A Decade of Change in the MSCI Emerging Markets Index & A Look To The Future

- China's dominant weight in Emerging Markets (EM) should lead to EM Ex China Investing.

- Demand for total China and EM Ex China solutions may rise in the future.

- EM country and sector weights have changed dramatically over the past five years.

"The best way to predict the future is to create it."

- Peter Drucker

Have you ever gotten an at-bat that you likely didn't deserve? You know, one of those chance opportunities that could meaningfully change your professional life?

In the spring of 2014, when KraneShares had been operational for just over one year, I managed to land a meeting with a large investment advisor that utilized Exchange Traded Funds. A lot of ETFs!

In the year prior, I had left my job at the world's largest asset manager to be a part of building KraneShares, a new, China-focused ETF firm based on the vision of Founder and CEO Jonathan Krane. The previous year had been a balancing act between building the firm's infrastructure and cold calling and emailing from dawn to dusk.

This meeting could have strongly benefitted the company if the firm were to buy one of our ETFs. I thought the meeting went well enough. However, it became clear by the lack of a response to my follow-up emails that the firm wasn't interested in investing with us at that time. Fast forward to today, we have the privilege of managing over $4 billion on behalf of our shareholders.

I happened to come across one of my post-meeting follow up emails I sent to the firm in April 2014. In the email I wrote:

The Premier of China recently announced a cross-border initiative between the Shanghai and Hong Kong stock exchanges. Mainland Chinese and Hong Kong-based investors will be allowed to invest in stocks listed on each exchange for the first time.

This was the announcement leading up to the November 2014 launch of the Shanghai-Hong Kong Stock Connect program, which allows foreign investors to invest in Shanghai-listed stocks without restriction. Shanghai Connect was subsequently followed by Shenzhen Connect in 2016.

I then stated:

A consequence of this announcement will be its eventual impact on the composition and weight of China in MSCI indices. We believe this announcement allows MSCI to include Mainland Chinese equities (A-shares) in their indices as the cross-border initiative means that trading in these shares no longer requires QFII or RQFII* licenses.

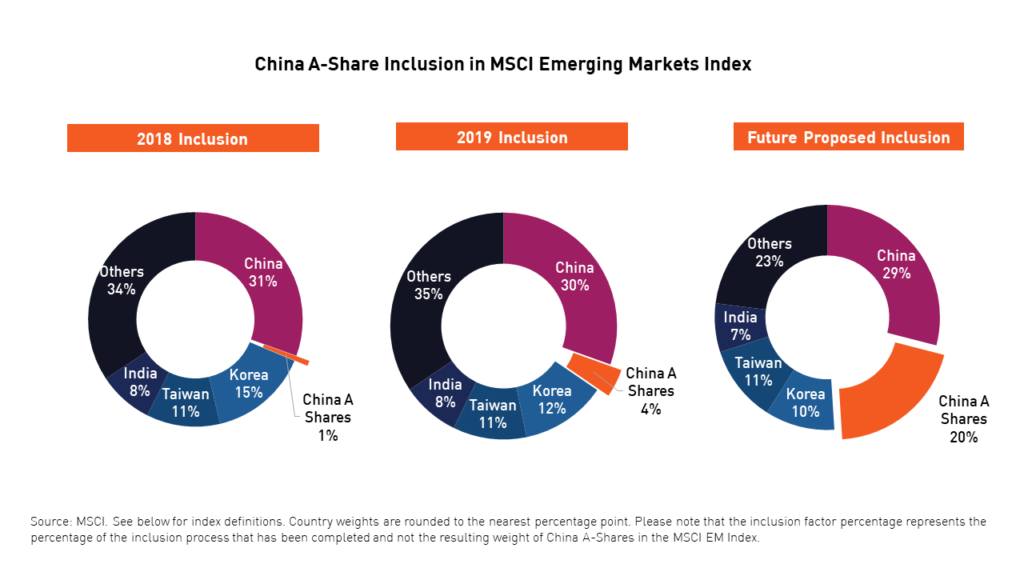

Admittedly, I was a little ahead of myself. While MSCI did indeed announce the inclusion of Shanghai and Shenzhen stocks in their indices, they did not do so until June of 2017. The first inclusion occurred in 2018.

I then wrote:

The full inclusion of Mainland Chinese equities would raise China's current 17% weight to 27% due to the additional 10% allocation to the MSCI China A Index within the MSCI Emerging Markets Index.

I had grossly underestimated the effect of the MSCI inclusion. Today, China’s weight in the MSCI Emerging Markets Index is over 40%! Think about that: China’s weight in MSCI Emerging Markets was 17% in 2014 and now it is over 40%.1

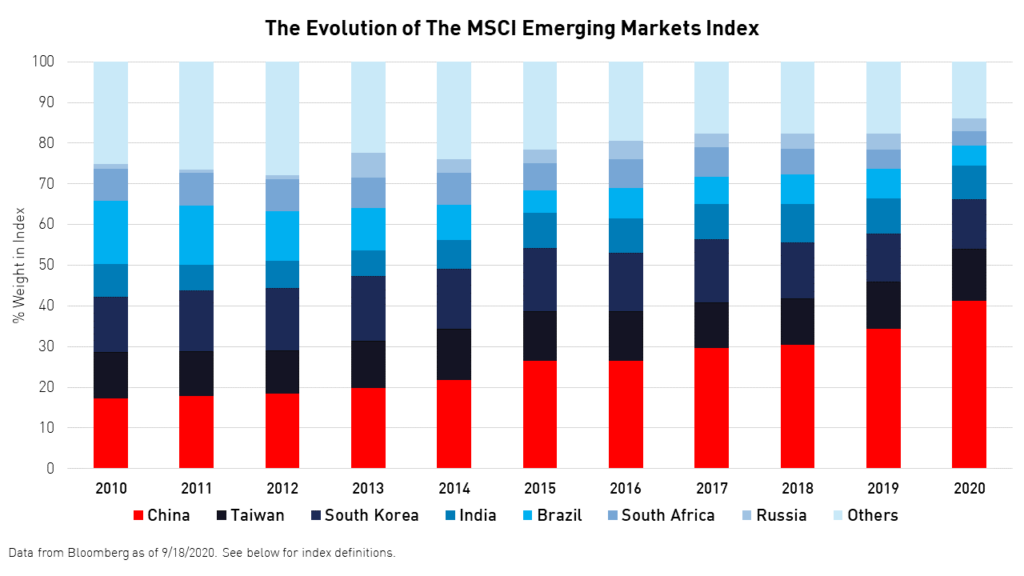

A massive shift has been taking place within the MSCI Emerging Markets Index over the last decade that has garnered little to no attention. Since December of 2010, China's weight has risen from 17% to 41% of the flagship EM index while the number of Chinese stocks in the index has increased from 138 to 713!1

The increase was driven by China's growing capital markets, MSCI's 2015 decision to include US-listed stocks in the MSCI Emerging Markets Index, and the index provider's 2018 decision to include Shanghai and Shenzhen-listed stocks (A-shares) in the index.

The establishment of Northbound Stock Connect, the platform on which foreign investors may buy and sell Mainland stocks via Hong Kong, allowed MSCI to increase the potential weight of Chinese A Shares within its index by 20% from 2018 to 2019. We know that MSCI will continue the inclusion process, which may raise the weight of Chinese A Shares from 5% of the MSCI Emerging Markets Index today to 20%, which would place the total China weight at nearly 50%.1

While inclusion has continued at a steady pace, MSCI still anticipates potential hurdles to further inclusion. These hurdles can be overcome, though doing so will require the cooperation of China's regulators. These hurdles include technical issues such as the fact that trades made on China's exchanges settle earlier than those made on other global exchanges and the difference in trading schedules between Hong Kong and the Mainland.

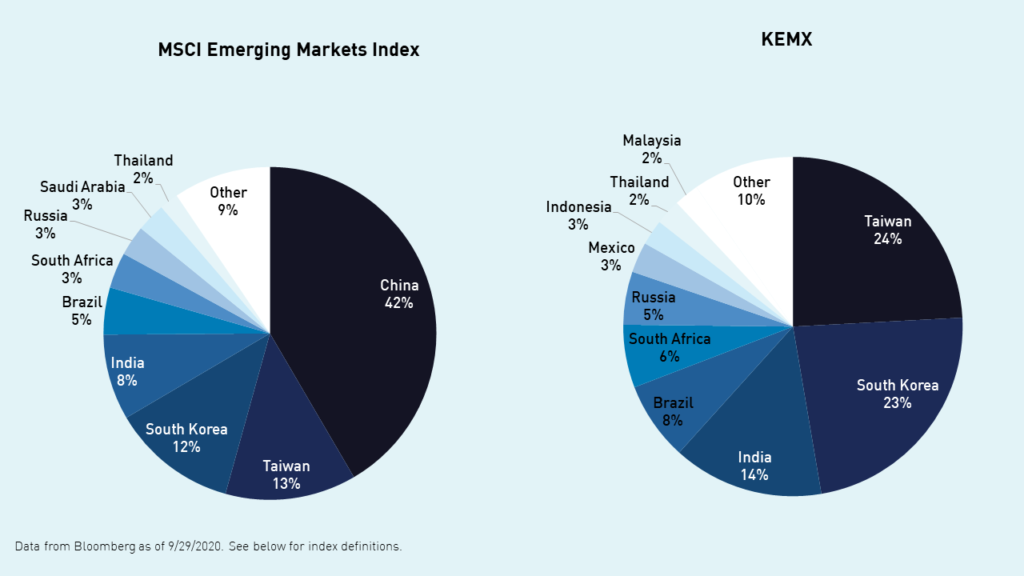

This evolution may sound familiar to some. Investors dealt with a similar issue when Japan became a significant country weight in MSCI EAFE leading to the advent of the MSCI Pacific ex Japan Index, which was launched back in August 31, 1987. Pacific ex Japan provided investors exposure to developed markets in Asia including Australia, Hong Kong, New Zealand and Singapore, which had been crowded out by Japan’s significant index weight.

As China becomes an asset class of its own, investors can allocate accordingly using our ETFs. For investors looking for exposure to the exact A-shares being included in the MSCI Emerging Markets Index, we have the KraneShares Bosera MSCI China A Share ETF (Ticker: KBA).

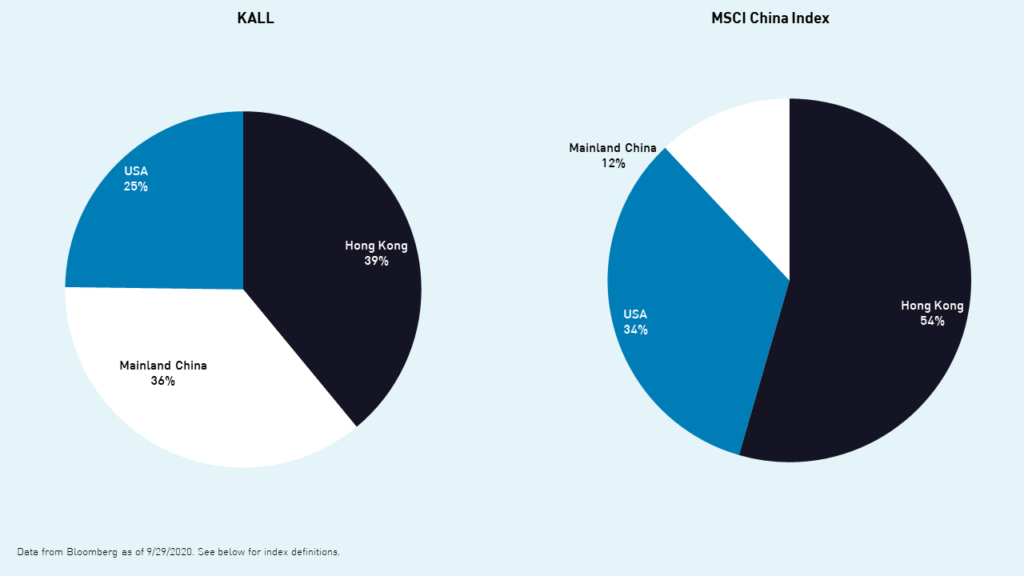

For investors looking for a holistic Emerging Markets solution, we have two ETFs that can be paired together: the KraneShares China All Shares Index ETF (Ticker: KALL), which offers exposure to the full China equity opportunity: A- Shares, based on their full inclusion weight, Hong Kong-listed Chinese stocks, and US-listed Chinese stocks.

We also have the KraneShares MSCI Emerging Markets Ex China Index ETF (Ticker: KEMX), which offers exposure to the Emerging Markets equity opportunity outside of China.

Investors can easily weight these two ETFs as they see fit. Investors may also dynamically allocate to KEMX and KALL using a model based on the valuation disparity of the two ETFs. The model will dial-up and down exposure to the two based on the belief that valuations are mean-reverting over time. The model can be accessed here.

In my follow up email, I ended with the above Peter Drucker quote. The quote still resonates with me as we build our firm with a vision for the future of EM investing. As China's equity markets play an ever-expanding dominant role in emerging markets portfolios, we believe investors will increasingly need to allocate to and around China and treat Chinese equities as an asset class in their own right. And, staying true to our original mission, we will be there for our clients as they navigate this new era in EM investing.

And should that large investment advisor decide they want to take a second look at their EM allocation, we will be here to share our latest insights for the next decade!

Citations

1. Data from MSCI and Bloomberg as of 9/30/2020

Index Definitions

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

MSCI China Index: The MSCI China Index captures large and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 703 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid-Cap A-shares represented at 20% of their free float adjusted market capitalization. The index was launched on October 31, 1995.

Term Definitions

Qualified Foreign Institutional Investor (QFII): The Qualified Foreign Institutional Investor program grants access to China’s domestic stock markets to foreign institutional investors that register with and are approved for trading by the State Administration of Foreign Exchange (SAFE). Until the launch of the Stock Connect program in 2016, this and the similar Registered Qualified Foreign Institutional Investor (RQFII) were the only means by which foreign investors could access stock markets in Mainland China.