The Humanoids Have Arrived! At CES 2026

By Joseph Dube, Head of Marketing

By now, the headline statistics have been well publicized. Goldman Sachs estimates annual humanoid robot shipments could reach one million units by the early to mid-2030s.1 Morgan Stanley goes further, projecting more than one billion humanoids deployed globally by 2050.2 The numbers are eye-popping—but at this year’s Consumer Electronics Show (CES) in Las Vegas, I saw something more important than forecasts. I saw the humanoid future moving out of research labs and into the real world.

CES is known to be a proving ground for technologies on the verge of mass adoption.3 Whether it was the VCR in the 1970s, the CD player in the early 1980s, DVDs in the 1990s, or smart TVs and mobile computing in the 2000s, the show has a long track record of spotlighting innovations just before they enter daily life. This year, from what I saw, I believe humanoid robots fit that pattern.

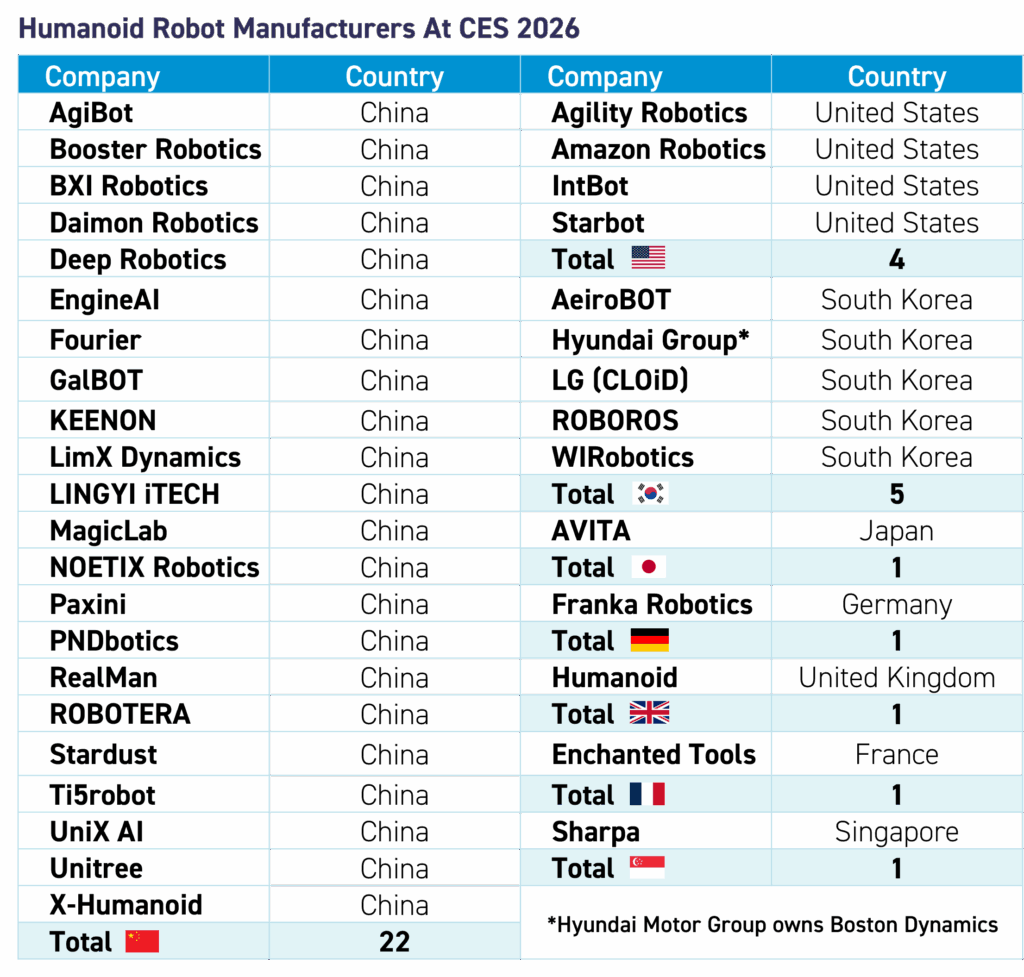

Walking the halls of CES, I encountered dozens of new humanoid robot brands—alongside component manufacturers, data-collection platforms, operating systems, and embodied-intelligence software providers. One thing quickly became obvious: the epicenter of this ecosystem is China. As seen in the chart below, many humanoid exhibitors either came directly from China or were founded by Chinese engineers now operating in Silicon Valley or elsewhere. Mandarin was spoken as frequently as English. I believe this may be a sign of an improving geopolitical atmosphere, as management teams were eyeing the US market and were enthusiastic about their future business prospects here.

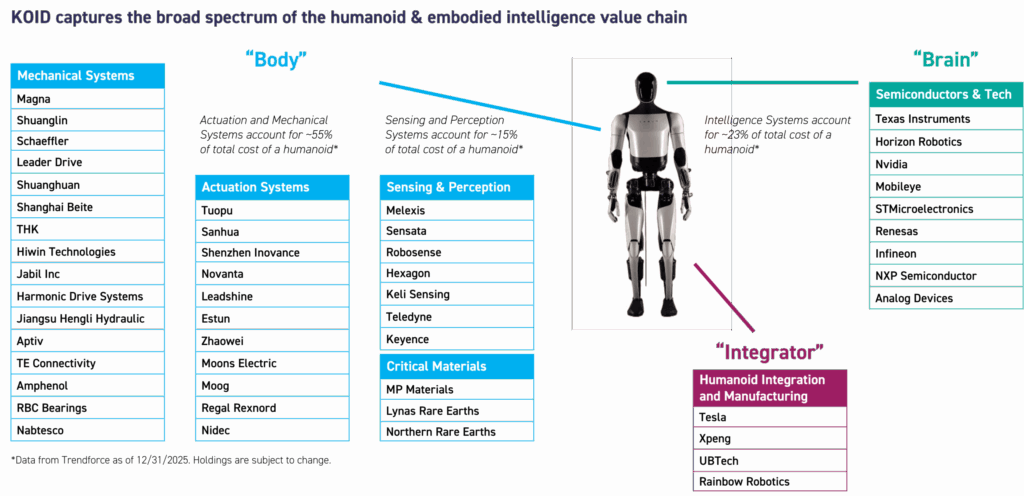

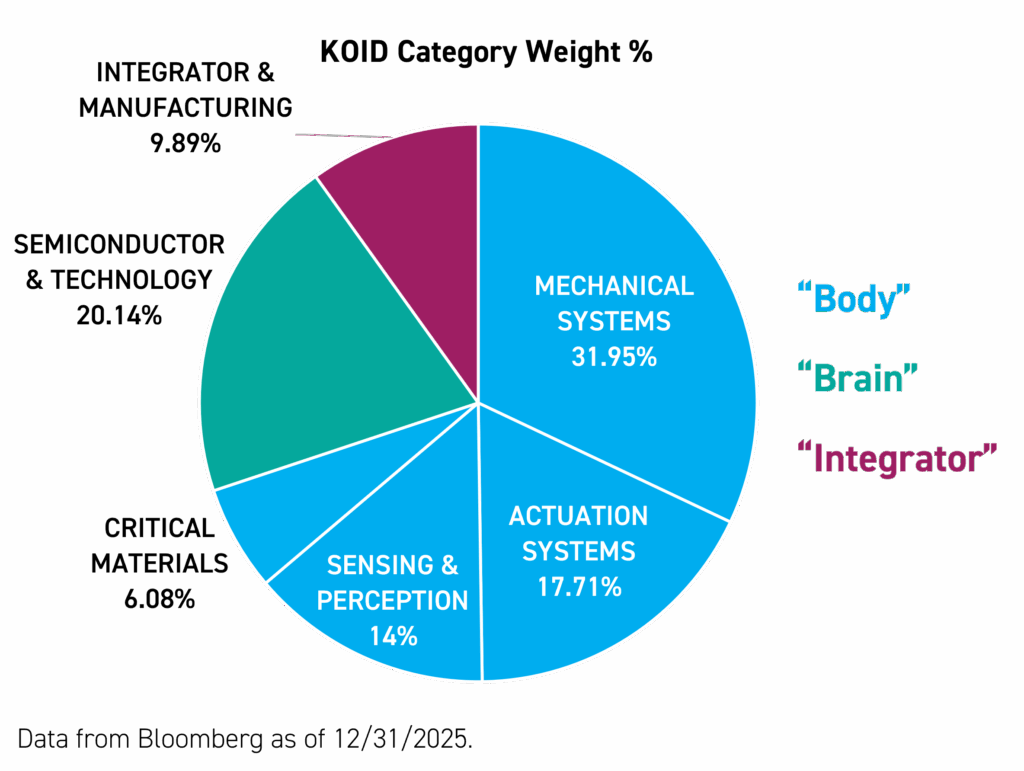

It was encouraging to see how closely the conference aligned with the investment framework of our KraneShares Global Humanoid and Embodied Intelligence ETF (Ticker: KOID). KOID is designed to capture the broad humanoid value chain: the components, the brains, and the integrators building real-world humanoid systems across the U.S., China, Europe, and broader Asia. CES confirmed that this ecosystem is not theoretical—it is already forming at scale.

With that opportunity comes risk. KOID is focused on a fast-evolving, global technology ecosystem, investing in AI- and robotics-related companies across multiple geographies, including non-U.S. issuers and companies at earlier stages such as IPOs, which can experience elevated volatility. While the fund provides exposure across different regions and segments of the humanoid value chain, it is a concentrated, non-diversified strategy. As a result, adverse developments affecting a single company, sector, or theme within the portfolio may have an outsized impact on performance.

Integrators steal the show

The stars of the show were the integrators, the companies assembling and selling humanoid robot models.

Unitree’s now-famous G1 boxing robots drew massive crowds, as did athletic humanoid demonstrations from EngineAI, whose booth placement directly adjacent to Unitree felt overtly strategic. AgiBot—whom we visited in China last fall—showcased its full-sized A2 humanoid, which recently set a record for longest distance walked by a humanoid robot (106.29 km/66.04 miles).4 Alongside it were the smaller X1 and X2 models performing choreographed dance routines, plus a robotic panda that quickly became a crowd favorite. Noetix, another company we visited at its Beijing factory last year, let attendees physically kick and push its lightweight N2 humanoid to demonstrate balance and durability. Booster Robotics staged a classroom of synchronized T1 robots waving in unison. Galbot (also part of last fall’s visit) demonstrated its award-winning autonomous retail clerk (which won the medical scenario drug sorting competition at the World Humanoid Robot Games).5 Galbot is already operating in real-world store environments, such as its consumer goods stand "Galaxy Space Capsule" in Beijing, and in factory workshops, with plans to scale deployment in 2026.5,6 Singapore-based Sharpa showcased a humanoid playing fully autonomous, fluid ping pong against a human competitor.

I also met white-label humanoid manufacturers. I spoke to one in particular, Lingyi iTech, which told me it is the integrator behind many flagship humanoid initiatives. They can handle everything from specific components of the humanoid supply chain to the production of entire models for their clients.

In a sign that humanoids are attracting serious corporate attention beyond automakers like Tesla and XPeng, LG unveiled its entry into the space with CLOiD—a laundry-folding humanoid robot (whose name is similar to a certain humanoid ETF ticker). More importantly, LG’s massive booth featured prominent displays highlighting its humanoid actuator manufacturing capabilities—another key theme featured throughout the conference.

Having been immersed in the humanoid robotics world since the launch of KOID last June, much of this felt both incredible—and increasingly expected. From what I saw, robot movement is becoming more fluid. Designs are wildly varied, reminiscent of the early smartphone era before convergence around a dominant form factor. Based on my observations, the pace of progress is moving quickly.

What truly stopped me in my tracks, however, were the advances in the brains of these robots.

Building the Robot Brain

One company in particular stood out: IntBot, based in San Jose, California. At CES, I spent time with their CTO, Dr. Sharon Yang, who explained how IntBot partnered with AgiBot to deploy humanoids powered by agentic AI for real-world service roles. Their first customers include hotels installing autonomous concierge robots at the Tulsa Marriott, the Nap York pod hotel in New York City, and the Otonomus Hotel in Las Vegas.

Dr. Yang was clear about where the frontier has shifted. The hardest problem in humanoid robotics is no longer mechanical movement—it is instant human understanding. Recognizing intent. Tracking gestures like a handshake. Adapting personality. Responding in real time without cloud latency.

I experienced this firsthand at the IntBot demo. The robot didn’t just speak fluently—it spoke naturally. When I asked whether it was familiar with our KOID ETF, it immediately responded yes, cited several holdings, and then began pitching why IntBot itself belonged in the portfolio. It wasn’t scripted. It reasoned. It was an awesome salesperson!

Dr. Yang mentioned the system could speak more than 50 languages fluently, so we tested it. Mandarin—perfect. Spanish—also perfect. Then someone challenged it in Farsi. To everyone’s surprise, its Farsi was flawless. The takeaway was evident: the next leap in humanoids isn’t motion—it’s interaction. In many respects, I think IntBot has already surpassed human capability in this domain.

Training Data

Movement is improving. Intelligence is advancing. But beneath both lies a quieter, less visible dependency: training data.

That became clear during a conversation at the PaXini booth.

PaXini was drawing steady attention for its humanoid hands and tactile sensing systems. The hardware demonstrations were polished and well attended. Inside the booth, however, a more understated process was underway. A real human technician sat slightly off to the side, wearing sensor-equipped gloves, repeatedly picking up and placing everyday objects.

I spoke with Jeremy Li, who explained that this activity was not a secondary demonstration, but a core part of how humanoid robots are trained.

While mechanical systems and AI models have advanced rapidly, generalized humanoid capability still depends on large volumes of high-quality real-world interaction data. Programming alone is insufficient. Robots must learn how humans grasp objects, apply pressure, adjust mid-motion, and recover from errors across varied environments.

PaXini’s approach relies on human-in-the-loop data collection. Operators wear gloves, vision systems, and motion-capture equipment inside standardized data-collection rooms. According to Jeremy, these sessions capture fine-grained information—grip force, pressure, orientation, and motion timing—paired with synchronized visual data. The resulting datasets are used to train embodied AI models governing how robots manipulate objects autonomously and safely.

Jeremy described PaXini’s dedicated data-collection facility in China, spanning approximately 12,000 square meters and employing roughly 500 staff focused exclusively on generating this training data.

According to Jeremy, for humanoids to move beyond controlled demonstrations and into service, hospitality, healthcare, and manufacturing environments, they must generalize across tasks and settings. He believes that generalization depends less on incremental software changes and more on exposure to real human behavior at scale.

Don’t forget the actuators!

My next “aha” moment came from a very different conversation.

I spoke with Houston Yu from ZeroErr, a humanoid actuator manufacturer based in Shenzhen with operations across Asia and the U.S. If IntBot represented the rapid evolution of humanoid intelligence, Houston explained where the economic reality of humanoids truly resides: actuators.

Houston walked me through ZeroErr’s integrated rotary actuator modules—compact systems that combine motors, drivers, dual encoders, harmonic gearboxes, brakes, and control electronics into a single unit. This level of integration is essential. Humanoid robots require precise, zero-backlash motion and real-time feedback at every joint to operate safely around humans.

Every joint in a humanoid requires an actuator. A single human arm has seven degrees of freedom—meaning seven actuators per arm. When I pointed to a nearby EngineAI humanoid and asked how many actuators it might contain, Houston estimated roughly 43 across the full body.

Actuators, he explained, can account for as much as 70% of a humanoid robot’s total production cost. That makes them not just a technical bottleneck, but the primary economic driver of humanoid scalability. It also explains why so much innovation is focused on integration—reducing part counts, improving reliability, and driving down system-level costs.

Conclusion: From CES Signal to Portfolio Exposure

CES 2026 made one thing clear: humanoid robotics has moved beyond isolated demonstrations and into early commercial reality. Integrators are delivering full systems. Intelligence is becoming conversational and adaptive. Training data is being industrialized. And the cost structure—particularly around actuators—is coming into focus.

This progress is no longer dependent on a single breakthrough. It reflects multiple layers advancing together. When movement, intelligence, data, and economics begin to align, adoption can follow. CES has signaled that pattern before, and I believe humanoids are following suit.

For investors, the opportunity is compelling but complex. The humanoid ecosystem is global, supply-chain driven, and multidisciplinary. Companies are distributed across regions, with China central to integration and manufacturing, the U.S. driving AI and software, and Europe and Asia contributing critical components. Isolating individual winners risks missing the broader system enabling scale.

That is why we built the KraneShares Global Humanoid and Embodied Intelligence ETF (KOID).

KOID provides differentiated exposure across the humanoid value chain—integrators bringing robots to market, intelligence platforms enabling interaction, data infrastructure training models, and component manufacturers shaping cost and reliability. CES reinforced that this framework reflects how the industry is already organizing itself.

Humanoid robots are moving into hotels, factories, classrooms, and retail environments. I believe that the question for investors is no longer if they matter, but how to potentially gain exposure as adoption expands.

This material contains the author's opinions. It is provided for informational purposes only and should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the fund. A balanced evaluation of both risks and potential rewards is essential when considering any investment. This material does not constitute a forecast or guarantee of future performance.

For KOID standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- Data from "The global market for humanoid robots could reach $38 billion by 2035," Goldman Sachs, retrieved 1/20/2026.

- Data from "A $5 Trillion Global Market," Morgan Stanley, retrieved 1/20/2026.

- Data from "CES 2026: The Future is Here," Consumer Technology Association, as of 1/9/2026.

- Data from "Longest journey walked by a humanoid robot," Guinness World Records, retrieved 1/20/2026.

- Data from "Galaxy General Robotics wins the World Humanoid Robot Games, leading the pack with fully autonomous operation and showcasing its impressive landing capabilities," Weixin, as of 8/17/2025.

- Data from "Galbot’s autonomous retail clerk expands into real-world store deployments," Galbot Inc, as of 10/3/2025.

Definitions:

Actuators: The mechanical components (essentially motors) that enable robots to move their joints.

Integrated rotary actuator modules: Compact motorized units that combine multiple motion-control parts (motor, sensors, brakes, gears) for precise robotic movements.

Human-in-the-loop data collection: A process where people perform tasks that generate real-world data to train AI models—used here to teach robots how humans move and interact physically.

Embodied intelligence: AI embedded in a physical machine (like a robot) that allows it to perceive and act in the real world.

Agentic AI: An AI system capable of autonomous decision-making and goal-directed behavior with minimal human supervision.

Cloud latency: The delay between a request sent to the cloud (remote servers) and the response received—important for real-time robotic actions.

Degrees of freedom: The number of independent ways a joint or mechanism (like a robot arm) can move.

Zero-backlash motion: Precise mechanical movement without looseness or delay—important for robots working safely with humans.