A Tale of Two Chinas

Divergent performance in China's "two-speed" economy

On October 1st 2015, Aaron Back from the Wall Street Journal published an article titled: “Why Apple and Nike Can Buck China Slowdown”. His piece explored why foreign retailers were continuing to achieve substantial sales growth in China while it appeared the Chinese economy was slowing. In the article, Mr. Back suggests the idea of a two-speed economy; one where traditional sectors were slowing, while sectors geared toward China’s new economy were experiencing robust growth.

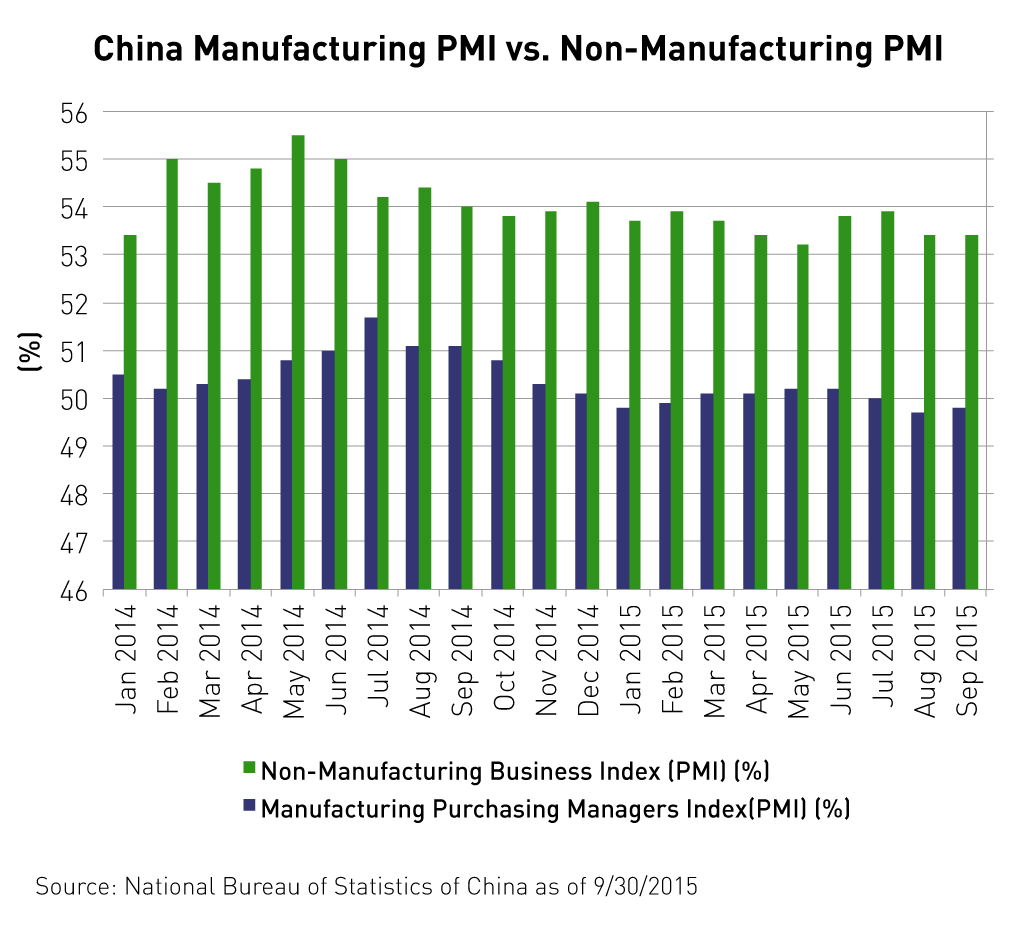

In his article, Mr. Back stated, “China’s heavy-manufacturing, resource-extraction and construction industries are in recession. But other sectors, including services like travel, dining and e-commerce, are still growing at respectable rates.” He offered a comparison between China’s Manufacturing Purchasing Managers' Index (PMI) and Non-Manufacturing PMI as evidence of the divergence in performance between the traditional and the “New China” sectors of China’s economy.

PMI is an index compiled from the results of a monthly survey of enterprise purchasing managers. It covers all aspects of the represented enterprises, including purchasing, production, logistics, etc. It is one of the leading internationally adopted methods of monitoring macroeconomic trends. A PMI of more than 50 means the represented sectors are expanding compared to the previous month. A reading under 50 represents a contraction, while a reading at 50 indicates no change.

As evidenced by the above chart, since the beginning of 2014, the non-manufacturing PMI has consistently registered above 50 and has outperformed the manufacturing PMI. In September the Non-manufacturing PMI was 53.4% indicating healthy growth, while the manufacturing PMI was at 49.8% indicating a contraction.

This comparison underscores one of our long-standing opinions: when looking for growth opportunities in China – a discerning sector exposure is paramount. As we have stated in the past, in 2012 China’s services sector surpassed its industrial sector as the largest contributor to GDP for the first time in the country’s history. We expect this segment of China’s economy to continue to outperform into the future.

Manufacturing Industries vs. Non-Manufacturing Industries as defined by the National Bureau of Statistics of China:

| Manufacturing Industries | Non-Manufacturing Industries |

|

|

Many China indices have not kept pace with China’s shifting economy and still have heavy concentrations in China’s manufacturing industries. Additionally, many news reports continue to view China’s declining manufacturing numbers as a holistic representation of its entire economy. We believe this thinking was partially responsible for the rise in correlation between traditional sectors and “new China” sectors of China’s economy over the summer. Many investors turned indiscriminately averse to China, which detracted from the stock performance of companies that were otherwise growing healthily.

Over the summer, after China’s onshore bull market ended, and negative China sentiment became widespread, there was a notable rise in correlation between China indices with and overweight to traditional sectors and China indices with an overweight to “new China” sectors. One particular “new China” segment we like to focus on is internet and ecommerce. Over the past year leading up to the peak of the onshore market’s rally on June 11th, the China internet sector, represented by the CSI China Overseas Internet Index1, exhibited a low correlation to traditional sectors of China’s economy – represented by the MSCI China Index2 and the MSCI China A Index3. After the pullback in the onshore markets took hold, this correlation rose substantially.

| Index Correlation 6/11/2014 – 6/11/2015 | |||

| Index Ticker | CSI Overseas China Internet Index (H11137) | MSCI China Index (MXCN) | MSCI China A Index (MXCN1A) |

| H11137 | 1.00 | 0.44 | 0.22 |

| MXCN | 0.44 | 1.00 | 0.53 |

| MXCN1A | 0.22 | 0.53 | 1 |

| Index Correlation 6/12/2015 – 9/30/2015 | |||

| Index Ticker | CSI Overseas China Internet Index (H11137) | MSCI China Index (MXCN) | MSCI China A Index (MXCN1A) |

| H11137 | 1.00 | 0.79 | 0.66 |

| MXCN | 0.79 | 1.00 | 0.70 |

| MXCN1A | 0.66 | 0.70 | 1.00 |

Data from Bloomberg as of 9/30/2015

We believe the proliferation of outdated “manufacturing-centric” viewpoints on China over the summer superficially affected all segments of China’s economy equally. Meanwhile, retail sales continued to increase and – as Mr. Back noted in his article – foreign retailers such as Apple and Nike continued to report significant profits from China. As China’s onshore market has stabilized and panic subsides we expect Chinese stocks to perform more inline with the direction of its economy.

Our fund the KraneShares CSI China Internet ETF (KWEB) provides exposure to e-commerce and internet companies that we believe benefit from retail sales taking place online. Online sales of consumer goods accounted for 9.8% of all consumer goods sold in China from January through August this year, a 33% increase year-over-year4. We believe the China internet sector represents one of the most attractive segments of the “new China” economy.

There are a number of upcoming events to watch out for that we hope – as Mr. Back’s article has done – may drive further attention toward the growth sectors of China’s two-speed economy.

- October’s Fifth Plenum – a key policy meeting of China's leadership focused on the country's economic blueprint – and drafting of the 13th Five Year Plan, which we will discuss in detail in coming weeks.

- KWEB portfolio companies will release earnings beginning in late October and into November.

- Singles Day, November 11th, is the largest e-commerce event globally as retailers offer deep discounts online5.

- December 1st MSCI will include the largest sixteen U.S.-listed Chinese companies (N-shares) within their indices such as All Country World Index, Emerging Markets, Asia Ex-Japan and China.

While the market might not anticipate these events until they occur, we believe KWEB offers a compelling entry point today to buy great companies at potentially discounted prices.

- CSI Overseas China Internet Index: Represents the Chinese internet companies listed in overseas markets (New York and Hong Kong), in order to measure the performance of the Chinese internet companies listed outside mainland China.

- MSCI China Index:The MSCI China Index captures large and mid cap representation across China H shares, B shares, Red chips and P chips. With 143 constituents, the index covers about 84% of this China equity universe.

- MSCI China A Index: Targets up to 99% of the investable market universe and provides deep exposure to the China A share market. The index can be broken down into the MSCI China A Large, Mid and Small Cap segments.

- Data from the National Bureau of Statistics of China as of 8/31/2015

- Liyan Chen, (Nov 10, 2014) "Happy Singles Day! China's Anti-Valentine's Festival Is The World's Biggest E-Commerce Holiday", Forbes