Tencent & CATL: DoD List Inclusion & What It Means For Investors

By Henry Greene

Key Points:

- Being on the CMC list does not mean required divesture by US investors nor the removal from indexes.

- The companies will appeal to the Department of Defense (DoD) to be removed.

- If the appeal is rejected, they are likely to sue, which has been done before in such cases.

What Happened?

Tencent, an international entertainment and communications giant, and CATL, the world's largest manufacturer of electric vehicle (EV) batteries, were added to a list of companies maintained by the US Department of Defense (DoD). This list specifies China-based companies with operations in the United States that are found to be affiliated with the Chinese military. It is also called the "Chinese Military Company" or CMC List. The list prohibits the Department from purchasing goods and/or services from the companies named.

Crucially, being on the CMC list does not prohibit US investors from investing in the companies. It also does not require the removal of the companies’ stock from global indices maintained by US firms. The CMC List is completely separate from a similar list maintained by the Office of Foreign Assets Control (OFAC). OFAC's list, by contrast, indeed prevents US investors from holding the companies named.

Tencent's Hong Kong-listed shares have fallen by more than -10% since the announcement that the company was being added to the CMC list. Why the sell-off off? Many investors are not familiar with these lists and their differentiations. In other words, they shot first in order to ask questions later.

In theory, President Biden could issue an Executive Order requiring divestment by US investors. President Trump took this step when he ordered the delisting of China's NYSE-listed telecom firms. Since then, OFAC has served as the authority on divestments by US investors.

What were the immediate market impacts?

Tencent's primary listing is in Hong Kong. While it does have a US listing through an American depositary receipt (ADR), the ADR is unsponsored and volumes in it are thin, a fraction of its Hong Kong shares.

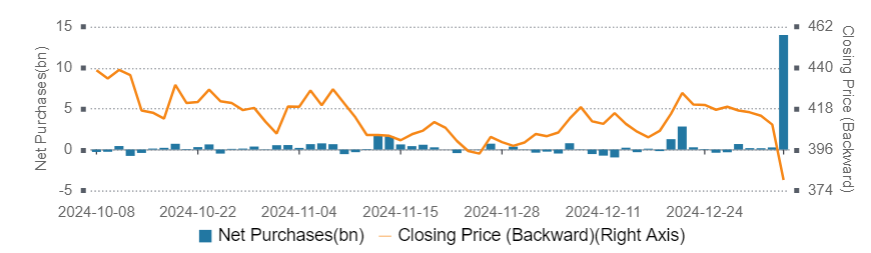

Through the Hong Kong listing, both Mainland investors and the company itself bought the dip:

- Tencent purchased 15 million shares in the week following the DoD release.

- Mainland investors bought a net $1.8 billion worth of Tencent stock via Southbound Stock Connect on Tuesday, January 7th, after the DoD's release on Monday. (see chart below)

- Mainland investors bought a net $6 billion worth of Hong Kong-listed shares for the week beginning on January 6th. Clearly, they are buying the dip on Hong Kong’s weakness.

Historical Examples of How This Could Play Out

Tencent predominantly derives revenue from selling video games (familiar games would be subsidiaries’ Fortnite and Clash of Clans), monetizing the WeChat social media platform via advertisers, and its FinTech unit through mobile payments and consumer loans. While the company has both AI and cloud computing efforts, their products in these spaces do not have clear military applications.

Following the release, the company immediately stated it would look to engage the DoD to rectify the mistaken clarification. If the DoD maintains the designation, Tencent could sue in US court. This has happened before.

The most high-profile similar case was cell phone and electric vehicle (EV) maker Xiaomi, which was added to the OFAC list on January 14th, 2021. The company engaged with the DoD, which declined to remove the company. Xiaomi sued in the District Court for Washington, DC and won on March 14, 2021. The DoD removed the company from the divestment list on May 11th.

Xiaomi’s stock fell -10% the day of the DoD list release and 30% over the next two months though has fully recovered.

FTSE Russell removed Xiaomi from its indices on March 10th, though MSCI did not remove Xiaomi from its indices due to the ongoing court case. FTSE reversed course following the court decision.

Why was Tencent added to begin with?

It is unclear. There may have been political motivations for the outgoing Biden Administration.

As the Company is neither a Chinese military company nor a military-civil fusion contributor to the Chinese defense industrial base, it believes that its inclusion in the CMC List is a mistake. Unlike other lists maintained by the U.S. Government for sanctions or export control measures, inclusion in the CMC List relates only to U.S. defense procurement, which does not impact the business of the Group.

Click here to view Tencent's official release on the topic.