Global Luxury: A Golden Opportunity?

The global luxury market is booming. Luxury equities demonstrated exceptional resilience during the COVID-19 pandemic, with many big names posting 3 years of top-line and earnings-per-share growth. After a strong start to 2023, investors are racing to be part of the multi-decade global luxury opportunity.

A Resilient Industry

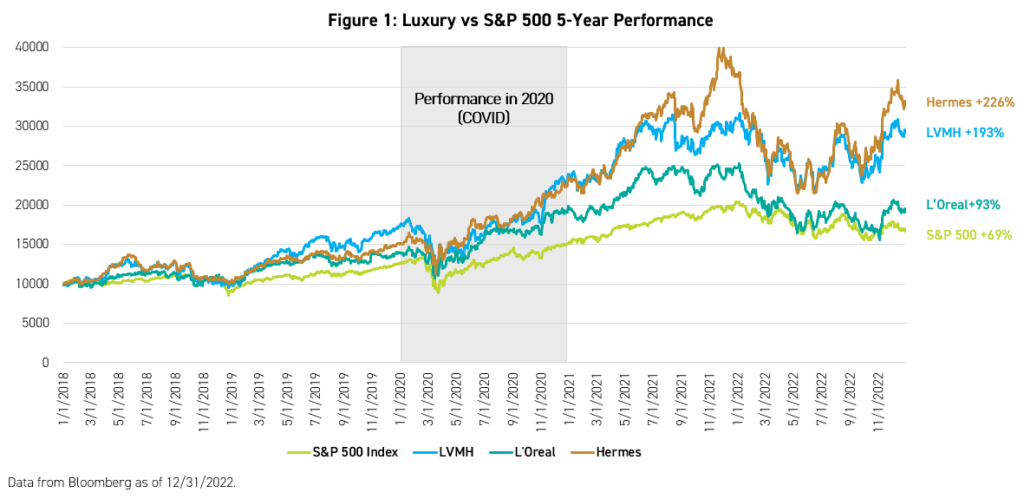

Despite the pandemic, the luxury sector was a bright spot for investors. During 2020, the peak of the pandemic, top global luxury names, including Hermes, LVMH, and L’Oreal, all outperformed the S&P 500. The S&P 500 finished 2020 up +18%, while Hermes returned +44%, LVMH returned +35%, and L’Oreal returned +31%.1 The same is true over the past five years, as shown in Figure 1. From 2018 to year-end 2022, the S&P 500 gained +69%, while Hermes returned +226%, LVMH returned 193%, and L’Oreal returned +93%.1

The outperformance of the luxury sector can be attributed to its loyal customer base, which is comprised of high-net-worth individuals, also known as “true-luxury” consumers. According to Bain & Company and Boston Consulting Group, these consumers spend an average of $43,000 per year on luxury goods and experiences, earn an average annual income of $558k, and have over $1 million in wealth.2 The same report states that true-luxury consumers account for 2-5% of total customers but generate 40% of industry sales.3

This dynamic underscores a pivotal aspect of the luxury market, where a small cohort of consumers drives a significantly disproportionate share of sales, highlighting the sector's resilience to economic fluctuations. True luxury consumers' buying power and loyalty create a substantial economic moat for luxury companies, offering a certain level of security against market downturns. It is a trend grounded in the notion that luxury is not just a purchase but a testament to a particular lifestyle, prestige, and exclusive experiences that these consumers are unwilling to compromise on, even in less favorable economic conditions.

Post-Pandemic Rebound

After global economies opened back up for business, there was a substantial uptick in consumer demand as the global travel and tourism sector witnessed a formidable resurgence. In 2022, international tourist arrivals more than doubled compared to 20204, leading to a boom in duty-free luxury shopping, especially at airports, which have transformed into hubs for luxury spending. Cities renowned for their luxury shopping experiences, including Paris, Milan, and Dubai, have attracted tourists in droves, who, despite the backdrop of rising prices, splurged on high-end items.

This rebound not only signified post-pandemic pent-up demand being unleashed but also highlighted the transformative power of the luxury sector in adapting and capitalizing on shifting consumer behaviors. The resilience and appeal of luxury goods and experiences, even in the face of inflation, affirm the sector's potential for sustained growth in the upcoming years.

Short-term Outlook

Despite rumors of a consumption slowdown in Europe and the U.S., recent U.S. CPI data and reports from the European Central Bank (ECB) suggest that market conditions could be improving. August’s CPI data report was in line with expectations5, indicating that concerns about slowing demand may be overstated. In Europe, the ECB is forecasting a slow yet firm road to recovery, with real GDP growth projected to bottom out at 0.7% in 20236. Furthermore, the travel and tourism sector is expected to provide a recovery of demand in both markets. According to Oxford Economics, there is an anticipated increase of about 23% in travel and tourism's total contribution to global GDP in 20237. This growth, amounting to $9.5 trillion in 2023 compared to $7.7 trillion in 20227, might present avenues of continued growth and expansion for global luxury brands.

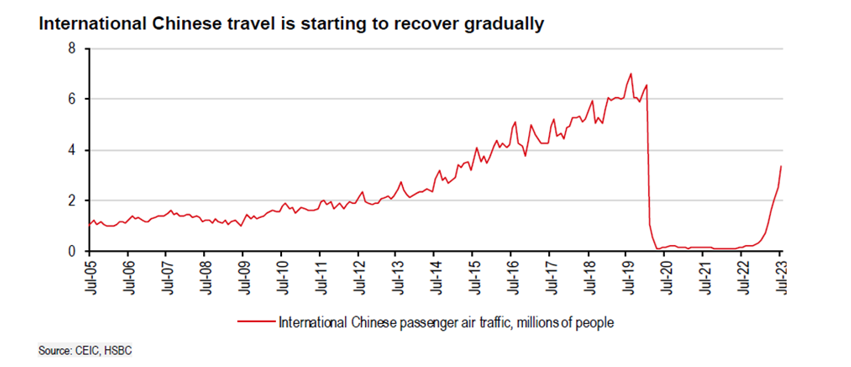

In China, the second largest consumer of luxury goods globally, travel and tourism have still yet to fully recover to pre-pandemic levels. However, it has seen an accelerated rebound, which may continue to benefit the luxury sector heading into 2024 and beyond.

According to HSBC, top names in the luxury sector reached valuations close to 40x price to earnings (P/E) during the pandemic, almost double its 20-year average of 22x P/Es8. After a lull in luxury equity performance, P/Es for top names are back around their 20-year averages8, which we believe may be a buying opportunity for investors.

Long-term Outlook

Looking forward, demand for luxury goods is on track to reclaim pre-pandemic levels in 2024. The projected market value of the sector is expected to double by 20309, underpinned by several positive trends and attributes that bode well for the luxury market.

Luxury companies are expanding E-Commerce efforts, allowing brands to reach a broader and more diverse consumer base globally. This digital shift is not just about widening the market reach but also about leveraging technology to offer consumers personalized and exclusive shopping experiences.

In the past, the global luxury market was fueled by a handful of countries, but there are now new major players emerging. The rising middle class in emerging markets, described as a “key megatrend sweeping the planet” by The World Bank, presents a significant growth opportunity and an increasingly affluent customer base for luxury firms. Particularly in China, the upper-middle class is growing exponentially, a trend driven by urbanization and economic growth. Though China has been among the fastest-growing globally, various other emerging economies, such as India, Southeast Asia, and the Middle East, also expect significant growth in their wealthy populations.

We believe that investing in the global luxury sector could be a compelling strategy to gain exposure to the surging consumer growth in emerging markets, all while maintaining allocation in developed market companies. Global luxury equities also grant substantial diversification benefits, attributable to the vast portfolio of brands many luxury conglomerates hold across the world. Furthermore, with a significant portion of luxury equities being listed on exchanges outside of the US, investors can reap potential asset-allocation advantages, fostering a globally diversified portfolio that can weather market volatility more effectively.

Diversification does not ensure a profit or guarantee against a loss.

Conclusion

We believe that the return of reasonable valuations in the global luxury sector offers investors a near-term entry point for a compelling long-term growth opportunity. The luxury market, characterized by resilient performance metrics and a loyal customer base, has historically emerged stronger in the face of challenges. Looking ahead, the sector has shown promising signs of continued growth, led by a booming travel and tourism sector, a steady customer base comprising of high-net-worth individuals, and the exponential growth anticipated in emerging markets backed by digital transformations.

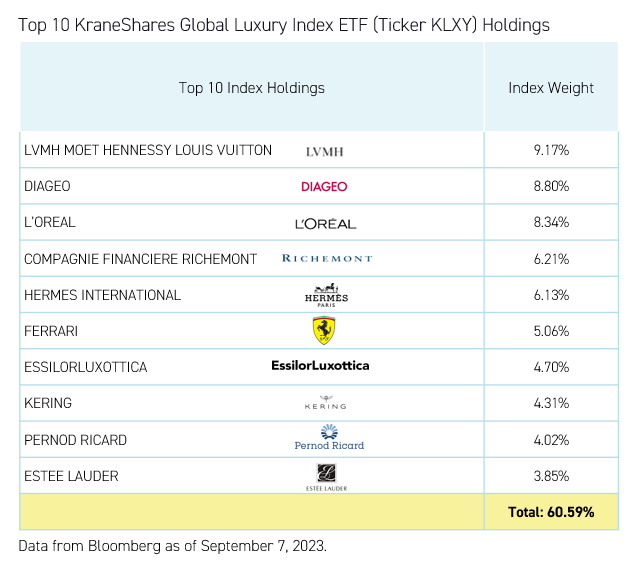

The KraneShares Global Luxury Index ETF (Ticker: KLXY) provides exposure to leading developed markets companies from global luxury-related sectors weighted by market capitalization. These companies operate across industries, including leather goods, jewelry, accessories, skincare, cosmetics, beverages, travel, and supercar businesses.

This should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the fund.

Citations:

- Data from Bloomberg.

- Data from Boston Consulting Group.

- Data from Boston Consulting Group and Bain & Company.

- Data from the World Economic Forum.

- Data from the Bureau of Labor Statistics.

- Data from the European Central Bank.

- Data from Oxford Economics.

- Data from HSBC.

- Data from Bain & Company.

Definitions:

Price to Earnings Ratio (P/E): The P/E ratio is calculated by dividing the market value price per share by the company's earnings per share.