2026 China Outlook: Galloping Into The Year of The Horse

Executive Summary

- China’s 15th Five-Year Plan, to be released in the first quarter, is expected to provide support for the development of high-technology industries, increasing technological self-reliance, and stimulating domestic demand and inflation.

- Efforts to curb overcapacity and race-to-the-bottom competition, especially in the solar panel industry, could pay off in 2026, leading to potentially better corporate profit margins and inflation.

- A reset in US-China diplomatic relations could provide greater clarity in global export markets for China’s goods, the status of its ability to import high-end chips, and reduced equity market volatility, especially offshore.

Introduction

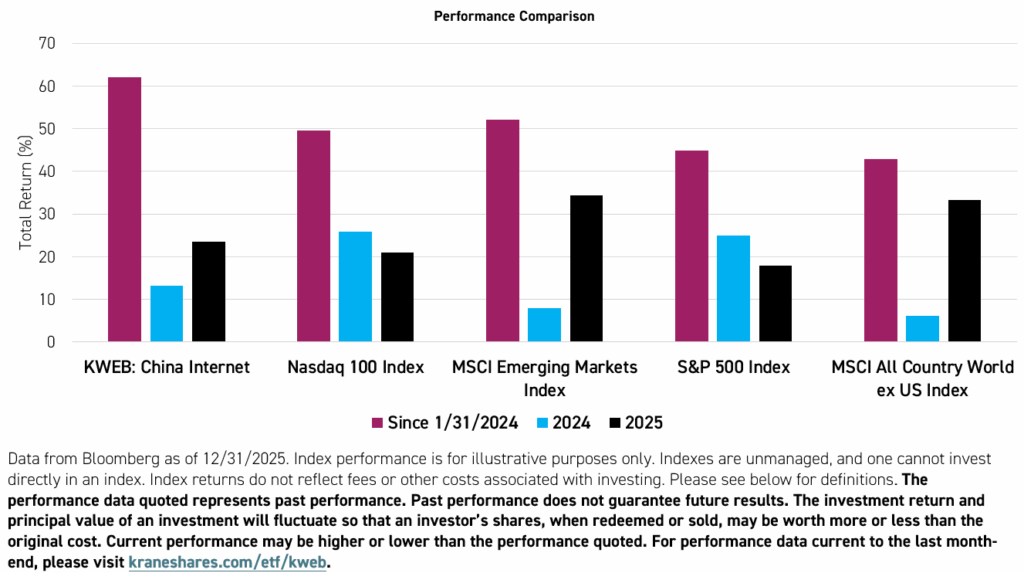

We remain constructive on China stocks after they delivered another impressive year of performance in 2025, outpacing US and global benchmarks. The release of DeepSeek's hyper-efficient large language model (LLM) in January coincided with a significant re-rating10 of China's internet and technology stocks. However, we believe the re-rating actually began in January 2024 after a derivative-linked selloff may have marked a potential bottom for China's internet firms' valuations.

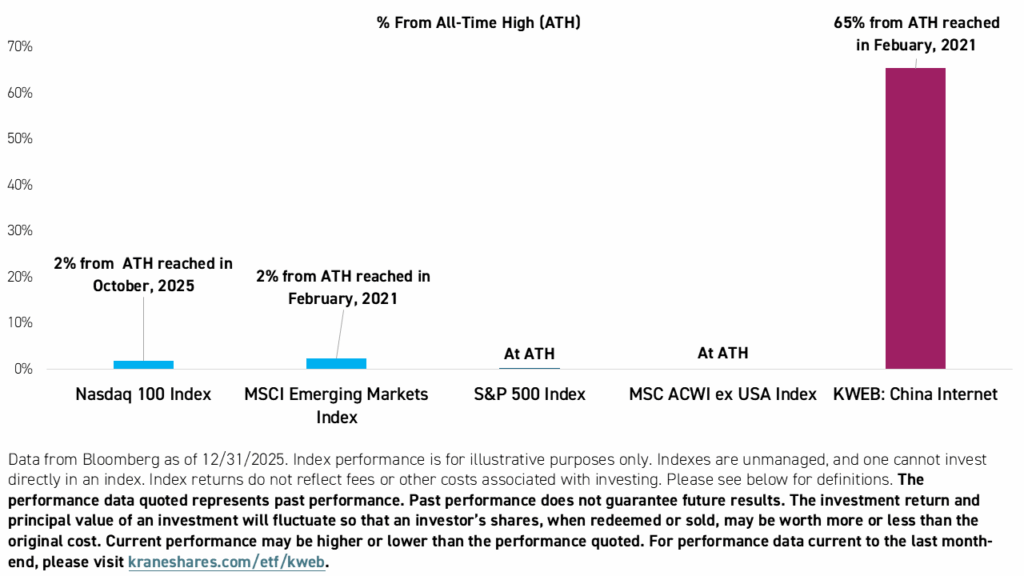

Despite strong performance in 2025, KWEB remains significantly below its all-time high.

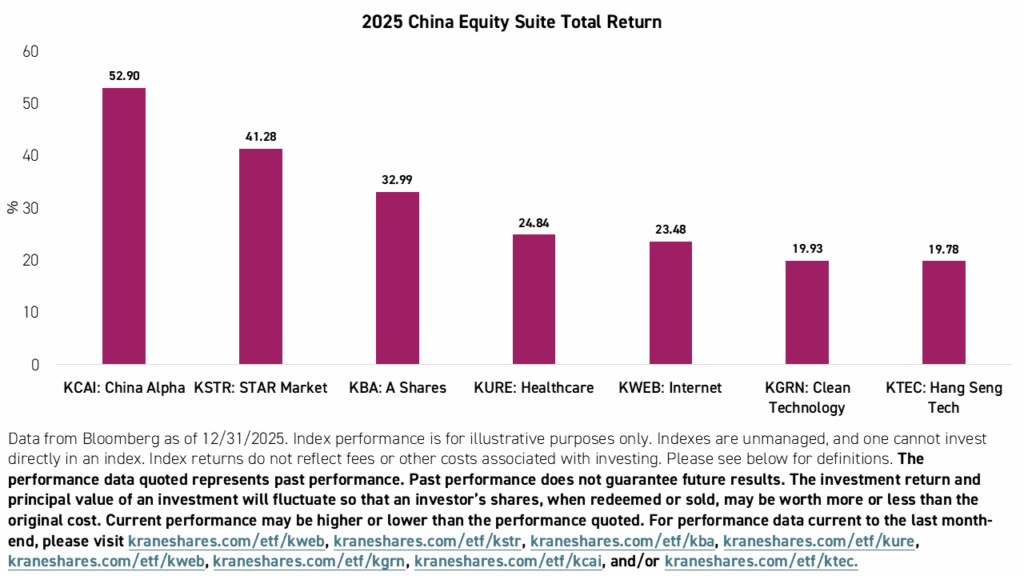

Many investors remain unaware of the strong performance of Chinese stocks due, in part, to Western media bias. The rally in 2025 was broad, and the below China ETFs delivered strong total returns.

We believe several headwinds may swing to tailwinds in 2026, allowing for a continued re-rating of China stocks.

Potential Tailwinds For 2026:

- The 15th Five-Year Plan emphasizes domestic consumption and technology self-reliance

- Raising domestic consumption seeks to address trade imbalance concerns from both the United States and the European Union.

- An increase in domestic consumption could improve the fundamentals of E-Commerce companies and end the heightened competition for the same high-income, urban wallets that has weighed on margins.

- President Trump’s April 2026 trip to China is an opportunity to broaden the US-China trade truce, which would help alter the geopolitical and media narrative.

- Anti-involution could be widely implemented beyond solar, which could help trigger inflation and improve corporate profit margins broadly.

Although these factors may support China's equity market, policy error is always a risk, and corporates and consumers should play a leading role in driving growth. Let’s take a deeper dive into these topics.

The 15th Five-Year Plan: Technology Innovation & Sustainable Growth

A key component of our original thesis for the creation of KraneShares was investing alongside government policy. We have seen firsthand the power of the government’s economic and social roadmap, as businesses often completely reorient themselves every five years to the sectors highlighted in each Five-Year Plan (FYP). Understanding what these plans entail is crucial for investing and doing business in China. In 2026, we will find out what the government's priorities are for the next five years through the release of the 15th FYP.

The 15th FYP will need to be approved at the National People’s Congress, which is expected to take place in March 2026. However, thanks to a draft released by the Central Committee in October, we already have a good idea of what to expect.

The goals from the draft are as follows:

- Achieve high-level self-reliance in science and technology, and lead the development of new quality productive forces.

- Build a strong domestic market and accelerate the construction of a new development pattern.

- Expand the nation's artificial intelligence (AI) ecosystem and enhance its governance.

- Promote healthy, rather than destructive, competition.

- Stimulate the economy through coordinated fiscal and monetary policy.

Based on press releases from subsequent meetings between President Xi and the State Council, quantifiable goals could include the following:

- Fiscal Deficit: 4% of gross domestic product (GDP)

- Special Central Government Bond & Local Government Bond Issuance Target: RMB 4.4 trillion ($0.6 trillion)

- Reserve Requirement Ratio (RRR): -0.5% cut to release RMB 1 trillion in liquidity (long-term)

- 7-Day Reverse Repo Rate: -0.1% cut

The Central Economic Work Conference (CEWC) is an annual economic meeting where President Xi and the State Council, i.e. the highest echelons of China's government (basically the President and his cabinet), face off with the Central Committee to develop an economic game plan for the coming year. This year, attendees acknowledged economic challenges, which is a good sign. Compared to the draft FYP, the CEWC placed more of an emphasis on supporting domestic consumption growth.

Below, we have translated and paraphrased key goals that came out of the CEWC in 2025:

- Strengthening domestic demand

- Taking special actions to boost domestic consumption

- Adherence to innovation-driven development and the acceleration of the cultivation and expansion of new growth drivers.

- Deepening the expansion of the "Artificial Intelligence +" policy while improving the governance thereof.

- Reforming policies to support high-quality development while further rectifying destructive competition.

- Adherence to opening up and the promotion of "win-win" cooperation in various fields

- Meeting the needs of both urban and rural households

- Reducing unemployment

- Strengthening clean energy and emissions reduction policies.

- Stabilizing the real estate market by implementing city-specific policies to optimize the housing supply, including the acquisition of some existing commercial housing for use as affordable housing.

Finally, in December, President Xi published an article titled Expanding Domestic Demand Is a Strategic Move. The article states that “the expansion of domestic demand is related to both economic stability and economic security” and that domestic demand will be supported by “promoting employment, improving social security" among other measures.

The proposed 15th FYP indicates that technological innovation and broad economic expansion are key priorities. Meanwhile, behind the scenes, particular attention is being paid to domestic consumption growth by the highest levels of government.

US-China Relations: Trump's Turn

We believe markets are underestimating President Trump’s desire to reset US-China relations. We are optimistic that trade and national security measures already implemented or underway could give the Administration confidence to work on better relations in the long term. These measures include the onshoring of auto manufacturing and other critical industries, as well as chip export restrictions.

We believe that President Trump could extend the trade "truce" established with President Xi during their meeting in South Korea earlier this year. While we could see more hawkish bills coming out of Congress, such as the BIOSECURE Act1, we believe these are unlikely to seriously derail the White House's efforts.

Although China's currency, the renminbi (CNY), initially weakened after Trump's tariff announcements in April, the currency rose steadily through the end of 2025.2 We believe this indicates that currency markets are no longer pricing in tariff-driven disruptions.

Allocation: Dollar Weakness Supports Flow To China Stocks

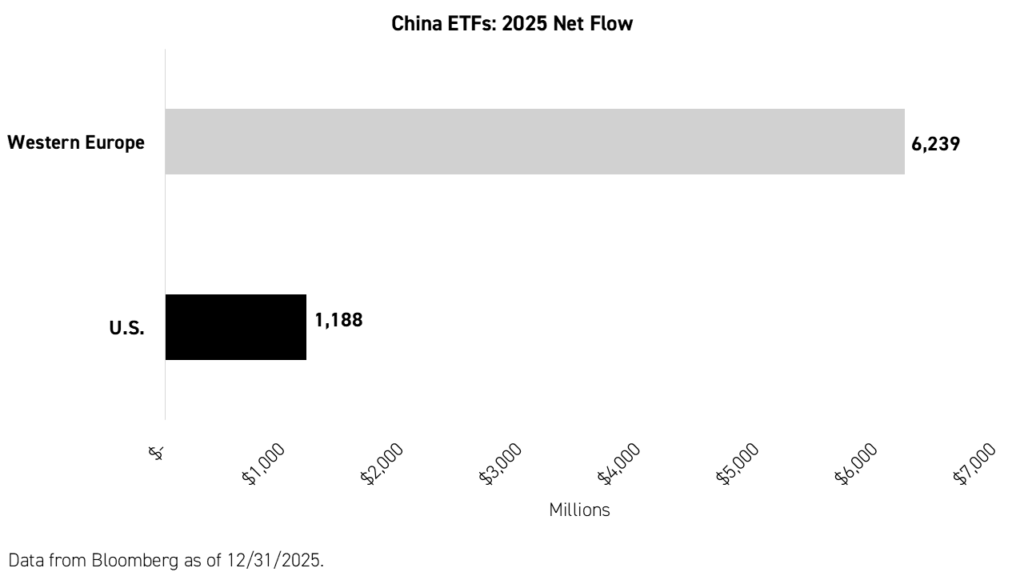

Despite compelling valuations on an absolute and relative basis, we believe a negative media narrative, driven by geopolitics, has weighed on US investor sentiment towards China. European investors, on the other hand, did not hesitate to increase their allocations to China in 2025, possibly to offset declines in the US dollar that threatened to erode gains in US equities.11

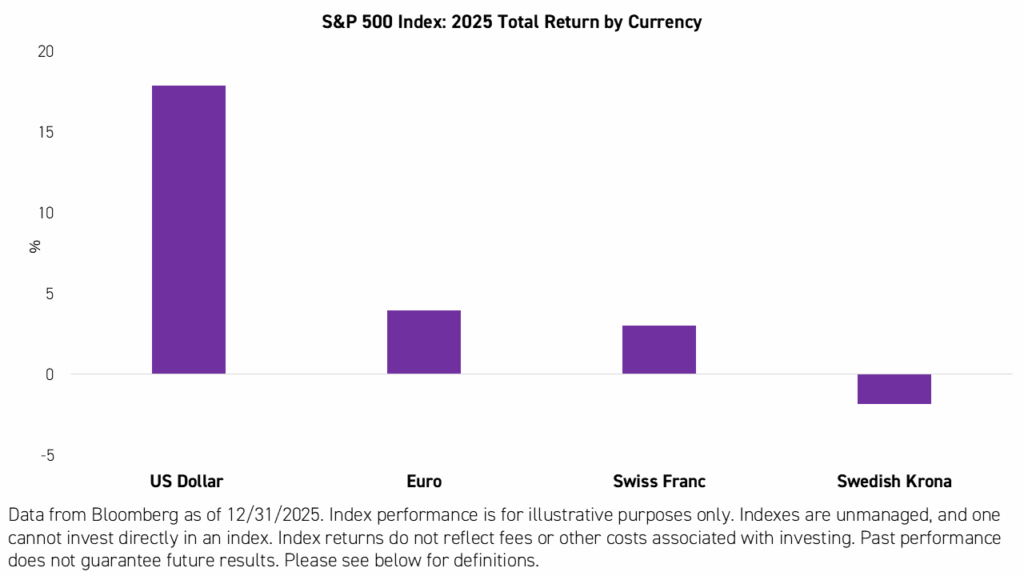

In 2025, the weakness of the US dollar compared to the Euro, Swiss Franc, and Swedish Krona in 2025 has deterred new equity investments in the United States. In Euro terms, the S&P 500 Index returned less than 5% in 2025.

Meanwhile, European flows to China ETFs were far stronger than in the US.

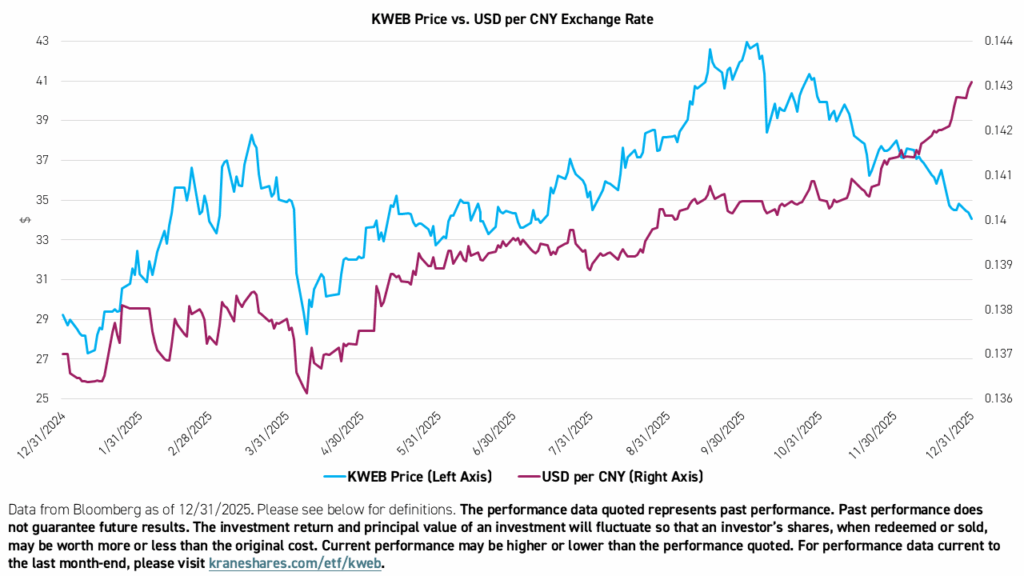

Gains in the US dollar exchange rate for the renminbi tend to lend themselves to positive performance in the equity prices of companies with revenues denominated in renminbi, though the currency is far from the only factor at play. In 2025, KWEB followed the renminbi higher up until October. We believe the correlation was broken after investors became concerned that AI enthusiasm was leading to unjustified valuations globally. In 2026, markets could continue to re-rate KWEB companies based on the rise in the dollar value of their revenues, as indicated by the renminbi exchange rate.

Anti-Involution: Addressing Excessive Competition To Trigger Inflation & Domestic Consumption Growth

A significant economic issue in recent years for China has been overcapacity and excessive competition. The consequences are wide-ranging, from slim profit margins for local companies, a deflationary spiral, and admonishments from the US and EU for the excess supply of goods being unloaded on their markets.

Efforts to resolve this problem are not new. China first implemented an annual production cap of 45 million tons of aluminum per year starting in 2017.7 However, these issues have become more acute in recent years, under pressure from protectionism globally and the sheer scale of China's manufacturing base today.

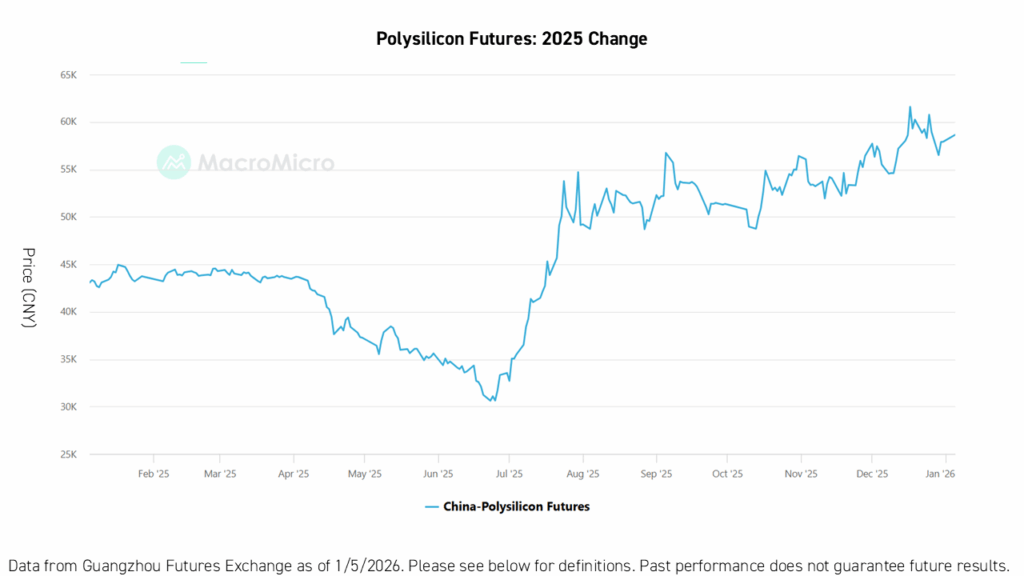

In a July speech, President Xi mentioned overcapacity directly.6 In short order, the State Administration of Market Regulation (SAMR) said that it would work with corporations to curb excess competition in photovoltaics.4 This may have helped the price of polysilicon, a key input in solar panels, increased significantly in 2025, based on futures markets.

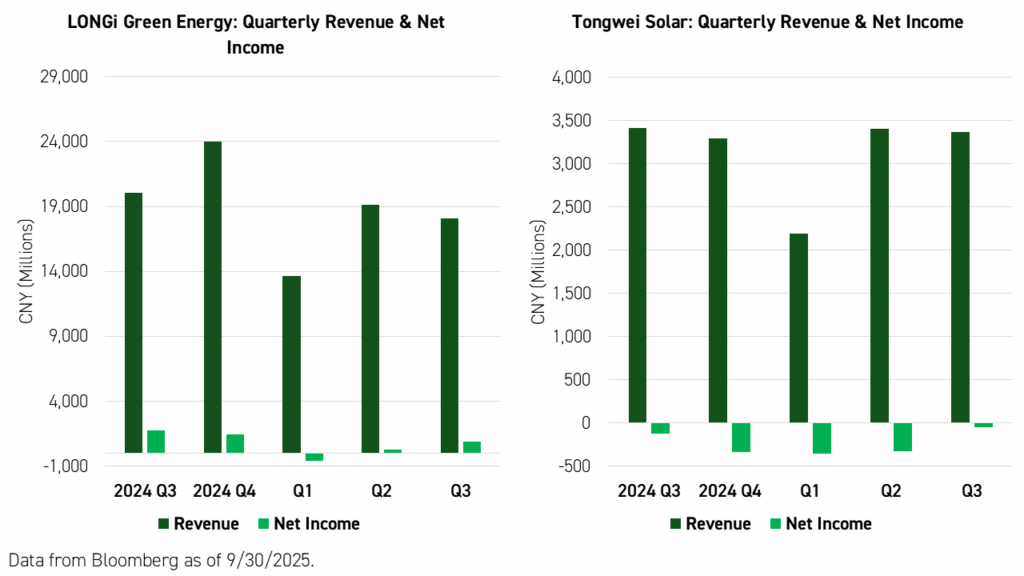

Solar panel production is dominated by China-based companies, including Tongwei and LONGi Green Energy. Despite being global leaders with historically strong top-line revenue growth, these companies have shown little to no net income in the past five quarters.

The next several quarters will determine if the companies can continue to reduce losses. In December, an industry association called Guanghe Qiancheng Technology Co., Ltd. (GQT) was organized by nine solar panel companies, at the request of China's ministers. GQT said it will “buy and shut down more than 1 million tons of capacity” in 2026.6

However, such direct and decisive action, in response to pleas from government officials, has yet to be seen in other industries. The Ministry of Industry & Information Technology (MIIT) has discouraged E-Commerce companies from continuing to drive down their own margins to compete in instant delivery in urban areas. Meanwhile, SAMR is looking to protect merchants from being undercut by platforms and has required that platforms adhere to reasonable price floors. However, E-Commerce platforms have yet to organize collectively in the same fashion as solar panel manufacturers.9

But, these agencies' comments on instant commerce have been echoed by the Mainland press, heightening urgency. On July 9th, the People’s Daily published an article on a “Takeaway War”, stating that, “there is no winner in price war, only innovation can bring the future”. The article notes that although “ultra-low prices may benefit consumers,” they can also cause irrational consumption, dilute profits per customer, and "make delivery drivers exhausted."8

We believe solving the involution issue could help trigger inflation, induce consumption, and improve the profitability of corporations, all of which could potentially benefit China's equity market.

Conclusion

2025 was a strong year for Chinese equities driven by improved sentiment, especially around growth and technology sectors. Many investors reallocated during the year, though some continue to sit on the sidelines, especially US investors sensitive to geopolitical headlines. We are hopeful that 2026 could see continued strong performance in China's equity market, supported by the 15th Five-Year Plan's focus on technological self-reliance, anti-involution policies improving corporate profits, and increased consumer spending. Meanwhile, we believe the Trump Administration will seek progress on resetting diplomatic relations with China, reducing headline risks and allowing some US investors to re-allocate.

The preceding discussion includes forward-looking statements. Forward-looking statements are based on an assessment of market conditions at a certain point in time, and the views they express are subject to change without notice.

Holdings are subject to change. For KWEB standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- BIOSECURE Act. 118th Congress, 2nd sess., H.R. 7085, Introduced 25 Jan. 2024. Congress.gov, U.S. Congress

- Data from Bloomberg as of 12/31/2025

- The Ministry of Industry and Information Technology (MIIT)of China. “Action Plan for the High-Quality Development of the Aluminum Industry (2025–2027)”.

- Jackson, Lewis. "Markets bet Beijing is getting serious about China's overcapacity," Reuters. July 24, 2025.

- Cash, Joe. "China's top leaders vow crackdown on price wars as deflation risks mount," Reuters. July 1, 2025.

- Bloomberg News. "China's Polysilicon Giants Join Forces to Tackle Overcapacity," Bloomberg. December 10, 2025.

- Bloomberg News. "China's Cap in Aluminum Capacity to Slow Output and Cut Exports," Bloomberg. January 14, 2025.

- "Takeaway War," People's Daily. July 9, 2025.

- Butts, Dylan. "Coffee at 30 cents is the latest gimmick in China's billion-dollar 'instant commerce' price war," CNBC. July 11, 2025.

- Shan, Lee Ying. "DeepSeek has stoked a rotation out of India stocks into Chinese equities - but experts advise caution," CNBC. February 24, 2025.

- Withers, Iain. "Europeans pile into local ETFs at record rate, at expense of US stocks," Reuters. August 13, 2025.; Data from Bloomberg, EPFR as of 12/31/2025.

Index Definitions:

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

S&P 500 Index: An American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The index was launched on March 4, 1957.

Nasdaq 100 Index: The Nasdaq-100 Index tracks 100 of the largest non-financial companies listed on the NASDAQ stock market, including major tech, retail, and healthcare firms, and was launched on January 31, 1985, as a benchmark for innovation-driven growth, not including financial firms.

MSCI All Country World Index (ACWI) ex USA: The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries*. With 1,973 constituents, the index covers approximately 85% of the global equity opportunity set outside the US. The index was launched on January 1, 2001.

Term Definitions:

Gross Domestic Product (GDP): The total dollar value of everything a country makes (goods like cars, services like haircuts) in a specific time, usually a year, showing how big its economy is and how healthy it's doing.

Revenue: The total amount of money that a company makes from selling goods and/or services within a specific period of time, before the deduction of any expenses.

Net Income: The amount of money that is left over from a company's revenue after taking into account the expenses required to produce said revenue.

Photovoltaics: The branch of technology concerned with the production of electric current at the junction of two substances. In this report, it refers to solar panels specifically.

ETF Net Flow: The money invested in a category of exchange-traded funds (ETFs) during a certain period of time, measured as buys subtracted from sell.

USD per CNY Exchange Rate: The amount of US dollars in one unit of the renminbi (CNY).

The Renminbi (CNY): The official currency of the People's Republic of China (PRC).

Polysilicon Futures: Polysilicon futures are standardized exchange‑traded contracts that obligate the buyer and seller to transact a specified quantity of polysilicon (a high‑purity form of silicon used mainly in solar cells and semiconductors) at a predetermined price on a future date. They are primarily used by producers, solar‑module makers, and traders to hedge against or speculate on volatility in polysilicon spot prices along the photovoltaic supply chain.