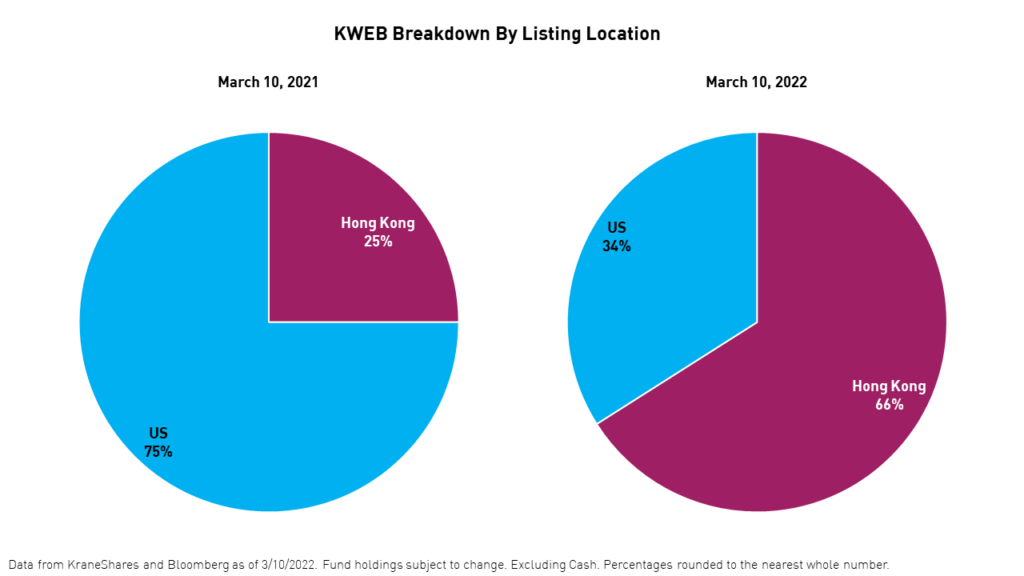

KWEB Aims to Fully Transition to Hong Kong Shares In Coming Months

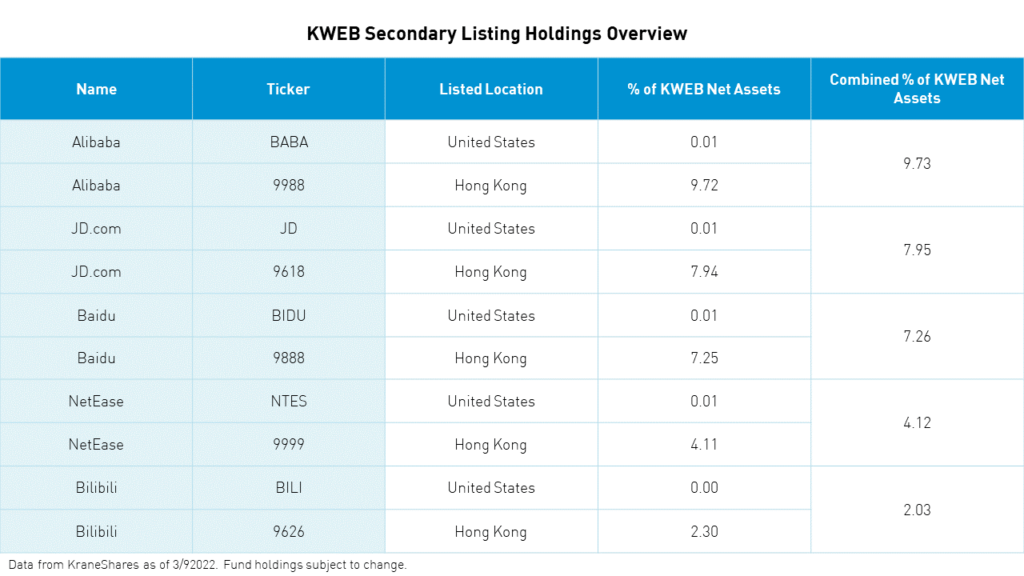

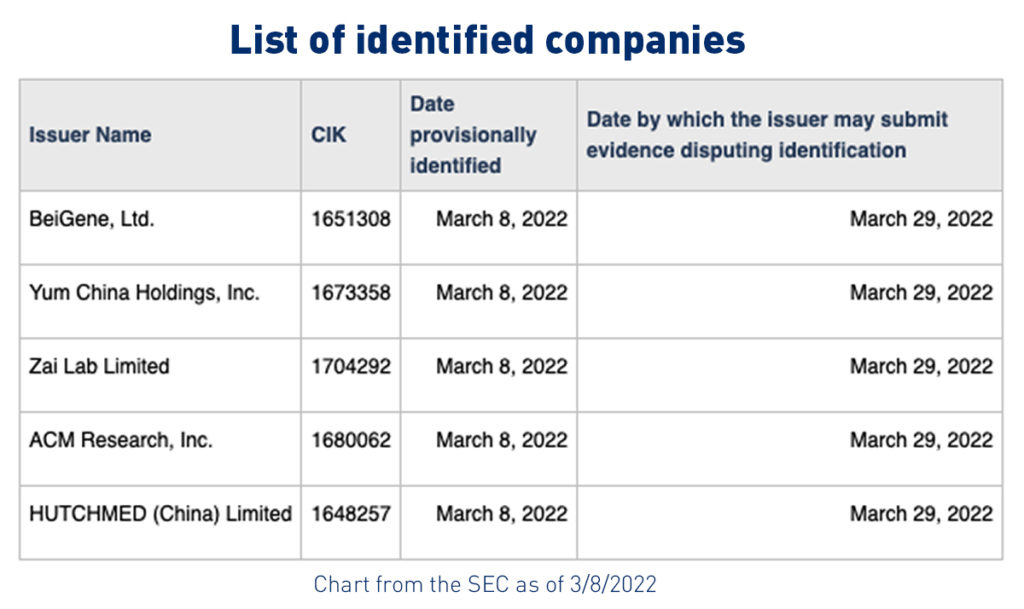

The KraneShares CSI China Internet ETF (Ticker: KWEB) does not hold the five American Depository Receipts (ADRs) identified by the Securities and Exchange Commission (SEC) as not in compliance with the Holding Foreign Companies Accountable Act (HFCAA). Non-compliance could lead to delisting in 2024 if a US/China negotiated resolution is not achieved. KraneShares has already converted the majority of our ADR holdings to their Hong Kong-listed counterparts, where available. We expect the portfolio to be comprised of solely Hong Kong listings by the end of the year driven by continued US ADR conversion and re-listings in Hong Kong.

As news is fluid and evolving quickly, we maintain a daily blog called China Last Night to keep investors informed on market events.

The first five identified ADRs could be delisted in 2024 if they do not come into compliance with the law. We anticipate all Chinese ADRs will be found non-compliant unless a resolution is achieved. The first five companies were added to the list following the release of their annual reports, lending some clarity to how the enforcement of the HFCAA will look. The release of non-compliant companies has been expected since the law was enacted in December 2020.

We have added a secondary listing table to the KWEB product page so that investors can track our conversion progress on a daily basis.

As we have noted in the past, these companies will not be able to comply with US demands without cooperation between securities regulators in the US and China. As it stands, these companies are prohibited from allowing the Public Company Accounting Oversight Board (PCAOB) access to their audit papers by Chinese law. Therefore, they would have to violate the laws of the jurisdiction in which they operate in order to comply with the laws of the jurisdiction in which their shares are traded.

This is a fluid situation and we know that the China Securities Regulatory Commission (CSRC) and Ministry of Finance (MOF) have been discussing a potential solution to this issue with the PCAOB. We believe a compromise between US and Chinese regulators is still attainable, but we are converting our ADR holdings to Hong Kong shares because we believe doing so is in the best interest of our clients.

For more in-depth information on PCAOB inspections, the HFCAA, and China internet regulations, please read our FAQ from December, 2021.

r-ks-sei