High Yielding Stocks in the 21st Century: How KVLE Captures the Power of Dividends and Value

Summary

An examination of the past twenty-five years shows that high dividend stocks beat both low dividend stocks and the market overall. Recent years have been challenging for high dividend investing, largely due to the impact of the Magnificent Seven on the market. An investor who believes that the market’s concentration in a very short list of companies is unsustainable might be wise to consider strategies focused on high dividend yielding stocks, such as the KraneShares Value Line® Dynamic Dividend Equity Index ETF (Ticker: KVLE), which seeks to capture the performance of companies with strong dividends and attractive valuations utilizing Value Line's rankings for both SafetyTM and TimelinessTM.

Introduction

For decades, there has been a low-intensity debate over dividends. While many investors prefer stocks that pay higher dividends, others argue that total return, the sum of dividends paid and price appreciation, is the only true measure of a stock’s success. Indeed, these skeptics argue that given the choice between a dollar of dividends and a dollar of capital gains, tax considerations imply a preference for capital gains.*

On the other hand, there is something fundamentally attractive and even reassuring about receiving a dividend payment. The success of a company is that much more tangible when it sends a share of its profits directly to shareholders.

As soothing as dividends may be, the more persuasive argument in favor of high dividend investing is more subtle. Dividends are a signal — a message sent by company management about corporate prospects. A high dividend says at least three positive things:

- The company’s cash flow is healthy and stable. Not only does management believe it can do without the cash it sends to shareholders, but the implicit promise to sustain dividends in the future makes a statement about confidence in the business going forward.

- Management believes the stock to be undervalued. A board of directors that sets a higher-than-typical dividend yield is saying, among other things, that it believes the stock price is too low.

- The company is a disciplined warden of shareholder value. A common objection to dividend-focused investing is that, ideally, companies would have attractive opportunities to reinvest in their businesses that are preferable to paying dividends. But most would agree that the majority of companies, especially large caps, do not have such compelling opportunities. Recognizing this fact of life is not always easy for corporate management. Sending cash that might otherwise go to a pet project to the company’s owners instead demonstrates a strong shareholder orientation.**

KVLE was built on this very premise, combining high dividend yield exposure with a systematic emphasis on value and profitability to capture long-term outperformance.

Twenty-Five and a Half Years of Dividends

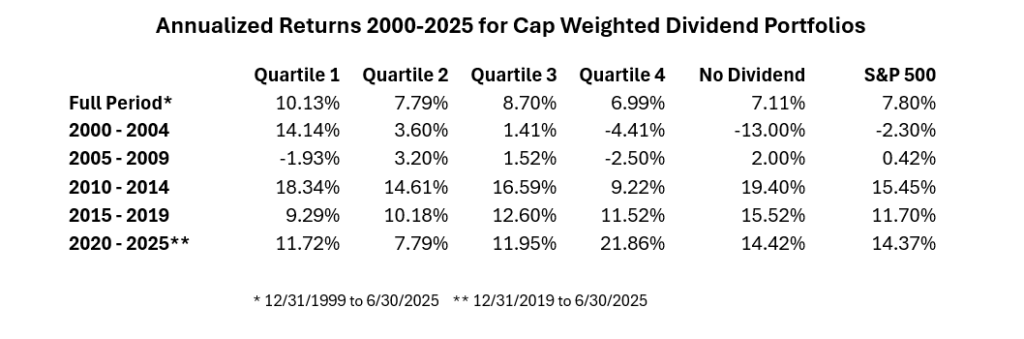

To examine the worth of dividends as a signal, we divided the S&P 500 membership into five buckets: stocks that paid no dividends, and four quartiles of stocks that paid dividends, ranked by yield, with quartile 1 having the highest yield and quartile 4 having the lowest yield. Each bucket held roughly 100 names. We then created capitalization-weighted portfolios for the buckets and calculated returns. Stocks were resorted and portfolios were reconstructed each month from December 31, 1999, to June 30, 2025.1

Over the 25 and a half years ending June 30, 2025, the Quartile 1 portfolio — the highest dividend payers — had a return of 10.13% annualized, easily outperforming the three lower dividend-paying quartiles, as well as the non-paying group and the total return S&P 500.

Although the quarter century was made up of a variety of market environments, most investors think of it as an age of high-flying growth stocks. And yet, a portfolio of about 100 high dividend stocks outperformed the S&P 500 by an average of 2.33% per year for more than 25 years.

The Past Five Years vs. the Twenty that Came Before

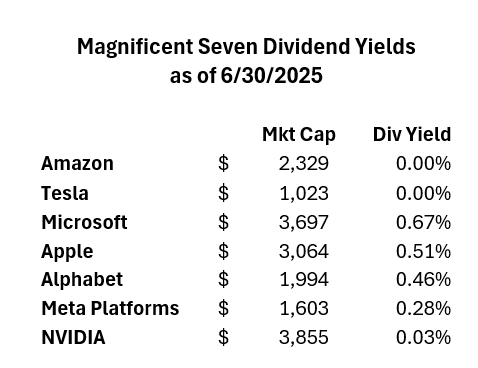

Returns over the most recent five-year sub-period (2020–2025) tell a different story. High dividend portfolios lagged as the market became dominated by a narrow group of mega-cap growth names — the so-called Magnificent Seven. Their low or nonexistent dividends distorted traditional relationships between yield and return.1

However, investors who believe this concentration is unlikely to persist may find the current environment reminiscent of the late 1990s, when highly valued growth stocks eventually gave way to a renewed interest in quality, cash-generating companies.

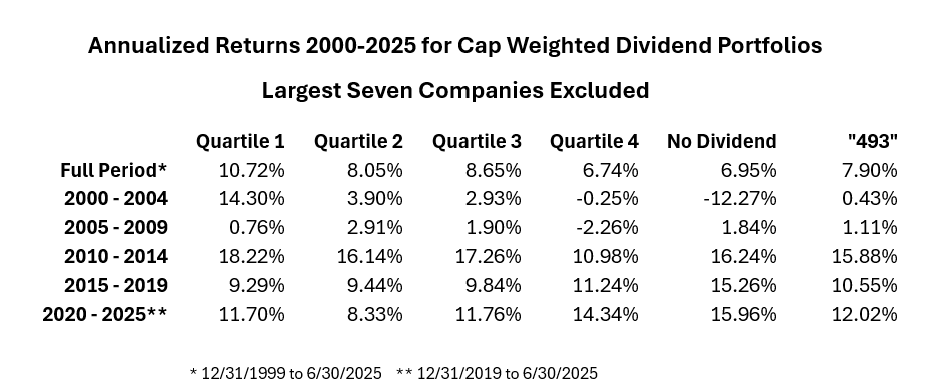

An Unmagnificent World

When the Magnificent Seven are removed from the analysis, the relative performance of high dividend stocks improves meaningfully. Over 2020–2025, the highest dividend quartile nearly matched the rest of the market (11.70% vs. 12.02%), compared to a much larger gap when the mega-caps were included.1

This reinforces the notion that high dividend investing can help investors maintain exposure to income and value factors that have historically delivered outperformance once market leadership broadens.

Dividend Investing Today

Is favoring higher dividend-paying stocks a wise strategy now? That depends on whether the next decade resembles the broad, fundamentals-driven markets of the past 25 years — or the narrow, growth-led markets of the past five.

While no one can predict the future, history suggests that concentration risk rarely lasts forever. As markets normalize, the appeal of quality companies returning capital to shareholders may reassert itself. KVLE systematically selects equities with strong dividend yields, attractive valuations, and solid fundamentals, and is designed to capitalize on that long-term trend.

Conclusion

The data spanning a quarter century underscores a persistent truth: dividends matter. Despite periodic shifts in market leadership, companies that return capital to shareholders have historically outperformed over the long run.

As investors evaluate the path ahead, strategies like KVLE may offer a balanced approach, combining high income potential with exposure to value opportunities, positioning portfolios for a world that may once again favor disciplined, dividend-paying businesses.

For KVLE standard performance, top 10 holdings, risks, and other fund information, please click here.

The Value Line® SafetyTM Ranking is based on historical data and applies to the underlying securities of the fund, and not the fund itself. Past performance is no guarantee of future results. SafetyTM does not imply stocks cannot lose value. All investing involves risk including the potential loss of principal.

*Tax treatment of any income will depend on each investor’s individual circumstances.

**High dividends may also indicate limited growth prospects or financial challenges. Not all high dividend stocks are safe or undervalued.

Citations:

- Data from FactSet as of month ends from 12/31/1999 to 6/30/2025.