MSCI’s Phase Two Inclusion is Coming

Phase Two of MSCI's inclusion of U.S.-listed Chinese companies will take place at the end of this month

On Thursday, May 12, MSCI announced the exact stocks that will be included into their global indexes as part of the Phase Two inclusion of U.S.-listed Chinese companies (N-shares). This inclusion story has largely been ignored by the mainstream financial press, yet it has captivated a niche group of ETF experts who understand that billions of dollars will be set into motion on May 31st, 2016.

There are $9.5 trillion dollars in assets from both actively and passively managed mutual funds and ETFs tracking MSCI indexes, with $1.6 trillion tracking the MSCI Emerging Market Index alone.1

N-shares were previously left out of MSCI’s international indexes because their U.S. listing precluded them from being counted as international stocks. This absence became glaring after the highly publicized Alibaba initial public offering (IPO) in September 2014. Since Alibaba chose to list on the New York Stock Exchange, it was absent from virtually every international ETF, with the exception of our KraneShares CSI China Internet ETF: ticker KWEB and a few other IPO-focused ETFs2.

In addition to Alibaba, N-shares comprise some of the largest and most recognized Chinese technology companies, such as: Baidu, Ctrip, JD.com, and others. MSCI’s move to include N-shares into their indexes is remedying the current gap in coverage for this important group of Chinese technology companies.

In order to minimize its effect on the markets, MSCI pragmatically divided the inclusion into two phases. Phase One took place on November 30, 2015 and Phase Two will occur on May 31, 2016. After Phase One inclusion took place, billions of dollars from both passive and active managers were reallocated into N-shares. This meant that fund managers had to sell off their holdings of Hong Kong listed Chinese stocks to raise money to buy the N-shares.

While this was not a mainstream news story there were a few ETF experts who wrote about the effect of Phase One inclusion.

N-Share Inclusion Phase One Coverage

At Krane Funds Advisors, we were aware of the nuances in MSCI’s index methodology when we launched KWEB on August 1, 2013. As we developed the fund we worked with KWEB’s index provider to make sure our methodology included N-shares. As a result, KWEB was both the first China and technology ETF listed in the U.S. to hold Alibaba after its IPO2. We first wrote about N-share inclusion on June 30, 2015 when we launched our N-share inclusion countdown clock. Analysts estimate that $70 billion could potentially flow into the N-share names, $35 billion from Phase One and another $35 billion from Phase Two.3

Outside our research, one of the few reporters who picked up on the trend was Elena Popina from Bloomberg News. Ms. Popina published an article on February 18th, 2016 that noted the 500% increase in the largest U.S. asset management company's holdings of the affected N-share stocks. This figure was calculated based on changes in the firm's third quarter to fourth quarter 2015 SEC filing of their stock holdings. In her article, Ms. Popina determined that this $4.3 billion dollar increase was due to Phase One inclusion4. While the article quantified the effect of inclusion on one specific asset management company, fund managers around the world who benchmark to MSCI also had to buy the securities.

Another ETF expert who took note of the effects of Phase One inclusion was Michael Krause from AltaVista Research, a New York based third party ETF research and due diligence firm. In his May 5, 2016 newsletter, Mr. Krause determined that Phase One inclusion caused the affected N-share stocks to rise by an average of 4.6% between November 27th and December 4th, 2015. Over the same period the non-included MSCI stocks declined by -0.8%.5

We published an additional recap on the effect of Phase One inclusion in our Power of Indexing article published on December 18th, 2015.

Phase Two Announcement details

In Thursday’s announcement MSCI divulged the exact stocks that will be added as a part of Phase Two inclusion. The only notable change between the Phase One and Phase Two roster was the exclusion of Youku, which was acquired by Alibaba on April 5, 2016. Below we compiled a list of the exact inclusion stocks and their weights in KWEB.

| Inclusion Stock | Weight in KWEB as of 5/12/2016 | |

| 1 | ALIBABA GROUP HLDG ADR | 10.95% |

| 2 | BAIDU ADR | 8.11% |

| 3 | CTRIP COM INTL ADR | 7.36% |

| 4 | JD.COM ADR | 5.65% |

| 5 | QIHOO 360 TECH A ADR | 4.51% |

| 6 | NETEASE COM ADR | 3.93% |

| 7 | 58.com | 3.76% |

| 8 | VIPSHOP HOLDINGS ADR | 3.53% |

| 9 | TAL EDUCATION GROUP ADR | 3.22% |

| 10 | YY INC ADR | 2.78% |

| 11 | SOUFUN HOLDINGS ADR | 2.41% |

| 12 | QUNAR CAYMAN ISLANDS ADR | 1.63% |

| 13 | NEW ORIENTAL EDUCATION ADR | 0% |

| The Fund’s Holdings Are Subject to Change. Click Here for latest full fund holdings. | ||

As of May 13, 2016, 57.84% of KWEB’s holdings are comprised of the MSCI inclusion stocks. According to AltaVista Research this is the highest concentration of any U.S.-listed ETF5.

Implications for A-share inclusion

In a much more high-profile decision in 2015, MSCI decided that it would hold off its inclusion of China A-shares, stocks listed on the Shanghai and Shenzhen stock exchanges, in order to give China's regulators time to clear up a few operational concerns we documented in our previous article: Not if, but when – A breakdown of MSCI’s decision on China’s onshore equity market. On June 14th, 2016, MSCI will make an important announcement regarding the timeline for when inclusion will commence.

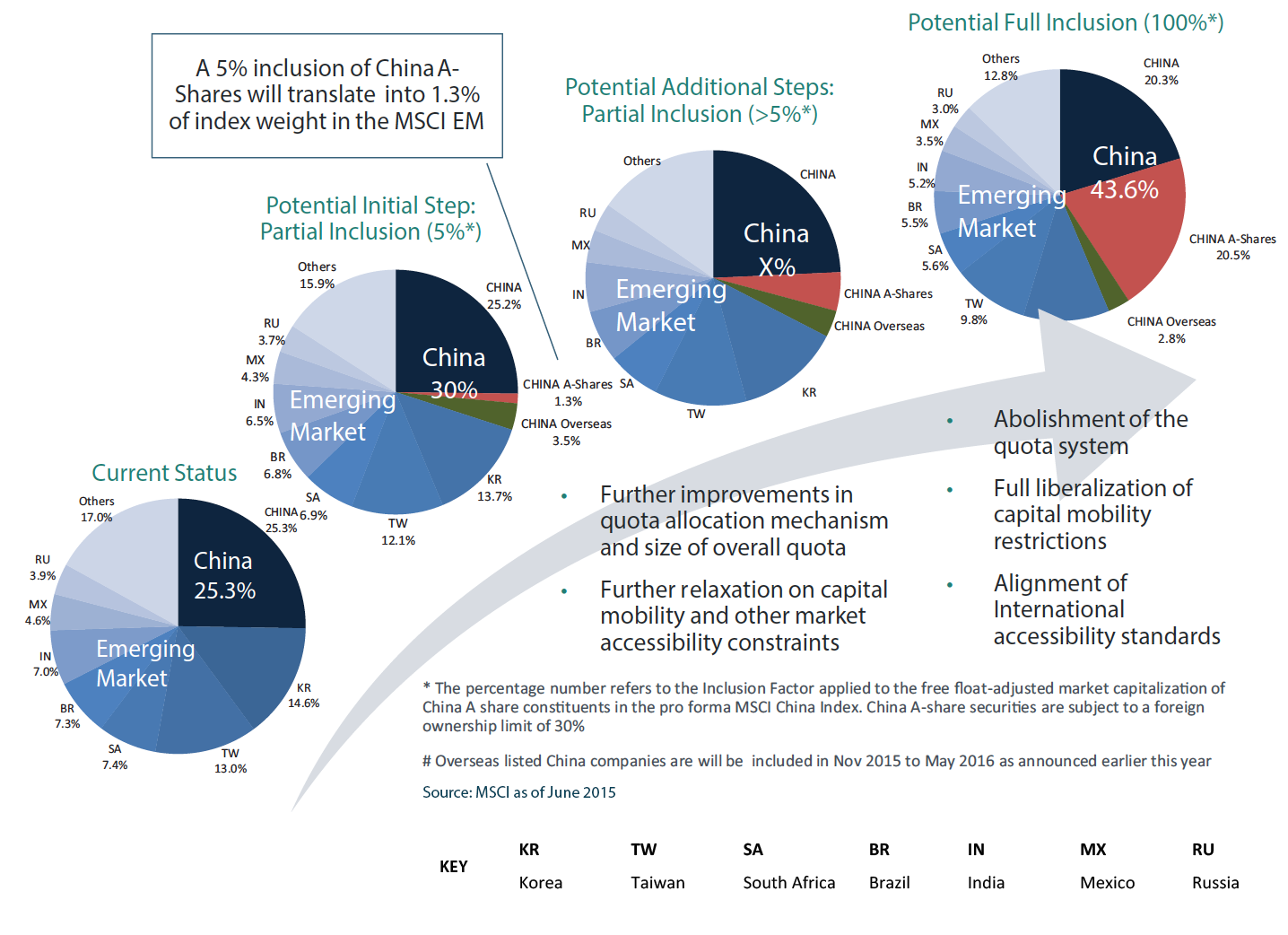

To put the magnitude of this inclusion into perspective China N-shares (labeled CHINA overseas in the chart below) will comprise 3.5% of the MSCI Emerging Markets Index after Phase Two inclusion. After China A-shares are fully included into this index they will represent 20.5% of the index. It is estimated that this move could add $400 billion to onshore equities over time6. The effect of full A-share inclusion would be over four times larger than N-share inclusion.

Our fund, the KraneShares Bosera MSCI China A ETF (ticker: KBA)* tracks the MSCI China A International Index, which represents the exact stocks MSCI will include into their indexes.

We will be conducting a live webinar on Wednesday June 15th from 11:00am to 12:00pm EST where we will review the results of MSCI’s announcement and discuss its impact on the mainland Chinese markets.

Click here to subscribe to the webinar.

*The KraneShares Bosera MSCI China A ETF does not hold any of the securities mentioned in this article.

- Annual MSCI data as June, 2015. Note: MSCI releases benchmarked assets on an annual basis.

MSCI Emerging Market Index: captures large and mid cap representation across 23 Emerging Markets (EM) countries. With 834 constituents as of 3/31/2016, the index covers approximately 85% of the free float-adjusted market capitalization in each country. (Start Date: Jan 1 2001) - (Oct 8, 2014), "Invest in Alibaba Stock with These 3 ETFs - ETF News And Commentary", Zacks

- TARIRO MZEZEWA (Nov 12, 2015), "MSCI adds Alibaba, other U.S.-listed China shares to indexes", Reuters

- Elena Popina (Feb 18, 2016), "BlackRock Boosts China ADR Holdings by 500% After MSCI Inclusion", Bloomberg.

- Michael Krause (May 5, 2016), ETF Advisor Strategy & trade ideas for ETF investors, AltaVista Research

- Nyshka Chandran (Jun 10, 2015), "MSCI move to give China stocks a $400B boost", CNBC

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Although Krane Funds Advisors LLC and its affiliates (“Krane”) shall obtain data from sources that Krane considers reliable, all data contained herein is provided “as is” and Krane makes no representation or warranty of any kind, either express or implied, with respect to such data, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Krane expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

There is no corporate relationship between AltaVista Research and Krane Funds Advisors, LLC.