Could China Stop Exporting Deflation?

On Wednesday, July 3rd, 2025, China's Central Committee for Financial and Economic Affairs, led by President Xi, announced plans to “promote the orderly exit of backward production capacity.” Overcapacity, especially in the auto and solar panel industries, has been a pain point in trade negotiations with the United States and European Union, as China has flooded both markets with cheap solar panels and automobiles.

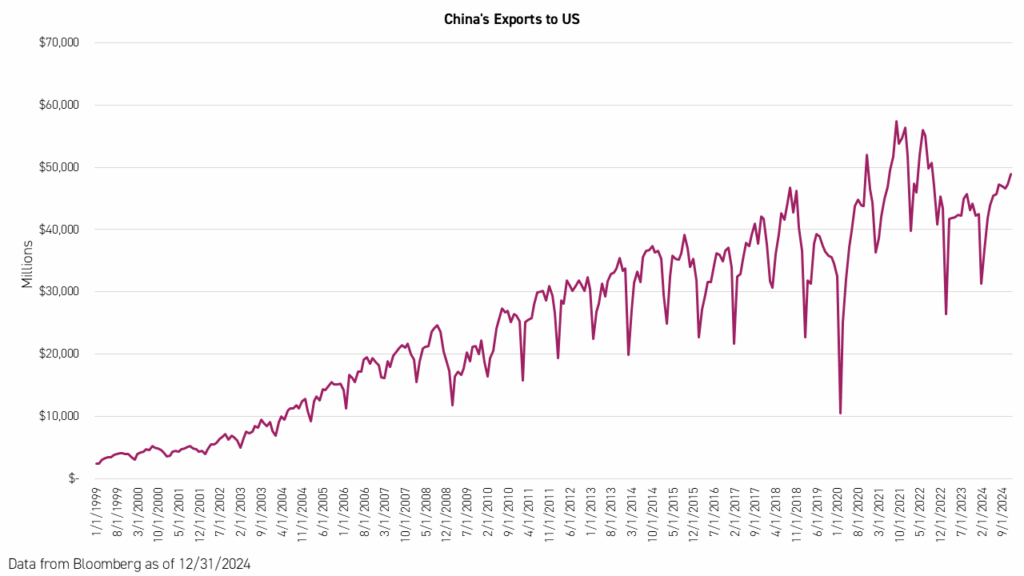

Since its accession to the World Trade Organization (WTO) in 2002, China has become the world's factory. As a result, Western markets have benefited for decades from the availability of affordable manufactured goods, from toys to industrial instruments. This has caused prices to fall in Western markets.

Western consumers were initially happy to purchase cheaper manufactured goods from China. But, as China's exports moved up the value chain to include vehicles and solar panels, they began to threaten local industries, especially the automobile industry. This has been a significant factor in the wave of protectionism that has swept the Western world since Trump's first term began in 2016.

China is responding to protectionism by systematically reducing overcapacity. This could mean that the days of China's deflationary impact on the Western world could be coming to an end. Reuters recently reported that China's government will target an even more expansive list of industries for capacity restrictions than initially expected, adding chemical industries, including plastic and steel, to the mix. This would mean an even broader downstream impact on the cost of almost all manufactured goods.

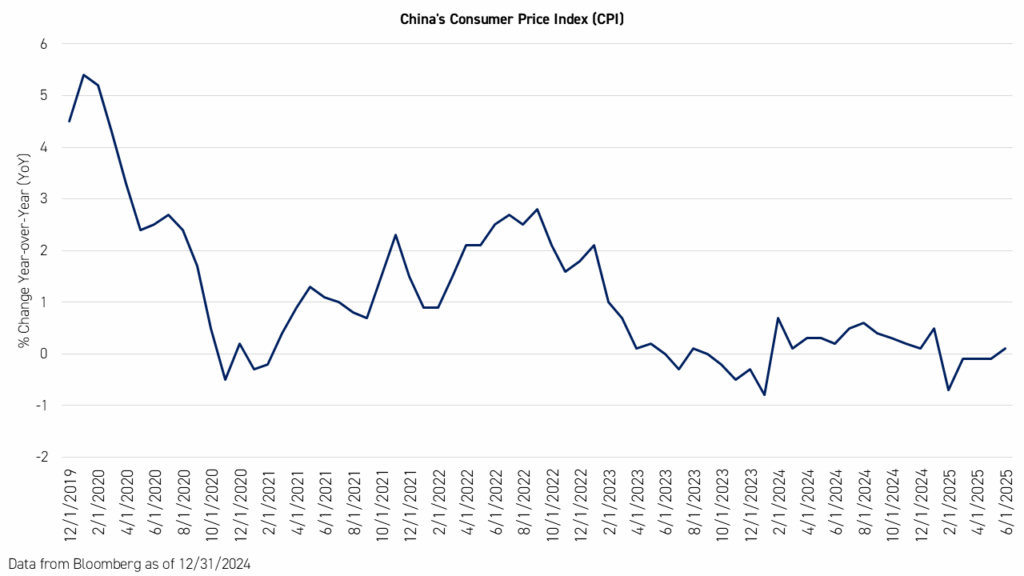

Beyond responding to protectionism abroad, China also needs to raise inflation at home. The country's consumer price index (CPI) has trended steadily downwards since 2019, driven by overcapacity, the rapidly aging population, and real estate deleveraging.

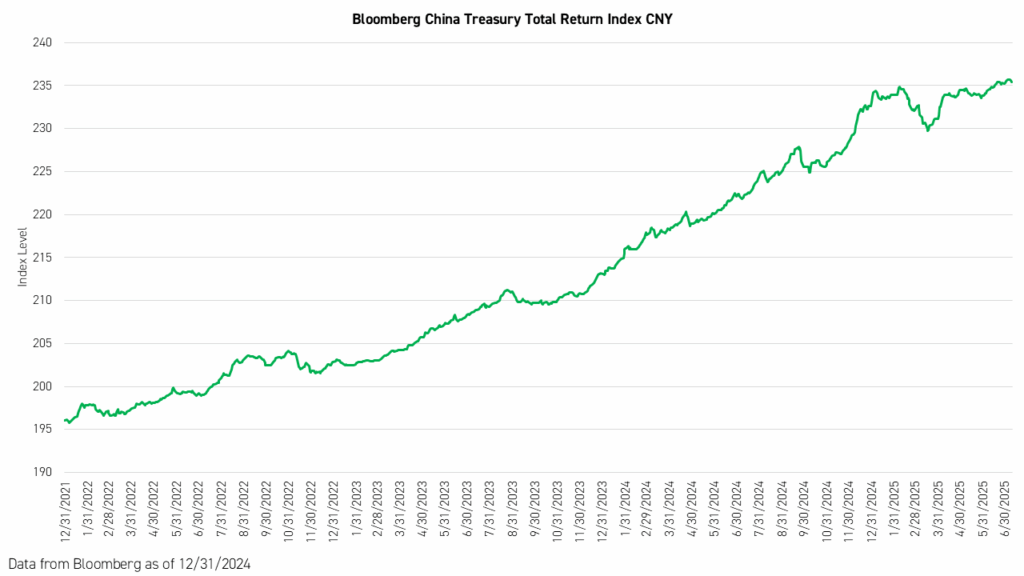

Raising inflation would help incentivize consumers to increase their current spending, as their money would be worth less in the future. Meanwhile, it could increase demand for stock investments. China's government bond market has risen steadily since 2021, as rates have dropped. Higher inflation could lead China's central bank to raise rates, causing government bond prices to fall. This disruption in the bond market could push more investors to migrate to stocks.

Takeaways

China's campaign to reduce overcapacity could have the following impacts:

1. Heightened long-term inflation in Western countries as the availability of affordable China-made goods declines.

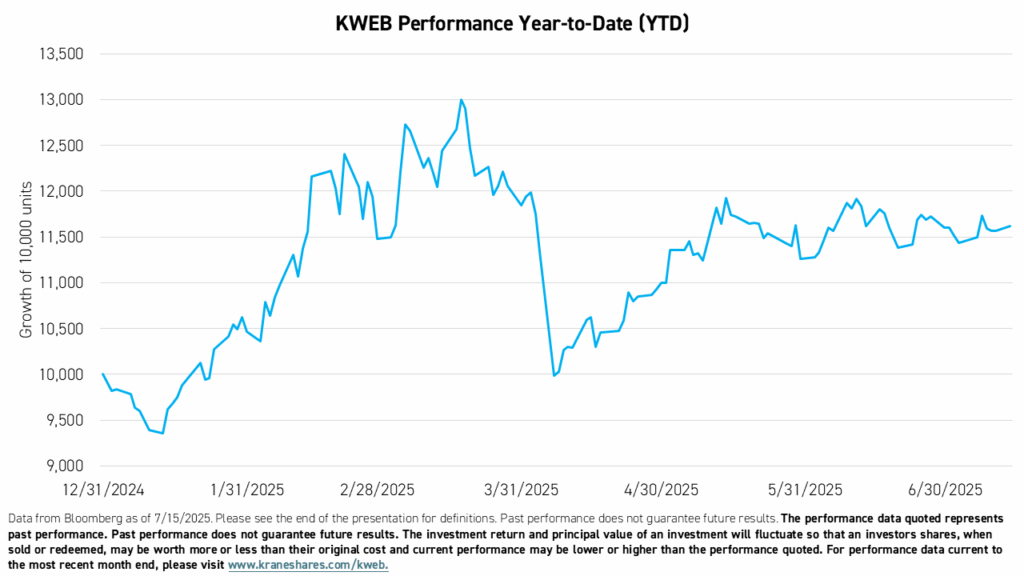

2. A potential boost to China's equity market in the long term as corporate profits rise with consumer spending and savings shift from bonds to stocks.

3. Improved trading relationships between China and Western economies as overcapacity tensions ease in key industries such as vehicles and solar panels.

The KraneShares CSI China Internet ETF (Ticker: KWEB), which is geared towards online spending by China's consumers, could be a strong diversifier to positions in Western markets and has the added benefit of being highly sensitive to potential positive trade developments.

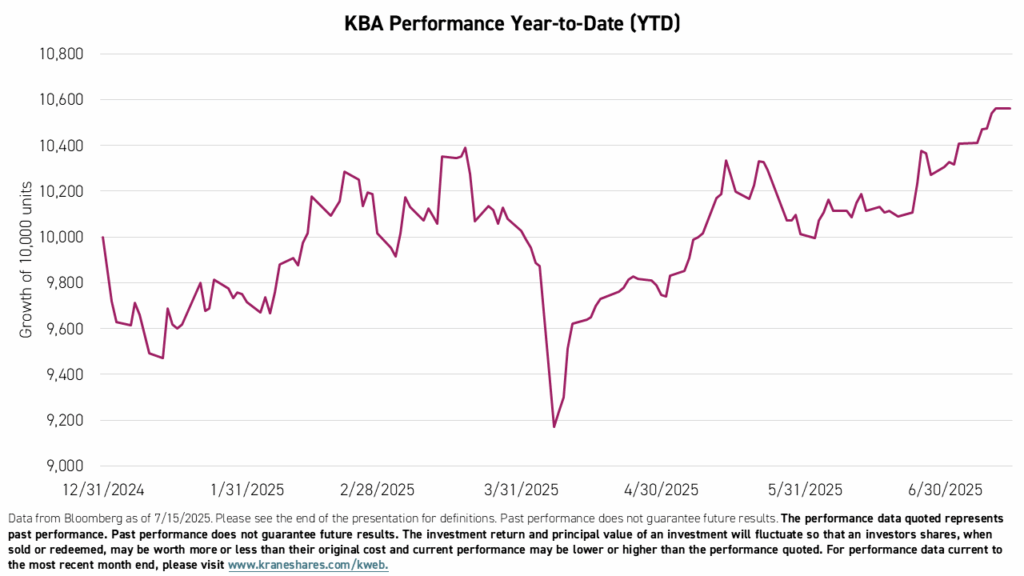

The KraneShares Bosera MSCI China A 50 Connect Index ETF (Ticker: KBA) may help investors capitalize on a potentially increased share of China's household savings becoming invested in local stocks. KBA owns the 50 largest, most liquid stocks listed on Mainland China's largest stock exchanges in Shanghai and Shenzhen, and available to foreign investors via Northbound Stock Connect.

Conclusion

Curbing overcapacity has become a priority for China's policymakers in recent months, as they respond to both external pressure from protectionism and internal challenges with deflation. This could result in higher inflation in Western countries, a potential boost to China's equity market, and improved trading relationships with Western countries.

For KWEB standard performance, top 10 holdings, risks, and other fund information, please click here.

For KBA standard performance, top 10 holdings, risks, and other fund information, please click here.

Diversification does not ensure a profit or guarantee against a loss.

Consumer Price Index (CPI): A consumer price index measures the monthly change in price for a figurative basket of goods and services. These items can change over time.