CATL – The Battery Giant Leading Innovation in China A-Shares

By Derek Yan, CFA

Few could predict that Yuqun Zeng, a rural farmer from Fujian Province, would go on to found the world's largest electric vehicle (EV) battery supplier. His company, Contemporary Amperax Technology Co., Limited (CATL), is now among the biggest, most innovative companies in China and supplies batteries for Tesla, Ford, NIO, and other global EV makers.

However, since CATL trades on the Shenzhen Stock Exchange, it is often excluded from international and emerging market ETFs. Additionally, since investors cannot buy CATL stock in most brokerage accounts, access to one of the world's most exciting companies is severely limited.

The KraneShares Bosera MSCI China A-Share ETF (Ticker: KBA) currently has CATL as its top holding. KBA provides exposure to the leaders of China’s A-Share market, like CATL, which we believe could be at the forefront of the next phase of global growth.

In 1968, Yuqun Zeng was born in a hilly village located 13 miles south of Ningde in Fujian Province, China. Raised in a poor family, he spent his early childhood as a farmer, like most children living in rural China back then. However, after getting a high score on China’s college entrance exam, Yuqun made it to a top college in China. He attended Shanghai Jiao Tong University, where he built a foundation to become one of the top engineers in the world. Years after graduation, he founded the world’s largest battery maker, CATL.1 He became the second richest man in China, even wealthier than Alibaba’s founder, Jack Ma. After his success, he chose to help his hometown by picking Ningde as the location to build his global battery giant’s headquarters.

CATL began as a spin-off of Amperex Technology Limited (ATL), which Yuqun Zeng founded as a battery company for consumer electronics in 1999. In 2011, when the electric vehicle (EV) industry started to boom in China, Zeng realized that EV batteries could present a massive, long-term opportunity. In 2012, Zeng and his vice-chairman, Shilin Huang, created CATL to tap into this burgeoning market.

Since establishing CATL in 2012, the electric vehicle industry has only grown. EV sales reached a record high of 6.6 million out of 66.7 million global auto sales in 2021, about a 9.9% penetration rate2. Bloomberg New Energy Finance estimates global passenger EV sales could reach 20.6 million in 20252. Further technological advances in batteries could even lead EVs to replace Internal Combustion Engine Vehicles gradually.

CATL is also a top holding in our KraneShares MSCI China Clean Technology Index ETF (Ticker: KGRN), which offers a dedicated exposure to the China clean technology theme and our KraneShares Electric Vehicles & Future Mobility ETF (Ticker: KARS), which captures the global EV and future mobility ecosystem.

Since China announced its goal to hit peak carbon emissions before 2030 and reach carbon neutrality by 2060, the Chinese EV industry has grown exponentially. CATL has accrued multiple partnerships with top EV companies such as NIO, Xpeng, Li Auto, and auto manufacturers such as SAIC, Geely, and BAIC. These companies sought CATL as their battery supplier for its advanced technology, expanding capacity, and competitive cost. China is now the world's largest country for EV sales, with 3.3 million EVs sold in 2021, accounting for around 50% of global sales2. CATL gradually established its position as a leading supplier and now holds nearly 50% of the market share in China1.

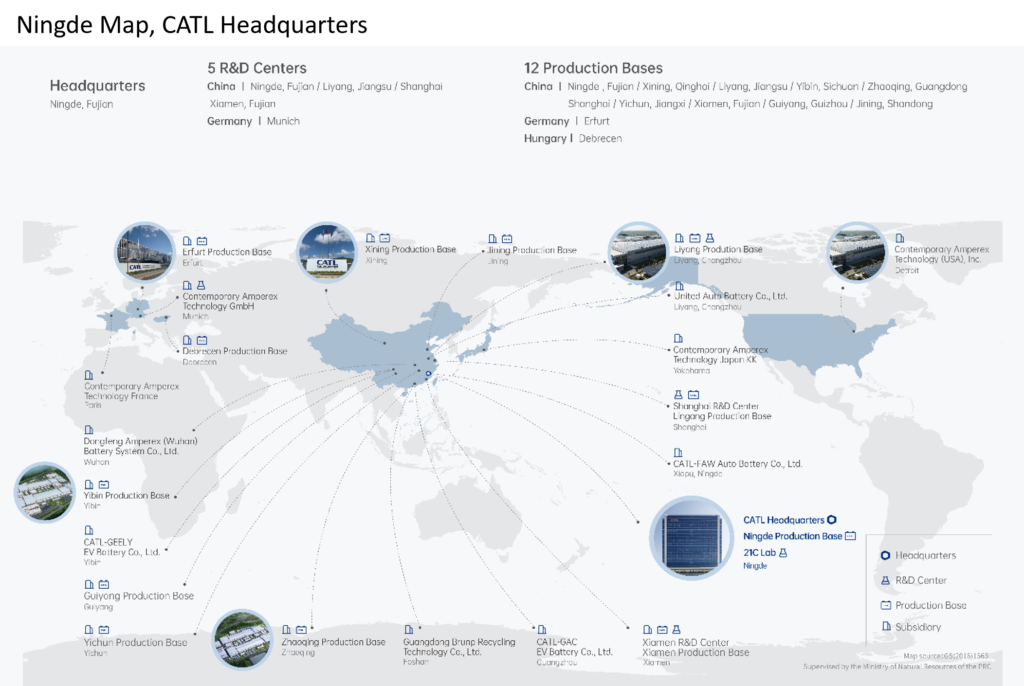

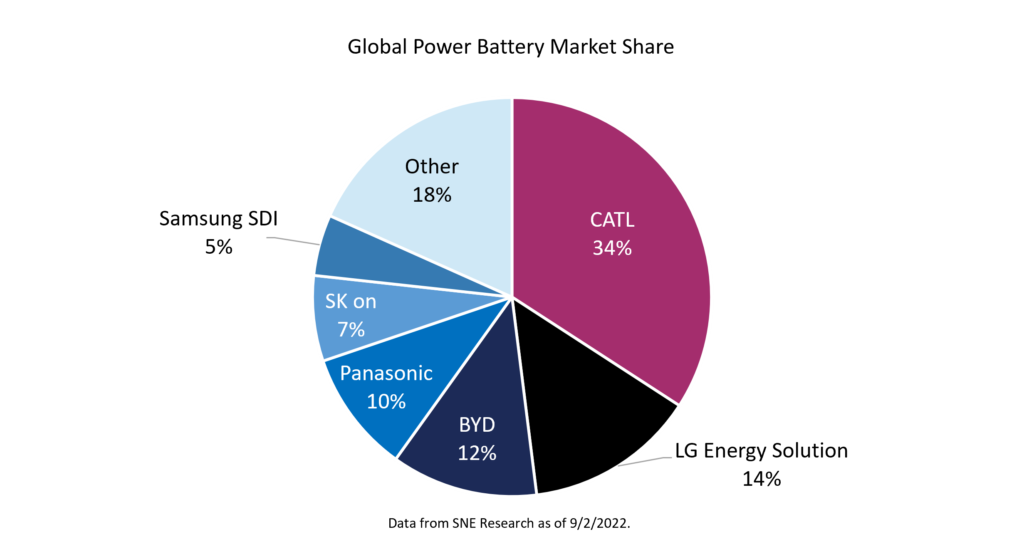

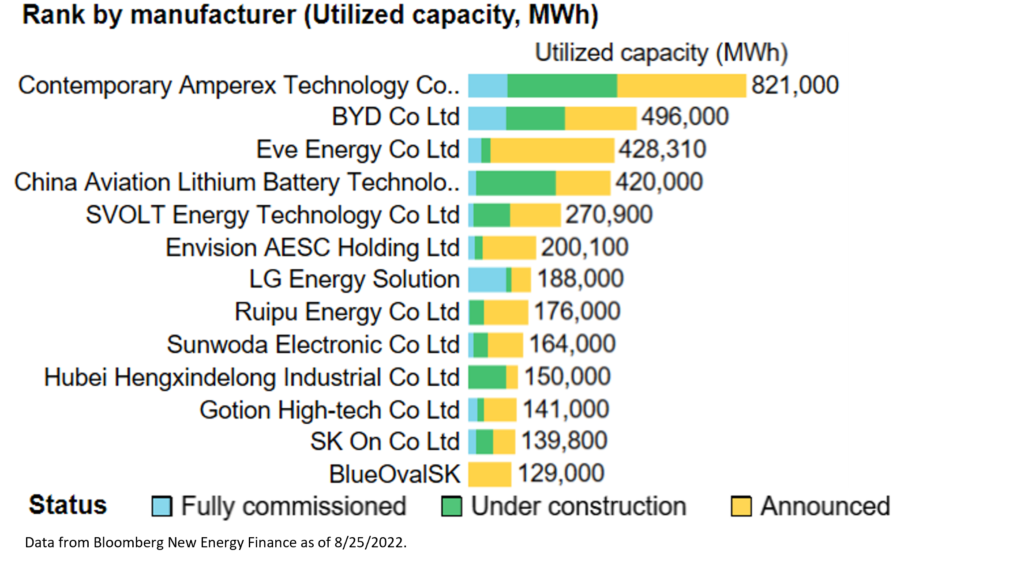

CATL is also actively working with companies outside of China. In 2013, CATL entered a strategic partnership with BMW. This partnership with the luxury car maker is an endorsement of the firm’s product quality. Tesla’s Shanghai gigafactory relies on CATL to supply batteries as well. CATL is now the largest battery maker in the world, with a 34% market share in 1H 20221, and still, the overseas market share for CATL has room to grow. Recently, CATL partnered with Ford for their EV production in China, Europe, and North America. The Ford Mustang Mach-E and F-150 Lightning will use CATL batteries in the coming years. The firm is building factories across Europe and North America and plans to increase the total annual capacity to 500GWh by 2025 and 800 GWh by 20303.

In CATL’s 2022 semi-annual report, the company reported 156.3% YoY revenue growth4. As the market for EV batteries grows, we believe CATL has many competitive advantages for it to remain the leader in the battery industry.

Extreme Efficiency

One of CATL’s advantages is the high level of sophistication and efficiency that they operate. CATL’s Ningde factory was recognized as a Global Lighthouse Factory by the World Economic Forum in 20215. This designation awards manufacturing leaders who have successfully applied advanced technologies such as artificial intelligence (AI) and big data analytics to improve efficiency, transform business models, and achieve profitable growth in tandem with environmental stewardship. Using these innovative technologies, CATL has built an extremely efficient manufacturing system to maximize productivity while maintaining product quality and safety. The factory integrates AI, advanced analytics, digital twins, 5G, and edge/cloud computing, so all procedures are seamlessly connected and coordinated.

Supply Chain Advantage

CATL also has a supply chain advantage compared to its global peers, with China having lower costs for metal refining and parts manufacturing6. China now controls over 50% of battery-grade metal refining capacity across all key materials7. It refines 68% of the world’s nickel, 73% of cobalt, 93% of manganese, and 100% of the graphite used in lithium-ion batteries8. As a market leader in the battery industry, CATL can establish strategic partnerships with supply chains and maintain stable pricing power.

The firm also invests in mineral resources and battery recycling to hedge the rising cost of raw materials. CATL’s battery recycling unit, Pubang, can recycle 99.3% of Nickle, Cobalt, Manganese, and 90% of Lithium from used batteries. When the battery market reaches a certain size, the industry could rely on recycling for most raw materials.

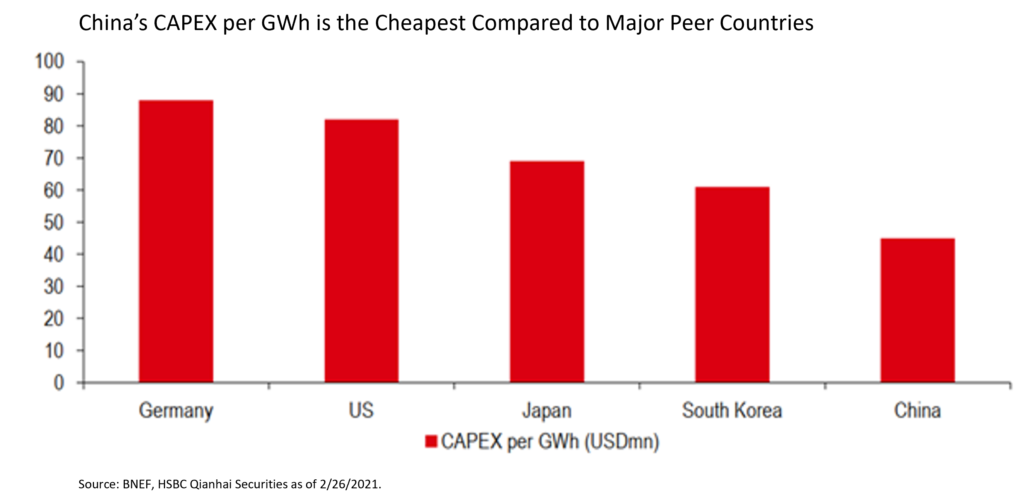

The capital required for CATL to build a battery-producing factory (CAPEX per GWh) is also very low due to China’s low cost of land, construction, infrastructure, and utilities. CATL now has a strong pipeline compared to global peers, allowing them to supply power batteries to global carmakers consistently.

Tech and R&D Leader

Another advantage for CATL is that it has positioned itself as a global leader in battery research and innovation. Being the revenue leader in the battery industry1, CATL can continue its high R&D spending to maintain its technological advantage. Its research team had over 10,000 people with 4,445 patents globally in 20214. Its leading position in the next generation of battery tech has positioned the company to continue its success over competitors.

CATL has an exclusive battery packaging technology called Cell-To-Pack (CTP) 3.0. The new generation of battery using CTP 3.0 is called Qilin, which has a 255Wh/kg energy density that could power an EV for over 1000 km (620 miles) with a 10-minute fast charge. At the same size as Tesla’s next-gen battery 4680, Qilin will have 13% more energy output9.

Summary

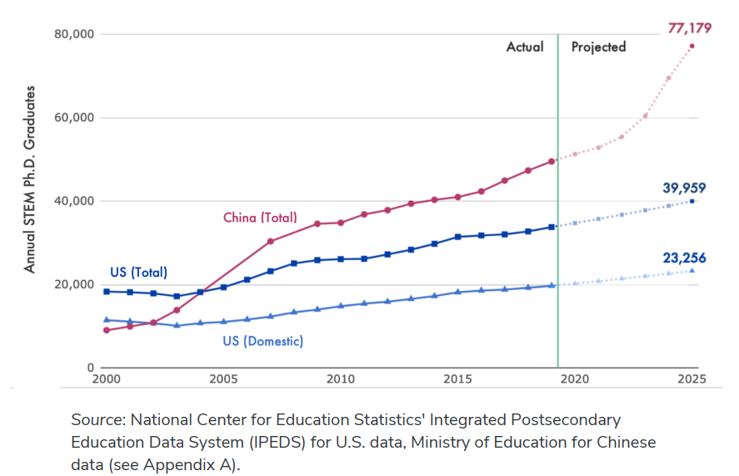

China was known as the world factory for low-end and cheap labor manufacturing. After decades of industrialization, the country is moving to higher value-add manufacturing for its competitive edge in talents, technology, and total cost. China now has more STEM PhDs graduates than the US10, making it a rising hub for science, technology, and engineering innovation. More and more people like Yuqun Zeng are receiving higher education and becoming entrepreneurs, allowing them the opportunity to modernize China and create massive wealth.

We believe more local Chinese companies like CATL will become leaders in the next phase of global growth. CATL and other companies listed on the Shanghai or Shenzhen Stock Exchanges are classified as China A-Shares, which are in the process of being fully included by MSCI in global indexes. However, most investors only hold Chinese companies listed in the US or HK (Alibaba, Tencent, etc.). They are under-allocated to China A-shares, despite them accounting for half of the market cap of Chinese equities11. Thus, China A-shares show a very low correlation to global equities11.

The KraneShares Bosera MSCI China A-Share ETF (Ticker: KBA) provides exposure to CATL and China’s A-share market, tracking the MSCI China A 50 Connect Index. CATL is KBA’s largest holding as of 8/31/2022, along with 49 other large-cap Shanghai and Shenzhen listed stocks available through Stock Connect. KBA offers the first officially recognized Futures contracts for Stock Connect-eligible A-shares, representing a powerful risk management tool for international investors. KBA focuses on the largest, most liquid stocks, which receive the most foreign interest and inflows. KBA may benefit from increased global investment in China’s A-share market over the long term. We believe KBA could offer investors access to innovative Chinese companies and diversified returns from global equity markets.

*Diversification does not ensure a profit or guarantee against a loss.

For KBA standard performance, top 10 holdings, risks, and other fund information, please click here.

For KGRN standard performance, top 10 holdings, risks, and other fund information, please click here.

For KARS standard performance, top 10 holdings, risks, and other fund information, please click here.

Holdings are subject to change.

Citations:

- SNE Research, 7/18/2022.

- “Electric Vehicle Outlook 2022”, Bloomberg New Energy Finance, 6/01/2022.

- “LFP to dominate 3TWh global lithium-ion battery market by 2030”, Energy Storage News, 3/22/2022.

- CATL.com, 8/24/2022.

- “Recognized by World Economic Forum as Global Lighthouse Factory, CATL Leads High-Quality and Sustainable Manufacturing in Battery Industry”, PR Newswire, 9/28/2021. Retrieved 10/4/2022.

- Bloomberg New Energy Finance, HSBC Qianhai Securities, 2/26/2021.

- “Race to net zero: Pressures of the battery boom in 5 charts”, Bloomberg New Energy Finance, 7/15/2022.

- Finley, Allysia. “China Gets a Great Leap Forward From Congress,” The Wall Street Journal. August 14, 2022.

- “CATL launches CTP 3.0 battery “Qilin,” achieves the highest integration level in the world”, CATL, 6/23/2022.

- National Center for Education Statistics’ Integrated Postsecondary Education Data System (IPEDS) for U.S. data, Ministry of Education for Chinese data.

- Bloomberg data as of 8/31/2022.

Definitions:

Northbound Stock Connect: The program that allows foreign investors to trade stocks listed in Mainland China via accounts in Hong Kong.

Southbound Stock Connect: The program that allows investors located in Mainland China to trade stocks listed in Hong Kong.