Emerging Markets: A Great Source of Growth? That Depends on Your Definition

With the S&P 500 reaching all-time highs and emerging markets (EM) lagging, many are wondering how long the US bull market can continue. Near-term, a trade deal, a dollar slump, a pickup in global growth, or all of the above may prompt a serious pivot to emerging markets. With this potential pivot on the horizon, we believe it may be time to take a second look at your current emerging markets exposure to analyze whether you are capturing the true growth opportunity.

For growth-seeking investors, emerging markets have long presented an alluring opportunity. One look at emerging market demographic statistics affirms why so many investors gravitate to this theme. From 2000 to 2018, incomes across major EM countries have increased by an average multiple of 2.7x compared to just 1.8x in major developed market (DM) countries.1 Also, consumer spending in the developing world is on the rise. McKinsey Global Institute projects consumer spending in emerging markets to reach $30 trillion by 2025, up from $12 trillion in 2010.2

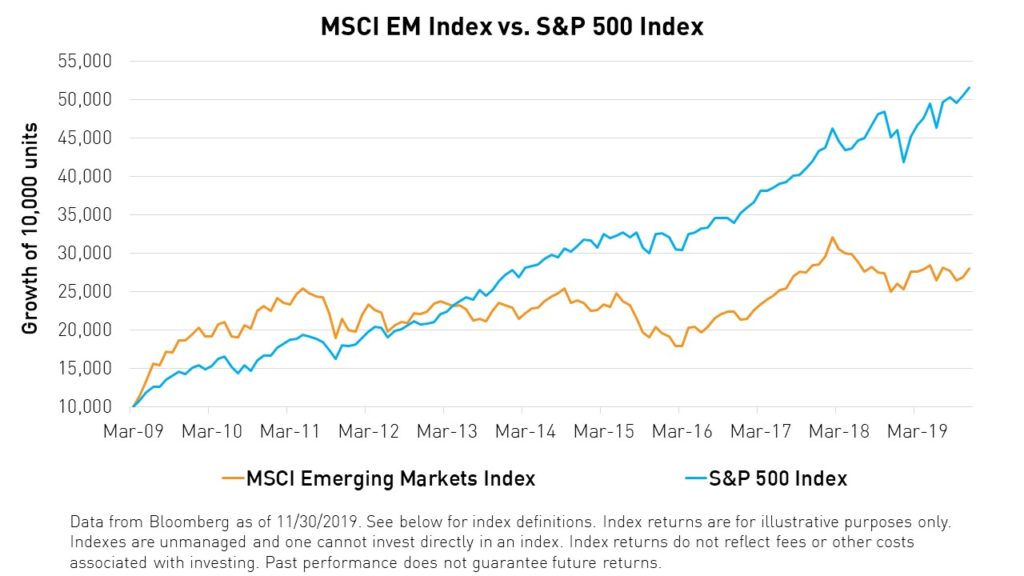

Given these statistics, one would assume that EM portfolios would have outperformed the S&P 500 by a wide margin, but they have not. Since the end of the 2008 recession, the cumulative return of the MSCI Emerging Markets Index was 181% compared to 416% for the S&P 500 Index.3

If the performance of broad-based EM has not reflected the massive growth trends present in emerging markets, then where is the growth really being reflected?

One logical place might be the companies that produce the products that emerging market consumers are buying. Often the first place that consumers with newfound wealth choose to spend their money is on household goods such as food, basic dry goods, cleaning products, and personal care items. However, focusing on staples in emerging markets can be problematic. Just as stock market investors have eyed the EM consumer for a boost to their portfolio returns, so too have large multinational corporations for a boost to their bottom lines. British consumer goods powerhouse, Unilever, controlled nearly half of the Indian personal care market in 2016,4 Nestlé controlled 70% of the Chinese coffee market in 2017,5 and Colgate-Palmolive derived nearly a quarter of its revenue from Latin America in 2018.6 Considering these numbers, a significant part of the growth from EM consumer staples has actually benefited developed market companies, not emerging market ones.

Neither a broad EM exposure nor a focus on consumer staples has historically reflected the growth trends present in emerging markets. Instead, we believe there is an alternative: allocating to the internet platforms on which EM consumers are transacting. In developed markets, companies like Amazon have widely outperformed the rest of the market over the past decade,7 and many investors are not aware that there may be an analogous growth trend occurring across emerging markets.

E-Commerce platforms represent “how” consumers are buying rather than “what” they are buying, and in many ways, these companies in emerging markets have leapfrogged their developed market peers. EM consumers have gone straight from using cash at local markets to using mobile payments. In doing so, they have skipped the big box store and credit card phase of development that still dominates in developed countries such as the United States.

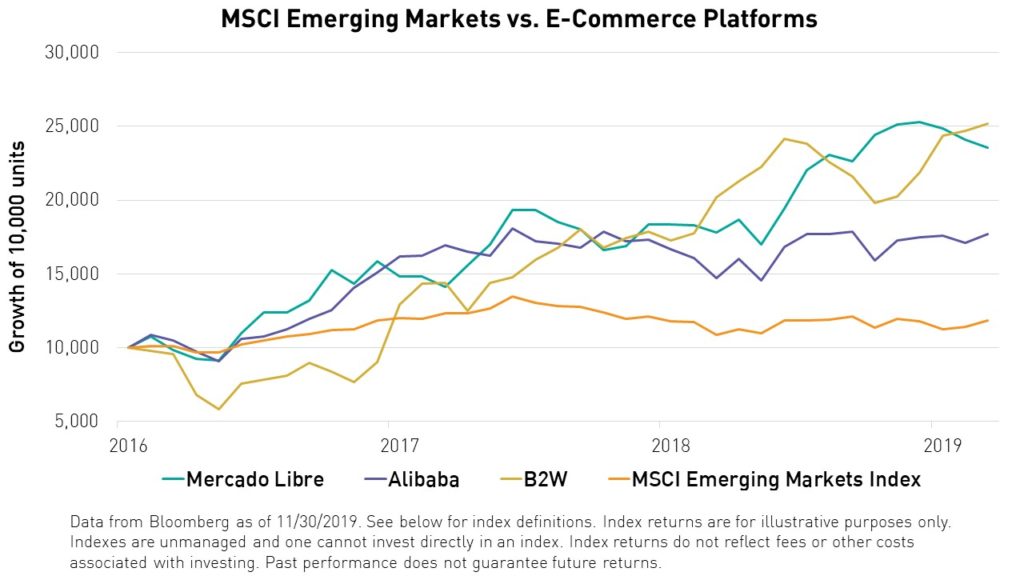

Alibaba, B2W, and Mercado Libre are just three examples of the innovative EM marketplaces that are providing these services and rapidly swallowing up market share in emerging markets. They have created self-sufficient ecosystems in which users buy products, interact with friends, consume entertainment, manage finances, get educated, and much more. EM E-Commerce companies are the firms that have facilitated and capitalized on the rise of the EM consumer, and their stocks have largely delivered outsized returns as a result.

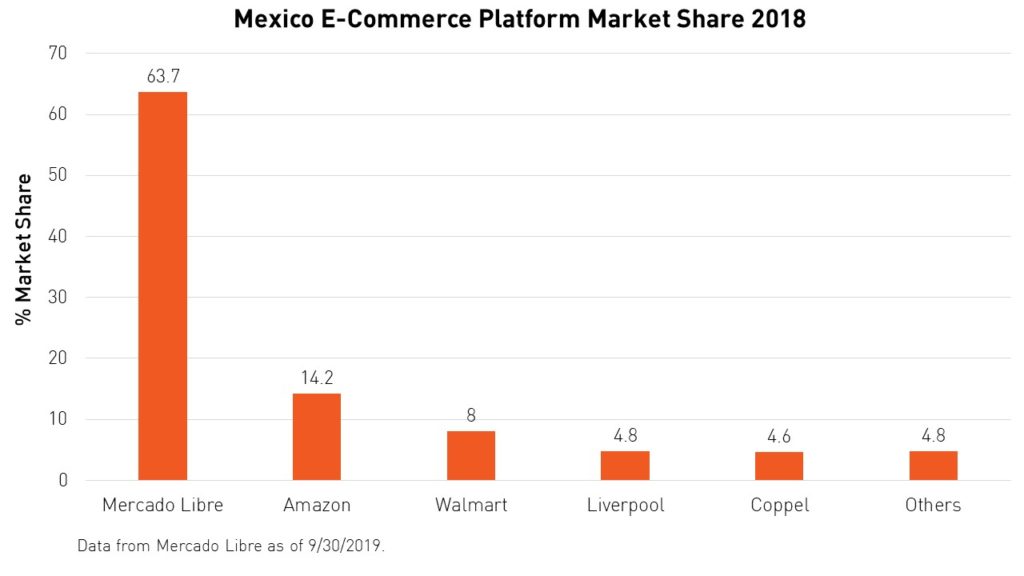

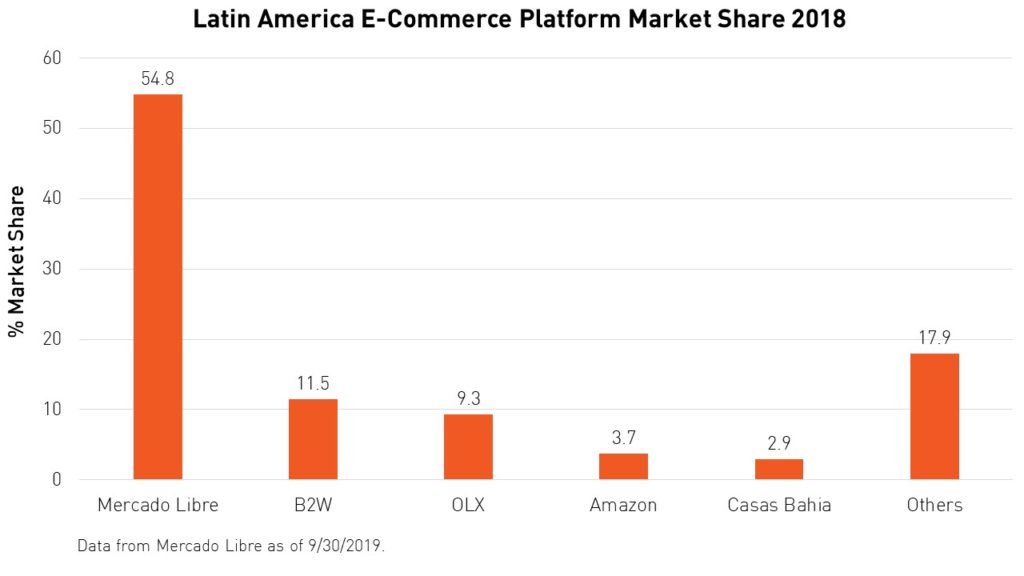

Admittedly, it may be puzzling to some that these consumer internet platforms maintain majority market share in their home markets. How have they avoided giving up market share to multinationals with developed world expertise and the price advantage of scale? How will they defend their market share in the future?

We find that the answer is simple: local know-how. Knowledge of local customs, tendencies, political landscape, and language are key to unlocking growth for an internet platform because they do not produce physical goods. Whereas, in the case of durable consumer products, the ability to produce physical goods at a low cost is the key to growth. Furthermore, local governments may be more likely to scrutinize foreign internet platforms, like Amazon, because of their potential influence on the population. Governments may prefer more localized platforms so that their ability to govern is not jeopardized. By contrast, the fact that a majority of the population in a given country buys coffee from Nestle, for example, is seen as more innocuous.

Evidence of this trend has come to light of late. Just look to Uber’s failure to expand into East Asia. Ride-hailing in East Asia is now dominated by Didi in China and Grab in Southeast Asia.8 In 2018, Mercado Libre also beat out Amazon in both Mexico and Latin America overall in terms of market share.9

Measuring Emerging Markets Consumer/Technology Performance

Capturing the performance of the EM consumer/technology sectors has been challenging. In the past, E-Commerce and internet platforms in both developed and emerging markets were classified by Global Industry Classification Standards (GICS) as information technology (IT) companies. However, as this sector evolved it ended up grouping many disparate types of companies together. This meant that social media platforms, E-Commerce, gaming, and internet companies were grouped with chip-makers and other hardware companies. In October 2018, GICS underwent a major reclassification to resolve this issue.

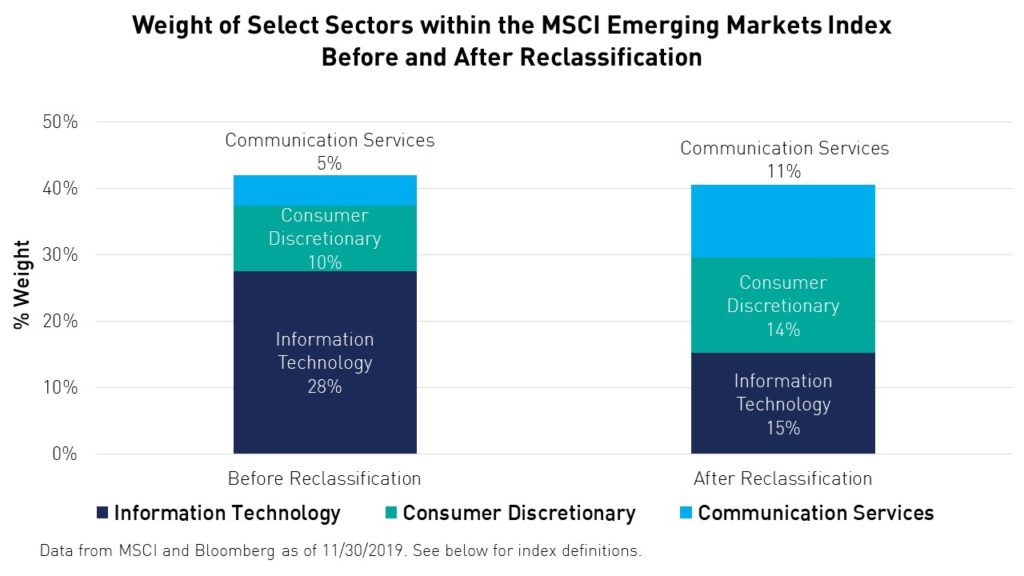

As a result of the reclassification, the information technology sector was left with mostly hardware companies, while E-Commerce and internet platforms were split between two other sectors: consumer discretionary and communication services (formerly telecommunication services). Most E-Commerce companies, such as Alibaba and Mercado Libre, were shifted to the consumer discretionary sector, while internet platforms, such as Baidu and Naver, were classified as communication services companies. Overall, the weight of the IT sector within the MSCI Emerging Markets Index was almost halved, going from 28% to 15%.10

These changes have had a significant impact on global portfolios. Now, a portfolio that is overweight information technology may no longer contain the growth names that were included prior to reclassification.

In order to show the historical performance of the EM consumer/technology sectors within the MSCI EM Index, we combined the Index’s information technology, consumer discretionary, and communication services sectors. We used the sectors’ pre- and post-GICS reclassification weightings pictured above.

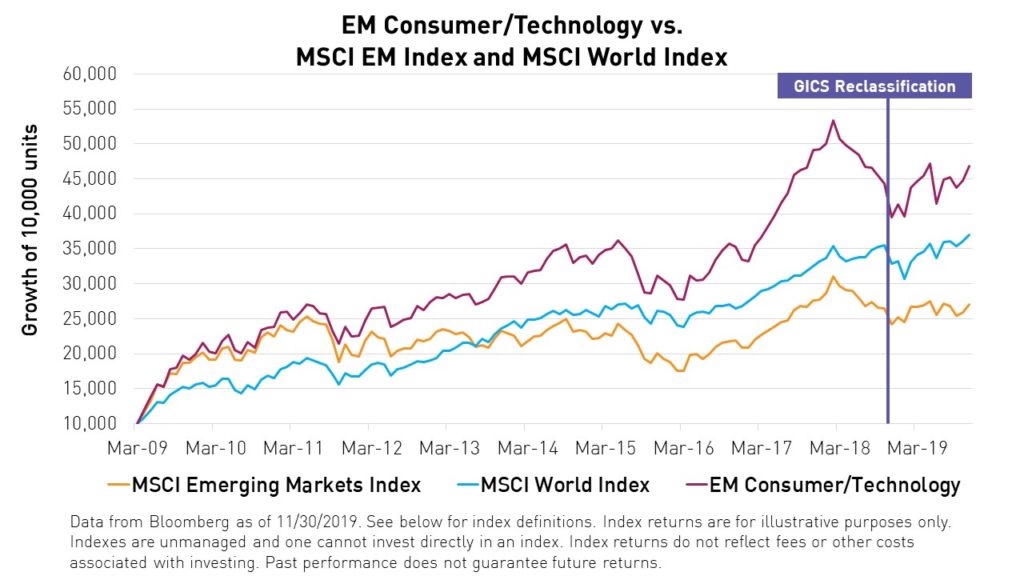

We found that EM consumer/technology outperformed both broad emerging markets and developed markets since the end of the recession. During this period, the MSCI Emerging Markets Index returned 181% while the MSCI World Index returned a sizable 270%. Over the same time period, EM consumer/technology outperformed both with a return of 368%.

Comparative Portfolio Analysis

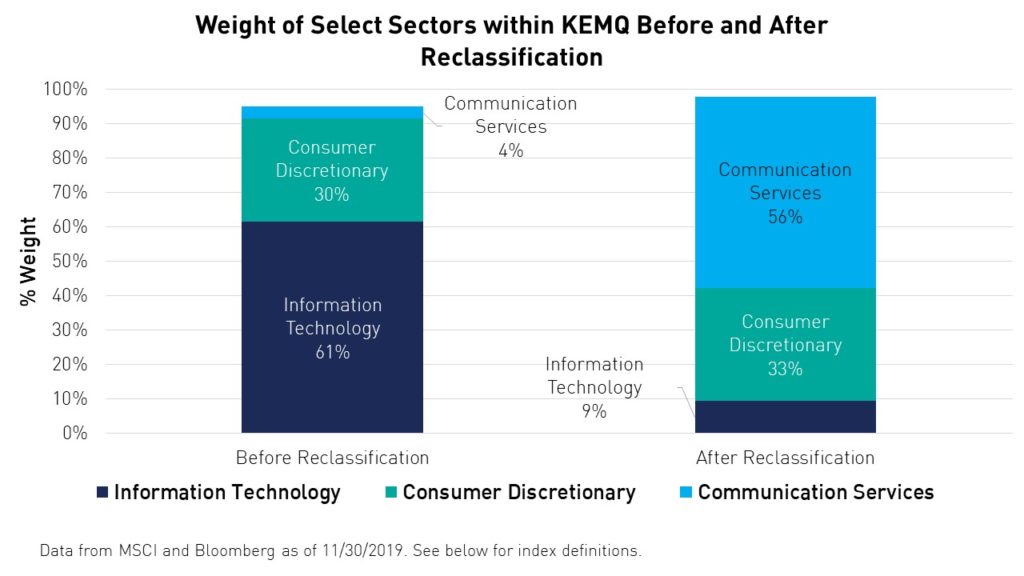

In 2017, we launched the KraneShares Emerging Markets Consumer Technology ETF (ticker: KEMQ) which tracks the Solactive Emerging Markets Consumer Technology Index. This represents our definition of the emerging market consumer technology sector. We took a bottom-up approach to constructing KEMQ’s index that is less dependent on sector classifications. While the reclassification had no effect on KEMQ’s individual holdings composition, its sector breakdown did change as the growth names we discussed were moved to different sectors.

KEMQ shifted its sector allocation along with the GICS reclassification, seeing information technology go from 61% of the fund’s weight to 9%.

KEMQ offers greater exposure to growth-oriented sectors than the MSCI Emerging Markets Index and lacks exposure to historically value-oriented sectors such as energy, materials, industrials, and utilities.

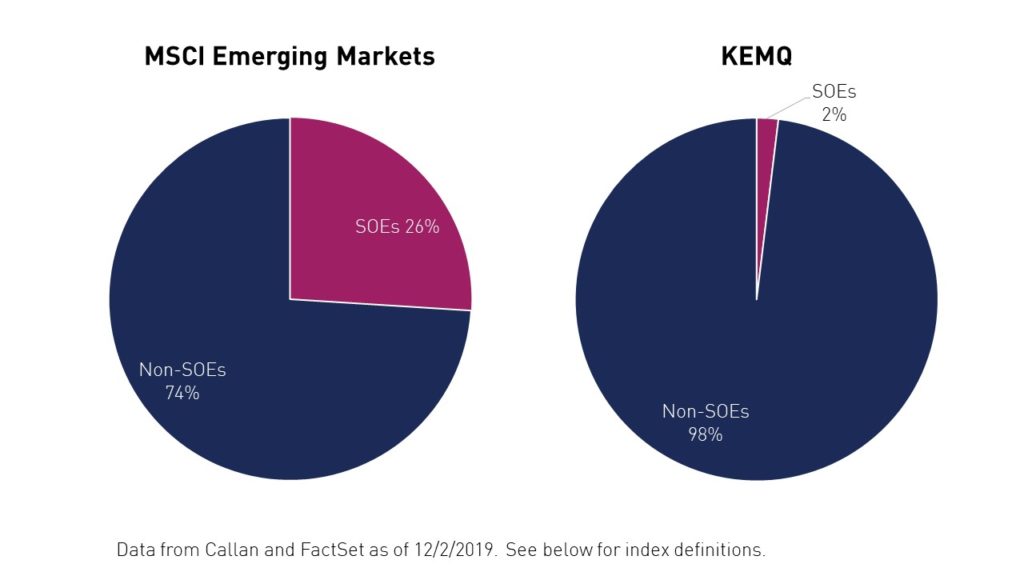

Another biproduct of this sector approach is that KEMQ holds significantly fewer state-owned enterprises (SOEs) than the broader MSCI Emerging Markets Index. Some argue that when a government is a major shareholder of a company, the company may prioritize a broader set of interests rather than generating the maximum possible return for shareholders. KEMQ may benefit investors who wish to reduce exposure to SOEs.

Conclusion

We believe that multi-faceted consumer internet platforms are the next step in the evolution of emerging market economies and perhaps where emerging markets have surpassed developed. As a result, KEMQ may deliver a higher exposure to the emerging market consumer and may complement or replace your current passive or active emerging market strategy.

Weights of KEMQ Holdings Mentioned:

- Alibaba % of KEMQ net assets as of 12/3/2019: 3.93%.

- B2W % of KEMQ net assets as of 12/3/2019: 3.47%.

- Mercado Libre % of KEMQ net assets as of 12/3/2019: 3.68%.

- Baidu % of KEMQ net assets as of 12/3/2019: 3.59%.

- Naver % of KEMQ net assets as of 12/3/2019: 3.96%.

Citations:

- Data from The World Bank as of 12/31/2018. ‘Major emerging countries’ is defined as Indonesia, India, Brazil, China, Malaysia, Philippines, Mexico, Thailand, Colombia, and South Africa. ‘Major developed countries’ is defined as the United States, the United Kingdom, France, Canada, Germany, Japan, Australia, Italy, and Spain.

- Alstom, Yuval. “Winning The $30 Trillion Decathlon: Going for gold in emerging markets,” McKinsey & Company. 2012.

- Data from Bloomberg as of 11/13/2019. Return is defined as price return only.

- Ananthanarayanan, Ravi. “Recovery eludes Hindustan Unilever,” Livemint.com. July 19, 2016.

- Euromonitor International 2017 Data.

- Colgate-Palmolive. 2018 Annual Report.

- Since 05/17/2012, Amazon stock has returned 248.81% compared to the S&P 500, which returned only 138.64% over the same time period.

- Forbes, “Where Uber Is Winning The World, And Where It Has Lost”, 9/19/2018.

- Data from Mercado Libre as of 9/30/2019.

- Data from MSCI and Bloomberg as of 11/30/2019.

Index Definitions:

MSCI World Index: The MSCI World Index is a free-float weighted equity index. It was developed with a base value of 100 as of December 31, 1969. The index includes developed world markets and does not include emerging markets. The inception date of the index is March 31, 1986.

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid-cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

The Solactive Emerging Markets Consumer Technology Index: The Solactive Emerging Markets Consumer Technology Index selects companies from 26 eligible countries within emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, or software for internet and E-Commerce transact. The index was launched on August 23, 2017.

The S&P 500 Index: The S&P 500 Index is an American stock market index based on the market capitalization of the 500 largest companies having common stock listed on the NYSE or NASDAQ. The index was launched on March 4, 1957.

Terms:

Emerging Markets Consumer/Technology: Prior to the GICS reclassification in October 2018, this is defined as 28% MSCI Emerging Markets Information Technology Index, 10% the MSCI Emerging Markets Consumer Discretionary Index, and 5% the MSCI Emerging Markets Communication Services Index. After the reclassification, this is defined as 15% the MSCI Emerging Markets Information Technology Index, 14% the MSCI Emerging Markets Consumer Discretionary Index, and 11% the MSCI Emerging Markets Communication Services Index.