Lesson Learned: China Acts to Retrain Bubbly Stocks

Barron's – Chinese stock valuations are far from stretched. According to Brendan Ahern, Chief Investment Officer of KraneShares, A-shares’ weight in global emerging market indexes could rise from 5% to 20% as the Shanghai and Shenzhen exchanges make technical improvements, forcing in more foreign cash. "Average share prices are not exorbitant, having just climbed back to early-2018 levels", he said.

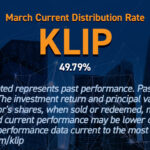

KBA standard performance

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. KBA's gross expense ratio is 0.80%. Top 10 holdings for KBA can be found here.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

r_us_ks