The Power of Indexing

A Recap of MSCI’s First Step in the Inclusion of Alibaba, Baidu, JD.com and Others*

The Dow Jones Industrial Average; the S&P 500; The NASDAQ 100. These names are familiar to anyone who listens to the news. Most people have a general understanding that they refer to indexes intended to reflect the broad performance of segments of the stock market, yet many are unaware of how critical indexes have become to the process of modern investing.

Exchange Traded Funds and index mutual funds have become increasingly popular over the last decade. Over $200 billion of new money has been invested in ETFs in 2015 in the United States alone1. Indexes have grown increasingly important in the investment process because passive funds determine which stocks to buy and sell based upon the indexes they track. Active managers also use indexes as benchmarks to gauge their performance. While passive managers are required to own the underlying securities of an index, active managers often buy a subset of an index’s holdings in an attempt to outperform it. Indexes set the rules for both active and passive managers globally. This begs the question, how well do investors know the index methodologies that guide trillions of investment dollars? What opportunities arise for investors who study the rules?

When it comes to international investing, indexes are perhaps the most popular method of tracking the performance of a foreign country’s stock market. One of the most important international index providers is a company called MSCI. There are over $9 trillion of active and passive assets tracking MSCI indexes2. On November 30th, 2015, MSCI demonstrated the breadth of its influence, and the power of indexing, when it included U.S-listed Chinese companies (N-shares) into its definition of China for all of its international indexes.

MSCI announced its decision to include N-shares in January of 20153. The inclusion was broken up into two phases, with Phase One completed on December 1st 2015 and Phase Two scheduled for June 1st, 2016. Shortly after MSCI’s announcement we started our N-share inclusion countdown clock to raise awareness of this major change in index composition. Due to their ability to buy and sell stocks as they please, active managers benchmarked to affected MSCI indexes were the first to buy the inclusion stocks ahead of the Phase One completion date. Passive managers were second to buy the stocks as they are confined to trade based on index rules, which did not officially include N-shares until December 1. Thus, all passive funds tracking affected MSCI indexes had to buy the new stocks at the close of trading on November 30.

Measuring the effect of inclusion from active investors

Our KraneShares CSI China Internet ETF (ticker KWEB) has a 60% weighting to the inclusion stocks4. Beginning in September 2015, KWEB began materially outperforming the MSCI China Index (MXCN)5, which we believe was partially due to active managers buying in advance of the Phase One inclusion. Active managers are not beholden to the index rules like passive ETF and index fund managers and thus were able to begin purchasing the inclusion stocks ahead of passive managers.

Click here for standard performance

Measuring the effect of inclusion from passive investors

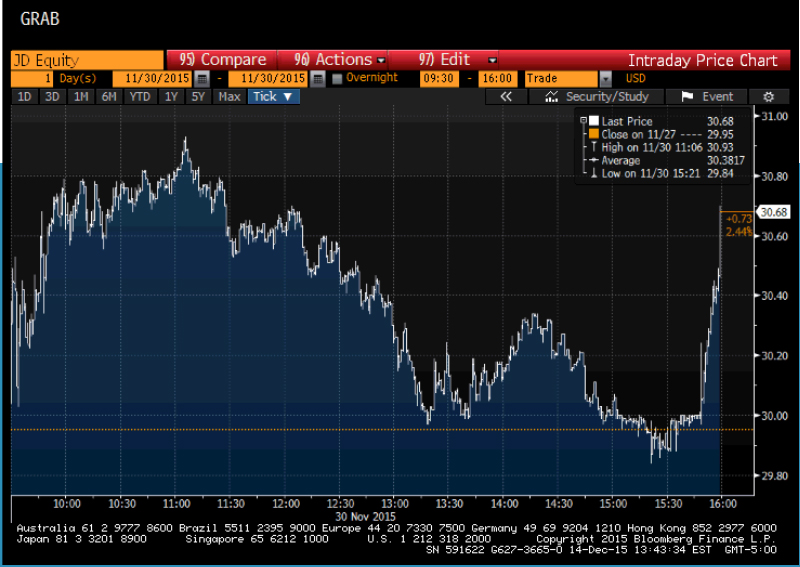

On November 30th the anticipated impact of passive managers required to buy the inclusion stocks did not disappoint as trading volumes and stock prices of U.S.-listed Chinese companies like Alibaba, Baidu, and JD.com* skyrocketed in the last minutes of trading.

JD 11/30/2015 One Day Performance

Alibaba 11/30/2015 One Day Performance

Baidu 11/30/2015 One Day Performance

Three Important Takeaways

First, November 30th marked the first phase of N-share inclusion. We believed we may witness another day of heightened inflows for the affected stocks during Phase Two of the inclusion commencing on May 30, 2016.

The second key takeaway is that a pure China technology strategy could potentially continue to outperform traditional broad-based China or emerging market indexes. Though the MSCI China Index will now more accurately reflect China’s economy through its inclusion of N-shares, it still has a hefty weight to China’s heavy-manufacturing, resource-extraction and construction industries, which have been contracting in recent months. We believe our Tale of Two China’s philosophy could hold true over the coming year and that China’s internet and technology companies may be the greatest beneficiaries of China’s shift toward a domestic consumption driven economy. The most recent report from China's National Bureau of Statistics provides further evidence of this shift as November retail sales increased 11.2% year over year6. We believe a strategy with pure exposure to China’s internet and technology sector could continue to outperform the MSCI China Index, which is still heavily weighted to traditional sectors of China’s economy.

The final key takeaway is that the November 30th rebalance offered concrete proof that index inclusions can potentially cause the affected stock prices to increase. Phase One of N-share inclusion offers a preview of what may happen when Phase Two commences on May 30, 2016. It also serves as foreshadowing for what might happen once MSCI includes the currently excluded onshore markets into its definition of China.

Much like the way U.S.-listed Chinese companies have historically been excluded from MSCI’s definition of China, so too have onshore companies listed on the Shanghai or Shenzhen stock exchanges. While the impact of N-share inclusion has been significant, the onshore markets are even larger than the N-share market. The total market cap of the MSCI China A International Index, MSCI’s definition of the onshore market, was $893 billion as of September 30, 20157. According to the Consultation On China A-shares Index Inclusion Roadmap published by MSCI in June 2015, onshore China equities would make up a 20% weight within the MSCI Emerging Market Index. With $1.6 trillion benchmarked to this index, full inclusion could trigger up to $320 billion to be reallocated to China’s onshore equities8. The effect of onshore inclusion would be over four times larger than N-share inclusion.

Our fund the KraneShares Bosera MSCI China A Share ETF (ticker : KBA) holds the exact securities that MSCI will include into its broader indexes. Additionally, our KraneShares FTSE Emerging Markets Plus ETF (ticker KEMP)** includes a full weight to onshore Chinese equities and U.S.-listed Chinese companies today before the onshore markets are included and Phase Two N-share inclusion is complete.

The power and significance of indexing goes far beyond just a soundbite in the news about the Dow Jones Industrial Average. Thanks to the first phase of N-share inclusion that occurred on November 30 investors now have a case study to analyze the effect that indexes can have on the markets. We have developed our funds to be well positioned to potentially benefit from a number of index inclusion events set to occur as China continues to open up various aspects of its economy to international investors.

*Percent of KWEB net assets as of 11/30/2015: Alibaba (9.28%), Baidu (8.88%), JD.com (5.85%)

**Percent of KEMP net assets as of 11/30/2015: Alibaba (0.90%), Baidu (1.61%), JD.com (0.27%)

- ETFGI, "ETFs/ETPs listed in the United States have gathered a record 201.7 billion US dollars in net new assets this year as of the end of November 2015" December 10, 2015

- Data from MSCI as of 6/30/2015

- MSCI, "Conclusions From The Consultation On Enhancements To The Coverage Of The Msci Global Investable Market Indexes" January 15, 2015

- Data from Bloomberg as of 11/30/2015

- Data from Bloomberg as of 11/30/2015.

The MSCI China Index (MXCN): The MSCI China Index captures large and mid cap representation across China H shares, B shares, Red chips and P chips. With 143 constituents, the index covers about 84% of this China equity universe. - National Bureau of Statistics of China, "Press Release Total Retail Sales of Consumer Goods in November 2015" December 12, 2015

- Data from MSCI as of September 30, 2015

- MSCI. "Consultation On China A-shares Index Inclusion Roadmap" June 2015