Why This ETF May Be The Better A-Shares Inclusion Play

Market Watch- KraneShares Bosera MSCI China A Share ETF (Ticker: KBA) is well positioned to benefit from the third step of the MSCI China A-Share inclusion process. KBA could be poised to surpass similar funds benchmarked to the CSI 300 index. The linked article below explains why.

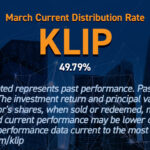

KBA standard performance

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. KBA's gross expense ratio is 0.80%. Top 10 holdings for KBA can be found here.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

r_us_ks

The above link will take you off the KraneShares website. Krane Funds Advisors, LLC (KFA) has included links to unaffiliated third parties for informational purposes only. The links and the views of the third parties do not necessarily reflect the views of KFA, its management, employees, officers, and affiliated entities. All opinions, evaluations, descriptions and statements do not purport to be complete and are subject to change. KFA makes no representation as to the adequacy of information and should not be construed as an endorsement by KFA, its affiliated entities, management, officers, employees and agents.