KVLE: Quality Trumps for Dividend Income

The dividend investing landscape has shifted dramatically. 10-year Treasuries, which are notes issued by the U.S. government that pay interest every six months and mature in 10 years, are yielding 4.45%. The S&P 500's dividend yield, which measures how much a company or fund pays in dividends each year relative to its share price, is only 1.29%. This means risk-free government bonds are offering over three times the income potential of the broader stock market. Similar market conditions existed briefly in 2006-2007 and again in 2021. This time around, we believe there is potential for a longer period of elevated rates.

In spite of the unfavorable macro conditions, dividend-focused ETFs have pulled in over $10 billion in flows* so far in 2025. Investors aren't abandoning dividend strategies. They're helping to evolve them. When evaluating dividend stocks, investors always need to consider their income objectives and risk tolerance.

Value Line®'s 60-Year Edge: Why Rankings Still Matter

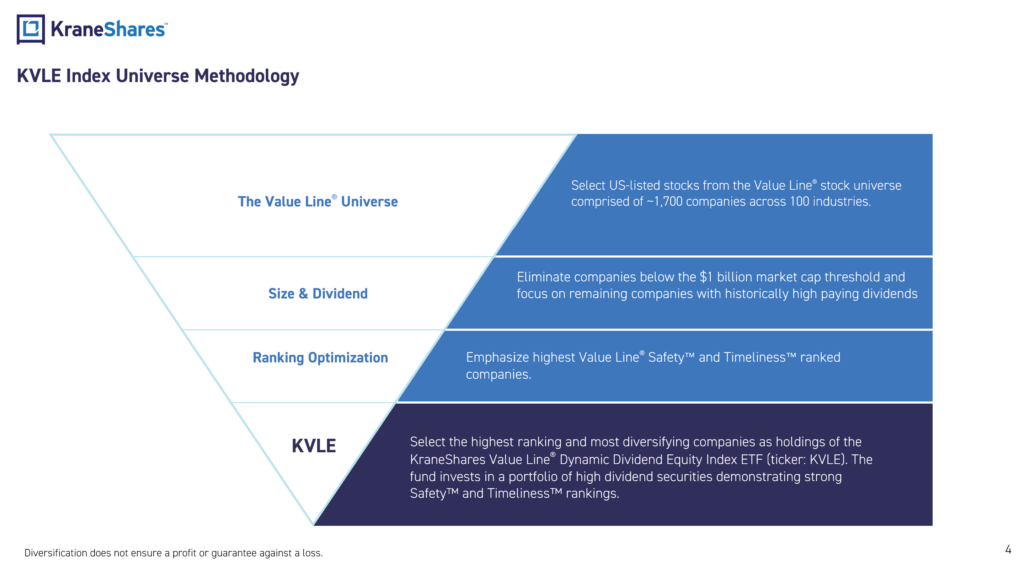

This is precisely where the KraneShares Value Line® Dynamic Dividend Equity Index ETF (Ticker: KVLE) becomes compelling. Dividend strategies may chose to target high yielders, dividend growers or some combination thereof. KVLE takes a slightly different approach by using Value Line®'s Safety and Timeliness ranking systems to select stocks.

Value Line®'s Safety rankings are designed to guide investors by aiming to identify companies with the financial strength that may help maintain and grow dividends through economic turbulence. The methodology examines price stability, financial strength, and debt levels that help to determine whether a 3% dividend yield today may turn into a 0% yield tomorrow.

Companies with Value Line® Safety ranks of 1 (highest) have historically fallen less during market downturns, while Timeliness ranks have tended to identify which stocks are positioned for near-term outperformance. KVLE combines both rankings with a third screen for dividend yield, creating a three-factor approach that goes far beyond traditional dividend investing criteria.1

An Income Rotation: Quality Over Yield

“Quality” can be a very subjective term, but it usually centers around looking for strong balance sheet characteristics. That may include things, such as cash flows, margins, debt levels, profitability or consistent dividend growth.

KVLE's current 30-day SEC yield2 is 2.56%**. That might seem modest compared to Treasury rates. The fund's holdings, currently led by NVIDIA, Microsoft, and Alphabet, represent companies that have historically grown their dividends with capital appreciation.

** note: 30-day yield is a standardized, annualized measure calculated by taking a bond or ETF's net interest and dividends earned over the past 30 days (after expenses), dividing by the fund’s share price at the end of that period, and projecting it over a year. It provides a consistent benchmark for comparing income-producing funds.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit https://kraneshares.com/etf/kvle/.

KVLE's adaptive risk management system adjusts portfolio beta between 0.8 and 1.0 based on market conditions, helping to provide downside hedge during volatility, such as the April 2025 tariff-driven selloff.

Tech and Dividends: A New Paradigm

One of KVLE's most compelling characteristics is its technology exposure which could represent over 30% of the portfolio. This isn't your grandfather's dividend strategy of utilities and consumer staples. When Apple and Microsoft qualify as dividend payers, dividend strategies must evolve to capture this new reality.

The integration of major technology companies as significant dividend payers potentially enables strategies to capture both income and growth characteristics. KVLE's methodology attempts to identify these technology companies through Value Line®'s ranking system, providing exposure to the digital economy's most profitable and cash-generative businesses.

The KVLE Opportunity: Quality Dividend Growth in Challenging Times

While Treasury yields create yield competition reminiscent of the mid-2000s it also illuminates which dividend strategies deserve attention. In an environment where risk-free assets yield 4.45%, we believe dividend strategies should justify their existence through superior risk-adjusted returns, not just current income.

KVLE's emphasis on Value Line®'s highest-ranked companies for Safety and Timeliness, combined with adaptive risk management and growth exposure, creates a unique approach to dividend investing.

*ETF net flows represent the difference between the money flowing into and out of an ETF over a specific period, potentially indicating investor demand.

For KVLE standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- https://www.valueline.com/investment-education/understanding-value-line-research

- Standardized performance information for the fund can be found at https://kraneshares.com/etf/kvle/

- As of 3/31/2025