KMLI: Latin America’s E-Commerce Revolution Doubles Up

Mercado Libre (MELI) could be considered a leading Latin American digital commerce company. They serve millions of customers and during the Q1 2025 reporting period, the company generated $13.3 billion in gross merchandise volume, a 13% increase year-over-year.¹

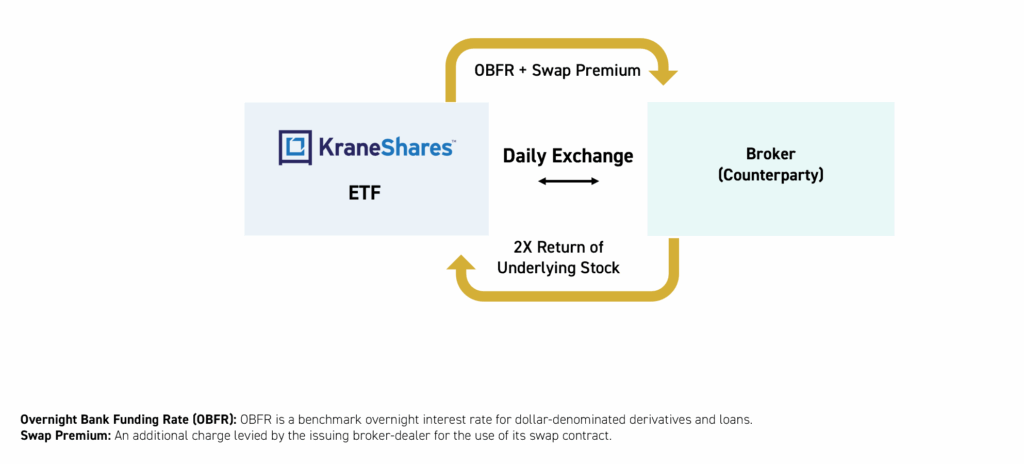

For investors who believe this leadership will continue, the KraneShares 2X Long MELI Daily ETF (Ticker: KMLI) aims to offer 2x leveraged exposure to Mercado Libre's daily price movements.

Latin America’s Digital Evolution

Mercado Libre began as a simple online marketplace aiming to address the challenges of operating in the Latin American market. Since it was founded in 1999, MELI has grown into one of Latin America’s largest digital commerce infrastructure companies. They combine e-commerce, payments, logistics, and financial services in a single platform.

KMLI aims to provide investors with 2x leveraged daily exposure to these growth dynamics via Mercado Libre's stock performance. The fund seeks daily investment results of twice the percentage change of Mercado Libre's share price, allowing investors to amplify their short-term exposure to the company's performance.

E-Commerce Expansion

The investment thesis for Mercado Libre centers on Latin America's current early-stage level of digital adoption. The company serves more than 218 million customers across 18 countries.2 Brazil, Argentina and Mexico generated the most total revenue for the company in Q1 2025.1

Overall, the company estimates it captures only 5% of total retail market share. This shows that there is plenty of room for expansion. Approximately 85% of retail spending in the region still occurs in physical stores so the potential digitization benefits could have long-term upside.3

The region's retail media advertising market presents a potential growth driver as it can use its customer data to provide targeted marketing solutions for brands seeking Latin American exposure.

Investment Considerations

Mercado Libre's regional leadership position provides natural defensive characteristics when it is compared to global technology companies. These global players face far more diverse regulatory and competitive pressures. MELI also benefits from growth in Latin America's middle class where internet penetration and digital payment adoption have increased recently.

Mercado Libre reported revenue, the total amount of income generated by a company from its normal business activities, of $5.9 billion in Q1 2025, an increase of 37% year-over-year. Operating income, the profit a company earns from its core business operations excluding interest and taxes, rose 45% to $763 million. Net income, the total profit remaining after all expenses have been deducted from revenue, reached $494 million, a 44% year-over-year increase. These figures all demonstrate how their operational advantage is growing as they scale up.⁴

The Leverage Strategy

KMLI is designed for sophisticated investors seeking to amplify their exposure to the daily performance of Mercado Libre stock. The fund aims to deliver 2x the daily return of the underlying stock, offering the potential for enhanced short-term gains.

However, with greater opportunity comes greater responsibility:

- Focused Exposure: Unlike traditional ETFs that diversify across many stocks, KMLI tracks a single company—magnifying both potential gains and losses.

- Daily Reset: The 2x leverage in KMLI is reset daily, meaning performance over periods longer than one day may diverge significantly from 2x the stock’s cumulative return.

- Active Management Required: KMLI is not a buy-and-hold investment. It is best suited for investors who actively monitor their positions and understand the mechanics of leveraged investing.

- Volatility Matters: Even small movements in Mercado Libre’s stock price, especially in volatile markets, can lead to unexpected outcomes—including losses during periods of flat or fluctuating performance.

KMLI is not appropriate for all investors. It is intended for those who are comfortable with higher risk, understand the impact of compounding and volatility, and are prepared to manage their investments closely.

Citations:

- Mercado Libre, Q1 2025 Earnings Presentation (May 7, 2025), PDF, accessed July 13, 2025, https://investor.mercadolibre.com/sites/mercadolibre/files/mercadolibre/result/meli-q125-earnings-presentation.pdf.

- Americas Market Intelligence, November 14, 2024, https://americasmi.com/insights/mercado-libre-logistics-expansion-latin-america/.

- "Latin Americas Biggest E-Commerce Platform Is Growing Fast and Shows No Signs of Slowing Down," The Motley Fool, May 14, 2025, https://www.fool.com/investing/2025/05/14/latin-americas-biggest-e-commerce-platform-is-grow/.

- “Mercado Libre builds on 2024 momentum with strong Q1 2025 results, reporting $5.9 billion revenue and $494 million net income," Mercado Libre Investor Relations, May 7, 2025,https://investor.mercadolibre.com/news-and-events/mercado-libre-builds-2024-momentum-strong-q1-2025-results-reporting-59-billion-revenue-and-494-million-net-income.

For KMLI standard performance, top 10 holdings, risks, and other fund information, please click here.