China ETFs: A Comprehensive Guide On How To Invest In China

By Henry Greene

China’s stock market is the second largest in the world.1,5 Global investors can use China ETFs to access this large, diverse opportunity set without having to pick individual Chinese stocks, and to target specific themes such as technology or China AI. Investing in China’s onshore A‑share market through single stocks can be difficult and complex for foreign investors, so ETFs listed on U.S. and international exchanges have become a practical way to invest in China’s equity market.

What are China ETFs?

China index-based ETFs offer investors a way to gain exposure to China's economic trends by tracking a tailored basket of Chinese securities. This allows investors to gain investment exposure to China's economy on US or international stock exchanges. These China ETFs can offer broad exposure to the overall Chinese equity market or more focused exposure to sectors such as technology, consumer, and artificial intelligence (AI) innovation. Global investors are still underweight Chinese securities - based on the results of a 2025 survey by Copley Fund Research indicating that active emerging markets managers are, on average, 3% underweight China compared to their chosen benchmark indexes 2,6 - so China ETFs provide an opportunity to gain exposure to China's various onshore and offshore themes while leveraging the flexibility, liquidity, and transparency of an ETF structure.

KraneShares is a leader in China ETF investing, having launched our flagship KraneShares CSI China Internet ETF (Ticker: KWEB) on the New York Stock Exchange in 2013 - the first China internet ETF.2 Today, it is one of the largest China ETFs globally2 and is widely used by investors looking for targeted exposure to China’s internet and AI‑enabled digital economy.

To learn more about the basics of ETF trading, please refer to ETF Trading 101.

Why invest in China ETFs?

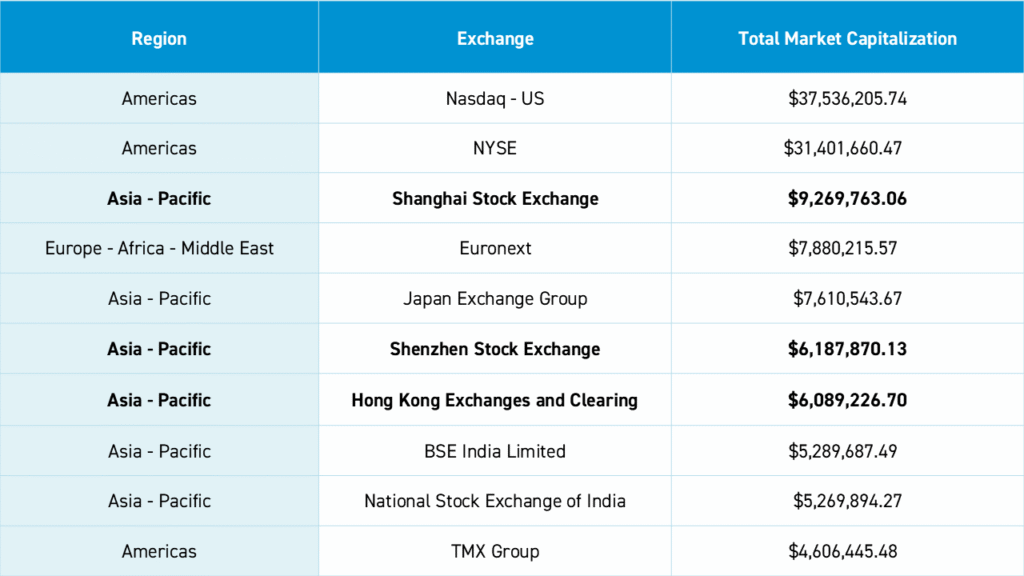

China ETFs are an efficient way for global investors to invest in China. To understand the benefits of China ETFs, it is important to consider the scale and composition of China's stock markets. Chinese companies are listed worldwide. This makes it difficult to develop a comprehensive definition of "Chinese stocks". For many years, the definition used by global investors and index providers like MSCI was Hong Kong-listed companies. This definition excludes over one-half of China's total market capitalization, listed in Shanghai and Shenzhen, as well as the numerous Chinese companies listed in New York using American Depositary Receipts (ADRs). KraneShares China ETFs attempt to provide investors with broad exposure to China's capital markets, leveraging our extensive knowledge of China investing.

Mainland China, represented by the Shanghai and Shenzhen stock exchanges, has a market capitalization of approximately $15 trillion, while Hong Kong has a market capitalization of approximately $6 trillion.4 Also, China-based companies’ listings in New York sum to just under $1 trillion in market capitalization.4 With all these listing venues put together, China boasts nearly 6,000 listed companies.4 Most investors do not have the time or resources to research thousands of stocks, so China ETFs can provide differentiated exposure through a single investment.

Top 10 Global Exchanges by Total Equity Market Cap in Millions of USD as of Dec 20255

KraneShares China ETFs also let investors refine their definition of “China” based on listing venue, sector, or theme, including focused China AI ETF strategies. For example, investors can choose all‑China exposures that blend onshore A‑shares with offshore H‑shares and US‑listed ADRs, or narrow exposures that tilt toward companies operating in faster-developing or innovation-driven themes such as e‑commerce, cloud, or AI‑related internet platforms. China’s push into high‑tech manufacturing, digital innovation, and artificial intelligence reflects a different return and risk pattern versus many developed markets, and China ETFs can be a practical way to access these long‑term themes while eliminating single‑stock risk.

Should I invest in China?

Before investing in a China ETF, one must first decide whether investing in China is a good idea in the first place. There are many reasons to invest in China. As the world’s second-largest economy, China remains a critical component of global portfolios, and China's transition toward high-tech manufacturing, digital innovation, and domestic consumption reflects a different return and risk pattern compared to developed markets. China’s commitment to developing innovative growth sectors such as AI, E-Commerce, and semiconductors is reflected in its "New Quality Productive Forces", a key pillar of China’s 15th Five-Year Plan.3 Meanwhile, many Chinese companies currently trade at a valuation discount to US equities, offering exposure to long-term structural growth themes at a potentially attractive entry point,1 depending on market conditions. For example, KWEB's holdings currently trade at an average price-to-earnings (P/E) ratio of 17.7 versus 34.4 for the Nasdaq 100 Index.7

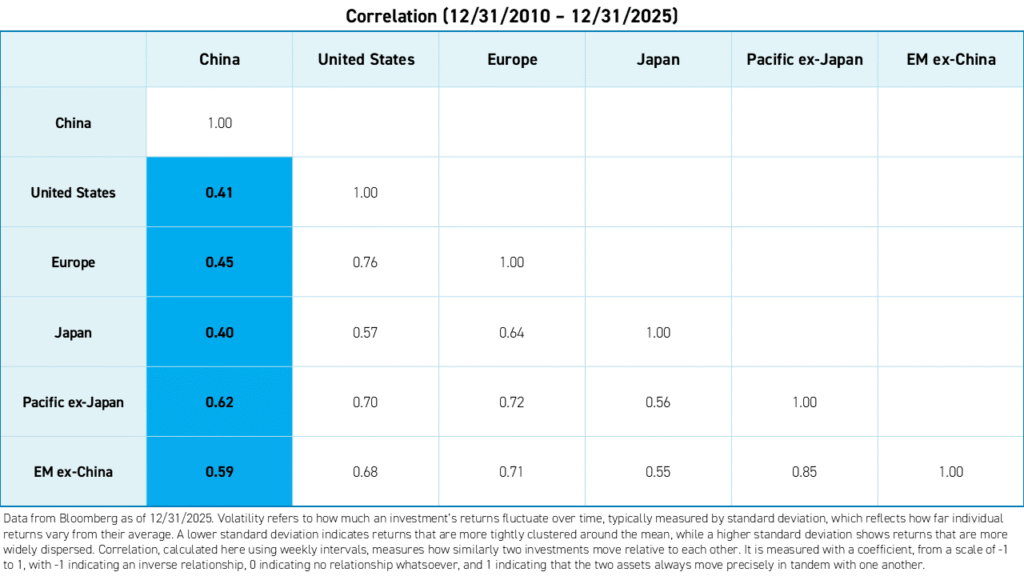

Also, China’s equity market has historically exhibited a low correlation to other major equity markets, maintaining correlation coefficients generally lower than 0.7.2 China exposure has historically acted as a potential diversifier* within a global portfolio.

What are the different types of China ETFs?

Not all China ETFs are created equal, and understanding the underlying share classes is essential for targeted exposure. China's equity markets are separated into different share classes: onshore-listed A-shares (Mainland China, i.e., Shanghai and Shenzhen), offshore-listed H-shares (Hong Kong), and offshore US-listed ADRs. Investors can use an ETF that invests in a single share class for specialized exposure or one that uses an "all shares" approach that combines onshore and offshore equities, offering the broadest possible opportunity set.

Our China ETFs provide access to all share classes and give investors the tools to tailor their China exposure for their needs. For instance, the KraneShares Hang Seng Tech Index ETF (Ticker: KTEC) focuses specifically on offshore Hong Kong-listed AI and technology companies. Meanwhile, the KraneShares MSCI China A 50 Connect Index ETF (Ticker: KBA) invests exclusively in onshore A-shares. Finally, the KraneShares CSI China Internet ETF (Ticker: KWEB) focuses on China's broader AI & digital economy with exposure to offshore stocks across both Hong Kong and New York.

What is the largest China ETF?

As of February 5, 2026, the largest US-listed China ETF was the KraneShares CSI China Internet ETF (Ticker: KWEB)2 with $8.22 billion in assets under management (AUM). This reflects its position as a widely used vehicle for investors who want to invest in China's internet and AI ecosystem.

What is the best-performing KraneShares China ETF?

Among the KraneShares China ETFs, as of February 5, 2026, the top-performing China ETFs over the past 12 months were the following, based on total return:

- The KraneShares SSE STAR Market 50 Index ETF (Ticker: KSTR), up 53.08%2

- The KraneShares China Alpha Index ETF (Ticker: KCAI), up 53.03%2

- The KraneShares MSCI China A 50 Connect Index ETF (Ticker: KBA), up 35.29%2

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be higher or lower than the performance quoted. For performance data current to the last month-end, please visit kraneshares.com/etf/kstr, kraneshares.com/etf/kcai, or kraneshares.com/etf/kba.

What is the most liquid KraneShares China ETF?

Among the KraneShares China ETFs, the most liquid is the KraneShares CSI China Internet ETF (Ticker: KWEB), as of February 6, 2026, based on 30-day average volume.2 This makes it a practical choice for investors who prioritize liquidity when deciding how to invest in China or in a China AI ETF.

Where are Chinese stocks listed?

Chinese stocks are mostly traded in Mainland China, Hong Kong, and New York. Most of China’s market capitalization is listed on the Shanghai or Shenzhen stock exchanges. Stocks listed on these exchanges are known as A-shares or onshore stocks. However, to access these listings from abroad, investors must either participate in the Stock Connect program or apply for a special quota under the qualified foreign institutional investor (QFII) program. In either case, these avenues for investment are mostly limited to financial institutions and are not available for individual investors. Most foreign investors access China through Hong Kong or New York, or by using China ETFs that invest onshore.

How can I invest in China’s A-share (Mainland/Onshore) market?

For global investors, options for investing in single stocks listed in Mainland China are limited. However, KraneShares offers ETFs listed on US stock exchanges that provide exposure to Mainland China A-shares. These include:

- The KraneShares MSCI China A 50 Connect Index ETF (Ticker: KBA)

- The KraneShares SSE STAR Market 50 Index ETF (Ticker: KSTR)

- The KraneShares China Alpha Index ETF (Ticker: KCAI)

Are there China AI ETFs?

We believe the KraneShares CSI China Internet ETF (Ticker: KWEB) is an option for investors to gain access to AI opportunities in China. Unlike in the United States, where private companies such as OpenAI are well-known for AI innovation, China's AI development is primarily led by publicly traded internet platforms. Some examples include Alibaba's Qwen large language model (LLM), Baidu's ERNIE bot, which is linked to the company's existing traditional search product, Kuaishou's Kling AI, a global video generator, and Tencent's Hunyuan LLM. Most of these platforms offer their models for free and then seek to generate revenue from demand for cloud services. We estimate that AI-related services accounted for 6% to the overall revenue generated by KWEB's holdings in 2024.

For KWEB top 10 holdings, please visit kraneshares.com/etf/kweb.

The KraneShares SSE STAR Market 50 Index ETF (Ticker: KSTR) also offers access to China's AI ecosystem. It provides exposure to some of the chipmakers powering China's AI ecosystem, including Cambricon, Hygon, and Montage Technology.

For KSTR top 10 holdings, please visit kraneshares.com/etf/kstr.

What are the risks associated with China ETFs?

Investing always involves risk. However, there are risks specific to investing in China ETFs. China is an emerging market that is vulnerable to domestic and regional economic and political changes. Regulatory changes in China can be rapid and sweeping. Such changes may have adverse impacts on the value of investments within the country. A-shares, in particular, are subject to various regulations and restrictions, including limits on asset repatriation and the possibility of closure of the Stock Connect program without prior notice. An ETF may also be unable to achieve its stated goal due to the limited availability of additional quota for onshore A-shares if it is not purchasing shares through Stock Connect.

Holdings are subject to change.

*Diversification does not ensure a profit or guarantee against a loss. Diversification in this context is not regulatory diversification. Many of KraneShares' products are non-diversified.

Citations:

- Data from MSCI as of 12/31/2025.

- Data from Bloomberg as of 1/28/2026.

- “China’s new quality productive forces gather steam to turbocharge future growth,” Xinhua. November 1, 2025.

- Data from Shanghai Stock Exchange, Shenzhen Stock Exchange, Beijing Stock Exchange, Hong Kong Exchanges, and Bloomberg as of 12/31/2025.

- Data from World Federation of Exchanges as of 12/31/2025.

- Data from Copley Fund Research as of 12/31/2025.

- Data from FactSet as of 2/3/2026.

Definitions:

Open Interest: The value of all options contracts on a particular security, measured on a notional basis, meaning it treats all values as positive, i.e., both put and call options are treated equally and summed.

Price-to-Earnings (P/E) Ratio: A stock valuation metric that shows how much investors are willing to pay for each dollar of a company's earnings, calculated by dividing the current share price by the earnings per share (EPS). It helps assess if a stock is overvalued (high P/E) or undervalued (low P/E) compared to its peers or its own history, often indicating growth expectations (higher P/E) or perceived risk (lower P/E).

Nasdaq 100 Index: The Nasdaq-100 Index tracks 100 of the largest non-financial companies listed on the NASDAQ stock market, including major tech, retail, and healthcare firms, and was launched on January 31, 1985, as a benchmark for innovation-driven growth, not including financial firms.

30-Day Average Volume: 30-day average volume is a liquidity metric calculated by summing the total shares or contracts traded over the past 30 days and dividing by 30. It indicates typical trading activity, helping investors assess ease of execution and potential price volatility.