MSCI says “ni hao” to Alibaba, Baidu, JD.com and others*

November 30 marks two landmark developments for China from both MSCI and the International Monetary Fund.

November 30th marks a big step forward for China’s growing importance in global markets. First, U.S.-listed Chinese companies like Alibaba, Baidu, JD.com, and others*, are going to be included into MSCI’s China, Asia Ex-Japan, Emerging Markets, and All Country World Indices. Second, the International Monetary Fund (IMF) will be meeting on November 30 to vote on the inclusion of China’s currency, the renminbi (RMB), within its reserve currency basket.

These two events have already started to have ramifications for investors’ portfolios, whether they realize it or not. We believe active institutional investors have begun positioning themselves to benefit from the expected inflows. The onshore China equity and fixed income markets have $11 trillion in total market cap. Today foreigners own just 1.7% of that $11 trillion, or less than $200 billion1. We believe these numbers will grow substantially as various pending inclusions come to fruition.

The Impact of MSCI Inclusion

MSCI is a leading provider of index solutions globally with $9.5 trillion benchmarked to its indices as of June 30, 2015, and $1.6 trillion tracking the MSCI Emerging Markets Index alone2. By adding the U.S.–listed Chinese companies to the China portion of their indices, MSCI is also changing the balance of its current country allocations. This means stocks in other countries such as India, Russia and Brazil must be sold in order to purchase the newly included N-shares. We anticipate the China weighting in the MSCI Emerging Market Index will increase 3.5% as a result.3

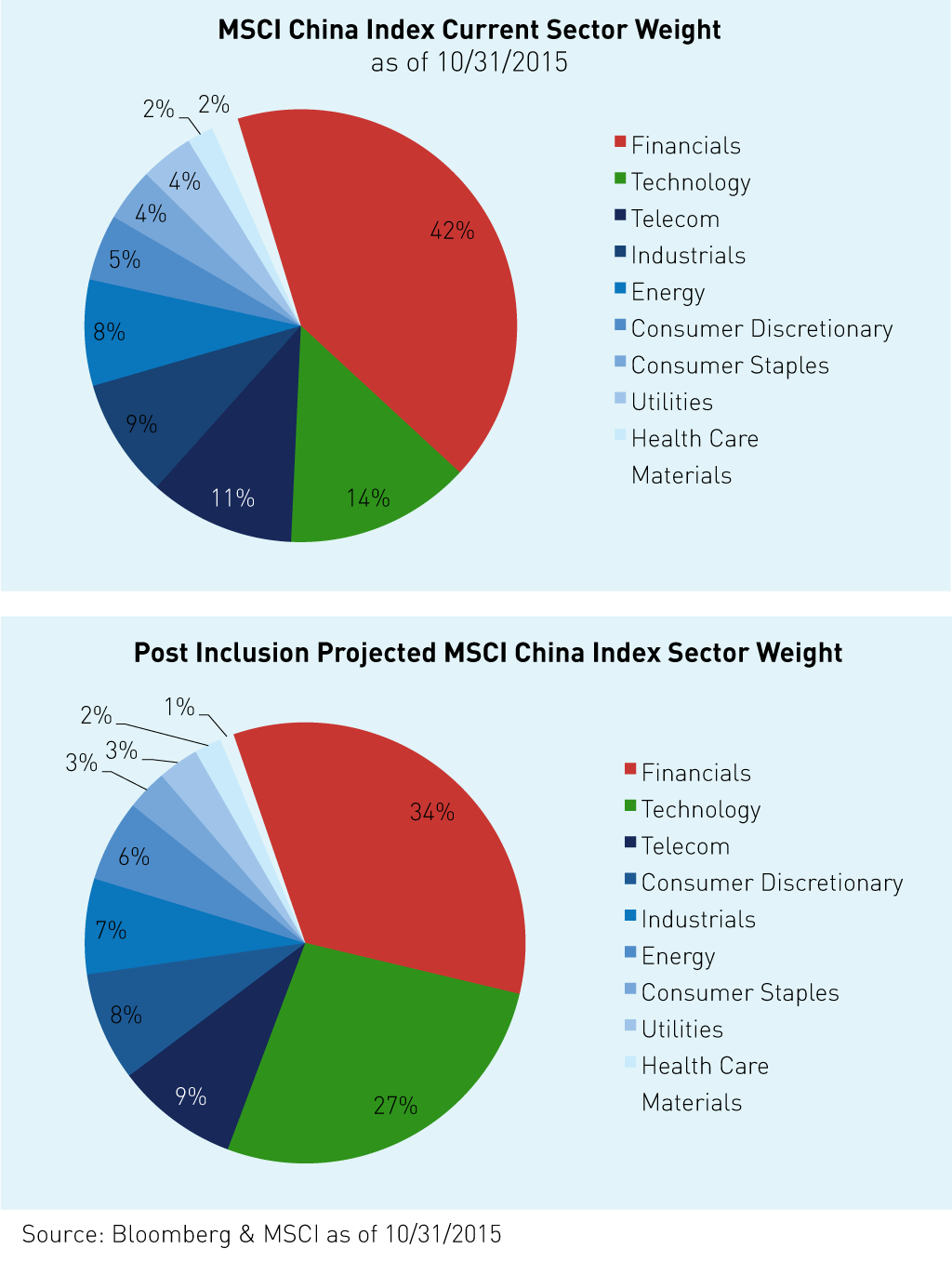

The sectors within the MSCI China Index4 will also see their weighting affected as the existing Hong Kong listed Chinese companies (H-shares) need to be sold to make room for the U.S.–listed companies. Upon inclusion, the financial sector will see its weight decrease, while the technology sector will see its weight increase dramatically.

To minimize the impact that MSCI's rebalance will have on the underlying securities, the index provider has taken the pragmatic approach of a two phase inclusion. The first inclusion is set to be complete by December 1 and the second on June 1, 2016. Goldman Sachs predicts they will see an uptick in their daily trading volume leading up to the inclusion as the rebalance may trigger $78 billion of net buying5.

We believe that N-share inclusion has already started to affect the markets as institutional investors who are aware of the pending inflows have started buying the stocks in anticipation of the rebalance. This could be one explanation for why the CSI Overseas China Internet Index6, primarily consisting of N-shares, outperformed the MSCI China Index (H-shares only) by 15.15% from September 1, 2015 to November 17, 20157. The 14 companies being included have demonstrated a significant outperformance over the last three months compared to the MSCI China index as it stands today pre-inclusion.

While we believe the addition of U.S.-listed Chinese companies into MSCI’s indices is already having a measurable impact on emerging markets, this inclusion may be dwarfed by the forthcoming addition of onshore Chinese equities. The total market cap of the onshore Chinese companies will require a significantly larger rebalance. MSCI is working with China’s regulatory bodies to ensure sufficient access for international investors before the inclusion can commence. Investors today can track the effects of N-share inclusion as a prelude for what is to come when their larger A-share counterparts are added to MSCI’s global indices.

A Key Decision From the IMF

While MSCI’s expansion of its China investment universe will increase international exposure to China's equity markets, the IMF’s pending vote on China’s currency will expand the global use of the RMB. The IMF will be voting on whether the RMB should be included into the Special Drawing Rights (SDR), which would in turn require every IMF member countries' central bank to hold RMB in reserve.

On Friday November 13, 2015, Christine Legarde, Managing Director of the International Monetary Fund announced "the Executive Board has determined the RMB to be freely usable and should be included in the SDR basket as a fifth currency, along with the British pound, euro, Japanese yen, and the U.S. dollar. The staff also finds that the Chinese authorities have addressed all remaining operational issues identified in an initial staff analysis submitted to the Executive Board in July.”8

The IMF Executive Board will meet on November 30 to vote on the RMB’s inclusion. For investors this inclusion is a step toward opening the third largest bond market globally with $5.6 trillion in assets. While sovereign wealth funds and central banks have recently been given access to China’s onshore bond market, investors globally have virtually no exposure. Much like the MSCI inclusion of U.S.-listed Chinese companies, we believe the RMB joining the SDR will lead to further investments in China’s bond market and currency. Deutsche Bank AG predicts that IMF inclusion will spur 4 trillion yuan ($628 billion) of inflows into Chinese assets over the next five years, while AXA Investment Managers has an estimate of $600 billion.9

As China pushes to internationalize its markets there will be a series of forthcoming inclusion events. We originally outlined a roadmap for how China could be 60% of the MSCI Emerging Markets Index. KraneShares is committed to helping investors understand China, its economy, and capital markets.

*Alibaba was 8.49% of KWEB net assets as of 10/31/2015 | JD.com was 6.43% of KWEB net assets as of 10/31/2015 | Tencent was 10.87% of KWEB net assets as of 10/31/2015

- TOM ORLIK AND FIELDING CHEN, (Nov 10 2015) “China's 13th Five Year Plan – The Report”, Bloomberg Intelligence

- Data from MSCI as of 6/30/2015. The MSCI Emerging Markets Index captures large and mid cap representation across 23 Emerging Markets (EM) countries*. With 834 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

- (Aug 2015) "MSCI China A International" pg 15, MSCI

- MSCI China Index:The MSCI China Index captures large and mid cap representation across China H shares, B shares, Red chips and P chips. With 143 constituents, the index covers about 84% of this China equity universe.

- Kana Nishizawa, Lisa Pham (Oct 29 2015) “Xi’s Dream for a High-Tech China Is Becoming a Reality in Stocks”, BloombergBusiness

- CSI Overseas China Internet Index: Represents the Chinese internet companies listed in overseas markets (New York and Hong Kong), in order to measure the performance of the Chinese internet companies listed outside mainland China.

- Data from Bloomberg as of 11/17/2015

- (Nov 13 2015) "Statement by Ms. Christine Lagarde on IMF Review of SDR Basket of Currencies", International Monetary Fund

- (Nov 15, 2015) "Yuan Advance Seen Along With Bonds After IMF Entry a Done Deal", Bloomberg News