Charts 4 & 5).

When compared with the portfolios of incumbent “Hedged” or “Buffered” products, the differentiation that the Hedgeye Hedged Equity Index’s dynamic approach offers is clear (Charts 6 & 7). While there are clear differences in the methodologies of the incumbent “Hedged” and “Buffered” products, which rebalance on a quarterly and annual basis, respectively, we believe the goals of these products align with KSPY’s Index in seeking to reduce volatility and provide downside risk management. KSPY's Index, which adjusts as often as daily based on Hedgeye's Risk Range™ Signals, is far more dynamic when compared to the stagnate nature of these incumbent products. KSPY's Index seeks to maximize return capture when positioned at or near the buy Risk Range™ Signal and minimize return capture when positioned at or near the sell Risk Range™ Signal.

Conclusion

Since its inception, KSPY has returned 6.08% compared to the S&P 500's 7.31% return.5 While KSPY did not outperform, it accomplished its goal of reducing volatility, with annualized volatility since inception of 8.22% compared to 14.43% for SPY.6 Additionally, KSPY has provided downside risk management, with downside capture since inception of 45.91% vs. SPY and upside capture of 50.57%.6 We believe KSPY can serve as a tool for investors seeking to participate in equity market upside while avoiding or cushioning the degree of drawdowns.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit kraneshares.com/etf/kspy.

For KSPY top 10 holdings, risks, and other fund information, please click kraneshares.com/etf/kspy.

Citations:

- Data from Bloomberg as of 1/31/2025.

- Data from Bloomberg as of 1/31/2025.

- Data from Bloomberg and Hedgeye Asset Management LLC as of 1/31/2025.

- Data from Hedgeye Asset Management LLC as of 1/31/2025.

- Data from Bloomberg and Hedgeye Asset Management LLC as of 1/31/2025.

- Data from Bloomberg and Hedgeye Asset Management LLC as of 1/31/2025.

Index definitions:

Hedgeye Hedged Equity Index (Ticker: KSPYUI Index): The Hedgeye Hedged Equity Index provides exposure to the S&P 500 while actively reducing volatility and providing downside risk management. The Index is managed by Hedgeye Asset Management, LLC and utilizes a model based on Hedgeye’s proprietary Risk Range™ Signals that analyze the daily trading range of the S&P 500. The Index toggles between three options strategies based on where the S&P 500 falls within these ranges. These options strategies are intended to provide downside risk management, option income, and potential compensation for the loss of upside. Depending on market conditions, the Index can change options strategies as frequently as daily.

S&P 500 Index (Ticker: SPX Index): The S&P 500 is a stock market index that tracks the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Definitions:

Portfolio delta: A measure of how sensitive a portfolio's value is to changes in the price of the underlying assets. It's a key tool for managing risk and assessing portfolio performance in different market conditions.