Introducing Krane Platform For Innovative Research And Investment Strategies

Krane Funds Advisors, LLC, (“KraneShares”), a global asset management firm known for its China-focused exchange-traded funds (ETFs) and innovative China investment strategies, announced the launch of the Krane Platform, a central hub for Krane’s growing service offering. The platform includes:

A daily blog produced by KraneShares research team led by Chief Investment Officer Brendan Ahern. Daily posts cover top news and events that moved China’s capital markets the night before. This daily recap provides color on China’s equity, fixed income, and currency markets performance. The analysis includes local broker insights, policy, trade, public company announcements, and sector performance.

www.chinalastnight.com

KraneShares launched a UCITS platform to meet European demand for its China-focused investment strategies. The first two funds to launch are the KraneShares CSI China Internet UCITS ETF (ticker: KWEB LN) and the KraneShares MSCI China A-Share UCITS ETF (ticker: KBA LN).

www.kraneshares.eu

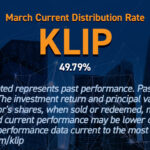

A premier platform for developing and delivering differentiated, high-conviction investment strategies to global investors. The first fund under this division is The Quadratic Interest Rate Volatility and Inflation Hedge ETF (ticker: IVOL) launched in collaboration with Quadratic Capital Management led by Chief Investment Officer Nancy Davis. Additional funds include KFA Large Cap Quality Dividend Index ETF (ticker: KLCD) and the KFA Small Cap Quality Dividend Index ETF (ticker: KSCD). KLCD and KSCD track the Russell Dividend Select Equal Weight Indexes designed to capture a concentrated portfolio of constituents demonstrating increased dividends and positive momentum.

www.kfafunds.com“With the launch of our China Last Night blog and KraneShares UCITS platform, we are deepening our commitment to providing world-class China-focused research and investment products,” said Jonathan Krane, Chief Executive Officer of KraneShares. “At the same time, we are excited to launch KFA Funds. KFA Funds is our platform for developing and delivering differentiated, high-conviction investment strategies.”

KFA Funds have accumulated over $100 million in assets under management since launching in May 2019.

R-KS-SEI