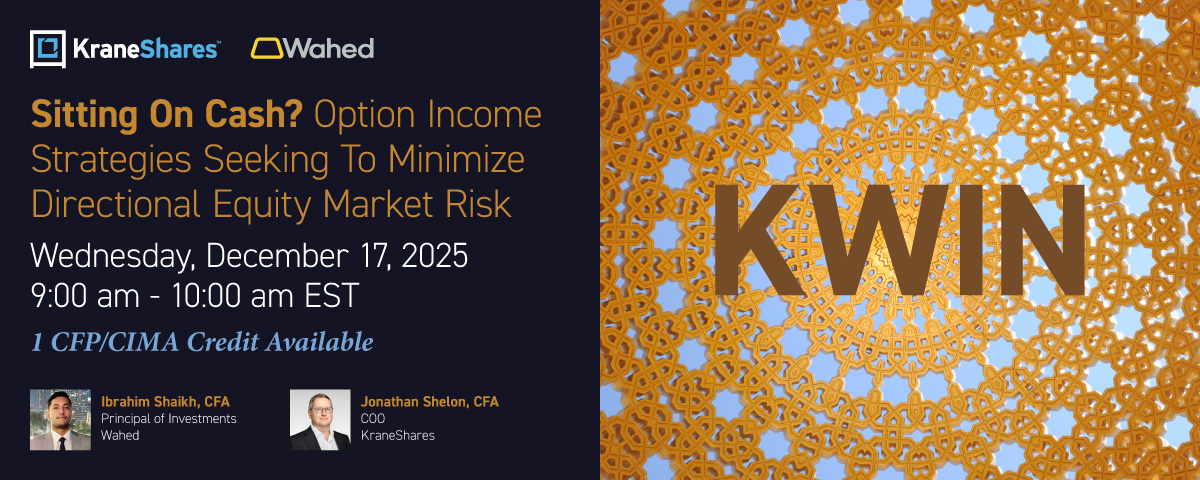

Replay: Sitting On Cash? Option Income Strategies Seeking To Minimize Directional Equity Market Risk

Wednesday, December 17, 2025 9:00 am - 10:00 am EST

Please register below to view this replay

Event Details:

Replay: Sitting On Cash? Option Income Strategies Seeking To Minimize Directional Equity Market Risk Wednesday, December 17, 2025 9:00 am - 10:00 am EST

For decades, corporate treasuries have relied on sophisticated option-based strategies to manage large cash balances. These institutional approaches, developed in the 1980s, were designed to preserve liquidity while minimizing volatility and avoiding directional market risk. The KraneShares Wahed Alternative Income Index ETF (Ticker: KWIN) is designed to offer a similar philosophy to investors seeking option income solutions.

KWIN aims to generate option income seeking to minimize directional equity market risk. The result is a potential alternative to traditional interest-based vehicles, potentially offering a way to allocate cash productively and with sufficient liquidity—this approach has the additional advantage of adhering to Shariah standards and principles.

In this session, KraneShares COO Jonathan Shelon, CFA, and Wahed Principal of Investments Ibrahim Shaikh, CFA, will discuss:

What we will cover:

- How KWIN’s strategy utilizes institutional investment techniques to seek alternative sources of income

- The structure of KWIN’s option-based approach and how it can generate alternative income while seeking to maintain low volatility and minimal directional risk

- How KWIN fits the needs of Shariah-focused investors by utilizing a screening and certification process, and how it impacts security selection and portfolio construction

- Performance of the KWIN Index since its launch on July 31st, 2025

Investors can submit questions by emailing [email protected]

1 CFP/CIMA Credit Available

For standard performance, top 10 holdings, risks, and other fund information on the KraneShares Wahed Alternative Income Index ETF (Ticker: KWIN), please visit https://www.kraneshares.com/etf/kwin or consult your financial advisor.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

This material is intended for a retail audience and is for informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security. References to institutional investors are included solely to describe the investment landscape and do not imply endorsement, validation, or suitability of any investment strategy for retail investors.

Please note:

- Institutional investors often have access to different investment terms, share classes, and due diligence resources that are not available to retail investors.

- Their participation in a fund or strategy does not guarantee performance, reduce risk, or ensure suitability for individual investors.

- Retail investors should not interpret institutional involvement as a signal of safety, quality, or future success.

A balanced evaluation of both risks and potential rewards is essential when considering any investment. This material does not constitute a forecast or guarantee of future performance.

Definitions:

Directional Market Risk: Risk that the value of an investment or portfolio will change because the overall market or a specific asset moves up or down in a particular direction, reflecting the sensitivity of a position’s gains or losses related to broad price movements.

American Style Options: Options that give the holder the right to exercise at any time up to and including expiration, allowing flexibility to capture intrinsic value or respond to changing market conditions.

European Style Options: Options that restrict exercise to the expiration date only, meaning their value is realized solely based on the underlying asset’s price at maturity.

Arbitrage Strategy: A trading strategy that seeks to generate low-risk or risk-free returns by exploiting temporary price discrepancies of the same or closely related assets across different markets or instruments, profiting as prices converge.

Put-Call Parity: A fundamental options pricing relationship stating that the prices of European call and put options with the same strike and expiration are linked through the price of the underlying asset and the risk-free rate, ensuring no-arbitrage conditions in efficient markets.

Convenience Yield: The non-monetary benefit of physically holding a commodity rather than a futures contract, reflecting advantages such as assured supply, production continuity, or inventory flexibility.