Come Off The Sidelines With KSPY

Hedgeye Asset Management’s John McNamara III Tells Us Why Hedged Equity Strategies Are Gaining Traction With Investors

With U.S. equities sitting near record valuations and equity market concentration standing near its highest level in 100 years, according to data compiled by Goldman Sachs, the conversation around risk management in equity portfolios has become increasingly relevant. In a comprehensive discussion with John McNamara III, CIO of Hedgeye Asset Management, we explored the role of hedged equity strategies in today's market environment.

KraneShares recently partnered with Hedgeye Asset Management, LLC ("HAM") to launch the KraneShares Hedgeye Hedged Equity Index ETF (Ticker: KSPY). HAM is a subsidiary of Hedgeye Risk Management, LLC ("Hedgeye" or "HRM"), which is known for, among other world-class products, its proprietary Risk Range™ Signals. The signals were developed by ex-hedge fund manager and current Hedgeye CEO Keith McCullough, with the goal of providing a quantitative risk management tool to augment fundamental views. The proprietary Risk Range™ model analyzes price, volume, and volatility to help market participants identify entry and exit points.

KraneShares brings Hedgeye’s renowned Risk Range™ signals to investors through KSPY, which seeks to offer a risk-managed approach to participating in US equity markets.

Market Context and the Compelling Case for Hedged Equity

KraneShares:

Given recent market strength and the potential for further rate cuts in 2024, why should investors consider hedged equity strategies now?

John McNamara:

U.S. equities have reached record valuations in 2024, primarily driven by the performance of a handful of stocks. The "Magnificent Seven," as they’re commonly referred to, added about $3.4 trillion in market value in just the first six months of 2024, surpassing their gains for all of 2023.1

These “Magnificent Seven” now make up approximately 31% of the total weight of the S&P 500 index and reached a valuation of $16 trillion by the end of September of this year.2 This concentration has led to a significant valuation imbalance in the market, with the Magnificent Seven trading at an average of 45 times estimated forward earnings, compared to just 24 times for the rest of the S&P 500.3 While this growth has been largely driven by strong earnings and expectations around future AI-related profits, such high concentration is a topic of increasing investor focus and, although elevated market concentration is not an immediate-term downside risk signal, data compiled by Goldman Sachs suggests high concentration is associated with lower returns over longer horizons.

The current market landscape presents a complex set of challenges for investors. While markets have shown strength and the Federal Reserve is expected to implement additional rate cuts, this isn't necessarily a straightforward bullish signal. Contrary to the current market narrative, rate cuts have historically not been a bull market phenomenon. While we are not making a call on when or if these challenges impact equity market returns, we would highlight that there is always a place for risk management in portfolios.

Performance Analysis: Navigating Market Volatility

KraneShares:

How has KSPY's Index performed during recent market volatility events?

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit our website by clicking kraneshares.com/kspy.

John McNamara:

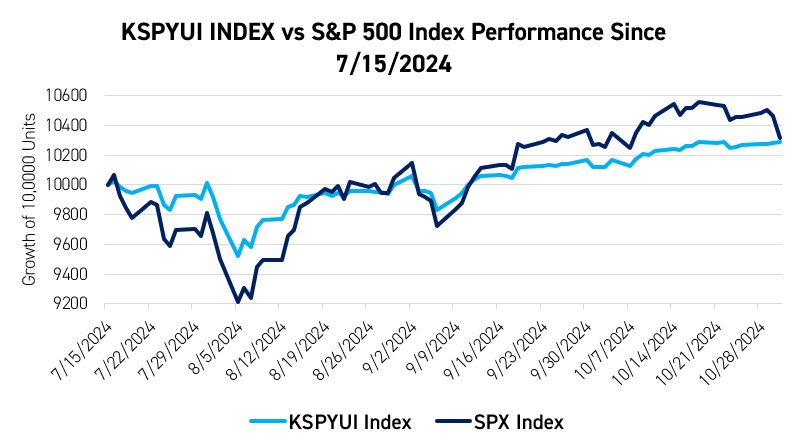

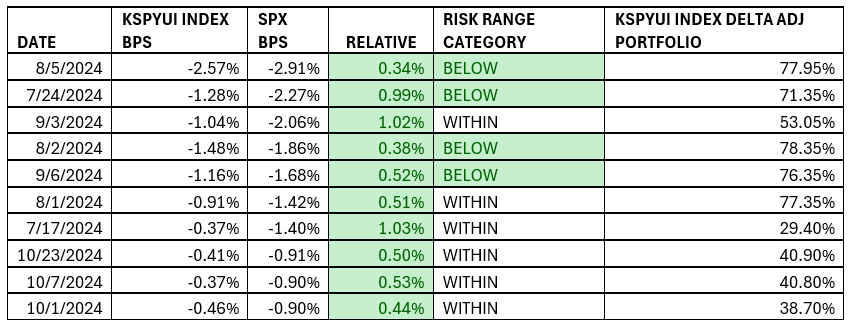

The strategy's effectiveness has already been demonstrated several times, despite only beginning trading in mid-July of 2024. On July 24, 2024, when the S&P 500 experienced a sharp decline of -2.27%, KSPY’s Index limited losses to -1.28%, providing nearly 100 basis points of relative outperformance.

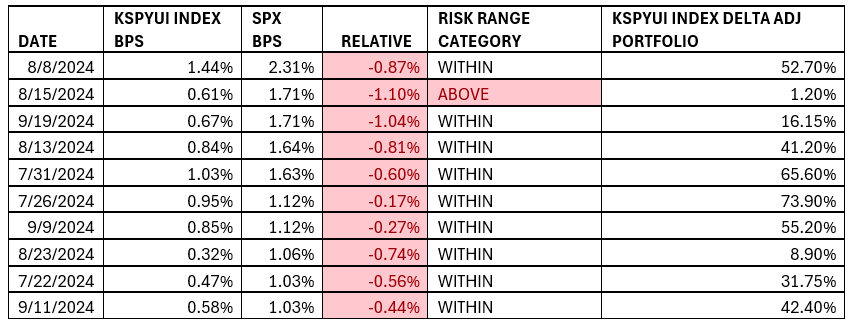

Another particularly notable period of performance occurred during August 2-6, 2024, when the strategy successfully navigated declines as well as a subsequent rebound. During this period, KSPY’s Index consistently outperformed the S&P 500 even during a 92-basis-point rally, as KSPY's Index was positioned in the "Below" Risk Range™ category and thus was not short a call coming into the August 6th rally.

KSPY's Index adaptability was further demonstrated on October 15th, as the strategy entered the day positioned in the "Above" Risk Range™ category, thus not shorting a put. This positioning allowed the Index to decline only by 6bps while the S&P 500 declined 78bps.

Since KSPY launched on July 16th, 2024, through October 28th, 2024, its Index has returned +2.15% versus the S&P 500’s +3.77% total return and has outperformed the S&P 500 35 of 74 trading days. KSPY’s Index performed as intended in those more volatile periods, providing downside risk management while also allowing for upside participation.

Notable Trading Days

Forward-Looking Volatility and Market Events

KraneShares:

What potential volatility events should investors be watching for?

John McNamara:

Looking ahead, there are several key factors that could lead to additional market volatility. The Federal Reserve's policy trajectory remains a critical focus. Our view is that the September consumer price index (CPI) print, which was reported in October, is the cycle low for inflation. This potential inflection point for inflation could significantly impact the Fed's ability to continue its rate-cutting cycle into 2025.

Sticking with inflation, broadly, asset prices saw gains following the Fed’s 50-basis point rate cut in September, only adding to our already elevated inflation expectations. This dynamic may also complicate the Federal Reserve's policy trajectory and lead to increased market volatility.

The upcoming election cycle adds another layer of uncertainty. Historically, election periods tend to coincide with increased market volatility, making risk management strategies particularly relevant during these times.

Implementation Strategy and Portfolio Construction

KraneShares:

How should investors think about incorporating KSPY's Index into their portfolios?

John McNamara:

We believe the Hedgeye Hedged Equity Index can serve multiple purposes, especially at a time when investors are increasingly concerned about the longevity of the current bull market. We see several strategic applications, including deploying new capital or realized gains back into equity markets with built-in risk management features.

This approach is particularly relevant for investors who are sitting on cash holdings and want to come off the sidelines with a risk-managed strategy, which allows for the maintaining of market exposure while managing potential downside. Over the past few years, we’ve seen many investors put their cash to work in high-yield money market accounts, becoming more popular as the Fed hiked rates.

The Hedgeye Hedged Equity Index's importance becomes particularly apparent when considering retirement planning. Investors constantly tell us that if their equity portfolio experiences a significant drawdown, it could completely change their ability to retire as well as their financial standing. For investors approaching retirement, the strategy offers a way to balance continued market participation with a potential downside hedge. The systematic approach and hedging capabilities can help investors navigate market uncertainty while maintaining long-term investment objectives. The current market environment may present an opportune time for portfolio repositioning. Given the market uncertainty we’ve discussed, it may be a great time for utilization of the Hedgeye Hedged Equity Index.

KSPY's Index Differentiated Approach: Breaking Down the Strategy

KraneShares:

Why KSPY's Index rather than other hedged equity strategies?

John McNamara:

Hedged equity strategies have gained substantial popularity recently. According to Bloomberg, hedged equity strategies have accumulated between $70 and $100 billion in assets as of October 2024. Given the current market uncertainties we’ve discussed, I’m not surprised that there is strong demand for hedged equity strategies.

With that being said, I believe the Hedgeye Hedged Equity Index stands out through its unique approach. Three fundamental differentiators set the strategy apart from traditional hedged equity products: the utilization of Hedgeye’s Risk Range™ Signals, the deployment of three distinct option strategies, and its fully systematic index-based methodology. Moreover, the Hedgeye Hedged Equity Index's Risk Range™ framework has demonstrated remarkable accuracy. Since 2015, the S&P 500 has closed within Hedgeye’s daily published Risk Range™ Signals 83% of the time.

The Hedgeye Hedged Equity Index also differentiates itself by rolling options at least once every three weeks, while traditional hedged equity products typically rotate options on a quarterly basis. The strategy also makes adjustments whenever the Risk Range™ regime changes, allowing for more flexibility, risk management capability, and potentially smoother returns over time.

Conclusion

The current market landscape presents both challenges and opportunities for investors. As U.S. equities reach record valuations, the need for effective risk mitigation becomes increasingly critical, especially with the potential for uncertainty around the Fed’s future moves and the upcoming election.

For investors looking to balance market participation with a potential downside hedge, maintain long-term investment goals, or redeploy capital into the market, we believe the KraneShares Hedgeye Hedged Equity Index ETF (Ticker: KSPY) offers a vehicle to enhance portfolio resilience amid volatility.

For KSPY standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- Data from Bloomberg as of 6/30/2024.

- Data from Bloomberg as of 10/25/2024.

- Data from FactSet as of 10/25/2024.

Index Definitions:

Hedgeye Hedged Equity Index (Ticker: KSPYUI Index): The Hedgeye Hedged Equity Index provides exposure to the S&P 500 while actively reducing volatility and providing downside risk management. The Index is managed by Hedgeye Asset Management, LLC and utilizes a model based on Hedgeye’s proprietary Risk Range™ Signals that analyze the daily trading range of the S&P 500. The Index toggles between three options strategies based on where the S&P 500 falls within these ranges. These options strategies are intended to provide downside risk management, option income, and potential compensation for the loss of upside. Depending on market conditions, the Index can change options strategies as frequently as daily.

S&P 500 Index (Ticker: SPX Index): The S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.