China Internet Sector Expanding, Despite Trade Tensions

Warren Buffett often talks of buying good companies at the right price and holding them for many years as investment returns compound. This requires not only patience and conviction but also timing. When consensus on a market is very negative, stocks can be bought low and held for many years to potentially achieve growth. We believe that one such opportunity is occurring right now in the China internet sector.

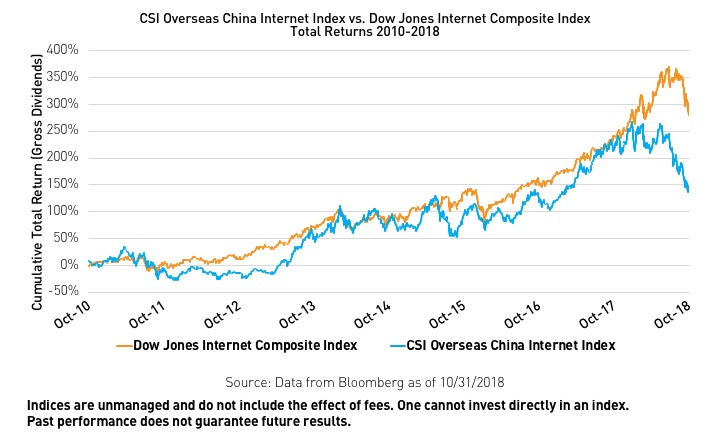

China internet stocks have traded down nearly 29% year-to-date (YTD)1 while US internet companies are up over 15% YTD2. This is the largest price gap these two groups have experienced since 20103. Every day we read about trade tensions and China’s slowing GDP growth, but what has been overshadowed is the continued growth of China’s services sector, retail sales, and the expanding universe of publicly traded Chinese internet companies. We believe this is a great example of noise and sentiment creating investment opportunities

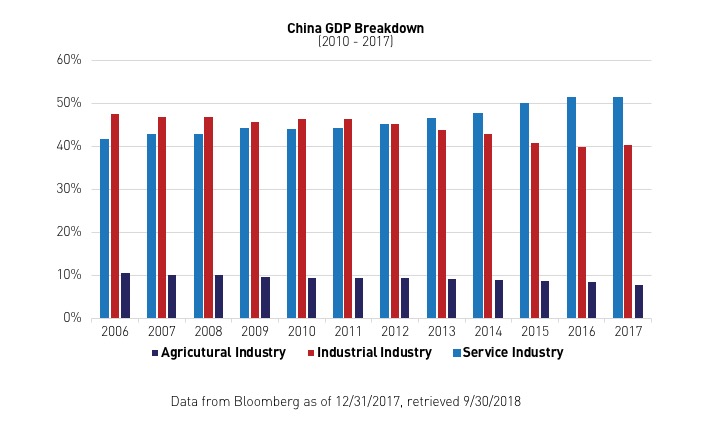

China’s recent third-quarter economic statistics put year-over-year GDP growth at 6.5%, missing analyst expectations of 6.6%4. The media focused heavily on China’s underperforming GDP growth numbers rather than highlighting the performance of its services sector which experienced 7.7% growth compared to just 5.8% growth in the industrial sector5. Additionally, retail sales beat expectations, growing by 9.2% versus a 9.0% estimate6. This reflects a well-documented phenomenon occurring in China over the past decade that still goes largely unreported. China is shifting from an industrial/export-driven economic model that represented the “old China” economy to a services/domestic consumption-based economic model that characterizes the “new China” economy. In 2013, China’s services sector surpassed its industrial sector as the largest contributor to GDP for the first time, and since then, it has continued to steadily outgrow the industrial sector7. The strong performance of China’s new economy shows us that while overall GDP growth numbers might have slowed in Q3, the fastest-growing areas of China’s economy still thrived.

The recent wave of Initial Public Offerings (IPOs) from Chinese internet companies also underscores the growth of the “new China” economy. So far in 2018, Chinese tech companies have generated more value from their IPOs than any other sector in the mainland or Hong Kong markets, raising a total of $12.8 billion while industrial companies have only raised $2.9 billion8. In fact, 2018 has been the most lucrative year for Chinese tech IPOs since 2014, accounting for 40% of all the cash generated by tech IPOs worldwide9. We believe these IPOs illustrate that the “new China” grew despite trade tensions, demonstrating that Chinese companies are optimistic about the future.

The two most notable among this year’s China technology IPOs were Meituan Dianping and iQiyi. These stocks were added to our KraneShares CSI China Internet ETF (Ticker: KWEB) within 10 days of their listings due to our fast-track inclusion methodology for qualifying companies with market caps over $10 billion. Meituan Dianping is best described as a combination of a food delivery company like GrubHub and an online review company like Yelp that services 290 million monthly active users (MAU)10. iQiyi is one of China’s top video streaming companies, often referred to as the “Netflix of China”. Meituan raised $4.2 billion from its IPO this year to reach a current market cap of $35.5 billion, and iQiyi raised nearly $2.3 billion to reach a market cap of $14.4 billion11. They each achieved success through innovative business models that allowed them to surpass foreign and domestic competitors to establish themselves as important, new members of the China internet ecosystem.

As described by Kai-Fu Lee, the former president of Google China, in his book “AI Superpowers”, the success of Meituan is a prime example of the fierce competition that Chinese entrepreneurs must go through to succeed. Back in 2011, Groupon entered the Chinese market through a partnership with Tencent and saw its valuation skyrocket to over $1 billion in just 16 months. The concept of a group buying company seemed tailor-made for China, and while Groupon was the frontrunner, many Chinese startups subsequently started popping up. By the time Groupon went public, China was home to over 5000 different group buying companies, one of which was Meituan. Its founder, Wang Xing, had built two companies in the past and sharpened his skills beyond computer engineering to serial entrepreneurship. Meituan pioneered an automated payment mechanism that got money into the hands of businesses quicker. The stability of Meituan's payment platform inspired loyalty amongst its customers, and Wang leveraged it to build out larger networks of exclusive partnerships.

By 2013, Groupon shut down its China business, leaving just three companies left in the space, Meituan, Dianping and Nuomi. In sharp contrast to Groupon, Wang expanded Meituan’s lines of business and reshaped its core products. As the new consumer wave began to take hold, Wang pivoted his company to participate in the fast-growing online-to-offline (O2O) business trend. Meituan merged with Dianping in 2015 to form a Chinese O2O behemoth, and Nuomi quickly changed business strategies, eventually being bought by iQiyi in May 2018. Finally, on September 20, 2018, Meituan Dianping went public on the Hong Kong Stock Exchange, cementing its status as the leader of China’s O2O market.

Although Meituan already triumphed over its competitors, it is still at a relatively early stage of development. In September 2018, Meituan had revenues of US $2.3 billion12. It also had 290 million monthly active users (MAU) in April 2018 which, while impressive, when compared to internet giant Alibaba’s 576 million MAU13, still leaves plenty of room for growth. JP Morgan expects Meituan’s revenue to grow 100% in the second half of 2018, making Meituan the fastest growing name within their China Internet coverage universe14.

iQiyi also has a compelling story and has risen to the top by innovating the Chinese online video space. In 2015, there were not many quality films being made for online distribution, and those that were had minimal resources and low-budgets. However, according to a report from Chinese media research firm, Entgroup, there was a notable surge in quality online movie production in 2016 when 2,500 online movies were produced, up from 689 titles the year before15. Very quickly, online video became one of the fastest growing verticals in the China internet space and now accounts for 25% of total time spent online16.

iQiyi saw this opportunity in 2015 and led China’s charge in hosting original content online. What separated iQiyi from its competitors was its unique business model with regards to hosting content. The company offered a 50-50 revenue split to titles that met certain quality standards. The deputy general manager of iQiyi’s membership business department, Ge Xufeng, described the advantages of this model saying, "We share the risks and the profits together, and we both have an incentive to market and promote the content to the best of our ability." As iQiyi’s focus shifted to quality over quantity, its revenue and subscriptions similarly increased. In May 2015, iQiyi had only 5 million paying subscribers, but by June 2018, that number had risen by more than 10x to 66.2 million17. By the end of 2017, iQiyi ranked first among Chinese video platforms with 463 million monthly active users, versus Tencent Video's 458 million and Alibaba-backed Youku's 374 million18.

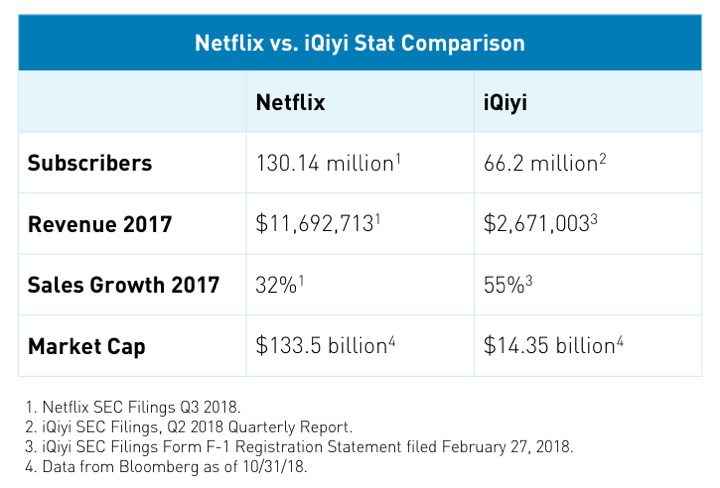

When compared to Netflix, iQiyi still appears to have plenty of room to grow. By the end of 2017, Netflix had twice the number of paying subscribers and four times the revenue of iQiyi, and its current market cap is about eight times larger19. However, iQiyi has advantages that Netflix did not have at a similar stage in its development. While about 96% of Netflix’s revenues come from subscriptions20, iQiyi’s revenue model is more similar to Hulu or YouTube, where users can either view content for free with advertisements or have a paid subscription. iQiyi sees 41% of its revenues come from advertising, 35% come from subscriptions, and about 24% from gaming, e-commerce and other sources21. This provides iQiyi with access to more revenue streams than just online video subscriptions.

iQiyi also utilizes Baidu’s world-class artificial intelligence (AI) research to improve the efficiency of its operations. In an interview conducted with iQiyi’s CEO Tim Gong Yu in December 2017, he described the benefits of Baidu’s AI saying, “We're able to predict the box-office potential of a theatrical film release with a pretty high degree of accuracy, which helps us determine how much to spend on licensing before the film has come out... But this is just the beginning: AI will dramatically change the media and entertainment industry over the next 5 to 10 years.”22 iQiyi’s access to cutting-edge AI research and technology will likely give it an edge and allow for it to optimize its business operations better than its competitors.

Both Meituan and iQiyi are prime examples of China internet companies that embody the growth of the new China economy. Despite trade tensions and slowing GDP growth, the China internet sector still grew and looks to continue to expand both within China and internationally. KWEB’s diversified approach allows investors to gain exposure to these exciting names and the growth of the China internet sector as a whole, typically with less volatility than holding a single company’s stock. When the overall consensus is negative, great investment opportunities can arise, and we believe China’s internet sector looks attractive right now.

Weights of KWEB Holdings Mentioned:

- Tencent % of KWEB net assets as of 10/31/2018: 9.70%.

- Alibaba % of KWEB net assets as of 10/31/2018: 9.21%.

- Baidu % of KWEB net assets as of 10/31/2018: 8.11%.

- Meituan Dianping % of KWEB net assets as of 10/31/2018: 6.30%.

- iQiyi % of KWEB net assets as of 10/31/2018: 3.94%.

* All other companies mentioned represent 0% of KWEB net assets as of 10/31/2018.

- Data from Bloomberg as of 10/31/2018 referencing the CSI Overseas China Internet Index (H11137 Index)*.

- Data from Bloomberg as of 10/31/2018 referencing the Dow Jones Internet Composite Index (DJINET Index)**.

- Data from Bloomberg as of 10/31/2018.

- Data from Bloomberg as of 10/31/2018.

- National Bureau of Statistics of China, Quarterly Data Retrieved 10/31/2018.

- Data from Bloomberg as of 10/31/2018.

- Data from Bloomberg as of 12/31/2017, retrieved 9/30/2018.

- EY, Global IPO Trends: Q1, Q2, and Q3 2018 Reports.

- CNN Business, “Chinese tech IPOs have had a blowout year. The wave may have peaked”, 10/4/2018.

- Forbes, “Meituan-Dianping: Finally, A Chinese Tech IPO With Some Value.”, 9/4/2018.

- Data from Bloomberg as of 10/31/2018.

- Nasdaq, “China's Meituan Dianping doubles revenue but losses widen ahead of IPO”, 9/4/2018.

- Alibaba SEC Filings, Q2 2018 Quarterly Report.

- JP Morgan Asia Pacific Equity Research, “Meituan Dianping: Pioneering China’s local consumption market”, 10/13/2018.

- Entgroup, Report on China’s Filmmaking Industry in 2016. Published 1/17/2017.

- China Internet Watch, “Chinese will spend 3 hours with internet every day in 2018”, 6/13/2018.

- iQiyi SEC Filings, Q2 2018 Quarterly Report.

- Questmobile: 2017 China Mobile Internet Report, 2/2/2018.

- Calculated by comparing Netflix SEC Filings, Q3 2018 Quarterly Report and iQiyi SEC Filings, Form F-1

- Netflix SEC Filings, Q3 2018 Quarterly Report.

- iQiyi SEC Filings, Q3 2018 Quarterly Report.

- The Hollywood Reporter, “iQiyi Boss on Netflix Deal, Dominating China's Streaming Video Sector”, 12/1/2017.

*CSI Overseas China Internet Index: selects overseas listed Chinese Internet companies as the index constituents; the index is weighted by free float market cap. The index can measure the overall performance of overseas listed Chinese Internet companies.

**Dow Jones Internet Composite Index: is designed to measure the performance of the 40 largest and most actively traded stocks of U.S. companies in the internet industry.

This article is intended for educational purposes only and should not be construed as investment advice. All opinions or views expressed in this article are current only as of the date of this article and are subject to change without notice. Holdings are subject to change. Securities mentioned do not make up entire the portfolio and, in aggregate, may represent a small percentage of the portfolio.

The KraneShares ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Fund. Additional information about SIDCO is available on FINRA’s BrokerCheck.