Major Oil Lobby Supports Carbon Pricing, A Potential Performance Catalyst For Carbon Allowance Markets

The American Petroleum Institute (API), one of the most powerful lobbyists in the United States, expressed support for carbon pricing to reduce emissions.1 The API’s announcement removes a formidable roadblock to the widespread expansion of emissions trading systems in the United States. At the same time, the Biden Administration is ramping up efforts to address climate change. Both moves could provide a performance catalyst for the global carbon allowance markets.

According to the Wall Street Journal, the API stated that it “supports economy-wide carbon pricing as the primary government climate policy instrument to reduce CO2 emissions while helping keep energy affordable, instead of mandates or prescriptive regulatory action.” 1

We believe that with the US rejoining the Paris agreement, the API is aware that the oil industry will soon need to take significant action to reduce carbon emissions. With the top oil lobbyist now onboard, the path forward for Congress to consider expanding emissions trading systems in the US is clearer.

Additionally, the API has felt pressure from within its ranks to take more significant action on climate change. French oil major, Total, opted not to renew its API membership in 2021, citing the group’s reluctance to act on carbon pricing as a factor.4 Total’s move follows a trend of European energy companies being ahead of the curve on embracing efforts to reduce emissions.

Meanwhile, the Biden Administration is continuing to press forward on climate-related issues. In late February, the administration set the social cost benchmark for emitting one ton of CO2 to $51 and directed federal agencies to incorporate this benchmark into all climate impact analyses.2 The new measure, though abstract, is far higher than current prices for carbon credits. In recent auctions in California, carbon credits traded at only $17.80 per ton. Meanwhile, in the latest auctions under the east coast’s Regional Greenhouse Gas Initiative, credits traded at only $8.48 per ton.

The vast gulf between auction prices and the Biden administration’s social cost benchmark suggests that the US carbon prices may continue to see upside potential for the near future. However, carbon pricing is a global effort; economists estimate that carbon allowance prices need to reach a range of $50 – $100 per ton of CO2 to achieve the emissions reduction goals of the Paris Agreement, a reality that inspired Climate Finance Partners to partner with IHS Markit and KFA Funds to create a global benchmark for the price of carbon, which currently prices the global cost of emitting one ton of CO2 at $26.42.3

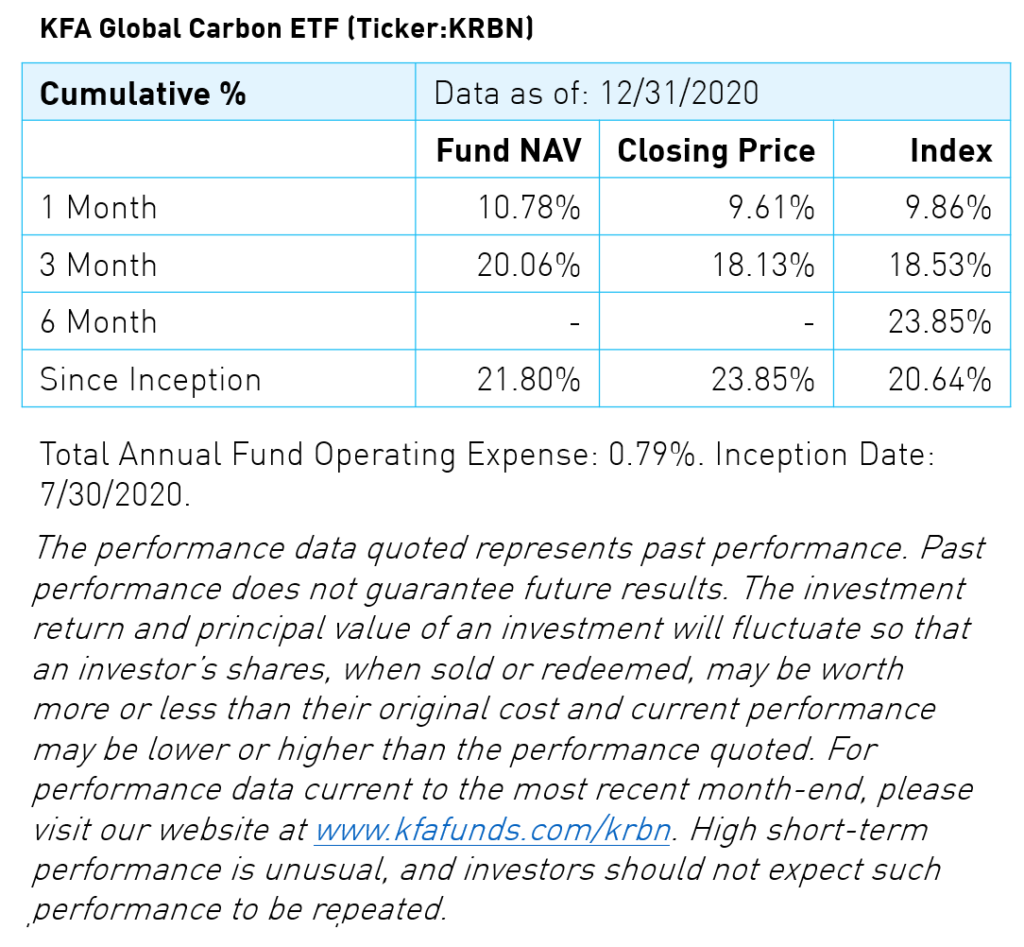

As a result of the positive developments discussed above, the KraneShares Global Carbon ETF (Ticker: KRBN) performed well during February, returning 9.88%.

February 2021 Global Carbon Pricing Summary:

- European Union Allowances (EUA) reached a new all-time high in the middle of February, and they continue to hold onto the bullish trend channel in place since November. Despite some profit-taking in the second half of the month, there is still plenty of support from industrial buyers as compliance season has begun. Prices ended the month up 13%.

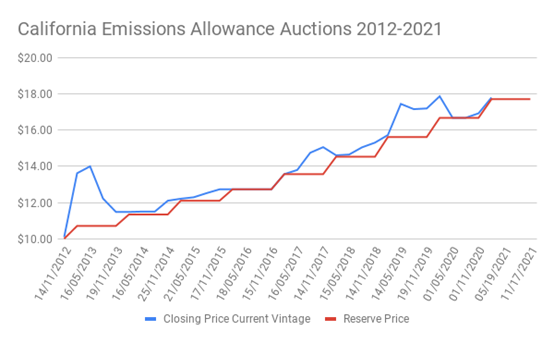

- California Carbon Allowance (CCA) prices rallied by around 1% ahead of the year’s first auction. The sale was fully subscribed and cleared $0.08 above the reserve price. Analysts noted that this auction saw the highest participation yet of speculative buyers.

- Regional Greenhouse Gas Initiative (RGGI) allowances gained around 3% over February as interest in the market picked up ahead of the year’s first auction on March 3, including Virginian allowances for the first time.

European Union (ETS)

Confidence remains high in the European market. EUA prices reached a new record of €40.62 mid-month as investors continued to build positions in anticipation of ambitious reforms, while industrial companies began their annual compliance buying.

EUA prices even shrugged off false media reports that the European Commission was considering whether to limit speculative activity in the market. Stakeholders dismissed these rumors, saying that regulators have had plenty of opportunities to act in the past but had chosen not to.

The December 2021 EUA futures contract ended February at €37.28/tonne on ICE Futures, compared with €23.61/t at the end of February 2020.

Traders see the current market in consolidation mode, banking the four months of gains and setting a new price level, before moving on to target €40.

Carbon emission demand increased because of colder-than-normal temperatures across much of Europe, leading to a big uptick in carbon-intensive power generation leading to more demand for allowances.

The second half of the month saw EUA prices settling back a little as traders took some profit after the new high. However, there has been strong support from industrials, who are becoming resigned to the new price paradigm.

Traders report healthy buying interest whenever intraday prices dip, while ICE Futures data show that nearly 250 investment funds are now engaged in the market.

California (CCA)

CCA prices rose slowly over February as the market prepared for the year’s first auction, which was held on February 17th. The sale was oversubscribed – the second consecutive sellout, which means that the Air Resources Board will release more than 10 million additional CCAs that were not sold at previous sales for the next auction in May.

There are more than 40 million unsold CCAs in the auction reserve, and, as long as sales continue to sell out, these CCAs will be gradually re-inserted into the auction pot over the rest of the year.

The market added $0.16 over the month to end at $18.59/tonne. The auction cleared at $17.80, compared to a reserve price of $17.71. Experts noted that this sale saw the highest participation of speculative investors yet, which they take as a sign that prices are set to rise further as the market’s supply becomes tighter in coming years.

The Air Resources Board is gearing up for the next review of the Californian market. By late spring ARB will start work on a Scoping Plan for the review, and it’s expected to publish the Plan by the end of the year.

Eastern US (RGGI)

The RGGI market had its first auction on March 3rd, which offered 23.4 million RGGI allowances (RGA). The reserve price was $2.38/short ton, but futures prices had been in excess of the floor price for the last seven years.

This was the first auction for which installations from Virginia will participate. The eleventh and newest member of RGGI is its largest emitter, and anticipation of demand from Virginian installations has helped push prices to record levels.

RGA prices advanced by around 3% over the month of February, reaching a high of $8.48. As with California, the regulator is preparing to launch a review of the market later this year, which will last well into 2022 before issuing recommendations to update the cap-and-trade system and set targets for the period after 2030.

The last market review in 2017 recommended lowering the cap by an amount roughly equivalent to companies’ holdings of unused RGAs, and it is likely that a similar adjustment will be considered in the next review. Reducing supply and setting ambitious reduction caps for post-2030 is very likely to boost prices in the long term.

Citations

- Mann, Ted. “Oil Trade Group Is Poised to Endorse Carbon Pricing,” The Wall Street Journal. March 1, 2021.

- Chemnick, Jean. “Cost of Carbon Pollution Pegged at $51 a Ton,” Scientific American. March 1, 2021.

- Data from IHS Markit as of March 3, 2021

- Press Release. “Total Withdraws From The American Petroleum Institute,” Total. January 15, 2021.