Top 5 Reasons A Win-Win Relationship With China Benefits The US Economy

While the trade war taught us that we are a global economy, the coronavirus pandemic shows that we are a global community. At a time when international unity is more necessary than ever, we believe the desire for increased cooperation will be the prevailing sentiment as the world reopens - even if headlines do not always appear that way.

There was a tremendous amount of positive momentum generated from the signing of the Phase One trade agreement earlier this year. While the coronavirus pandemic and pending US election have diverted attention away from these accomplishments, we believe it is essential to focus on strengthening the win-win aspects of the relationship between the US and China for the following reasons:

1. A cooperative relationship between the world's two largest economies is more important now than ever.

Behind the scenes, there were signs of a more cooperative relationship during the pandemic than what the headlines portray.

As China began to grapple with the first significant outbreak of COVID-19, the US exported much-needed medical supplies to China. While there are no official numbers to quantify the full extent of cooperation, reports indicate that in January and February, US companies shipped $58.6 million worth of ventilators, masks, and medical garments to China and the U.S. Department of State donated an additional 17.8 tons of medical equipment.1

As the virus began to hit the United States, multiple leaders in China's business community spearheaded the reciprocal effort to send much-needed personal protective equipment to the US. In March, Alibaba co-founder and owner of the Brooklyn Nets, Joe Tsai, donated 2.6 million masks, 170,000 goggles, and 2,000 ventilators to various New York hospitals.2 Alibaba founder Jack Ma personally chartered a plane to deliver $1 million worth of masks and testing kits to New York. Following these private individuals' efforts, China's government loosened restrictions on exporting medical supplies initially reserved for China's domestic stockpile in order to facilitate emergency shipments of medical supplies to the US.3

While the common perception is that US / China relations were only strained further due to coronavirus, China and the US supported each other at the government, business and individual level throughout the pandemic. As both countries have the highest numbers of clinical trials currently in motion, a cooperative relationship would ensure that the future vaccine reaches the world's population as efficiently as possible.

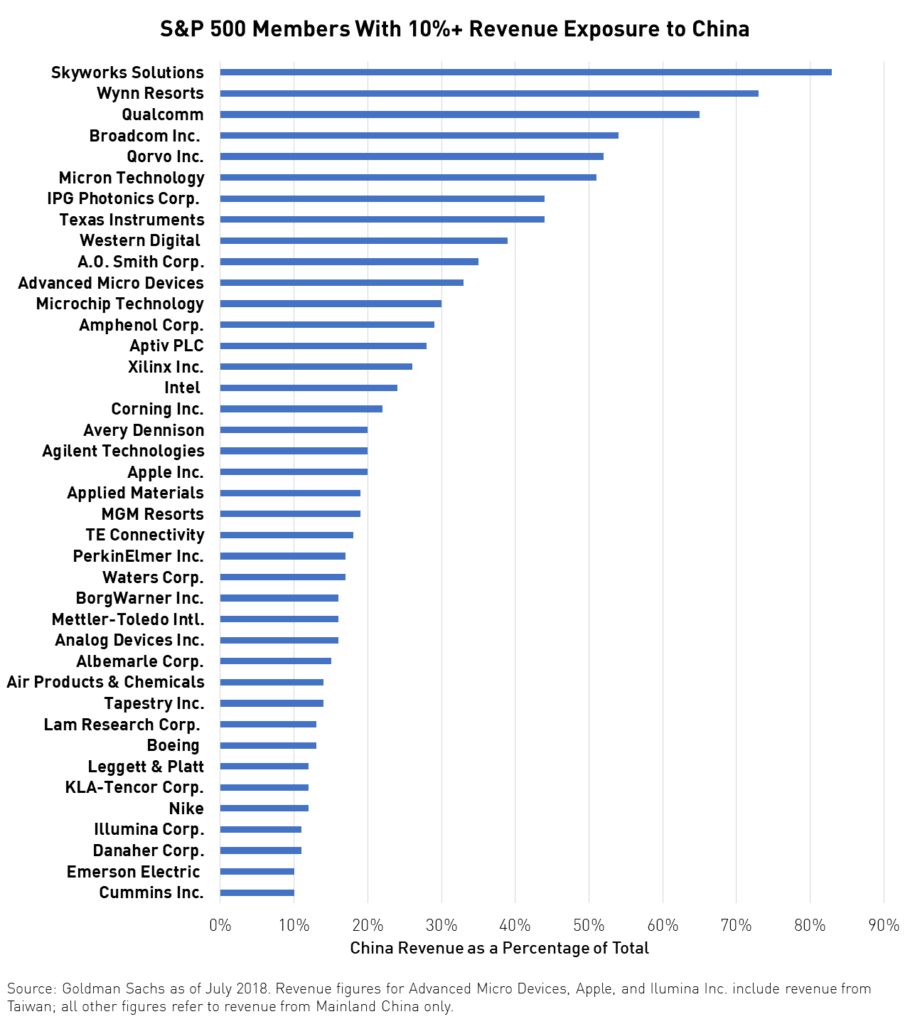

2. US companies continue to look to China's consumer market for growth.

American companies are increasingly relying on the Chinese consumer as a key source of revenue growth. In 2017, US multinationals generated revenue of approximately $376 billion in China.4 Even amid the pandemic, fast food brand Popeyes opened its first store in China, and the company hopes to open 1,500 more soon. Costco plans to open seven new stores in China, and Walmart hopes to open 500.5 Despite rhetoric from US leaders, US companies have found that the Chinese consumer nonetheless continues to appreciate American brands and takes "made in the USA" as a sign of quality.

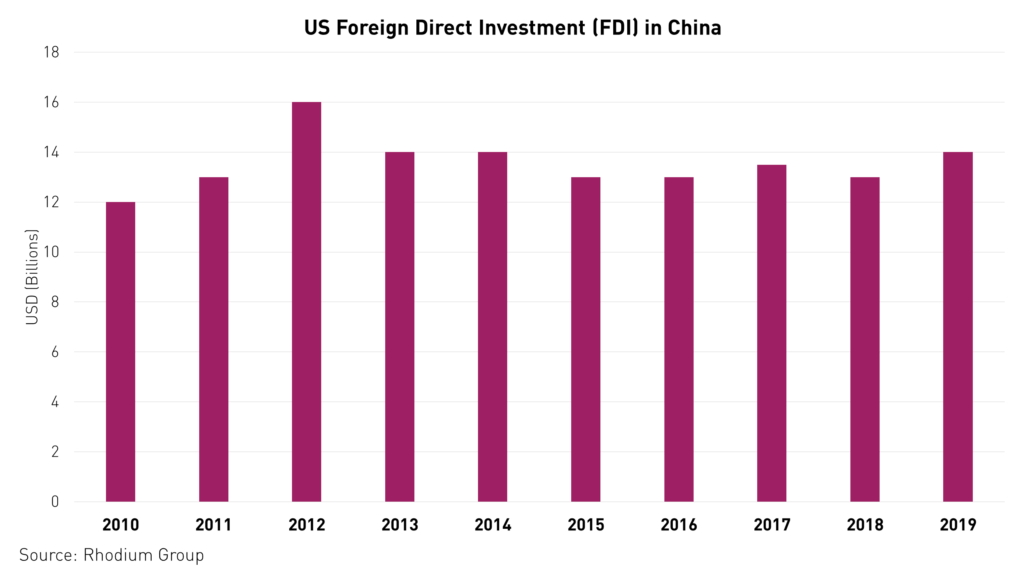

Paradoxically, American investment in China has remained steady through the trade war. 36% of US businesses surveyed by the American Chamber of Commerce in China said that they would move forward with investment plans regardless of guidance from Washington.5

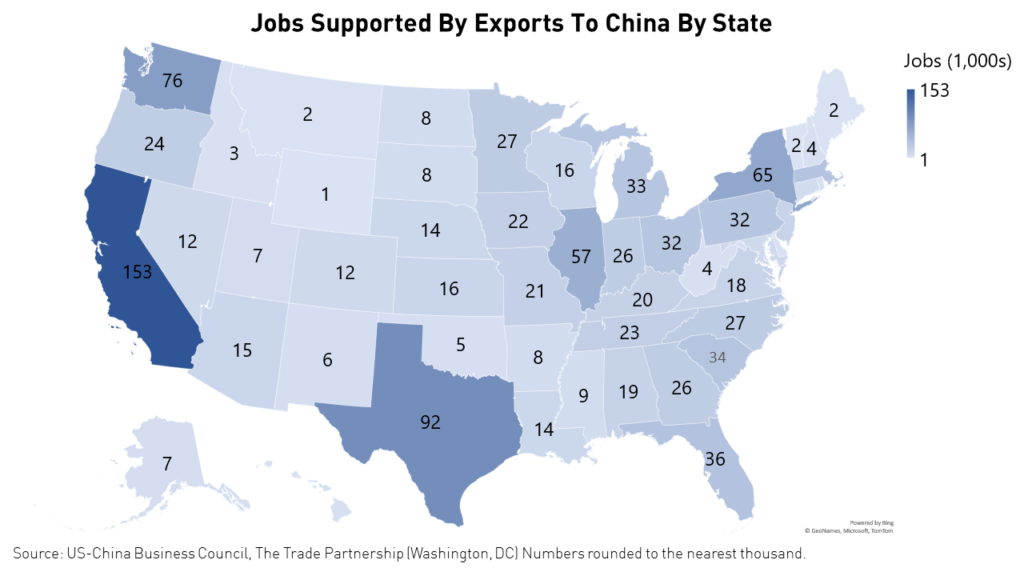

3. Trade with China supports more than 1.1 million US jobs.6

Under the Phase One trade agreement, China promised to increase agricultural purchases from the US by nearly $40 billion, offering significant relief for farmers, many of whom are now seeing the brunt of the impact from the coronavirus pandemic. Goods exports to China grew at an average annual rate of 6.2% from 2009 to 2018, while services exports grew at a 15.2% annualized rate from 2008 to 2017. In recent years, American business have profited greatly from trading with China, however as a result of the trade war, goods exports to China contracted for the first time in a decade, falling by -7.4% from 2017 to 2018.6

We believe carrying out the Phase One trade deal is in our best interest as well as China's. The Phase One trade deal involved, among other provisions, a commitment by China to respect intellectual property rights and increase its purchases of US goods. The agreement is the landmark of the president's foreign policy that also achieved strong bipartisan support. Thanks to China's compliance with the terms of the agreement, China surpassed Canada and Mexico to become the US' largest trade partner in April this year.7

4. The Trade War Hurt US Stocks

Trade headlines tend to ripple through markets and dampen business confidence all over the world. US equity markets surged once the US and China signed a trade deal in January. Equity markets on both sides of the Pacific have consistently contracted with every trade tweet or negative communication. The Federal Reserve Bank of New York estimates that every significant announcement of new trade restriction was followed by an average -2.9% drop in the stock price of affected companies within five days of the announcement. According to the NY Fed, announcements of trade restrictions have lowered the market capitalization of US-listed firms by $1.7 trillion so far.4 At this challenging moment, increasing trade tensions risk pushing an economic recession into a full-blown depression.

Fortunately, the US and China have been communicative on trade, and the Phase One deal remains in effect. State-owned firms purchased over 1 million tons of soybeans in only two weeks in May, some of which are scheduled for future delivery. The purchases came after China had already begun to increase purchases of other agricultural products such as wheat and sorghum since the Phase One agreement was signed.8

5. US Investors cannot ignore China's recovery

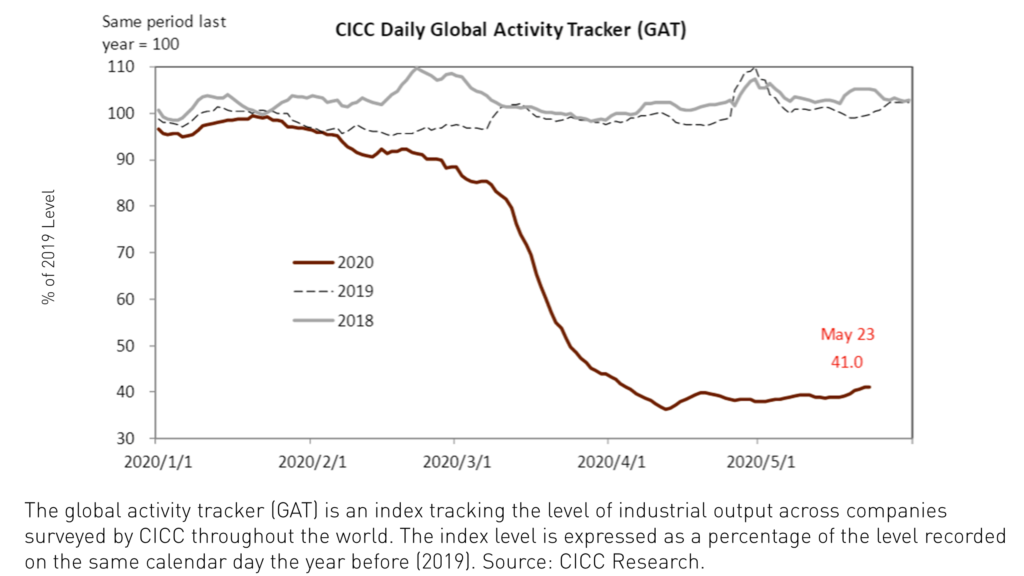

We believe there are currently multiple tailwinds for growth in Chinese stocks. These include an economy that has been swiftly recovering from the pandemic, valuations that may rise thanks to new Hong Kong listings, significant recent steps to further open Mainland markets that are being applauded by the global investor community, and a thriving domestic market that has survived the pandemic.

While CICC projects real GDP growth of only 2.6% YoY in 2020, it projects a staggering 9% YoY rebound for 2021.9 By comparison, the Congressional Budget Office projects US GDP growth of -5.6% YoY in the US and a 2.8% YoY rebound in 2021.10

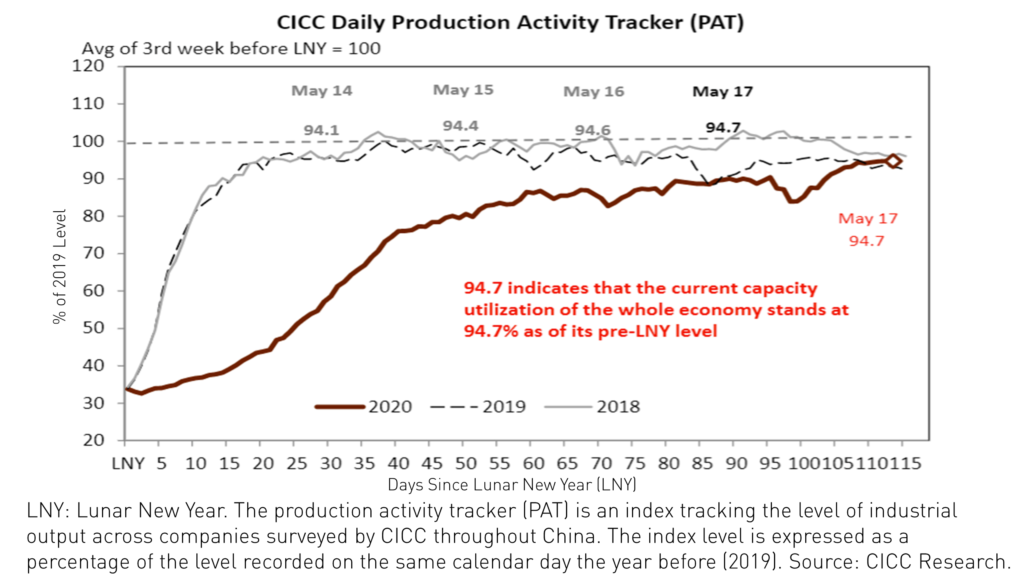

China has the advantage of having been the first country to experience the pandemic and therefore is likely to recover first. China has mostly restarted its vast production engine as well as allowed numerous offline businesses to reopen including restaurants, brick-and-mortar retail, and movie theaters. With offline businesses reopened in most provinces, China already has a head start over the rest of the world. We believe participating in this recovery in demand may yield significant returns for global investors.

Citations:

- Zhang, Dian. "US exported millions in masks and ventilators to China in response to the coronavirus crisis," USA Today. April 2, 2020.

- Alesci, Cristina. "Billionaire Brooklyn Nets owner Joe Tsai donates ventilators and masks to New York," CNN Business. April 4, 2020.

- Lin, Liza. "China Seeks to Ease Medical Goods Shipment Delays With New Rule," The Wall Street Journal. April 26, 2020.

- Amiti, Mary. "The Investment Cost of the U.S.-China Trade War," Liberty Street Economics, Federal Reserve Bank of New York. May 28, 2020.

- Moss, Trefor. "Neither Coronavirus Nor Trade Tensions Can Stop US Companies' Push Into China," The Wall Street Journal. May 19, 2020.

- 2020 State Export Report: Goods and Services Exports by US States to China Over the Past Decade, The US-China Business Council. April 2020.

- US Census Bureau as of April 31, 2020.

- Almeida, Isis. "China Steps Up U.S. Soybean Buying With Million-Ton Purchase," Bloomberg. May 11, 2020.

- "Cutting growth forecast amidst escalating global COVID-19 pandemic," CICC Research. March, 2020.

- Swagel, Phil. "CBO's Current Projections of Output, Employment, and Interest Rates and a Preliminary Look at Federal Deficits for 2020 and 2021," Congressional Budget Office. April 24, 2020.