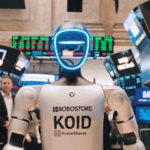

KraneShares Launches U.S. Focused Private Company Fund Tracking New S&P Dow Jones Indices

New York, NY – October 7th, 2025 – Krane Capital Management, LLC (“KraneShares”), a global asset management firm recognized for its innovative investment solutions, today announced the launch of the Krane S&P U.S. Private Stock Top 10 Vintage 2025 Series.

This new offering is designed to provide accredited investors with targeted exposure to the top U.S. private technology companies as selected and tracked by the S&P U.S. Private Stock Top 10 Vintage 2025 Series Index.

S&P Global, the parent company of S&P Dow Jones Indices (S&P DJI), projects that private markets will reach more than $18 trillion by 2027, driven by strong growth in private credit/debt, real assets, and secondary markets.1

Many leading U.S. technology companies are choosing to stay private for longer, building up high valuations through private funding rounds and secondary markets. The fund aims to acquire shares in targeted private companies through direct purchases or secondary transactions. The portfolio will consist of the ten private companies included in the index, like SpaceX, OpenAI, xAI, Stripe, Databricks, Anthropic, and others.

As of September 10, 2025, the Index’s constituents collectively represent nearly $1.4 trillion in market capitalization2, spanning industries such as artificial intelligence, humanoid robotics, aerospace, and defense.

The Krane S&P U.S. Private Stock Top 10 Vintage 2025 Series fund has been successfully onboarded and is now available for investment through Schwab (SSID: 116218137) and Fidelity (CUSIP: 48299C193).

“We believe this fund has the potential to transform the landscape of private markets where innovation and growth increasingly take place outside of public equities,” said Jonathan Krane, CEO of KraneShares. “By leveraging S&P Dow Jones Indices’ Index, we are able to offer investors the ability to invest in innovative and potentially high-growth private companies that could shape the future of technology.”

“At S&P Dow Jones Indices, we’re energized by the accelerating demand for private markets data and benchmarks as these markets evolve,” said Cameron Drinkwater, Chief Product Officer at S&P Dow Jones Indices. “As we expand S&P DJI’s capabilities through the launch of the S&P U.S. Private Stock Top 10 Index, an innovative representation of the largest and most accessible private companies in the U.S., we remain committed to providing high quality private markets benchmarks that enhance transparency and access to this important and growing segment of the market.”

PM Insights, an independent data provider for private growth and pre-IPO companies provides valuation data for the fund. Nicholas Fusco, CEO of PM Insights said, “We are elated to see KraneShares taking a leadership position around the evolution of private company focused funds with Krane S&P U.S. Private Stock Top 10 Vintage 2025 Series. There's an increased demand for transparency on the trading of this asset class, and I am confident that the team will be adding a lot of value to this end.”

For more information on the Krane S&P U.S. Private Stock Top 10 Vintage 2025 Series, please visit https://kraneshares.com/private-funds/krane-sp-us-private-stock-top-10-series/.

Fund Structure and Terms

| Fund Legal Name | KC VC 2, LP |

| Schwab SSID | 116218137 |

| Fidelity CUSIP | 48299C193 |

| Index Provider | S&P Dow Jones Indices |

| Index | S&P U.S. Private Stock Top 10 Vintage 2025 Series Index |

| General Partner | KCM GP, LLC |

| Management Company | Krane Capital Management, LLC |

About KraneShares

Krane Capital Management, LLC is a subsidiary of Krane Funds Advisors, LLC (KraneShares), a specialist investment manager focused on China, Climate, and Alternative Assets. KraneShares seeks to provide innovative, high-conviction, and first-to-market strategies based on the firm and its partners' deep investing knowledge. KraneShares identifies and delivers groundbreaking capital market opportunities and believes investors should have cost-effective and transparent tools for attaining exposure to various asset classes. KraneShares was founded in 2013 and serves institutions and financial professionals globally. The firm is a signatory of the United Nations-supported Principles for Responsible Investment (UN PRI).

Citations:

- Data from "Private Markets – A Growing, Alternative Asset Class," S&P Global. Retrieved 6/30/2025.

- Data from S&P Dow Jones Indices LLC as of 9/10/2025. The total market capitalization provided by S&P Dow Jones Indices was obtained from the S&P U.S. Private Stock Top 10 Index.