KEMQ: Emerging Markets As The Next Consumer Tech Growth Catalyst

Walk into any electronics store in São Paulo, Mumbai, or Jakarta and you'll notice something. The same consumer behaviors driving tech valuations in Silicon Valley are happening in each one. People want to own smartphones. They want to stream music and video. They want to pay online via e-commerce apps and use digital payments. The difference? Emerging market consumers represent the next 3 billion people coming online.1

The KraneShares Emerging Markets Consumer Technology ETF (Ticker: KEMQ) attempts to position investors to capture this massive demographic shift by selecting companies that are focused on building digital infrastructure for emerging market consumers.

Just Tech Stocks Are Not Enough

KEMQ tracks the Solactive Emerging Markets Consumer Technology Index. This index screens for companies across 26 emerging market countries whose businesses derive revenue from internet retail, software services, payment processing, and E-Commerce technology. The fund does not aim to speculate on on which emerging market will produce the next unicorn. It's about investing in companies already serving hundreds of millions of customers—customers who are just beginning their digital journeys.

The fund's geographic spread matters. While many emerging market funds get dominated by Chinese companies, KEMQ's approach captures the entire emerging markets technology ecosystem. The fund accesses growth themes from Latin American fintech companies processing mobile payments to Southeast Asian e-commerce platforms competing with Amazon.

The Smartphone-First Economy

Most emerging market consumers are now bypassing traditional desktop computing entirely. They experience the internet first through smartphones. This crucial difference alters purchasing patterns, software requirements, and business models compared to what worked previously in the United States or Europe during their mass adoption phase.

The mobile-first commerce base for many emerging markets means that integrated super-apps are highly lucrative. These platforms, that combine everything from messaging to transportation, we believe are vital hubs for the customer experience. The companies building these hubs could have an edge as they can have first mover advantage. They don't need to displace any existing systems because they're building the first systems many consumers will ever use.

Demographics Meet Technology

The average internet user around the globe now spends over 6.5 hours every day online, 60% of which is on mobile phones.2 If we marry that fact with the overall population of internet users worldwide, which, as of October 2024, was 5.52 billion, we can see the large addressable market.1 Most importantly, nearly 96% of that global digital population used a mobile device to connect to the internet in mid-2023.2

Unlike mature markets where growth comes from stealing market share, emerging market consumer tech companies can grow by simply expanding access. When a payment app adds its first million users in Kenya or when an E-Commerce platform enters a new Indonesian island, they're creating markets, rather than competing for existing ones.

Policy Wind at Your Back

Government policies across emerging markets are favoring digital infrastructure development. Digital payment initiatives in India, fintech regulatory sandboxes in Brazil, and technology investment zones across Southeast Asia are creating supportive environments for the companies KEMQ aims to hold.

This policy support is vital in emerging markets. If the government actively encourages broad digital adoption, whether through regulatory changes, tax incentives, or infrastructure investment, it can accelerate growth timelines and turn decades into years on project implementation.

The KEMQ Difference

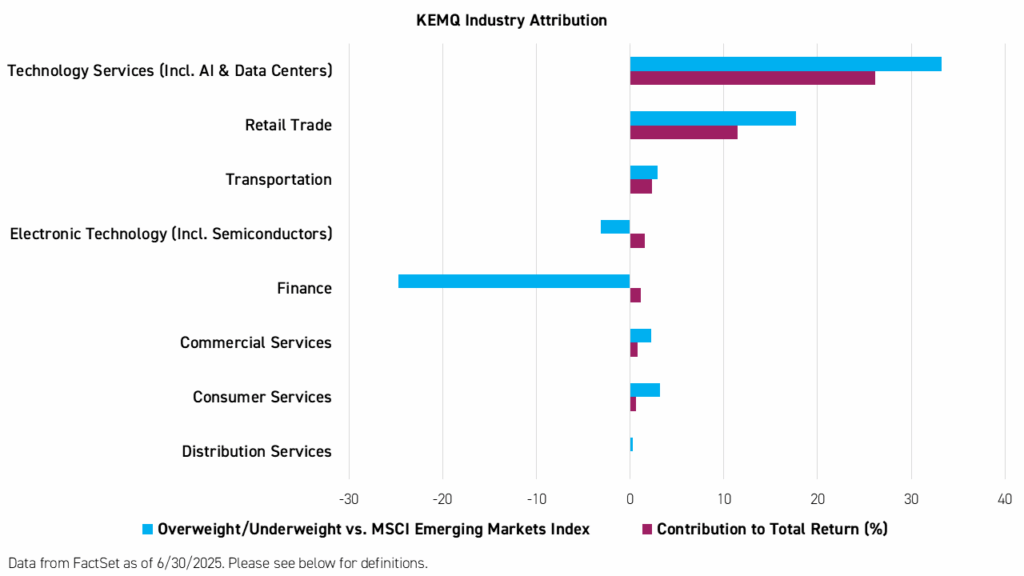

Traditional broad emerging market equity funds often include substantial allocations to commodity, old economy, and slow-growth companies. KEMQ filters out these sectors to focus purely on consumer technology themes but includes not only directly consumer-facing firms but also firms working behind the scenes operating data centers and building AI solutions for online businesses. As a result, KEMQ has returned 43.96% over the past year, compared to only 15.89% for the MSCI Emerging Markets Index.3

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit kraneshares.com/etf/kemq.

This concentrated portfolio approach can be favorable for investors wishing to access emerging market growth trends without exposing themselves to the cyclical or political risks that can be associated with old economy companies.

The KraneShares Emerging Markets Consumer Technology ETF (KEMQ) offers investors targeted exposure to the digitization of billions of people. For investors seeking growth outside of developed market technology companies, KEMQ aims to provide access to consumer technology companies focused on building the digital infrastructure for the next generation of global internet users.

Index returns are for illustrative purposes only and do not reflect management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Sources:

- Data from Statista and the World Bank as of 12/31/2024.

- "Digital Around the World," 2025. Data Reportal.

- Data from Bloomberg as of 7/10/2025.

Please click here for KEMQ standard performance, top 10 holdings, risks, and other fund information.

Diversification does not ensure a profit or guarantee against a loss.