Investment opportunities from China’s

“two sessions” and supply-side reform

Executive Summary

- Following a key meeting of China's leadership, a new investment theme has taken hold in China's onshore markets

- The new theme is "supply-side reform", which aims to improve competitiveness, reduce overcapacity and foster growth of emerging industries

- There are a number of key differences between the U.S. and Chinese approach to supply-side economics

- Investment opportunities: cyclical stocks with the concept of cutting overcapacity as well as emerging industries may potentially benefit. Focus on sectors such as healthcare, education, network technology and new manufacturing technologies

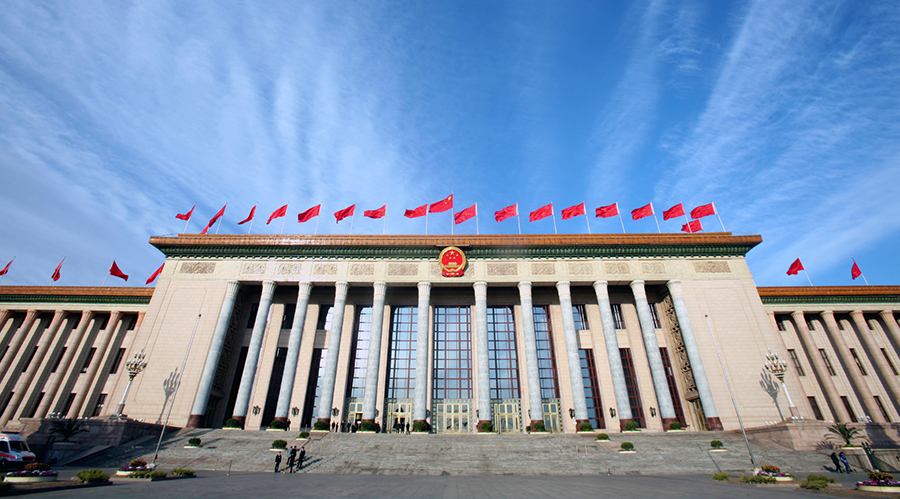

Every year China holds an annual meeting of its two most important governing bodies, the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC). During the “two sessions”, as they are commonly known in China, the country’s leadership makes major announcements that shape the policy and economic direction of the world’s second largest economy for the rest of the year and into the future. This year’s meetings, held from March third through fifteenth, yielded a number of results that will impact global investors.

Our partners from E Fund Asset Management’s international investment team provided us with the following commentary on the outcome of the two sessions.

Themes endorsed in the annual top-level meetings of the NPC and the CPPCC (popularly called the “two sessions”) tend to become a major focus of the market and serve as an unofficial guide for where Chinese investors allocate their money. The “two sessions” typically discuss a range of recurring topics like healthcare, education and environmental protection, however, the key theme for the meeting is different every year.

One can ascertain the importance of the key theme from the “two sessions” simply by looking at key themes from the past two years and how they have dominated state media and government policies in China. 2015’s key theme was “Internet Plus”, which is a strategy that provides stimulus and incentives to companies in the internet and technology sector. 2014’s theme was “regional development”, where the government announced its One Belt One Road Initiative, which focuses on building infrastructure to better connect China with its trading partners. Evidence of the government’s work in promoting these themes is ubiquitous in China.

This year’s theme was “supply-side reform”. President Xi Jinping first spoke about the topic in November last year, since then the term has been widely discussed and was the hottest catchphrase during the “two sessions”.

“Supply-side reform” enhances competitiveness

According to the Report on the Work of the Government, “while working to achieve an appropriate expansion of aggregate demand, we need to give particular emphasis on supply-side structural reform.” Some scholars interpret “supply-side structural reform” as launching reform from the supply and production sides to improve competitiveness, by reducing overcapacity and focusing more on emerging and innovative industries.

One example of where supply-side reform can benefit China’s economy is through raising competitiveness of Chinese domestic goods. In recent years, shopping abroad has become a major trend among Chinese consumers. This is attributable to increased aspirational buying and changes in consumption patterns. As China’s middle class has expanded, Chinese consumers’ taste and expectation of quality has also risen. Chinese consumers are eager to buy things like Japanese electronics, Korean cosmetics, and Australian milk powder. Supply-side reform aims to raise the production standards of Chinese manufactured goods to match their international competitors, reducing oversupply of less desirable goods.

Supply-side reform, four key points

President Xi Jinping summarized four key points to addressing supply-side reform: 1) resolving overcapacity, 2) lowering the cost of capital financing for corporates, 3) addressing property inventories and 4) controlling systemic financial risks.

The related policies have been highlighted in the Report on the Work of the Government 2016. Some of the specifics include:

- Reducing overcapacity in coal and steel industries: 100 billion yuan will be provided by the central government to resettle employees laid off from these industries.

- State Owned Enterprise (SOE) reform: Some SOEs will be developed through innovation, others will be reorganized or merged, and still others will exit the market.

- De-stocking of the real estate industry: The government will “ensure that cities take policies appropriate to their local conditions to ease the real estate industry's problem of excess inventory,” implying stricter real estate policies in higher tier cities and implementation of stimulating measures in lower tier cities.

The Experience of US Supply-side economics

Some relate president Xi’s new “supply-side reform” policies with supply-side economics as practiced in the United States. In reality, there are a number of differences between the U.S. and Chinese policies.

Supply-side economics emerged in the early 1970s when the US suffered stagflation; persistent high inflation combined with high unemployment and stagnant demand. There were several structural problems including extremely high tax rates, limited access for some industries and price control.

Under Ronald Reagan’s administration, supply-side economics were applied to help solve the stagflation issues. Reagan emphasized reducing tax rates and government intervention in the economy. The Economic Recovery Tax Act and the Tax Reform Act were passed in 1981 and 1986 respectively, resulting in a wave of deregulation in transportation, communication, energy, financial and other sectors of the economy. After a series of measures, the US economy recorded an average of 4% growth for 92 consecutive months in the 1980s1.

Unlike supply-side economics in the US, which put the emphasis on market liberalization, China is taking a more policy-oriented approach. The government will be more proactive guiding the transition from demand-side momentum to supply-side structural changes. Similar to the US in the 1980s, China is facing problems attributed to high corporate income tax and entry restraints in certain sectors. We believe China could also draw upon the experience of the US and reduce corporate tax rates and relax market entry requirements.

Investment opportunities in China's onshore markets

Before the "two sessions" began, savvy investors were already looking for opportunities likely to be triggered in the context of the “supply-side reform” story in stock markets. Cyclicals such as coal, ferrous metals and steel industries performed well during the two sessions. While the rebound of commodity prices was a favorable factor, the “supply-side reform” that involves reducing overcapacity in cyclical industries also rendered support.

The impact of “supply-side reform” on cyclical sectors, where the elimination of overcapacity is focused, may result in more mergers and acquisitions in steel, coal and cement industries, leading to higher concentration of capacities in these sectors. When overcapacity is resolved and supply/demand conditions and balance sheets have improved, companies that are likely to emerge stronger after SOE reforms constitute potential opportunities. Meanwhile, de-stocking in the real estate market would improve property sales and boost the leasing market, which in turn may benefit the real estate and related service industries.

Apart from reducing overcapacity in traditional industries, “supply-side reform” would also encourage the development of emerging industries, implying abundant investment opportunities in healthcare, education, network technology, new manufacturing and innovative technologies such as robotics.

By focusing on supply-side reform, China’s goal is to shape a more dynamic economy through reducing overcapacity and boosting growth of emerging industries.

International Investment Team

E Fund Management (HK) Co.,Limited

E Fund, located at Suite 3501-02 35F, Two International Finance Center, 8 Finance Street, Central, Hong Kong serves as the Co-Adviser of the The KraneShares E Fund China Commercial Paper ETF (KCNY).

1.) Robert Bartley, The Seven Fat Years (New York: Free Press, 1992), pp. 135, 144.