2026 Emerging Technology Outlook: Bull Market Broadening?

Introduction

Artificial intelligence (AI) appears to be igniting another industrial revolution. But alongside its rapid adoption, investor concerns around valuation and concentration risk are mounting. A slowing consumer, a weakening labor market, and elevated equity valuations continue to suggest a late-cycle environment, even as AI enthusiasm pushes major indexes to new highs.

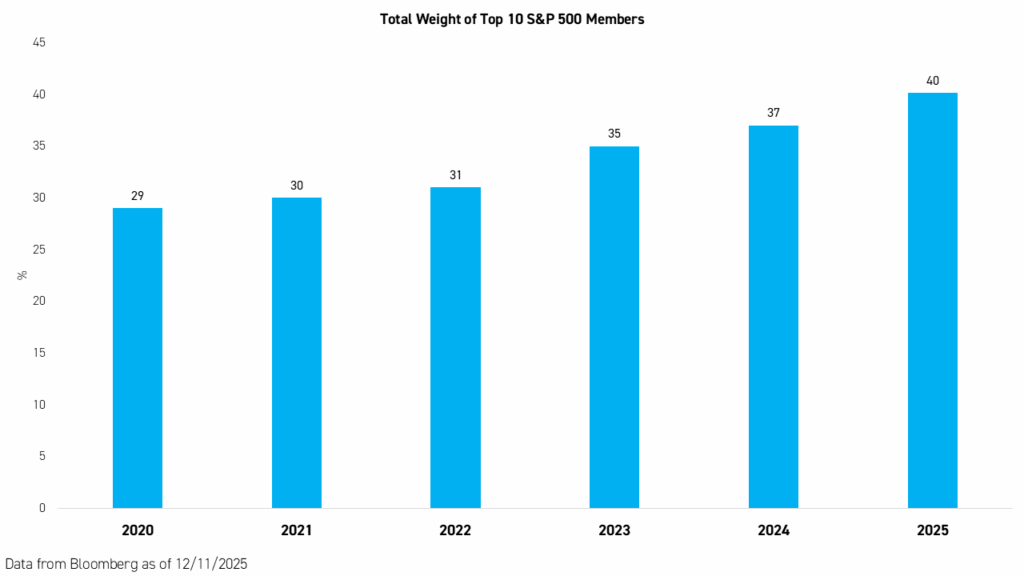

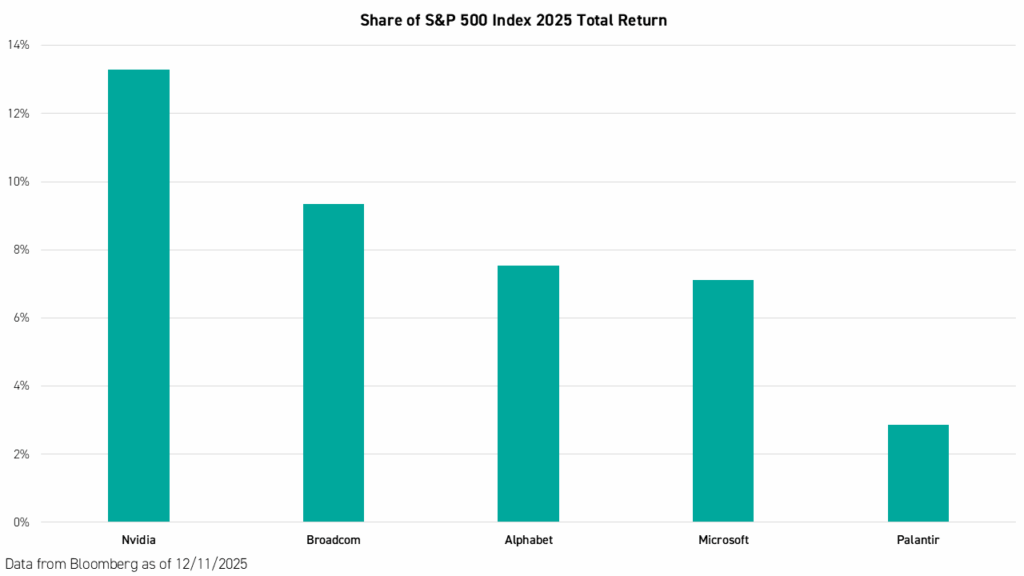

More concerning, however, is how narrowly those gains have been generated. AI-led market performance has been concentrated in the so-called "Magnificent Seven" and a small group of core infrastructure beneficiaries. Nearly 40% of the S&P 500 Index’s total return in 2025 came from just five stocks: Nvidia, Broadcom, Alphabet, Microsoft, and Palantir.1 For investors, this creates an uncomfortable trade-off: remain exposed to one of the most powerful technological shifts in history, or risk overconcentration in a handful of names.

Where do we go from here?

We believe investors should remain invested in AI and technology, but rethink how that exposure is constructed. In 2026, diversification may matter as much as innovation. Potential ways to achieve this include broadening exposure beyond public U.S. mega-caps through private markets, expanding into physical AI and robotics, diversifying geographically—particularly toward China—and employing weighting methodologies that go beyond traditional market-capitalization approaches, such as equal-weight or theme-relevance weighting.

Concentration Risk Mounts

AI-led market performance has been concentrated in the Magnificent Seven and a handful of core infrastructure beneficiaries. Many investors today are grappling with the risk of concentration.

More concerning is that most of the gains in the S&P 500 Index for the past two years are concentrated in a handful of names. As we mentioned above, 40% of the S&P 500 Index's total return in 2025 came from only five stocks: Nvidia, Broadcom, Alphabet, Microsoft, and Palantir.

The next question is how AI leadership can broaden. In 2026, the diversification of the AI ecosystem is expected to accelerate as enterprise adoption scales and the ecosystem expands across data infrastructure, AI-native software, cybersecurity, industrial automation, and edge- and device-level intelligence. At the same time, investors should remain cautious of “AI theater”—companies rising on hype rather than demonstrable products, distribution, or economic impact.

For these reasons, we prefer an equal-weight strategy or a theme relevance weighting scheme as opposed to market capitalization weights when it comes to technology exposure. Employing these strategies can help reduce concentration risk and avoid the “AI theater” trap. Equal weights are especially useful for themes that are just taking off, in which the leaders have yet to be determined, like humanoid robotics. Meanwhile, strategies that weight companies by relevance to a theme, rather than just technology or market capitalization ranking, can maintain a balanced exposure to that theme, rather than being dragged along by exuberant markets and momentum in top names.

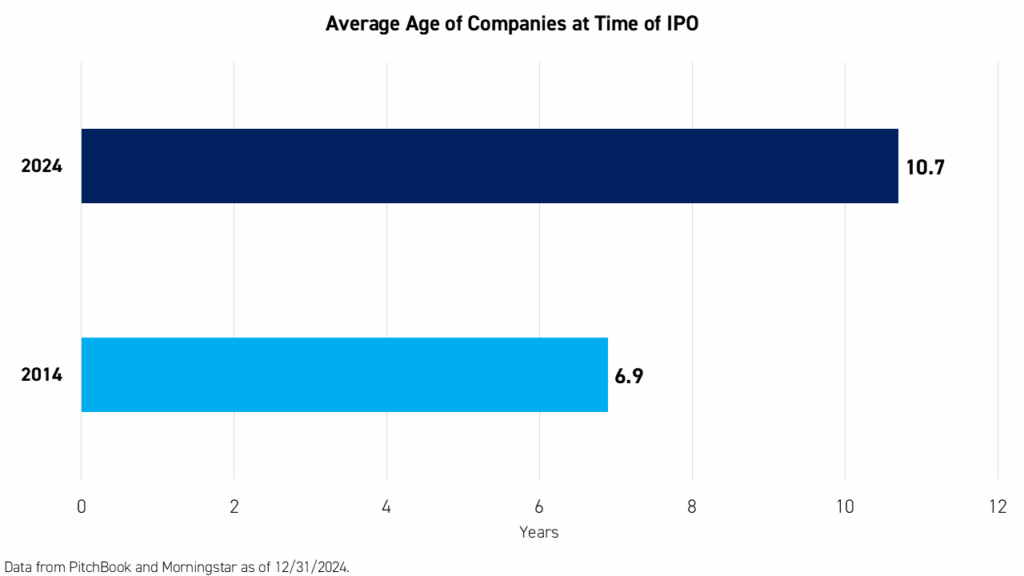

Giants Avoid Public Markets

Companies are staying private for longer. This is a global phenomenon that is playing out in the United States, with examples including OpenAI, xAI, and Anthropic, and in China with companies like ByteDance and Ant Group. Higher interest rates, the increasing complexity of present investments in AI infrastructure, and a host of other factors are leading companies to put off listing publicly, increasing the average age of a firms at IPO.

Moreover, many of the US’ market leaders in AI today are private companies. Private company OpenAI, for example, boasts the most chatbot users among the large US players, including those offered by publicly-traded companies.2 We believe giants like OpenAI are likely to remain private through the end of 2026. For investors, this creates a structural gap: without some allocation to private markets, it may be difficult to achieve truly diversified AI exposure. Absent a wave of new public listings in 2026, accessing private companies through innovative investment structures may be one of the few ways to broaden technology exposure beyond today’s dominant public-market incumbents.

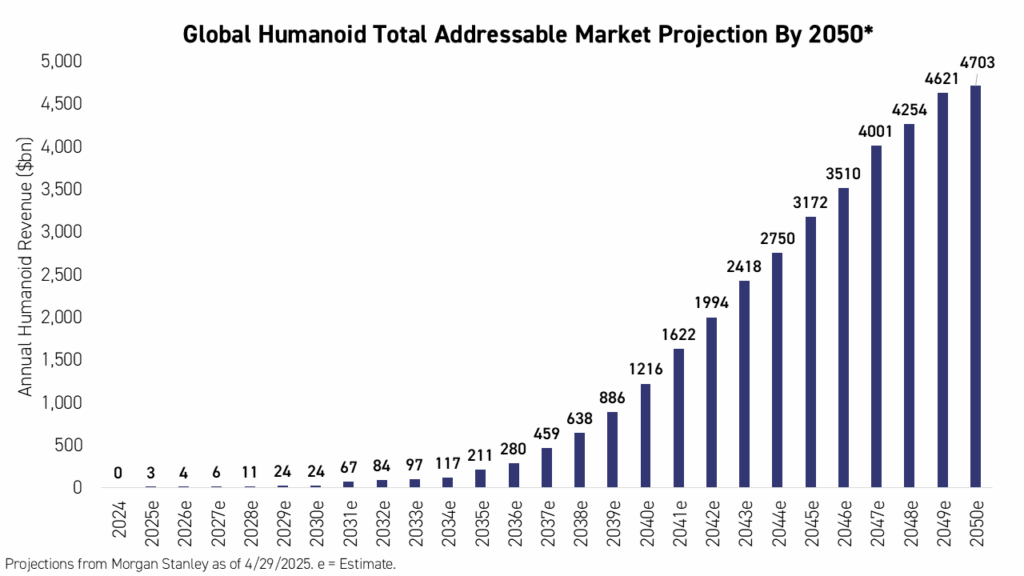

Physical AI Broadens Impact Across Industries

A new frontier to watch is physical AI. Real-world breakthroughs in robotics and autonomous systems, particularly the early progress in humanoid platforms, could shift investor attention from purely digital AI toward embodied applications with visible productivity benefits. Due to rapid aging in advanced economies and resulting labor shortages,3 the market for AI-enabled, physical productivity tools, i.e. humanoid robots, is expected to experience strong growth in 2026 and beyond. Embracing this transition could be a reason to include more industrial and materials firms in a technology allocation, enhancing diversification.

Pictured Above: A humanoid robot walks through Times Square in New York City.

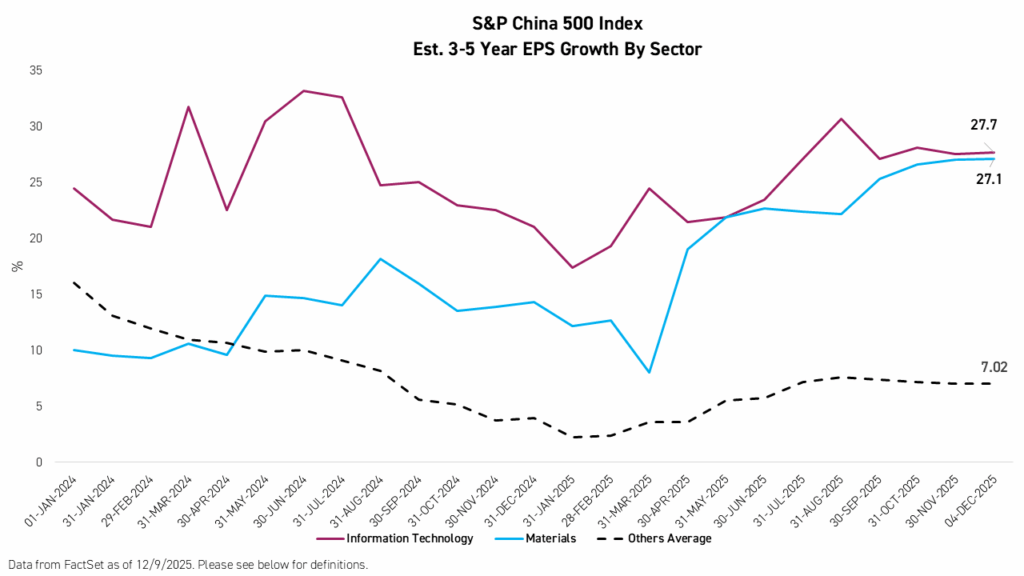

Markets are increasingly recognizing that AI’s benefits extend far beyond software. The technology may enter the physical world faster than originally anticipated. This could help explain why materials firms saw their long-term earnings expectations rise significantly in 2025, even as earnings expectations for the technology sector within the S&P 500 Index remained elevated but largely flat throughout the year.1

China To Solidify AI Duopoly With US

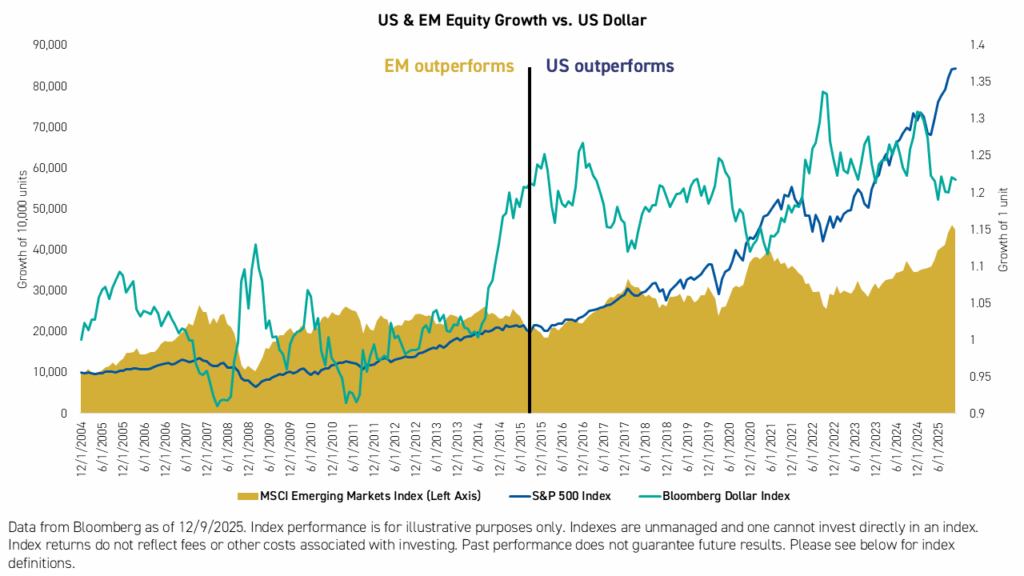

The past decade saw U.S. equities significantly outperform their international counterparts, accompanied by a steady rise in the U.S. dollar against most major currencies. We believe the next decade may not resemble the last. Instead, it could echo the period preceding it, when emerging markets outperformed amid persistently higher U.S. interest rates and a weakening dollar.

Below, we can see that the MSCI Emerging Markets Index was outperforming the S&P 500 Index cumulatively up until mid-2015, when the cumulative outperformance flips, coinciding with a reversal in the US dollar versus a basket of major currencies, represented by the Bloomberg Dollar Index.

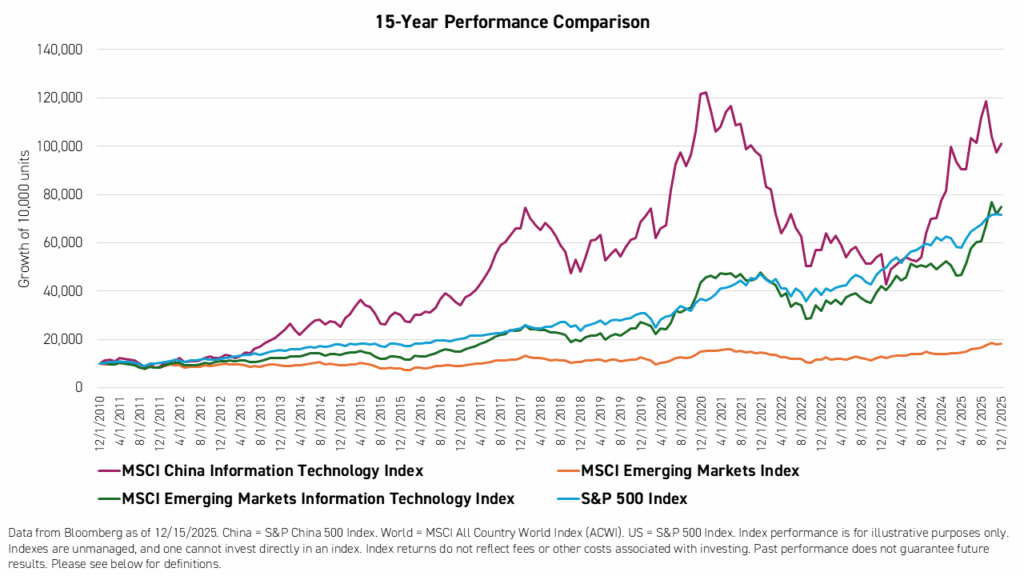

That being said, there is one segment of emerging markets that has outperformed through most of this period. China's technology sector, as measured by the MSCI China Information Technology Index, has outperformed broad-based US, global, EM, and EM technology indexes over the past 15 years, albeit with significantly more volatility.

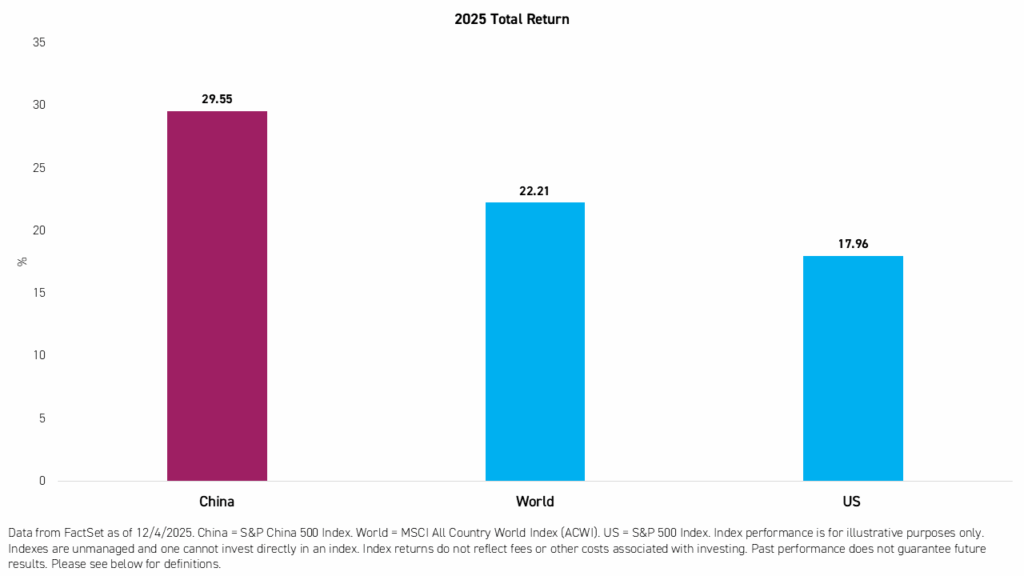

In 2025, international markets overall bucked the decade-long trend, outperforming the US. And, after years of macro-driven declines, China led this outperformance. We believe this could herald the beginning of a new normal in global markets, which could be sustained over multiple years.

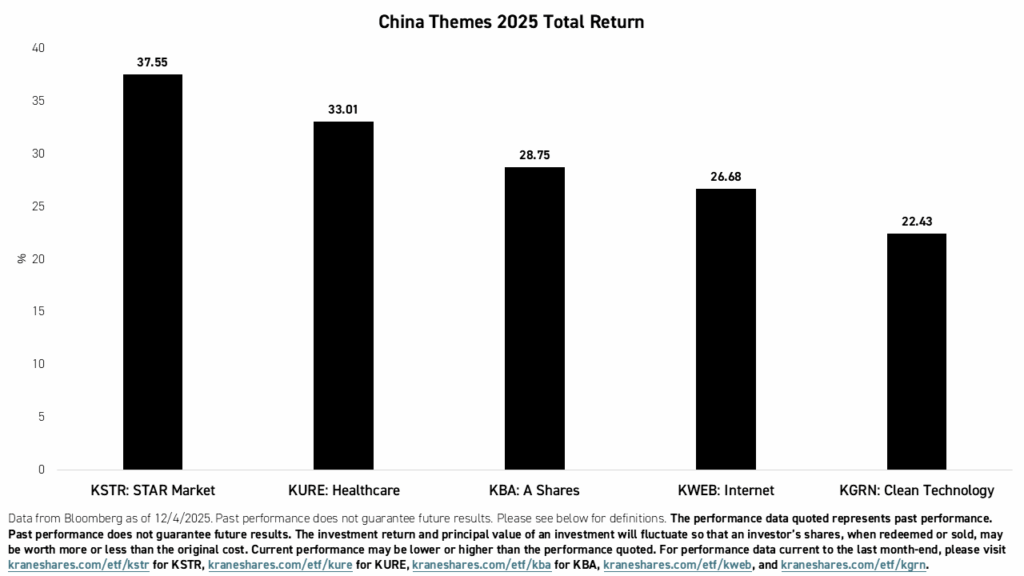

China’s equity market gains were driven not only by positive geopolitical developments, but also by homegrown technological innovations, especially in artificial intelligence. These included DeepSeek's hyper-efficient large language model (LLM), released in January, Alibaba's Qwen LLM, which is now favored by some global corporations like Airbnb, and Cambricon's AI chips. This led to strong equity market gains for technology stocks, especially the hardware stocks listed on Mainland China’s STAR Market Science & Technology Innovation Board.

While earnings expectations in China have increased overall, expectations for growth in the information technology sector are among the highest, followed by Materials.

Meanwhile, China’s 15th Five-Year Plan, due to be released in the first quarter, may provide a significant tailwind to technology stocks. Strengthening technology self-reliance is expected to be a key goal under the plan.

Also, the Trump Administration is likely to either build on the significant progress made in 2025 to reach a comprehensive agreement with China, perhaps culminating in the US President’s scheduled state visit in April, or maintain the status quo with an effective tariff rate of approximately 15% and exemptions for a variety of consumer goods. As such, we believe that trade-driven market noise in China will be limited in 2026, which may allow China’s technology sector to continue its strong performance.

Finally, our thesis is that the US and China will continue to be the global leaders in the development and application of artificial intelligence technology for the foreseeable future, forming a duopoly in the industry. As such, maintaining allocations to both markets not only increases diversification but also provides a more comprehensive capture of the global AI ecosystem compared to focusing solely on the US and Europe.

Implementation

- To reduce concentration risk, investors can add the KraneShares Global Humanoid and Embodied Intelligence Index ETF (Ticker: KOID), which employs an equal-weight strategy, and/or the KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX), which employs a theme-weight strategy.

- To easily add some private exposure to a portfolio, investors can also use the KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX), which holds direct shares of xAI and Anthropic, in addition to a theme-weighted basket of publicly-traded AI companies selected using a methodology developed by AI-native engineers and experienced investors.

- We have also launched a suite of funds that provide accredited investors with access to a diversified portfolio of large and dynamic venture-backed private companies. Please click here to learn more.

- To allocate to the global humanoid robotics opportunity, investors can use the KraneShares Global Humanoid and Embodied Intelligence Index ETF (Ticker: KOID), which consists of a diverse array of players in the robotics space, including hardware developers, software developers, and materials firms.

- To diversify into China’s AI, internet, and technology ecosystem, investors can use the KraneShares CSI China Internet ETF (Ticker: KWEB), which focuses on the largest internet firms, the KraneShares SSE STAR Market 50 Index ETF (Ticker: KSTR), which provides exposure to cutting-edge hardware and healthcare innovators, and/or the KraneShares Emerging Markets Consumer Technology ETF (Ticker: KEMQ), which provides comprehensive access to internet platforms and chipmakers in China and over 11 different emerging markets.

Conclusion

Despite concerns that the much-anticipated impact of a late-stage economic cycle could be felt by technology investors in 2026, we believe that technology shares could continue their bull run. This is thanks to strong earnings expectations and a potentially sustained boost from innovation acceleration, especially from AI companies, mostly concentrated in the US and China. Nonetheless, uncertainty remains and we believe investors may benefit from reducing concentration by switching to weighting strategies that do not rely heavily on market capitalization, building meaningful geographic diversification, having an allocation to private equity, and expanding their definition of technology to include upstream sectors of AI development like materials.

For Fund standard performance, top 10 holdings, risks, and other fund information, please click here for KWEB, here for KSTR, here for KEMQ, here for AGIX, here for KOID, here for KURE, here for KBA, and here for KGRN.

Citations:

- Data from Bloomberg as of 12/11/2025.

- Wiggers, Kyle. “Chat GPT: Everything you need to know about the AI-powered chatbot,” Tech Crunch. November 26, 2025.

- Madgavkar, Anu. "Help wanted: Charting the challenge of tight labor markets in advanced economies," McKinsey Global Institute. June 26, 2024.

Diversification does not ensure a profit or guarantee against a loss. KWEB, KURE, KGRN, KSTR, and KOID are non-diversified funds. The statement regarding diversification refers to sector exposure, not regulatory diversification under the Investment Company Act of 1940.

Index Definitions:

MSCI China Information Technology Index: The MSCI China Information Technology Index captures large and mid cap representation across China H shares, B shares, Red chips and P chips. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization. All securities in the index are classified in the Information Technology sector as per the Global Industry Classification Standard (GICS®). The index was launched on September 15, 1999.

MSCI Emerging Markets Information Technology Index: The MSCI Emerging Markets Information Technology Net Total Return USD Index is a free-float weighted equity index. The parent is the MSCI Emerging Markets Index. The index was launched on September 15, 1999.

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

S&P 500 Index: An American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The index was launched on March 4, 1957.

Term Definitions:

Earnings per share (EPS): A company's profits divided by the number of shares outstanding.