12/04/2014 – ETF.com: New China ‘Paper’ ETF A Groundbreaker

By Dennis Hudachek | December 04, 2014

The opinions and material presented in articles are an assessment of the market environment at a specific time and are not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

On Wednesday, China ETF specialist KraneShares brought to market one of the more innovative ETF launches I’ve seen in years.

The new KraneShares E Fund China Commercial Paper ETF (KCNY) tackles a specific niche within China’s massive $5 trillion “onshore” bond market: commercial paper.

KCNY breaks new ground because it’s not only the first China commercial paper ETF, it’s the first U.S.-listed commercial paper ETF, period. There is currently no other ETF focused exclusively on commercial paper.

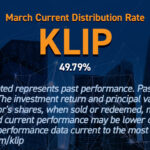

The fund tracks an index of “investment grade,” ultra-short-term Chinese sovereign and corporate debt that yields north of 4 percent. KraneShares said in regulatory paperwork that the fund’s average maturity is only 128 days.

This is significant because KraneShares is clearly aiming for a sliver of the trillions of dollars parked in U.S. money market funds earning little to no interest at the moment.

Having been a renminbi bull for years myself, I’m excited to see a renminbi-denominated fixed-income ETF aimed for capital preservation with such an attractive yield.

Read the full article on ETF.com