Humanoid Turning Point: Highlights From Our KOID ETF Q&A With RoboStore’s CEO Teddy Haggerty

The humanoid robotics era has arrived.

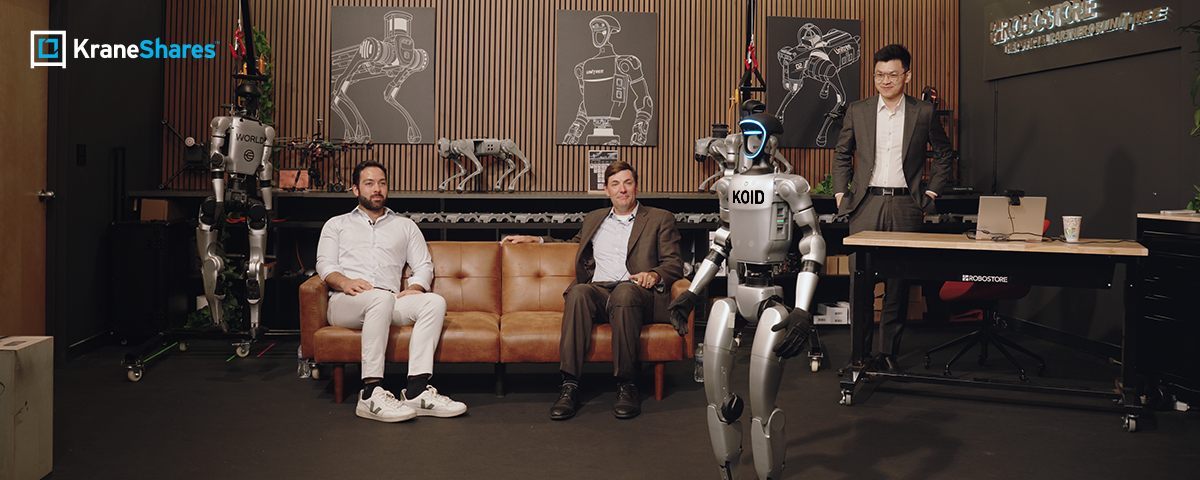

KraneShares recently hosted a Q&A with RoboStore CEO Teddy Haggerty, KraneShares CIO Brendan Ahern, and KraneShares Senior Investment Strategist Derek Yan, CFA, to discuss humanoid robot use cases, breakthroughs, hurdles, and the convergence of advanced manufacturing and artificial intelligence (AI).

This session brought investors face-to-face with Morgan Stanley's projected $5 trillion humanoid robotics opportunity through a live demonstration of the Unitree G1 Ultimate humanoid robot.1 Following the demo, participants asked questions about where the industry is headed and how KOID, the KraneShares Global Humanoid & Embodied Intelligence Index ETF, is positioned to capture the global humanoid opportunity.

Below, we share expanded highlights from the event.

Why Humanoids, Why Now? Accelerating Hardware Meets AI Intelligence

Teddy Haggerty set the tone by putting the current humanoid robotics boom into context:

“We are on the precipice of the adoption of humanoid robotics, driven by the convergence of industrialized manufacturing with artificial intelligence… We are moving so quickly.”

Haggerty explained that just a few months ago, Unitree’s humanoids were walking more robotically. Then, Unitree pushed a software update, and now they walk like humans. He said this phenomenon is similar to how Tesla’s electric vehicles (EVs) evolve with each software update; today’s general-purpose robots receive continuous upgrades, instantly boosting their capabilities once new code is released.

He emphasized the dual-development track: robotics hardware, motors, actuators, and batteries have advanced dramatically, but the true explosion of application potential comes from the accelerating pace of AI software. “The hardware is well beyond where the software is, but every day we get more data, and we’re able to push updates to consumers and see the hardware catch up.”

Real-World Adoption: From Classrooms and R&D to Industrial Deployment

A significant share of early adoption is educational. “Most of our clients are universities and K-12 schools now trying to get their hands on humanoids,” Haggerty told participants. Companies such as Nissan and OpenAI are also tapping this technology through RoboStore for advanced research and development, but the momentum isn’t limited to the classroom. Industrial and commercial applications are moving into focus at pace. Haggerty outlined how RoboStore is fielding daily inquiries from businesses interested in practical automation solutions.

“So many customers reach out asking if the robot can fold clothes, carry out simple tasks, or work in hazardous environments. The answer is yes, it's all possible, but we’re still early. These robots need to be programmed to learn these tasks. A real turning point will be broader software development and lower entry pricing.”

He described how industrial quadrupeds, especially Unitree’s B2, are already excelling in harsh environments and that the introduction of task-specific humanoids, such as those for firefighting, will rapidly expand use cases. Haggerty pointed to how “every update brings us closer to meaningful commercial deployment,” with operating system upgrades now enabling advances like basic conversational AI through embedded chatbots.

The Case for Human-Like Form: Built for Our World

Why is the sector focused on robots shaped like humans rather than more “logical” forms, such as quadrupeds or wheeled machines? According to Haggerty, “The whole world is made for humans. Doors, tools, and infrastructure are all built for human hands and scale. Humanoids fit right in.”

Brendan Ahern made an analogy to support this case: “I read this book about the history of energy usage. It explained that in the early 20th century, the transition to electricity from candle power was simply retrofitting candle and gas fixtures to work with electric bulbs. It allowed them to upgrade to a new technology without changing their existing infrastructure.”

Brendan’s point was that revolutionary technologies are most rapidly adopted when they can slot into existing infrastructure with minimal disruption. In the same way that electrified lighting was accomplished by just adding sockets, wires, and bulbs to previously candle-powered or gas-powered holders, humanoid robots are designed to operate seamlessly in a world already tailored for human activity, making adoption in homes, factories, and warehouses easier and more cost-effective.

That’s why, as Haggerty explained, humanoids are ideally positioned for mass adoption in sectors with acute labor shortages, including logistics, warehousing, healthcare, and hazardous workplaces, without the need for expensive infrastructure overhaul.

Teddy further discussed how teleoperation already allows workers in one location to control humanoids in remote or dangerous environments, effectively diversifying and future-proofing the workforce:

“With teleop, you could have someone on the West Coast managing a warehouse on the East Coast. Pair that with AI and you’re unlocking an entirely new labor paradigm.”

Breakthroughs & Hurdles: The Road to Mainstream

Haggerty also highlighted the recent leaps in sensor technology and spatial awareness.

“Matching vision and LIDAR data for spatial recognition and navigation was a big hurdle. Now, robots know exactly how far away an object is, but the next leap is true sensor integration, combining touch, vision, and memory like a human.”

LIDAR (Light Detection and Ranging) is a remote sensing method that uses laser pulses to measure precise distances to objects. Haggerty explained that advances in this technology have allowed robots to accurately map and understand their environments in real time.

Additionally, improvements in battery life, miniaturized supercomputers (often using NVIDIA or Intel chipsets), and actuators are enabling robots to run for hours on a charge and perform more sophisticated tasks. Haggerty noted, “Batteries have jumped to incredible heights in recent years; two hours of continuous use in a humanoid is now possible.”

Still, pricing remains an issue, with advanced humanoids costing as much as $100,000. However, Haggerty predicted these barriers will fall rapidly as manufacturing scales and more developers generate software for practical applications.

“I think in a few years, or even months, as prices drop, you’ll see exponential growth in what these robots can do for real businesses and homes.”

U.S.-China Collaboration: The Manufacturing-Technology Nexus

Additionally, Haggerty spotlighted the unique marriage of advanced U.S. technology and software and Asian, especially Chinese, manufacturing know-how. Haggerty explained that “the hardware might be developed in China, but it’s U.S. technology inside, like NVIDIA or Intel chips. We’re seeing a marriage of strengths, extensive manufacturing expertise in Asia, and cutting-edge design and AI coming from the U.S. That’s enabling unthinkable progress.”

Yan agreed, reflecting on the mutual dependencies along the global value chain and stressing that advanced robotics development is an international effort. “This is a global opportunity, with KOID, about 38% of allocation is U.S., 30% China, 12% Japan, and 5% Germany. It’s diversified by sector and geography, capturing both innovation and manufacturing excellence.”

How KOID ETF Captures the Investment Opportunity

Derek Yan detailed the investment rationale and methodology behind KOID. “Old automation, industrial arms, and factory robotics have plateaued in many markets. Humanoid robots are the next frontier, especially as factories and warehouses face persistent labor shortages. KOID is the first U.S.-listed ETF targeting companies across the full humanoid and embodied intelligence ecosystem.”

KOID was built to capture suppliers, integrators, and enabling technology from sensors to actuators to AI “brains”. “By equal weighting, we maximize diversification and minimize concentration risk. This is important because the sector’s still emerging and we want to ensure exposure to potential leaders across the value chain, not just top-heavy bets on a few names,” Yan stated.

Research from Morgan Stanley projects a $5 trillion total addressable market and as many as one billion humanoid robots by 2050. KOID’s index composition reflects this entire spectrum, from critical components companies like rare earth providers, which Teddy noted are seeing four times the demand compared to EVs, to major AI semiconductors and upcoming integrators.

KOID’s composition can adapt as the sector matures, capturing value as it migrates along the value chain from mechanical components toward software and AI. Read our white paper here to learn more about KOID’s methodology and how investors can potentially capture the humanoid robotics opportunity.

Conclusion

As Unitree’s official North American partner, Teddy Haggerty and RoboStore now sells hundreds of robots each month to top universities and research teams, accelerating real-world adoption at a rapid pace. Their work underscores that the humanoid robotics era is no longer a distant vision and is beginning to take shape in real-world applications..

KOID is designed to offer diversified exposure to companies involved in humanoid robotics and embodied intelligence across geographies, technologies, and suppliers. For those seeking to participate in emerging automation trends and embodied intelligence, KOID offers a globally diversified, forward-looking option.

Diversification does not ensure a profit or guarantee against a loss.

This material contains the speakers' opinion and third-party projections. It is provided for informational purposes and should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the fund.

For KOID standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- “Humanoids: 1bn Robots and $5tn Revenues by 2050, China is in Pole Position” Morgan Stanley Research, 4/28/2025.