Will Anthropic or xAI IPO in 2026?

By Cole Wenner

Since this article was published, xAI has merged into SpaceX. Read our update regarding SpaceX's updated IPO timeline.

Anthropic and the 2026 Initial Public Offering (IPO) Discussion

Anthropic is a widely recognized force in generative artificial intelligence (AI), best known for its Claude family of large language models. The company stands out for its deep focus on AI safety, alignment, and scalable enterprise adoption.

According to reporting by the Financial Times, Anthropic has engaged Wilson Sonsini to begin IPO-related preparations, placing the company within broader discussions around potential 2026 public listings alongside other high-profile private technology firms like SpaceX and OpenAI.1

Additionally, betting platform Kalshi displays Anthropic as more likely to IPO before OpenAI. While the odds can change as more developments surface, and Kalshi’s listed percentage is dependent on the volume traded, Anthropic is sitting at a 72% chance.2

In 2025, Anthropic took several steps commonly associated with public-market readiness, including:

- Expanding its leadership team with public-company experience

- Enhancing governance and internal operating frameworks

- Attracting additional capital from large institutional investors

While no IPO timeline is guaranteed, we believe these developments suggest Anthropic is positioning itself for a potential public offering.

How To Buy Anthropic Today Before Its Potential 2026 IPO

Anthropic remains privately held, and direct access to its equity is typically limited.

The KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX) is currently the only publicly listed ETF with direct ownership exposure to Anthropic.3

AGIX established its Anthropic position in early 2025. By year-end, the position had appreciated to an estimated fair value that was fourfold its initial cost. This occurred over a relatively short holding period (~10 months), which we believe speaks to the strong momentum in private-market valuations.

- As of December 31, 2025, Anthropic represented 4.21% of the AGIX portfolio.4

- Anthropic is AGIX’s fourth-largest holding.5

AGIX provides access to Anthropic through a daily-liquid, NAV-based ETF, available via standard brokerage accounts without private-market lockups, capital calls, or accreditation requirements.

xAI: AGIX’s Largest Holding

AGIX also maintains direct ownership exposure to xAI, an artificial intelligence company founded by Elon Musk.

IPO rumors for xAI are less intense compared to those for Anthropic, with only a 12% chance of going public before 2027, according to Kalshi.6 However, its trajectory is starting to resemble a pre‑IPO sprint. xAI recently closed a $20 billion Series E that exceeded its original $15 billion target.7 Additionally, the company is reportedly on a path from roughly $500 million in 2025 revenue to more than $2 billion in 20268, and now claims about 600 million monthly active users across X and Grok7. Additionally, Elon Musk recently celebrated on X about how “Grok [is now] ahead of Gemini in the Android Store,” which is an impressive milestone for the company.9

Layer in growing speculation that sister company SpaceX could pursue a listing as soon as 20261, and the picture that emerges is of an xAI that may not ring the opening bell this year, but is rapidly assembling the scale, capital, and user momentum that can precede an IPO.

AGIX invested in xAI in mid-2025. By year-end, the initial position’s estimated fair value had more than doubled over a relatively short period, excluding a subsequent purchase completed later in the year.

- As of December 31, 2025, xAI represented 6.60% of the AGIX portfolio.4

- xAI is AGIX’s largest holding.5

AGIX maintains direct ownership and cap-table positions in both Anthropic and xAI, offering investors differentiated exposure to private AI companies through a single, publicly traded ETF structure.

AGIX & The AI Access Gap

Artificial intelligence is reshaping global markets, but for many investors, the primary challenge in AI investing today is not identifying opportunities; it is accessing them.

A growing share of next-generation AI innovation is occurring in private markets, particularly at the foundation model and agent layers. Many of the most influential AI companies remain privately held for extended periods, restricting participation to venture capital and select institutional investors. This dynamic has created an AI access gap between where innovation is happening and where most investors can easily invest.

The AGIX ETF seeks to help bridge that gap.

AGIX is designed to give investors broad exposure to the AI ecosystem, combining liquid, index-based public equities with selective access to private AI firms. KraneShares believes this hybrid model has played a pivotal role in the fund’s differentiated performance.

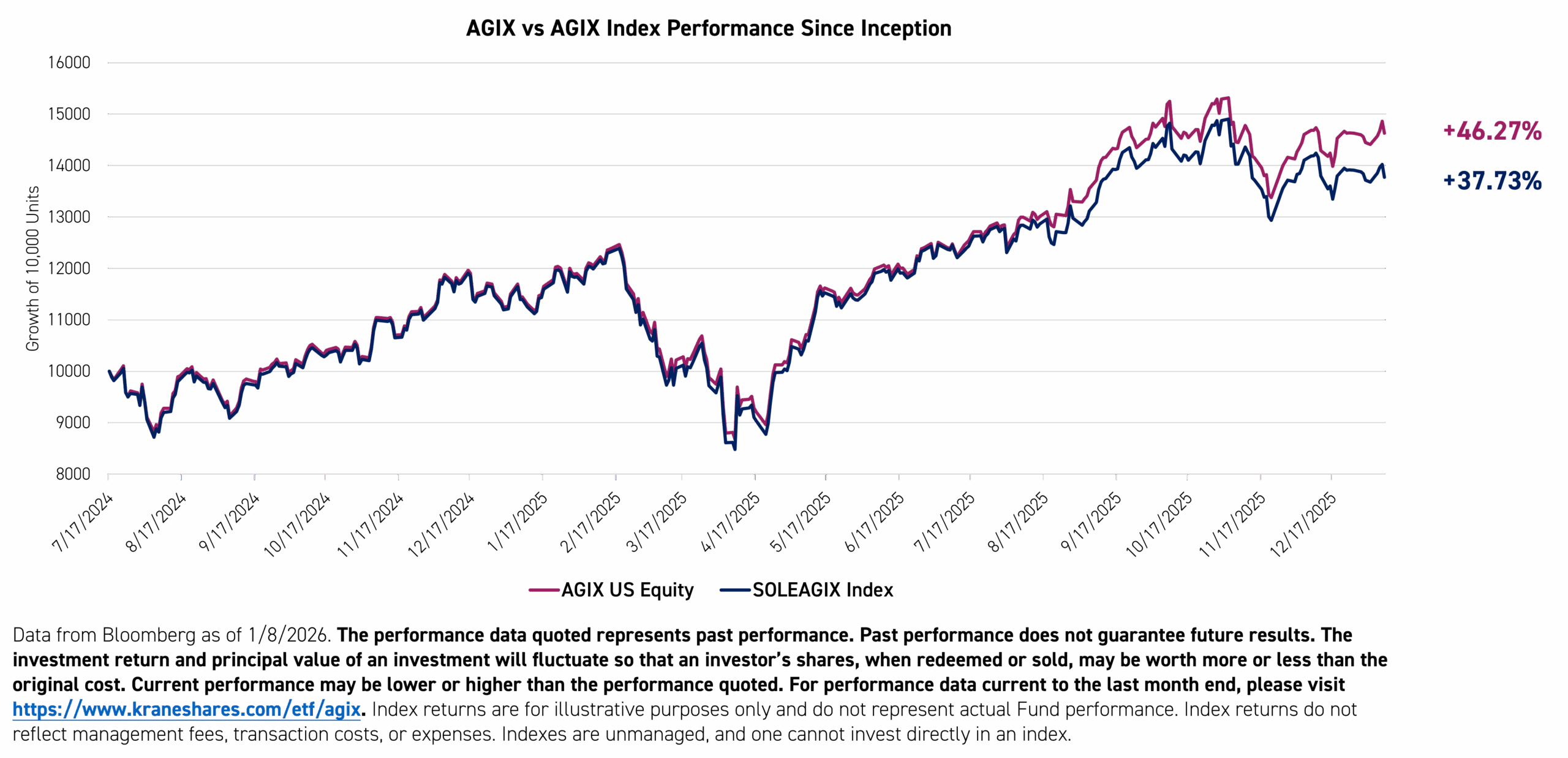

AGIX’s private AI holdings have been a key source of value creation. While the fund’s public equity sleeve closely tracks its underlying index, AGIX has outperformed that benchmark by 8.54% since inception, driven primarily by gains from its private AI investments.10

Where does AGIX fit in an investor’s portfolio?

AGIX can serve as a targeted satellite allocation for investors seeking exposure to the AI value chain and access to select private AI innovators, such as xAI and Anthropic. Rather than relying solely on mega-cap public equities to express the AI thesis, AGIX is built to capture opportunities across AI hardware, infrastructure, and applications, complemented by private-company exposure that is typically difficult to access in traditional portfolios. If used alongside a core equity allocation, AGIX may help investors participate in the next phase of AI development with a single, portfolio-ready solution.

Investing in AI may offer a compelling opportunity, but it also carries potential risks. Private AI companies, such as Anthropic and xAI, often have limited disclosure, changing valuations, and uncertain commercialization timelines, which can make assessing returns difficult. Exposure obtained through public vehicles may also be affected by valuation methods and regulatory developments. For more information on our fair valuation process, the potential benefits, and challenges, please click here.

For AGIX standard performance, top 10 holdings, risks, and other fund information, please click here.

Holdings are subject to change.

Citations:

- Data from “SpaceX, OpenAI and Anthropic prepare to launch landmark IPOs,” Financial Times, 1/1/2026.

- Data from “Will OpenAI or Anthropic IPO first,” Kalshi, 1/6/2026.

- Data from Bloomberg as of 1/6/2026.

- Data from Bloomberg as of 1/6/2026.

- Data from Bloomberg as of 1/6/2026.

- Data from “Which Companies will officially announce an IPO before 2027,” Kalshi, 1/6/2026.

- Data from "xAI Raises $20B Series E," xAI website, as of 1/6/2026.

- Data from "Musk's xAI Burns Through $1 Billion a Month as Costs Pile Up," Bloomberg, as of 6/18/2025.

- Data from X as of 1/9/2025.

- Data from Bloomberg as of 1/8/2026.

Definitions:

Solactive Etna Artificial General Intelligence Index (SOLEAGIX Index): Captures the performance of companies engaged in developing and applying artificial intelligence technologies.

Kalshi: Kalshi is a regulated online prediction market exchange where users trade event-based contracts on the outcomes of real-world events, such as economic indicators or policy decisions.

Cap Table Position: A cap table position is an entry on a company’s capitalization table that shows a specific owner’s equity stake, including their number of shares, ownership percentage, and any special terms attached to those securities.

Foundation Model Layer: The foundation model layer is the base AI infrastructure, consisting of large, general-purpose models trained on massive datasets that provide reusable capabilities for applications and downstream models to fine-tune for specific tasks.

Agent Layer: The agent layer is the part of an AI system where individual autonomous or semi-autonomous agents operate, each using models, tools, and context to pursue specific goals or tasks within a broader architecture.