How AGIX and KWEB Provide Access To The Distinct U.S. & China AI Ecosystems

By Cole Wenner

Artificial intelligence (AI) has become the world’s defining growth catalyst. Now, the world is undergoing a transformative shift: the emergence of a multipolar global order (an international system in which power and influence are distributed among multiple countries or regions). At the heart of this transformation are the United States and China, the two largest economies in the world. Each leads unique AI ecosystems shaped by different technological paths, development cycles, and market demands.

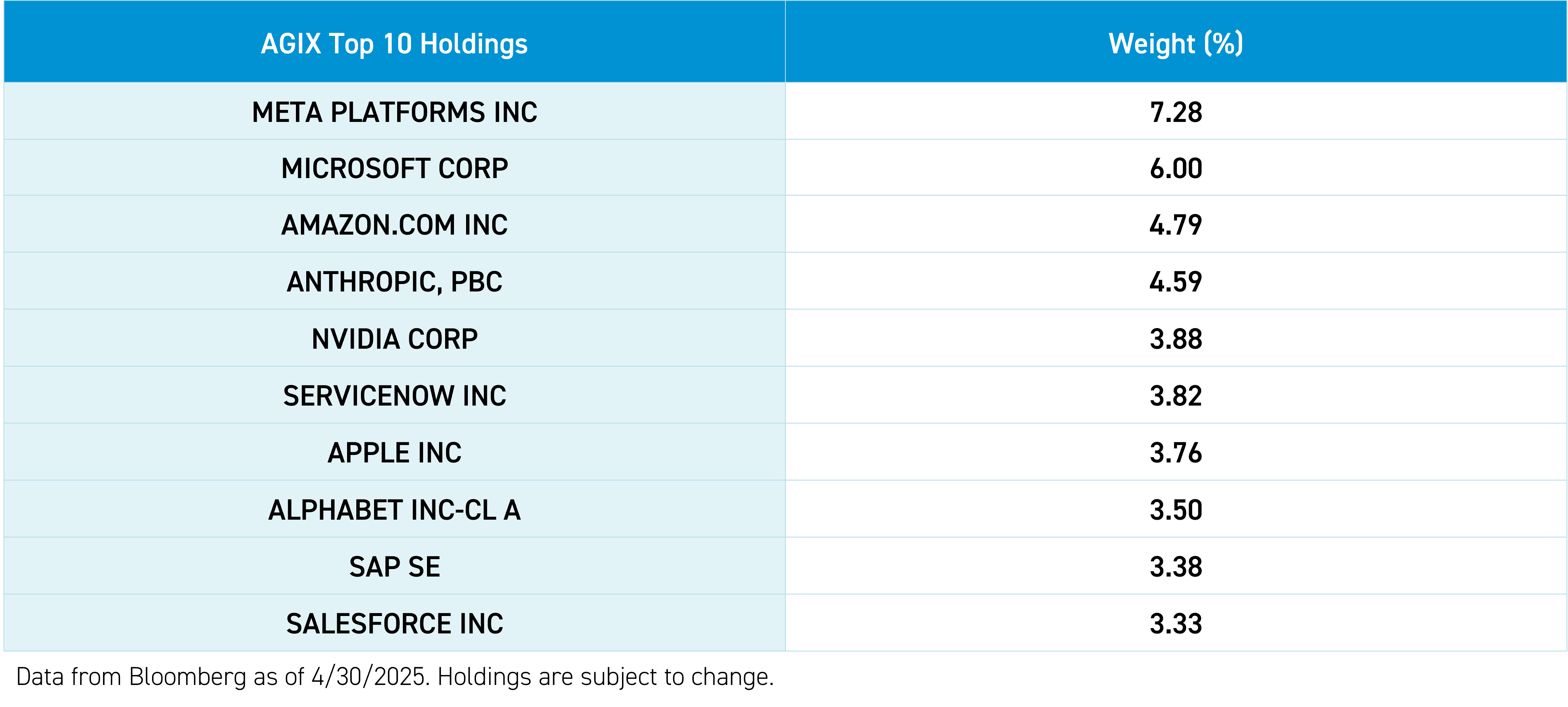

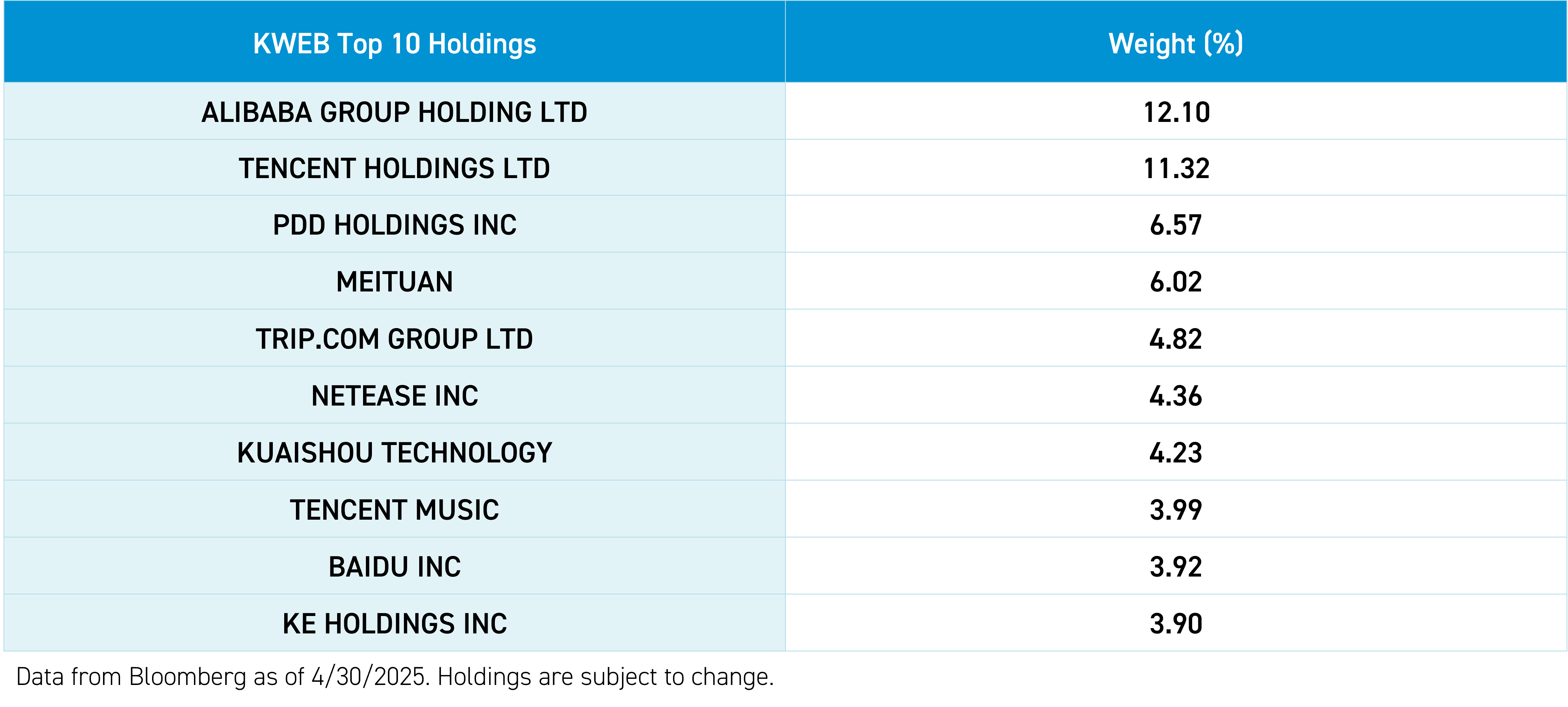

Rather than betting on a single winner, we believe a blended approach that includes both U.S. and Chinese AI leaders is an optimal way to harness the global AI opportunity. The KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX) offers broad exposure across the entire U.S. AI ecosystem, from hardware and infrastructure to applications, including private innovators like Anthropic, the fourth-largest holding in AGIX. The KraneShares CSI China Internet ETF (Ticker: KWEB) provides targeted access to China’s rapidly advancing internet and AI sector, characterized by cost-efficient, open-source innovation and massive domestic adoption.

The Multipolar AI Race: Two Distinct Ecosystems

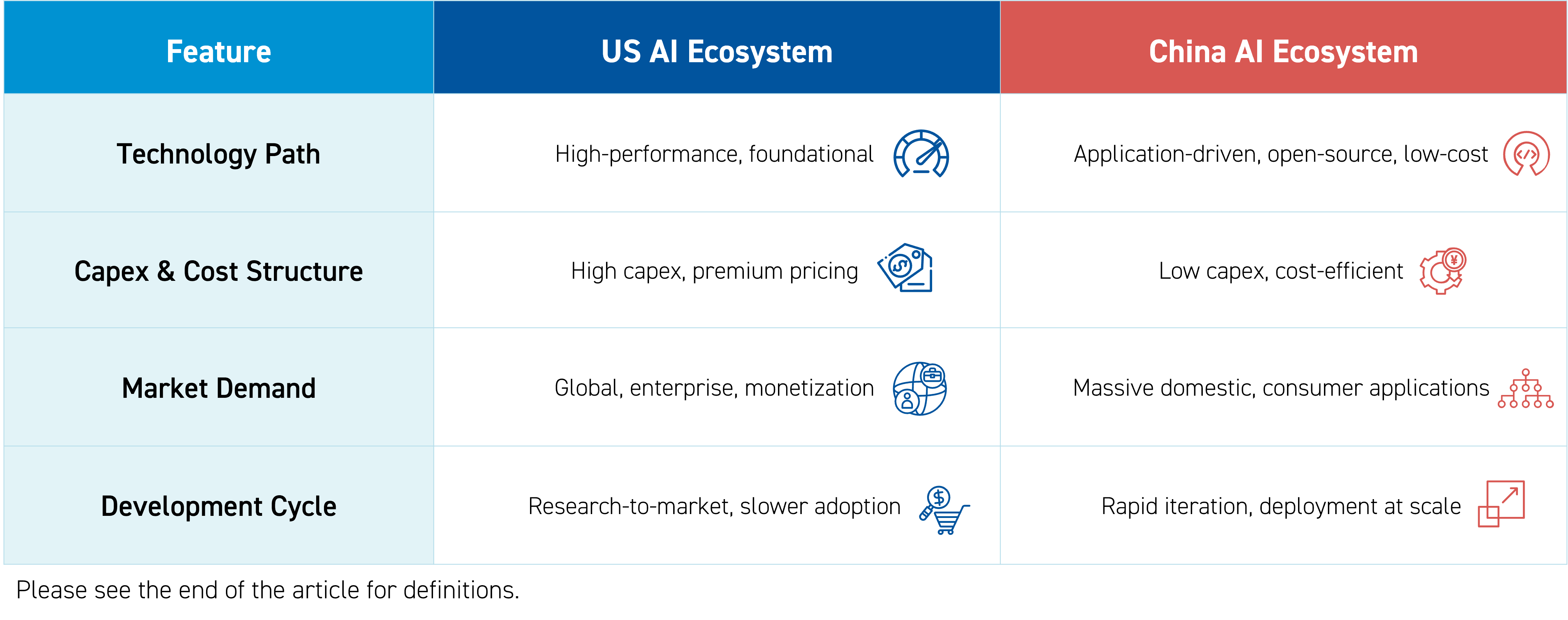

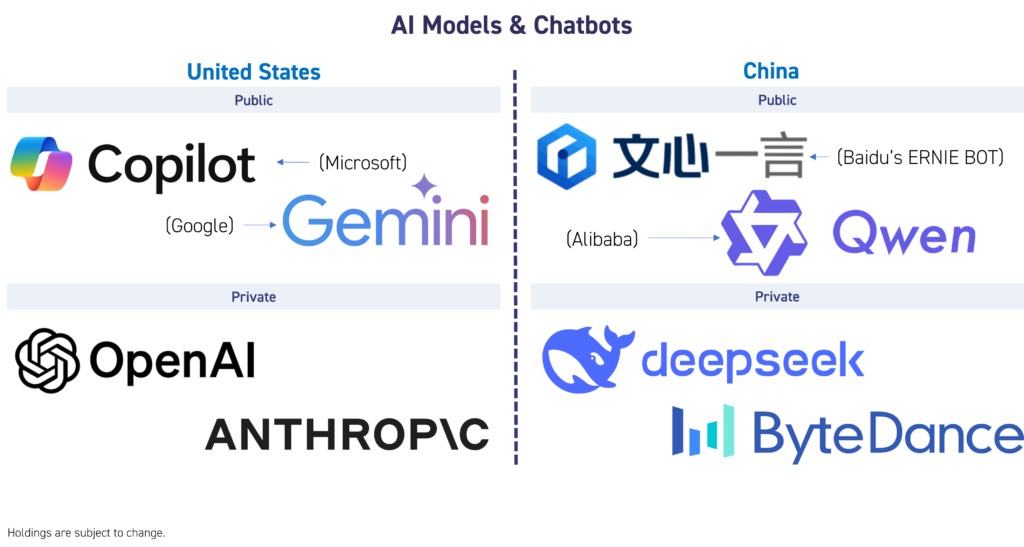

The U.S. and China represent two powerful but fundamentally different AI ecosystems:

These differences contribute to AGIX and KWEB exhibiting largely independent movements, reflected in their low correlation of 0.173 since AGIX’s inception.1

The Spark That Ignited the U.S.-China AI Race

When OpenAI unleashed ChatGPT in late 2022, it wasn’t just a product launch, it was the starting gun for a modern technological "space race". Within months, ChatGPT became a household name, drawing millions of Americans and forcing the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) and the broader tech sector to pivot AI from a strategic priority to the very core of their business models.2 By April 2025, over half of U.S. adults were using large language models (LLMs) like ChatGPT, Google Gemini, Anthropic's Claude, and Microsoft Copilot in their daily routines, making generative AI one of the fastest-adopted technologies in history.3

The U.S. tech sector responded with rapid innovation. NVIDIA’s GeForce RTX 5090, GB10 AI Superchip, and Blackwell B200 GPU now power everything from AI-driven diagnostics in healthcare to autonomous vehicles and personalized entertainment.4 U.S. technology companies didn’t just scale AI, they embedded it into the fabric of everyday life, forging partnerships with companies like Toyota and MasterCard to integrate global supply chains with intelligence and automation.5 The result: an ecosystem where foundational research and real-world deployment move in lockstep, propelling the U.S. ahead on most innovation metrics.

DeepSeek and the Domino Effect in China

In China, the AI race took on a different energy. The arrival of DeepSeek’s R1 model in early 2025 sent shockwaves through China’s tech sector and jolted U.S. rivals out of complacency. DeepSeek, a startup, achieved what many thought was impossible. It matched the reasoning capabilities of top Western LLMs at a fraction of the cost, using far fewer chips and resources.6 This feat didn’t just impress, it triggered a domino effect. Alibaba swiftly upgraded its Qwen LLM to outpace DeepSeek’s R1, while startups like Manus unveiled sophisticated AI agents capable of executing complex tasks autonomously.

Now, China’s internet giants, including Alibaba, Baidu, Tencent, ByteDance, and Kuaishou, are in a full-throttle AI innovation sprint. LLMs became both economical for consumers and lucrative for cloud providers, fueling a price war that slashed costs by over 85% in a single year.7 Kuaishou’s Kling AI democratized video animation, letting anyone create studio-quality content, while NetEase and Tencent injected lifelike AI into video games, blurring the line between human and digital actors. To learn more about the AI initiatives of leading Chinese internet companies, read our latest China internet report here.

China’s AI revolution is powered by more than just technical prowess. A massive user base, government investment, and a regulatory environment that encourages rapid deployment have created the ideal environment for innovation. Open-source models like DeepSeek and Qwen are lowering barriers for startups and researchers, while integration with cloud services ensures AI’s reach extends to every corner of China’s economy.

The New AI Frontier: Head-to-Head and Neck-and-Neck

The U.S. and China now stand nearly neck-and-neck in the global AI race. While U.S. companies still lead in foundational research and hardware, China’s cost-effective, rapid-fire innovation is closing the gap, sometimes leapfrogging Western benchmarks entirely. DeepSeek’s rise has proven that scale and deep pockets aren’t the only keys to AI supremacy; agility, open-source collaboration, and relentless iteration can be just as powerful.

In both countries, AI is no longer confined to labs or boardrooms. It’s animating digital assistants, powering connected vehicles, reinventing customer service, and transforming how people create, communicate, and play. The next chapter of the AI race will be written not just by the biggest companies, but by the speed and ingenuity of the AGIX and KWEB investment universes.

Conclusion

By combining AGIX and KWEB in a single portfolio, investors can take advantage of the complementary strengths of both countries: U.S. innovation and monetization alongside China’s scale and rapid adoption. As AI continues to transform industries worldwide, we believe a blended portfolio approach is the most effective way to harness the sector’s long-term growth potential.

For AGIX top 10 holdings, risks, and other fund information, please click kraneshares.com/etf/agix.

For KWEB top 10 holdings, risks, and other fund information, please click kraneshares.com/etf/kweb.

Citations:

- Data from Bloomberg as of 3/31/2025.

- Data from "ChatGPT sets record for fastest-growing user base," Reuters, as of 2/2/2023. Retrieved 4/30/2025.

- Data from "Survey: 52% of U.S. adults now use AI large language models like ChatGPT," Elon University, as of 3/12/2025.

- Data from NVIDIA company website and "NVIDIA’s Prescription for the Future: Transforming Healthcare With AI," Forbes, as of 4/2/2024. Retrieved 4/30/2025.

- Data from Toyota and Mastercard company websites as of 4/30/2025.

- Data from "How DeepSeek’s AI Stacks Up Against OpenAI’s Model," Wall Street Journal, as of 1/29/2025.

- Data from “Alibaba cuts AI visual model cost by 85% on last say of year as price war rages on,” South China Morning Post, as of 12/31/2024.

Definitions:

Large Language Model (LLM): A type of artificial intelligence that is specifically designed to understand and generate human language by being trained on massive amounts of text data, allowing it to perform tasks like writing, translating, summarizing, and answering questions in a human-like way; essentially, it's a complex AI system that can process and generate text with a high degree of accuracy.

Capital Expenditure (Capex): A capital expenditure, or Capex, is money invested by a company to acquire or upgrade fixed, physical, or nonconsumable assets.

Correlation: Correlation in finance is a statistical measure that describes how the returns or prices of two assets move in relation to each other, typically expressed by the correlation coefficient, which ranges from -1.0 to +1.0. A high correlation (close to +1) means the assets tend to move in the same direction, while a low correlation (close to 0) indicates their movements are largely independent.