Does Harnessing AI For Investment Decisions Work? Quant Insight Gets Results In China

AI and machine learning appear to have invaded all aspects of investing. AI is probably the hottest theme in technology investing since the internet itself. Meanwhile, machine learning is being deployed in many ways to harness alpha in investment portfolios, to varying degrees of success.

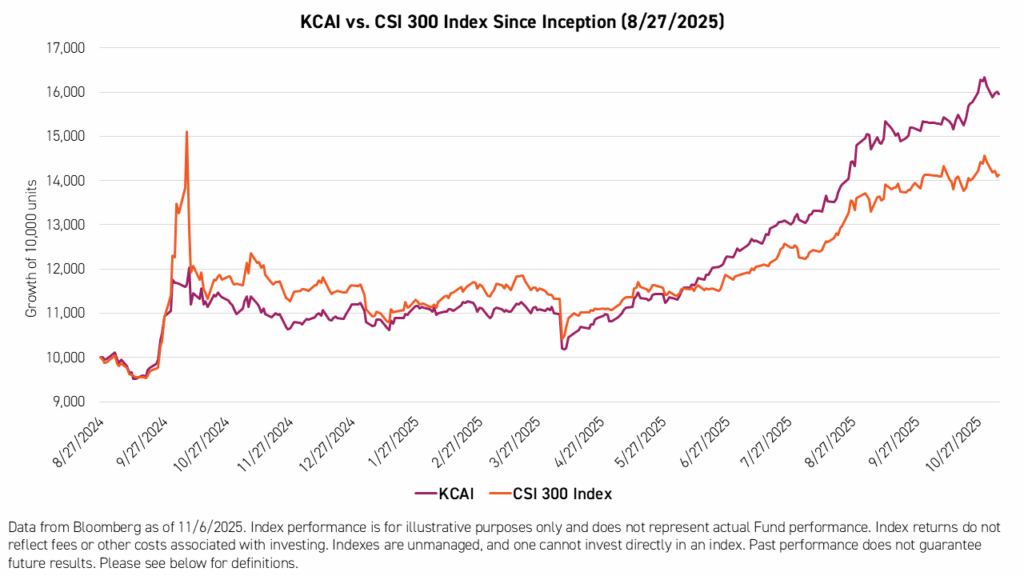

According to investment research firm Quant Insight, which boasts a team of seasoned researchers including Cambridge astrophysics professor Michael Hobson, machine learning strategies are most effective in so-called "inefficient" markets, which have less complete information flow, higher retail participation, and behavioral biases, creating mis-pricings that can be exploited. This year, Quant Insight has found success in the China A-share market. The KraneShares China Alpha Index ETF (Ticker: KCAI) started using Quant Insight’s unique methodology last year and has delivered compelling results, outperforming the CSI 300 Index. This approach has generated cumulative excess returns of approximately 18% since KCAI's inception and 21% year-to-date, compared to the CSI 300 Index, its benchmark, as of November 6, 2025.1

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit kraneshares.com/etf/kcai.

KCAI seeks to provide a total return that exceeds the CSI 300 through a disciplined, machine learning–driven portfolio construction process powered by Quant Insight’s proprietary algorithm. Its since inception results were primarily from stock-specific alpha, rather than style or macro tilts. This approach has been particularly effective following "Liberation Day" announcements of proposed new tariffs on US imports from China in April, when the performance dispersion among the CSI 300's constituents increased significantly.

How does KCAI’s machine learning algorithm work?

Quant Insight’s China algorithm seeks to utilize price signals to help deliver outperformance – behind this simple story lies a complex web of intelligence and actions. Price might seem like just one piece of data. But, there are multiple calculations that can be extracted that generate signals and value, as follows.

- Momentum – Is it trending up or down strongly?

- Time Window – Should I be looking at the last month, quarter, or year?

- Volatility – By how much it is moving up and down?

- Relativity – How does all this info for the stock measure up compared to the index

Using all these bits of information still leaves a significant challenge – the number of different combinations of stocks and weights to create the portfolio is enormous. The algorithm cannot evaluate all possibilities. Quant Insight’s algorithm constructs, rather than selects, the portfolio from the ground up. It creates clusters of stocks that outperform the index with minimal volatility. And it does this month after month – learning the market as it goes.

What are some examples of calls produced by the algorithm?

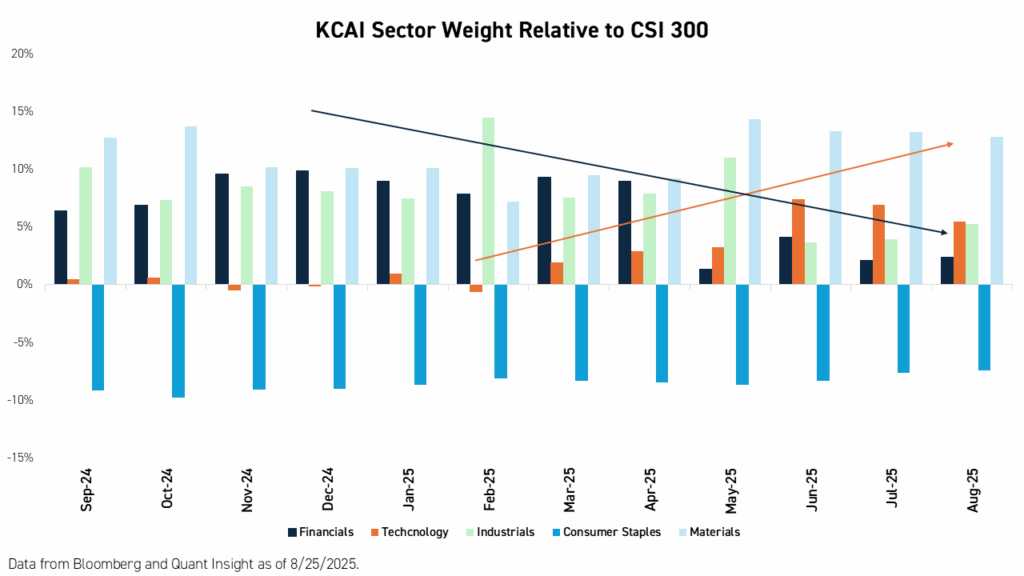

1. Sector Rotation

The algorithm shifted its overweight position versus the CSI 300 Index from financials to technology stocks over the past year, which contributed to recent returns.

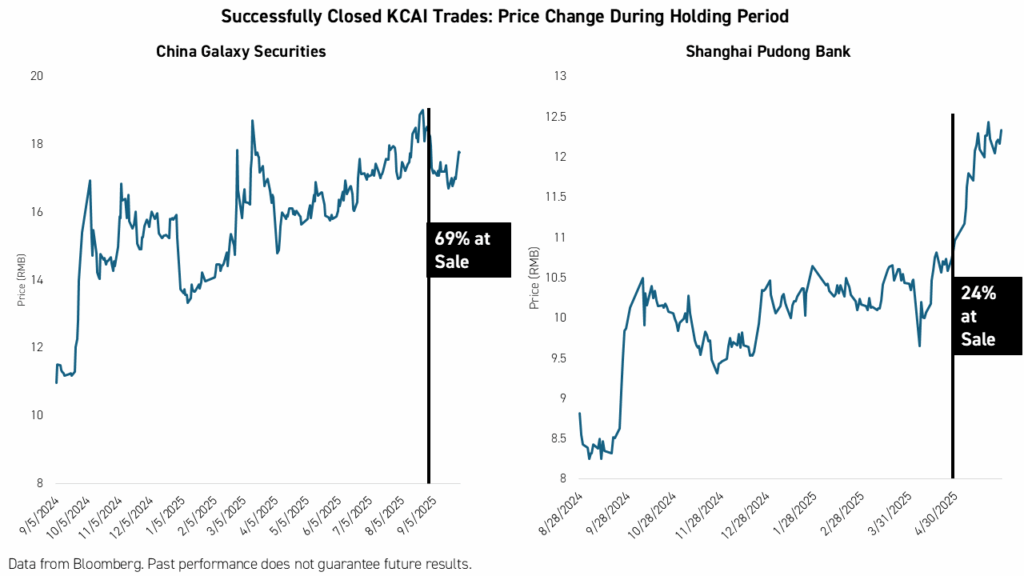

2. Stock Picks

The algorithm has made some solid trades so far this year, selling stakes in financial firms China Galaxy Securities and Shanghai Pudong Bank in August and April, respectively.

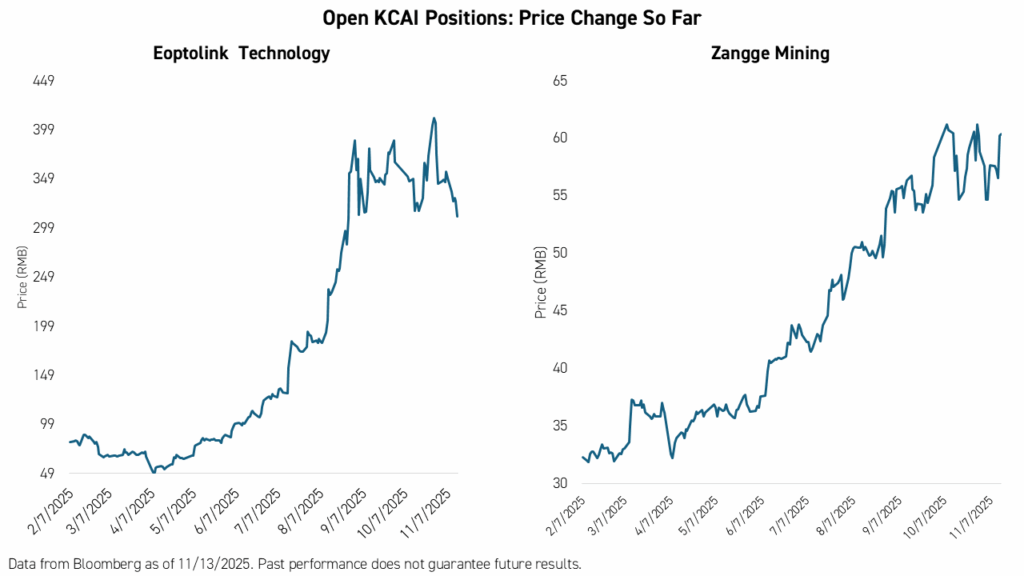

The algorithm recently picked some winners and is letting them run. These include Eoptolink Technology, which manufactures critical communication equipment used for cloud computing, AI data centers, and telecommunications networks, and Zangge Mining, which mines potash, lithium, and other salt-lake materials critical to the global clean energy and batter supply chains.

Conclusion

We believe AI-powered investing should be focused on specific markets and is not one-size-fits-all. Quant Insight’s experience may prove that China’s A-share market is well-suited to machine learning strategies. The KraneShares China Alpha Index ETF (Ticker: KCAI) provides exposure to China's A share market and utilizes a disciplined, machine learning–driven portfolio construction process that has delivered compelling results relative to the CSI 300 Index since inception.

For KCAI top 10 holdings, risks, and other fund information, please click here.

CSI 300 Index: The CSI 300 Index consists of the 300 largest and most liquid A-share stocks. The Index aims to reflect the overall performance of China A-share market. The index was launched on April 8, 2005.

Citation:

- Data from Blomberg as of 11/6/2025.