The New Five Year Program is Poised to Bolster Internet Companies

As details of the new program are released, domestic consumption and internet companies may be the biggest winners

The Fifth Plenum – an important meeting of China’s leadership – was held in Beijing last week from October 26th through the 29th. For those who are unfamiliar; plenum meetings occur semi-annually in numbered intervals over the course of a five-year cycle. There are typically seven plenum meetings within a cycle, with each meeting dedicated to a different area of focus; such as: appointing new leaders, drafting economic and societal plans, and strategizing how to best enact these plans.

Last week’s Fifth Plenum meeting was one of the most important meetings of the plenary cycle as China’s leadership drafted the 13th Five Year Program (FYP). The FYP acts as China’s economic blueprint that will influence virtually every decision made by the country’s leadership over the course of the next five years. An official draft of the 13th FYP will be released on November 7th1 and will be finalized and officially enacted in March of 20162.

While the entire contents of the draft have yet to be announced, we are paying particularly close attention to the following areas: liberalization of equity, fixed income and currency markets, support for internet related businesses in the form of the “Internet Plus” strategy, and finally further domestic consumption incentives.

We believe the most striking theme from what has been reported so far is China’s focus on domestic consumption and specific emphasis on the internet and technology sector through the Internet Plus strategy. Internet Plus is an action plan that seeks to drive economic growth by integration of internet technologies with manufacturing and business. The plan was first announced last year by China’s “chief operating officer” Premier Li Keqiang. In regard to Internet Plus, Premier Li stated, "I am willing to advertise for new businesses including online shopping, express delivery and e-commerce. They have given a strong boost to employment and consumption for our country”3.

China’s leadership clearly views the internet as one of its most important tools for making the shift to a domestic consumption driven economy. We expect as further information about the 13th Five Year Program is announced there will be additional articulation of how the Internet Plus strategy will function and how Chinese internet companies might benefit from the plan.

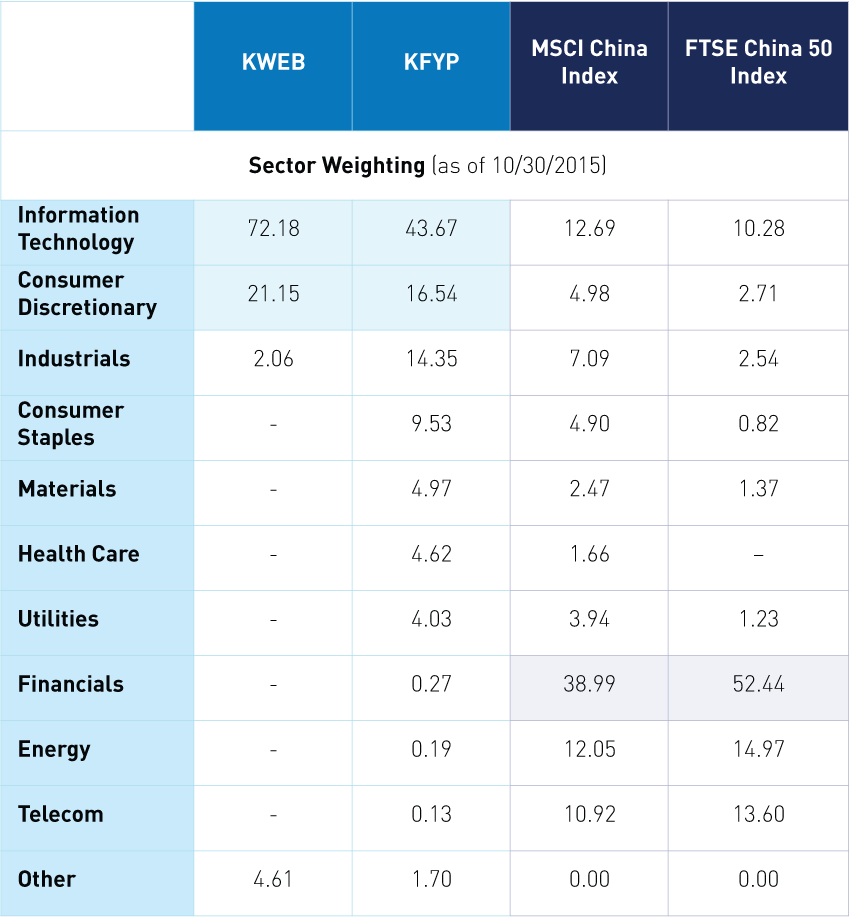

Surprisingly many investors remain underexposed to China’s internet and technology sector. This is partially due to the investment universe of some of the leading China indices that are tracked by popular exchange traded funds. Both the FTSE China 50 index4 and the MSCI China index5 limit their investment exposure to Chinese companies listed in Hong Kong, which has caused their sector weights to skew heavily toward financials – a sector conspicuously missing from preliminary reports on the new FYP.

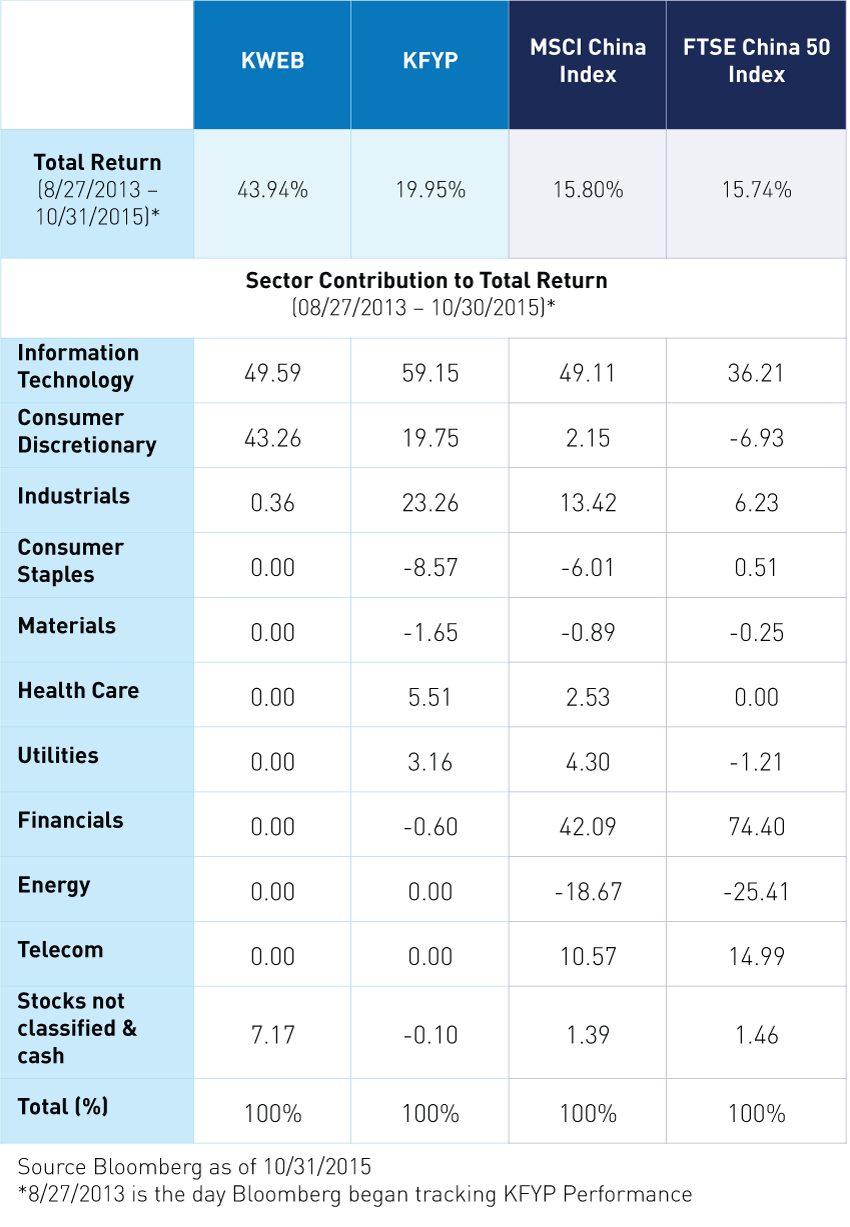

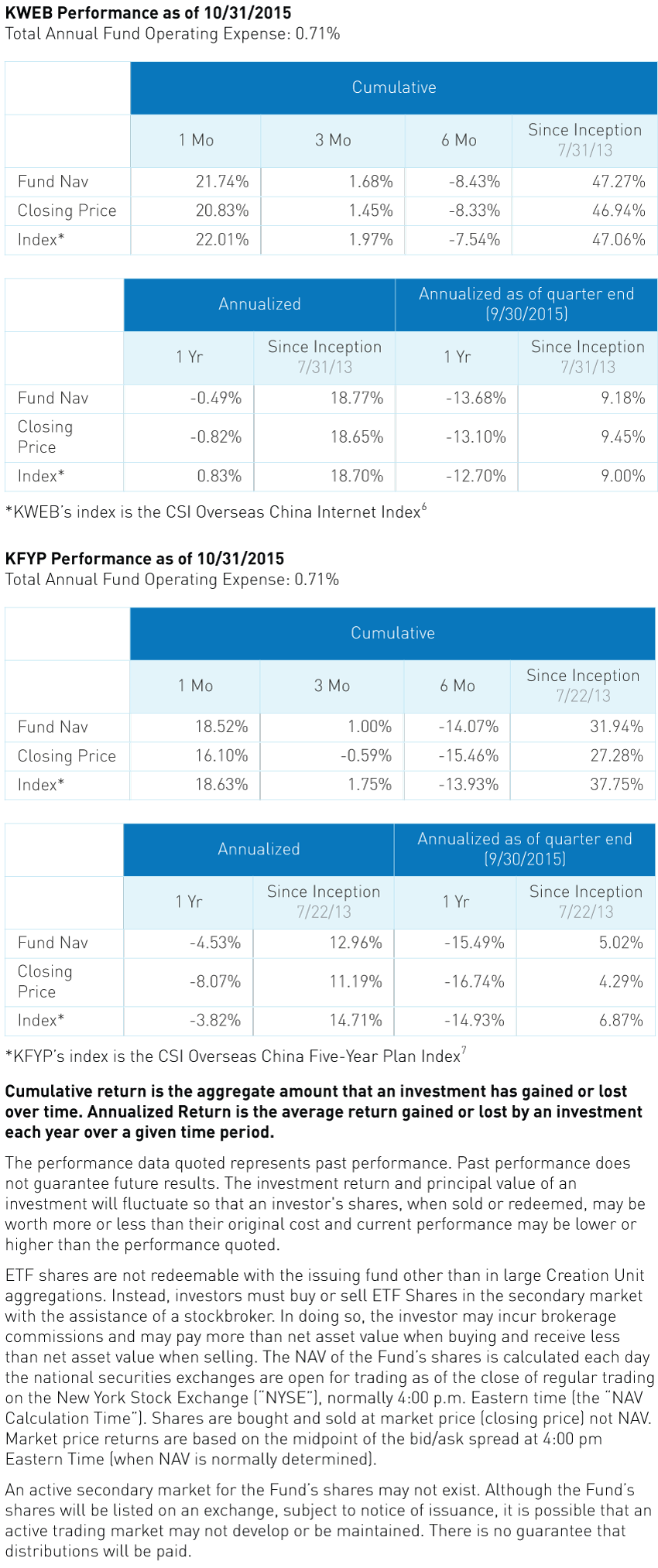

Our funds, the KraneShares CSI China Internet ETF (ticker : KWEB), and the KraneShares CSI New China ETF (ticker : KFYP) hold stocks listed in both the United States and Hong Kong. Both KWEB and KFYP have an overweight to China’s consumer discretionary and information technology sectors, which are two of the most important areas targeted for growth by the new FYP. Additionally, KFYP holds the exact sectors the Chinese government has targeted for growth in the current Five Year Program and will be rebalanced to capture any changes in the new FYP as soon as the plan is enacted.

Since Bloomberg began tracking KFYP and KWEB their exposure to consumer discretionary and information technology sectors outperformed the MSCI China and FTSE China 50’s exposure to the same sectors, and contributed to the funds' overall outperformance of these indices. We believe KWEB and KFYP's outperformance was due to their inclusion of New York listed Chinese companies (N-shares), which we believe represent some of the best companies in China.

View the funds' standard performance as of most recent month end: KWEB, KFYP

Beyond the FYP there are a number of other short-term catalysts that should continue the current tailwind we are experiencing in China’s internet sector. On October 23rd China cut interest rates and banks’ reserve requirement ratio8. This stimulus could flow through to the domestic consumption sector over the months to come. Additionally Singles day, the world's largest online shopping holiday9, is coming on November 11th, which typically boosts quarterly earnings for China's ecommerce companies. Finally, MSCI’s inclusion of the top U.S.-listed Chinese companies into their indices will trigger massive inflows into the stocks KWEB holds today. On October 23rd Goldman Sachs estimated the inflows could be as high as $78 billion10. With all these factors firmly in place, we believe KWEB may continue its recent strong performance.

- Wen / Cheng Jun, (Oct 29 2015) "Fifth Plenary Session planning proposals for the 13th Five Year Program", Wallsreetcn.com

- Wen / Cheng Jun, (Oct 29 2015) "Fifth Plenary Session planning proposals for the 13th Five Year Program", Wallsreetcn.com

- Huaxia, (Mar 15 2015) "Internet Plus set to push China's economy to higher level: Premier", Xinhua

- FTSE China50 Index: Is a real-time tradable index comprising 50 of the largest and most liquid Chinese stocks (H Shares, Red Chips and P Chips) listed and trading on the Stock Exchange of Hong Kong (SEHK).

- MSCI China Index:The MSCI China Index captures large and mid cap representation across China H shares, B shares, Red chips and P chips. With 143 constituents, the index covers about 84% of this China equity universe.

- CSI Overseas China Internet Index: Represents the Chinese internet companies listed in overseas markets (New York and Hong Kong), in order to measure the performance of the Chinese internet companies listed outside mainland China.

- CSI Overseas China Five-Year Plan Index: Measure the performance of Chinese overseas listed companies that benefit from the Chinese Five-Year Plan

- Gabriel Wildau in Shanghai and Chris Giles in London, (Oct 23, 2015) "China joins nervous global easing", The Financial Times

- Liyan Chen, (Nov 10, 2014) “Happy Singles Day! China’s Anti-Valentine’s Festival Is The World’s Biggest E-Commerce Holiday”, Forbes

- Kana Nishizawa, Lisa Pham (Oct 29 2015) "Xi’s Dream for a High-Tech China Is Becoming a Reality in Stocks", BloombergBusiness