How to Unlock Private Markets With Hybrid ETFs

The KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX) is bridging the gap between public and private markets. Public-private hybrid ETFs combine traditional stocks and bonds with allocations to private assets that can be difficult to access. As investors seek greater diversification*, products like AGIX are gaining traction, expanding opportunities for everyday investors to incorporate private market returns.

What Are Public-Private Hybrid ETFs?

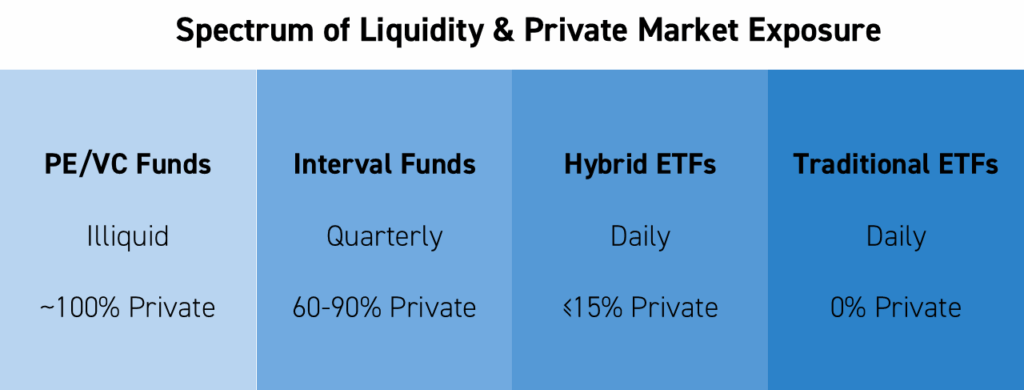

Unlike traditional ETFs, which invest solely in publicly traded stocks and bonds, public-private hybrid ETFs allocate a portion of their portfolio to private assets. These private holdings can include late-stage private companies (in equity-focused hybrids) or private credit instruments (in fixed income hybrids).

Hybrid ETFs may gain exposure to private companies either by participating directly in financing rounds or by purchasing interests through special purpose vehicles (SPVs) in the secondary market, though AGIX does not currently invest through SPVs. In practice, most current products focus on late-stage private companies, whose valuations and business profiles more closely resemble public companies.

Pros of Investing in Public-Private Hybrid ETFs

The key benefits of hybrid public-private funds revolve around access, liquidity, cost, growth potential and diversification.

Expanded Access: Historically, private equity investments required high minimums and accreditation, keeping most investors on the sidelines. Hybrid ETFs are breaking down these barriers, offering everyday investors exposure to private firms through a liquid, exchange-traded vehicle.

Daily Liquidity: Traditional private equity and venture capital funds often lock up investor capital for years. In contrast, hybrid ETFs offer daily liquidity, allowing investors to buy or sell shares on the open market. This real-time access not only increases flexibility but also enhances price discovery and market efficiency.

Cost Efficiency: Hybrid ETFs deliver exposure to private markets at a fraction of the cost of traditional private equity or venture capital funds, making them a cost-effective option for investors seeking alternative assets. Other funds accessing private investments sometimes not only charge an annual management fee, but also take a significant portion of any profits on the underlying investment, sometimes as much as 20%.

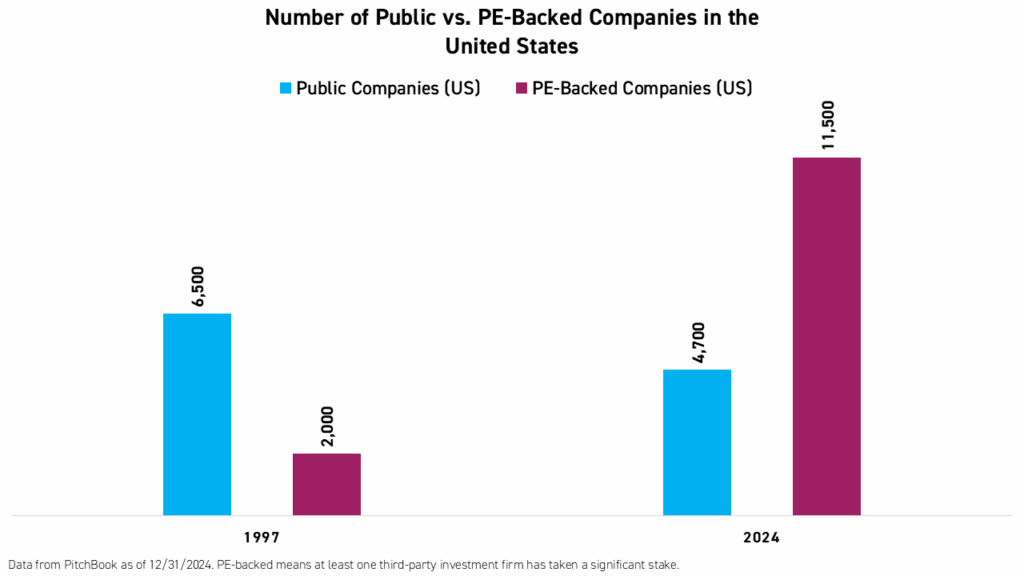

Growth Potential: The private markets are expanding. PitchBook projects global private capital to reach nearly $20 trillion by 20281, fueled by robust capital inflows and a trend toward companies staying private longer. From 1998 to 2023, the annualized total return of the Cambridge Associates Global Private Equity Index outperformed that of the MSCI World Index by more than 5%2. Hybrid ETFs enable investors to access late-stage ventures, private credit, and more—all within a single, liquid vehicle.

Enhanced Diversification:* The universe of private companies dwarfs that of public firms. Moreover, we have observed that companies are staying private longer due to a myriad of factors including rapid technological innovations that are becoming more difficult to value and data security concerns that make public disclosures more challenging. In the United States, about 2,800 public companies generate annual revenues above $100 million, there are roughly 18,000 private businesses of a similar size3.

The Challenges Facing Public-Private Hybrid ETFs

While public-private hybrid ETFs offer investors access to private markets and greater diversification, these structures also introduce a new set of challenges—particularly around valuation, liquidity, and regulatory compliance.

Valuation Challenges: One of the most significant hurdles for hybrid ETFs is the valuation of private assets. Unlike publicly-traded securities, which are priced continuously on open markets, private companies lack transparent, observable market data. As a result, fund managers must rely on valuation committees or third-party experts to estimate fair value, following SEC fair valuation guidelines.

Liquidity Mismatch: A core appeal of ETFs is daily liquidity—investors can buy or sell shares on the open market. However, this creates a fundamental mismatch when a portion of the ETF’s holdings are private assets, which are inherently illiquid and difficult to sell quickly.

To address this, the Investment Advisors Act of 1940 requires ETFs to implement robust liquidity risk management programs. Specifically, per SEC Rule 22e-4, funds may not allocate more than 15% of their net assets to illiquid investments, including private company shares. For hybrid ETFs, this regulatory cap limits the extent of private market exposure and is intended to help protect investors from liquidity shortfalls during periods of heavy redemptions.

The KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX)

We believe the KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX) offers investors direct access to private companies, including Anthropic and xAI, which are in the fund's top ten holdings4. AGIX directly acquired shares in these companies and sits on their market cap tables.

Traditionally, reliable information and fair valuation of private companies have posed major challenges for investors and fund managers alike. AGIX addresses this by leveraging a fair value committee, which works in tandem with the fund’s auditor, to ensure valuations are aligned with industry best practices and SEC guidelines. The fund prioritizes primary round valuations as the basis for fair value. However, since primary financings for late-stage private companies like Anthropic occur infrequently, AGIX supplements these with data from the secondary market, where trading volumes and bid/ask transparency are improving for larger private technology companies.

AGIX’s Fair Value Process

- Primary round pricing is used as the baseline when available, reflecting the latest arm’s-length transaction.

- Secondary market data factors into our decisions once secondary trading in late-stage private companies becomes more active. AGIX’s committee integrates these real-world transaction prices as additional inputs. The fund increasingly relies on external providers that aggregate and analyze secondary transaction data, further enhancing valuation accuracy and transparency.

- The valuation committee then documents the process and the decisions made, including all methodologies and benchmarking assumptions used.

This multi-source, committee-driven approach enables AGIX to meet daily net asset value (NAV) requirements, even as the fund holds illiquid, private assets.

Liquidity Management

AGIX balances private exposure with regulatory constraints such that no more than 15% of net assets are allocated to illiquid holdings, as required by SEC Rule 22e-4. The ETF structure itself provides daily liquidity to investors, while the secondary market offers a practical path for the fund to liquidate private positions if needed for redemptions or regulatory compliance.

The need to potentially meet redemptions or dispose of shares if a position becomes too large within the fund is also why AGIX focuses on large private companies, which are likely to have deep secondary markets for their shares. Anthropic and xAI are the seventh and eighth largest unicorns, respectively, in the world as of June 30, 2025, according to CB Insights.

Conclusion

The KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX) offers access to private equity alongside traditional public assets in a single, liquid vehicle. While these products promise enhanced diversification*, they also introduce complexities around valuation, liquidity, and regulatory oversight that set them apart from conventional ETFs.

*Diversification does not ensure a profit or guarantee against a loss.

Citations:

- "PitchBook Analyst Note: Private Capital's Path to $20 Trillion," PitchBook. May 1, 2024.

- Data from Cambridge Associates as of 12/13/2023.

- Data from Morgan Stanley as of 12/31/2024.

- Data from KraneShares as of 7/21/2025.

AGIX Holdings Mentioned:

- Anthropic (3.55% of AGIX Net Assets as of 7/21/2025)

- xAI (4.45% of AGIX Net Assets as of 7/21/2025)

Holdings are subject to change.

For AGIX standard performance, top 10 holdings, risks, and other fund information, please click here.

Definitions:

Unicorn: A private company with a valuation above $1 billion.

MSCI World Index: The MSCI World Index captures large and mid cap representation across 23 developed market countries. With 1,325 constituents, the index covers approximately 85% of the free-float market capitalization in each country.

Cambridge Associates Global Private Equity Index: The index is designed to measure the performance of global private equity funds. The index includes only funds formed between 1986 and 2023. Index performance reflects actual pooled horizon returns, net of fees, expenses, and carried interest.

Special Purpose Vehicles (SPVs): a legal entity created for a limited and specific purpose. SPVs are distinct legal entities with their own assets, liabilities, and legal status separate from the parent company. They are commonly formed as Limited Liability Companies (LLCs) or Limited Partnerships (LPs).