China’s Renewable Push Should Benefit Solar and Wind Companies

"Heaven does not speak, and it alternates the four seasons; Earth does not speak, and it nurtures all things." China's President Xi Jinping shared a Chinese poem espousing the virtues of protecting the natural environment during the Climate Ambition Summit on Saturday, December 13th, 2020. President Xi went on to say that "Earth is our only shared home" as he renewed China's commitment to the principles of the Paris Agreement on Climate Change and announced new environmental goals for China by 2030 focused on the renewable energy industry, especially solar and wind.

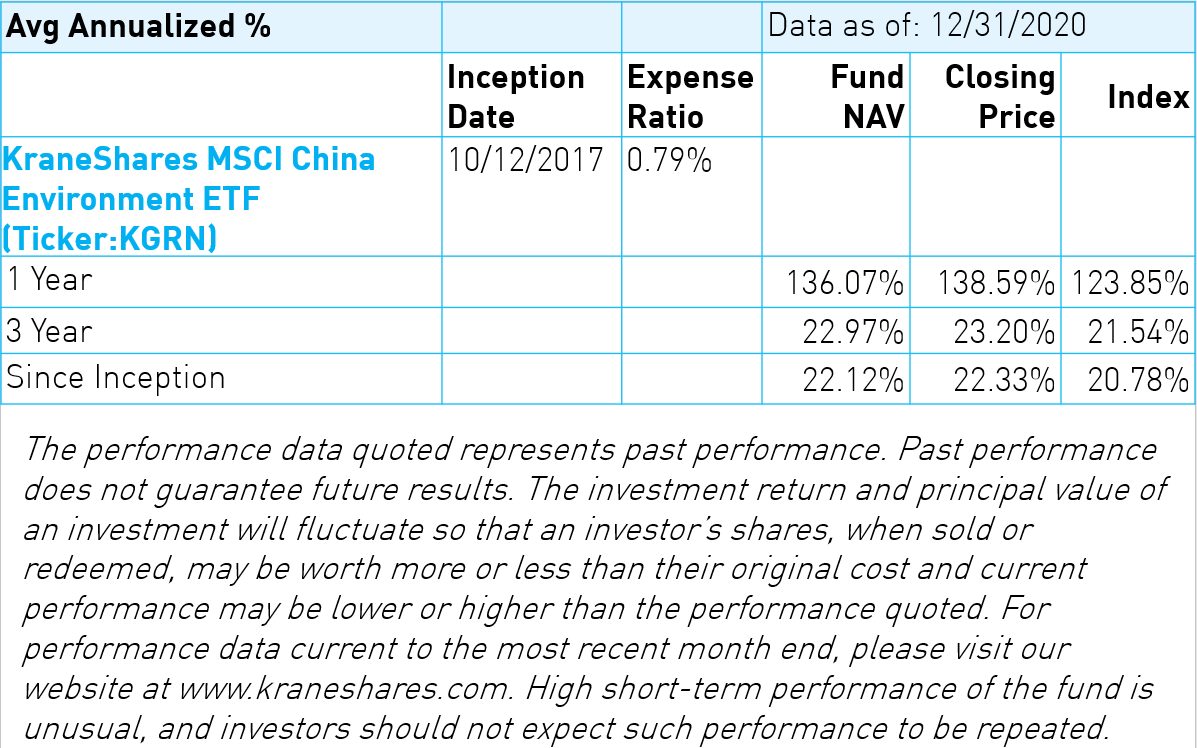

2020 was a good year for cleantech companies with electric vehicles and solar and wind companies leading the way. The KraneShares MSCI China Environment Index ETF (KGRN) was up nearly 139% in 2020. Investors were continuously pricing in higher demand targets driven by stronger than expected adoption and favorable government regulations. Furthermore, Tesla announced in September that it expects to cut its battery cost by almost 56%, another step towards achieving grid parity with internal combustion engine (ICE) automobiles.1

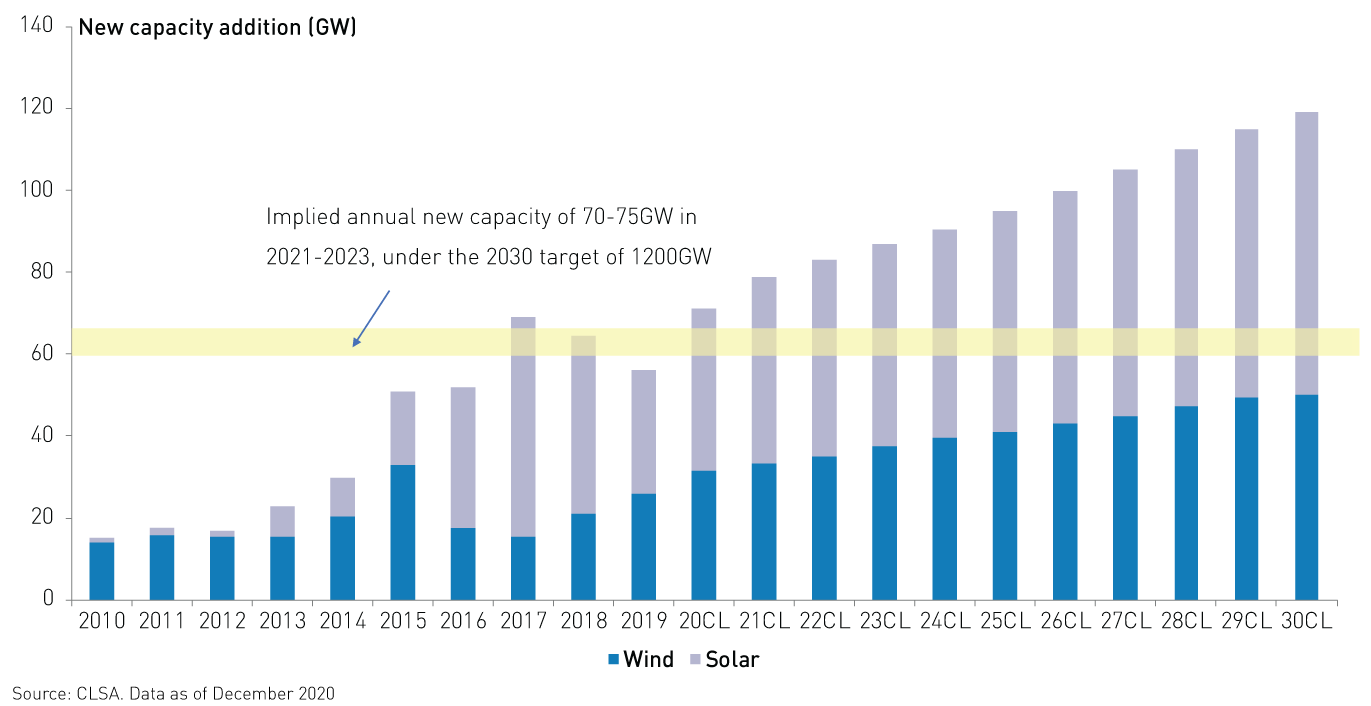

One of the commitments announced during the summit was to bring total solar and wind capacity to 1,200GW by 2030 from the current approximate level of 455GW capacity (227GW wind and 228GW solar). To meet these goals, China will have to initiate an average of 70-80GW of new solar and wind installations per year over the next nine years.

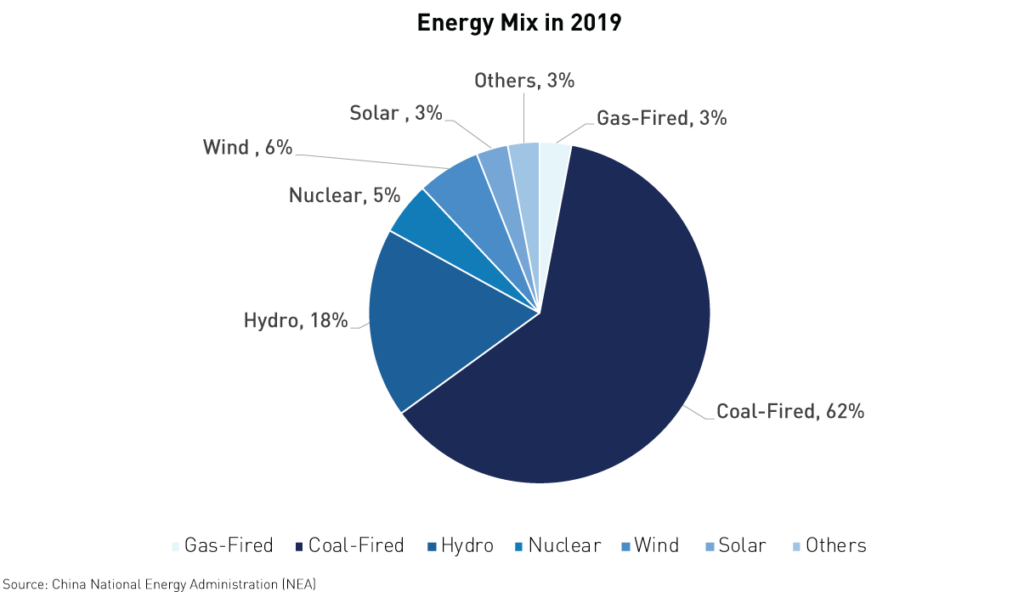

Analysts believe these targets are not very aggressive and will be overachieved. Although China is now the world's largest producer of renewable energy, solar and wind remain only a tiny portion of China's energy generation mix (3% of energy is generated by solar versus 6% by wind). They are expected to take a more prominent role in the next ten years. 62% of China's electricity generation is from coal-fired plants, 18% from hydro, and 5% from nuclear. Globally, only 1.1% of energy is produced by solar and 2.2% by wind compared to ~85% by fossil fuels (oil, coal, and gas).2

Solar and wind are the favorites in the race of renewables as R&D and technological improvements have allowed cost to approach grid-parity with fossil fuels. Grid-parity is a term used as the price of a renewable energy technology becomes economically feasible. The price of producing energy using solar is now equal to or below the current price per unit of energy without government subsidies in many regions.3 As a result, the industry is now far less impacted by government policy than a few years ago.

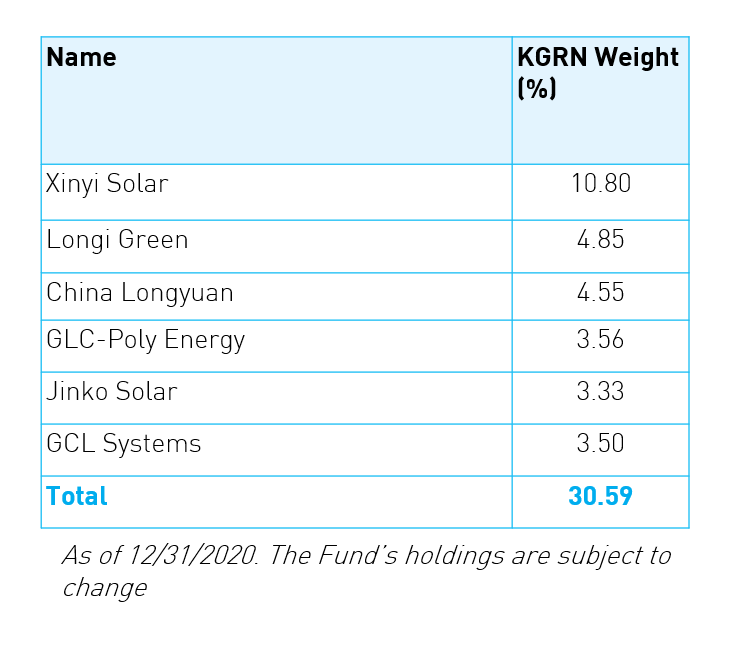

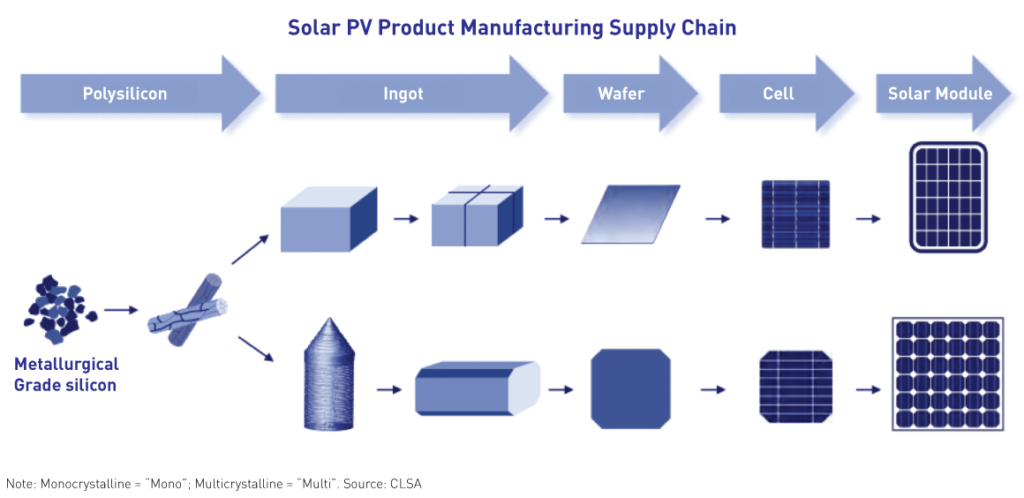

According to Bloomberg, the global average cost of solar energy has declined by more than 80% since 2010, and we could see another 25% drop by 2025.4 The cost reduction has been due to two factors: First is the continuous drop in the price of all solar upstream materials such as silicon, wafer, and glass. The other reason for the price reduction is innovations across the solar Photovoltaic (PV) product supply chain. These innovations include higher quality silicon, bigger solar wafers, more efficient solar cells, and bifacial modules that can gather light on both sides.3 According to China's Photovoltaic Industry Association (CPIA), solar cell efficiency could increase by another 1 to 2% by 2025, a significant gain.5 China has been leading the way in solar power innovation with companies held within KGRN leading the way such as GCL-Poly Energy, Longi, Jinko Solar, and Xinyi Solar.

There has been great excitement for renewable energy over the past few months as many countries have renewed their commitment to a greener planet. However, economic and social barriers remain significant as countries try to perform a balancing act between moving to renewables and supporting those employed by the fossil fuel industry. As the cost of renewable energy falls and governments increase their support for the sector, innovative companies in the space are poised to benefit. China currently leads the world in cost reduction, public support, and implementation, providing a long-term catalyst for the country's clean energy firms.

Citations

- Tesla announcement during the "Battery Day" annual shareholder event.

- Data from the International Energy Agency (IEA) as of 12/31/2020.

- Jonathan Lau, CLSA, SunKissed report, December 2020.

- Bloomberg Green, "Renewable Investment", retrieved 12/31/2020.

- Data from CPIA, retrieved 12/31/2020.