China Market Connect March 2024: Marching in Asia

By Dr. Xiaolin Chen, Head of International

"For investors seeking to understand China's markets, there's no substitute for experiencing the country firsthand” - a lesson long understood by KraneShares CEO Jonathan Krane.

This past March, Jonathan and I flew to Beijing, which marked my first visit back to China in over 40 months. I was beyond excited to see how China has developed over the past few years in my absence. Despite maintaining daily contact with our onshore partners in China, nothing compares to being there in-person.

We arrived on a Tuesday morning, two hours before our first meeting was scheduled to commence. During our packed 3.5-day stay in Beijing, we engaged in 21 total meetings with diverse stakeholders, including clients, partners, Chinese regulators, onshore asset managers, wealth managers, prominent banks, securities firms, institutions, and professional investors.

We believe that sharing the invaluable insights we gained from stakeholders in China is key to our business’s success. The overall eagerness, engagement, and openness to share candid feedback exceeded my expectations and cemented our belief that post-COVID China is truly open for business.

China Trip - Key Takeaways

My reflections on the series of meetings underscore a notable shift among onshore investors toward a more favorable appraisal of China's new leadership. They expressed confidence that the current leaders harbor the right intention for economic expansion, supported by the announcement of pro-growth policies and the facilitation of rich liquidity to support this growth—a sentiment widely echoed regarding the current situation in China.

Furthermore, there is a prevailing perception among local investors that Chinese regulators are actively contributing to the establishment of a pro-market framework aimed at stabilizing the market. A particularly insightful comment emerged from our session with the executive of the largest bank in China, a company with the world's third-largest market capitalization. They stated, "Three years ago, there was concern over whether Chinese policymakers would take any action to support the market. Now, the concern has shifted to whether their clients are adequately positioned to capitalize on the potential rally." From my perspective, the feedback from onshore investors is evolving toward a more cautiously optimistic outlook.

Another standout moment from my visit to Beijing was during our final meeting with the China Securities Regulatory Commission (CSRC). Anticipation for this meeting was high, as KraneShares represents over 350,000 investors worldwide who entrust us with their investments. Over the years, I have had the privilege of meeting thousands of you in person. Our fiduciary duty compels us to advocate on your behalf and share our insights with China's top financial regulators. I am delighted to report that Jonathan and I had an exceptionally fruitful discussion with them. We presented feedback from global investors, which was received with an open and constructive attitude. The initial question they asked, "How can we help investors?", was a profound indication of their commitment to creating a welcoming and supportive environment for international investment.

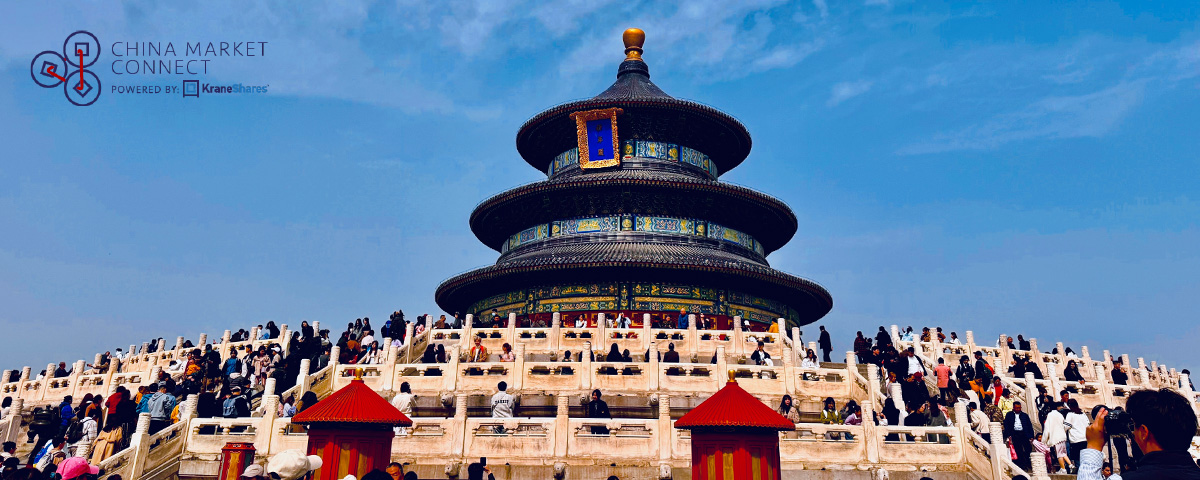

On our final day in China, Jonathan and I had the opportunity to indulge in some personal sightseeing. We visited the Temple of Heaven (天坛), the majestic site featured on this month's cover page. Despite waiting nearly 30 minutes to capture a photo with fewer people, achieving a clear shot proved to be mission impossible.

We also explored the Lama Temple (雍和宫) together, though we momentarily parted ways—indeed, it was I who got lost. The notion of losing my way in a temple, especially with someone as conspicuously tall as Jonathan, who stands at 6 feet and 7 inches, had never crossed my mind. The temple, thronged with tourists, allowing only 5,000 visitors per hour with a daily cap of 40,000, made it challenging to locate one individual in a sea of thousands. Luckily, we managed to find each other after an hour.

This experience highlighted the increasing trend of domestic tourism among Chinese travelers, exemplified by the staggering attendance of over 60,000 visitors at this Temple on Chinese New Year's Day alone. This shift toward domestic travel reflects a burgeoning interest among the Chinese population in discovering the rich tapestry of destinations within their country and bolstering the local economy.

Vietnam Trip – Key Takeaways

My trip continued after China. I marched on to Ho Chi Minh City (HCMC), the vibrant capital city of Vietnam, as the subsequent destination on my Asian itinerary. Vietnam is celebrated for its profound historical heritage, dynamic culture, and breathtaking natural scenery. Positioned to the south of China, it is home to roughly 97 million people. The nation's economy has undergone a significant transformation in recent years, evolving from a predominantly agricultural society to one that is progressively industrialized and oriented towards market-driven principles.

During my visit to the British Consulate General in HCMC, I had the privilege of attending a panel discussion featuring Mr. Dang Huy Dong, the former Vice Minister of the Ministry of Planning and Investment, former Deputy Chairman of the Party Central Committee’s Economic Commission, and former Chairman of the Vietnam Small and Medium Enterprises (SME) Development Fund. Mr. Dang shared insightful perspectives on the opportunities and challenges associated with conducting business in Vietnam.

Reflecting on the discussions at the event, while Vietnam does not pose a direct, large-scale challenge to China's status as a leading global exporter, it is progressively emerging as a competitor in certain sectors. This competitive edge is partly due to the rising labor costs in China and Vietnam’s strategic efforts to integrate into the global economy, notably through free trade agreements such as the European Union-Vietnam Free Trade Agreement (EVFTA). These developments have positioned Vietnam as a burgeoning manufacturing hub, especially in the electronics, textiles, and footwear industries.

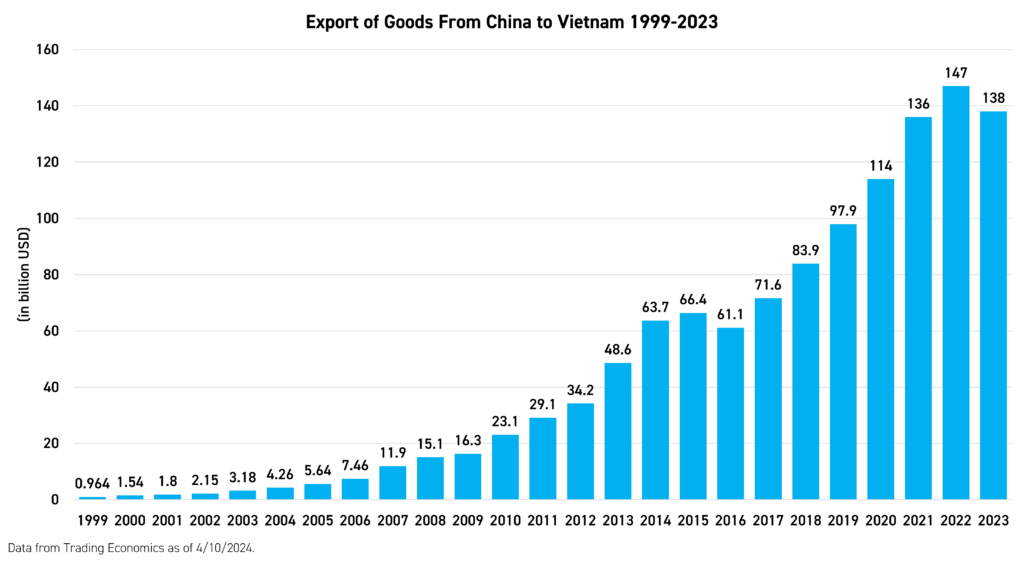

Being in Ho Chi Minh City evokes memories of China in the early 2000s, yet the two are also materially different from each other in many ways. Back then, China's massive capital investment in infrastructure, technology, and logistics, and its large population and diverse geography solidified its position as the world's largest exporter. I believe that the growing significance of Southeast Asian countries in diversifying the global supply chain holds potential mutual benefits for all nations in the region. This is evidenced by the growing exports between China and Vietnam, emphasizing a collaborative rather than competitive relationship that can enhance the economic landscape of Southeast Asia.

Notable Developments in China’s Political/Economic Landscape

In March, several noteworthy events unfolded in China, capturing the attention of global investors, most notably developments from the National People's Congress (NPC). This key political event saw the participation of China's senior leadership, including a presentation of the Government Work Report by Premier Li, which I had the opportunity to watch - my reflections on the event are as follows:

- The leadership of China, including President Xi Jinping, demonstrated a keen awareness of the challenges facing China's economic recovery and expressed a strong commitment to supporting sustained growth. Premier Li's detailed account of the challenges encountered in the past year and those anticipated ahead, delivered in his opening remarks in the presence of his superior, effectively dispelled any doubts regarding President Xi's comprehension of the economic landscape.

- The economic objectives outlined during the NPC, which consider a range of domestic and international quantitative and qualitative factors for the current year, reflect a prudent and realistic approach to future planning. I applaud the leadership's conservative stance and readiness to implement necessary policies to achieve these targets as evidence of strategic foresight.

- The emphasis on new productive forces throughout the NPC, which garnered significant media coverage, signals the areas deemed pivotal for China's future economic expansion. The focus on sectors where China is ascending the export value chain and leading in urbanization and industrialization initiatives, including smart electric vehicles, renewable and clean energy, and a more advanced consumption ecosystem, underscores their role as integral drivers of economic growth.

These insights highlight China's strategic direction and the critical areas of focus that will likely shape its economic trajectory in the years to come.

Conclusion

This year signifies the second consecutive year in which Chinese policymakers have maintained an accommodative stance to foster economic growth in the post-pandemic era. It also marks the second year of President Xi's current term in office. From the diverse messages conveyed during key meetings in China, it is evident that economic expansion is at the front and center of their agenda. However, certain questions are still awaiting clarification. From both a top-down and bottom-up perspective, I observe an emerging potential for positive developments.