Important Notice Regarding Executive Orders 13959 & 14032 and Office of Foreign Assets Control Regarding Certain Chinese Securities

June 22, 2021

KraneShares Trust offers 19 U.S.-listed index-based ETFs that invest in the securities of issuers worldwide, including China. On June 3, 2021, Executive Order 13959 (“Executive Order”) was amended by Executive Order 14032. While the underlying indexes for KFVG (the KraneShares CICC China 5G & Semiconductor ETF), KBA (the KraneShares Bosera MSCI China A Share ETF), and OBOR (the KraneShares MSCI One Belt One Road ETF) include newly Subject Securities, all funds will be optimized promptly to comply with the order and will cease to include any Subject Securities by June 30, 2021.

March 15, 2021

KraneShares Trust continues to closely monitor the impact of Executive Order 13959 (“Executive Order”). As of March 15, 2021, we can confirm that none of our Funds hold Subject Securities.

January 27, 2021

KraneShares Trust has listed KraneShares SSE STAR Market 50 Index ETF (“KSTR”) on the New York Stock Exchange (NYSE) on January 27, 2021. KSTR will fully comply with Executive Order 13959 (“Executive Order”). While the underlying index for KSTR (the SSE Science and Technology Innovation Board 50 Index) includes Subject Securities, the KSTR portfolio has been optimized and will not include any Subject Securities.

January 1, 2021

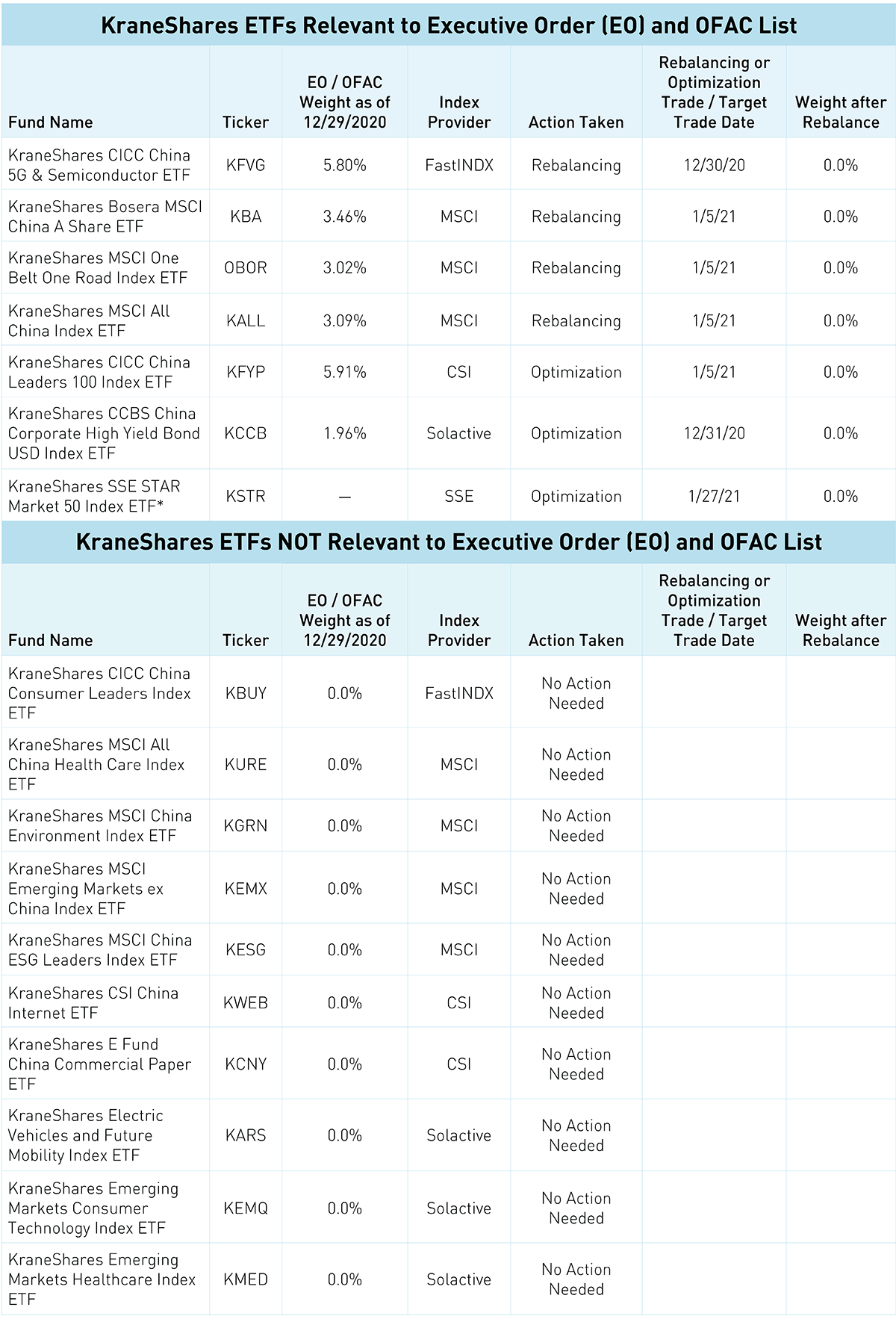

KraneShares Trust offers 16 U.S.-listed index-based ETFs that invest in the securities of issuers worldwide, including China. On November 12, 2020, Executive Order 13959 (“Executive Order”) was issued, prohibiting transactions by U.S. persons in certain Chinese issuers’ securities (“Subject Securities”), beginning on January 11, 2021. On December 28, 2020, the Office of Foreign Assets Control (“OFAC”) issued a list, specifying the Subject Securities.

- Ten of the KraneShares ETFs are not affected by the Executive Order as they do not hold, or have any exposure to, Subject Securities.

- The six KraneShares ETFs that currently do hold, or have exposure to, Subject Securities will liquidate such positions no later than January 5, 2021.

- KraneShares ETFs have no exposure to the three U.S.-listed Chinese telecom stocks that will be suspended by the New York Stock Exchange (NYSE).

As index-based ETFs, the 16 KraneShares ETFs track underlying indexes. Ten such underlying indexes do not include any Subject Securities. While six of the KraneShares ETFs’ underlying indexes do currently include Subject Securities, four of them will remove all Subject Securities in advance of the January 11 effective date of the Executive Order, and the KraneShares ETFs will rebalance their portfolios to the revised underlying indexes. With respect to the two KraneShares ETFs whose underlying indexes may not remove Subject Securities by January 11, the ETFs’ adviser will nevertheless liquidate any Subject Securities, including any derivative exposure thereto, on or before January 5, and optimize the portfolios accordingly. Through these actions, the KraneShares ETFs will continue to seek to track their stated underlying indexes.

Please see the table below for detailed information on the weight of Subject Securities in the KraneShares ETFs before and after the actions described above.

*KSTR launched on 1/27/2021

The KraneShares ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Fund. Additional information about SIDCO is available on FINRA’s BrokerCheck. [R-KS-SEI]